Pouvez-vous transférer de l'argent de Cashapp vers Chime ?

Alors que vous naviguez dans le monde de services bancaires numériques, you're likely to wonder if you can transférer de l'argent from Cash App to Chime. The answer is yes, you can associez votre compte Chime to Cash App, allowing you to transfer funds between the two. You'll need to access the banking section in Cash App, enter your Chime account details, and verify the information. But before you initiate the transfer, it's important to grasp the requirements, potential fees, and transfer times involved. Now, let's explore the specifics to guarantee a smooth transaction process.

Linking Cash App to Chime

Pour lier votre Compte Cash App to Chime, you'll need to access the Cash App's banking or linking section, where you can add Chime as a recipient or an external account. You'll be prompted to enter your Chime account details, such as your account number and routing number. Vérifier you double-check your account information to avoid errors. Once you've added Chime to your Cash App, you'll need to confirm the link. This may involve confirming a small test deposit or using an authentication code sent to you by Chime. After verification, your accounts will be securely linked. This process typically takes a few minutes, and you'll be able to initiate transfers between your Cash App and Chime accounts once complete. Confirm your accounts are secure by using authentification à deux facteurs.

Cash App Transfer Requirements

Before initiating a transfer from Cash App to Chime, you'll need to meet certain requirements, which include having a compte Cash App vérifié et fonds suffisants to cover the transfer amount. Your Cash App account must be in good standing, and you must have a linked debit card or bank account to facilitate the transfer. Additionally, you'll need to verify that your Chime account is also active and properly linked to your Cash App account. It's crucial to review Cash App's termes et conditions, as well as any applicable fees, before proceeding with the transfer. By meeting these requirements, you can help guarantee a smooth and secure transfer process. Always verify the informations du destinataire to avoid any potential errors or unauthorized transactions.

Sending Money to Chime

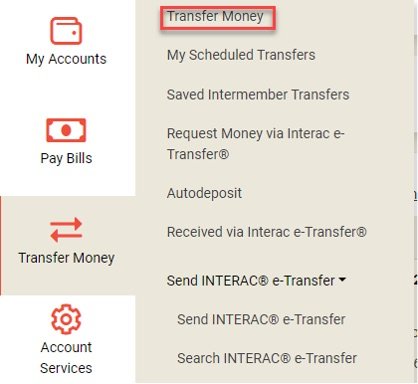

Once you've verified that your Application Cash et Chime accounts are properly linked, you can initiate a transfer by accessing the 'Send' or 'Pay' feature within your Cash App account. You'll need to enter the informations du destinataire, which, in this case, is your own Chime account. Make certain to double-check that the recipient's details are accurate to avoid any transfer errors. Next, specify the amount you want to transfer and confirm the transaction. It's important to review the détails du transfert carefully before finalizing the transaction. By taking these steps, you can securely send money from your Cash App account to your Chime account. Verify that your device and app are up-to-date and secure to protect your financial information.

Délais et frais de transfert

After confirming the transfer details and finalizing the transaction, you'll likely want to know how long it'll take for the funds to become available in your Chime account and whether any fees will be applied. The transfer time from Cash App to Chime usually takes 1-3 business days, but it may vary depending on the transfer method and processing times.

You should consider the following factors to understand transfer time and fees better:

- Méthode de transfert: Cash App offers Instant Transfers, which attract a 1.5% fee but are faster, and Standard Transfers, which are free but take longer.

- Montant du transfert: The amount being transferred can also impact the transfer time and possible fees.

- Délais de traitement: Weekends and holidays can delay transfer processing times.

- Chime's Processing: Chime may also have its own processing times, which can affect when funds become available.

Dépannage des problèmes courants

When transferring money from Cash App to Chime, you may encounter certain issues, and understanding how to troubleshoot them can help you resolve problems quickly and avoid delays. Knowing what to do if your transfer fails or is delayed can save you time and frustration.

| Problème | Cause possible | Solution |

|---|---|---|

| Transfer failed | Insufficient funds, incorrect recipient info | Check balance, verify recipient details |

| Transfer delayed | Server issues, maintenance | Wait, try again later |

| Transfer pending | Verification required | Check email for verification link |

| Error message | App glitch, outdated version | Update app, restart |

| No confirmation email | Email issue, spam filter | Check spam folder, contact support |