Comment calculer le choc de paiement : un guide étape par étape

Are you wondering why your mortgage application was turned down or why your lender seems concerned about your new loan? It might be due to something called “payment shock.”

Understanding payment shock is crucial, especially if you’re planning to make a big financial commitment. It’s the sudden increase in your monthly payments that can catch you off guard and disrupt your budget. We’ll break down what payment shock is and, more importantly, how to calculate it.

By the end, you’ll have the tools to manage your finances better and avoid any unpleasant surprises. Keep reading, and let’s turn your financial anxiety into confidence.

Understanding Payment Shock

Payment shock happens when your payment amount changes suddenly. It’s important because it affects your budget. You might pay much more than expected. This can cause stress and confusion. Understanding it helps you plan better. You need to know how it works. You need to be ready for changes. This helps avoid surprises. Planning prevents financial problems. It’s crucial for your peace of mind.

Many face payment shock in different situations. When rates go up, monthly payments rise. Buying a new home can cause this shock. Loans with adjustable rates may also lead to sudden changes. Rent increases are another common scenario. Sometimes, insurance costs go up suddenly. This impacts budgets too. Knowing these scenarios helps in preparing. It makes financial planning easier. Avoiding payment shock is possible with the right knowledge.

Key Factors Influencing Payment Shock

Interest rates can go up or down. A small change can cause big effects. Higher rates mean more money to pay back. This can lead to payment shock. It’s important to watch for rate changes. They can happen at any time. Be ready to adjust your budget. Keeping an eye on rates helps plan better.

Loans come with rules. These are called terms and conditions. Some loans have strict rules. Others might be more flexible. Read your loan terms carefully. Know what you agree to. If terms change, payments might change too. Stay informed about your loan. This helps avoid surprises later.

Loans can be variable or fixed rate. Variable rates can change. They go up and down. Fixed rates stay the same. Variable loans can lead to payment shock. Fixed loans are more stable. Think about which type is best for you. Know the risks of each kind. Choose wisely for peace of mind.

Gathering Necessary Financial Information

Track your monthly revenu from jobs or business. Then list your regular dépenses. These include rent, food, and utilities. Write down each one. This helps you see your financial health. Knowing both income and expenses is key.

Make a list of all your dettes. This includes loans and credit card balances. Write down the amounts and interest rates. Knowing your debts helps you plan better. It shows how much you owe each month.

Think about future plans like buying a car or a house. These are future commitments. Write down expected costs. This helps you budget for upcoming expenses. Planning helps avoid surprises later.

Calculating Payment Shock

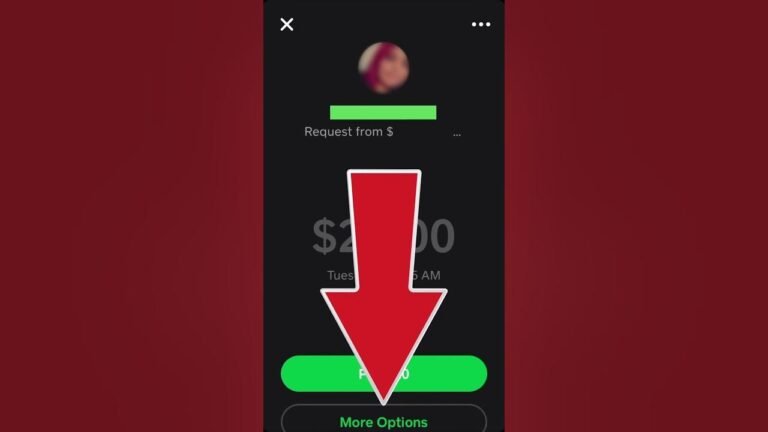

Tout d’abord, trouvez votre current monthly payment. Check your bills or bank statements. Then, find your new monthly payment. You can ask your bank or lender. Subtract the current payment from the new payment. This gives you the payment change.

Next, divide the payment change by your current payment. Multiply by 100 to get the percentage change. This is your payment shock. For example, if the change is $200 and current payment is $800, the shock is 25%. This means your payment grows by 25%.

Online calculators can help with payment shock. They are easy and fast. Enter your current and new payments. The calculator shows the percentage change. Some tools even show graphs. This helps you see the payment shock.

Financial tools can track changes over time. They can help you plan better. Use them to avoid surprises. Stay aware of your payments.

Mitigating Payment Shock

Adjusting your budget helps manage payment shock. Start by looking at your dépenses mensuelles. Find areas to cut costs. Eating out less can save money. Buying fewer clothes can help too. Try making a monthly savings plan. Save a little each week. This helps in the long run.

Refinancing can lower payments. Talk to a loan officer. Ask about new payment plans. Sometimes, a longer loan term helps. This reduces the monthly amount. Check if the interest rate is lower too. Lower rates mean smaller payments. It’s worth asking about.

Saving for emergencies is smart. Even small amounts help. Open a special compte d'épargne. Deposit money there regularly. This builds a safety net. Set a goal for emergency savings. A little each month adds up. Being prepared eases stress.

Real-life Case Studies

Payment shock can surprise many people. Sarah, un teacher, faced this when her monthly mortgage went up. She struggled to pay more each month. Her budgeting was not prepared for the increase. John, a young engineer, experienced payment shock with his car loan. His job was stable but expenses rose unexpectedly. Both learned the hard way. Dépenses imprévues can lead to stress.

Planning ahead is important. Budgétisation helps avoid payment shock. Sarah learned to save more money. John learned to watch his spending. Monthly bills can change quickly. Always check for hidden costs. Talk to financial experts if confused. Preparation reduces stress and surprises.

Expert Tips And Advice

Calculating payment shock requires understanding your current financial state. It’s crucial to know your monthly income. Compare it with your current expenses. This helps you see any big changes. Payment shock happens when your new payments are much higher. This can surprise you. Your budget might not handle it. It’s important to plan ahead. Make sure you have a coussin financier. This prevents stress and panic. Look at your savings and investments. They can help balance the shock.

Rushing without proper analysis leads to errors. Many don’t check their expenses closely. This can cause surprises inattendues. Failing to save for emergencies is risky. Always have extra funds set aside. Overspending without a budget causes issues. It’s easy to spend too much. Lack of advice from experts can be harmful. Orientation professionnelle is helpful. Avoid guessing or assuming figures. Use accurate data for calculations.

Questions fréquemment posées

What Is Payment Shock In Finance?

Payment shock occurs when a borrower’s monthly payment increases significantly, often due to adjustable-rate mortgages. This sudden hike can strain finances and lead to defaults. Understanding payment shock is crucial for financial planning and mortgage management. Calculating it helps borrowers anticipate and prepare for potential payment changes.

How Do You Calculate Payment Shock?

To calculate payment shock, subtract your current payment from the new payment amount. Then, divide the result by the current payment. Multiply by 100 to get the percentage increase. This percentage indicates the extent of the payment shock, helping you understand its impact on your budget.

Why Is Understanding Payment Shock Important?

Understanding payment shock is vital for financial stability. It helps borrowers anticipate potential financial strain from rising payments. By calculating payment shock, borrowers can prepare for increased expenses, adjust budgets, and avoid financial pitfalls. This foresight aids in maintaining a healthy financial status and prevents default risks.

How Can You Mitigate Payment Shock?

Mitigating payment shock involves thorough financial planning and budgeting. Consider refinancing to a fixed-rate mortgage to stabilize payments. Build an emergency fund to cushion unexpected increases. Regularly review your financial situation to adapt and plan for potential payment changes, ensuring financial resilience against shocks.

Conclusion

Understanding payment shock helps manage your finances better. It prepares you for unexpected expenses. Calculating payment shock isn’t complex. Follow the steps and use tools available. Keep an eye on your budget. This way, financial surprises won’t stress you out.

It’s crucial for maintaining financial health. Stay informed and plan ahead. Regularly review your financial situation. This keeps you on track and in control. Remember, knowledge is power. Applying what you’ve learned here can make a big difference. Start today and secure your financial future.