Puis-je régler mon Harley avec une carte de crédit ? Découvrez comment.

You’re staring at your Harley-Davidson payment reminder, wondering if you can pay it using your trusty credit card. You’re not alone.

Many Harley enthusiasts find themselves in the same boat, seeking convenience and possibly some extra rewards points. The idea of managing your payments more efficiently or even reaping some unexpected benefits from your credit card might sound appealing. But is it possible?

And, more importantly, is it the right choice for you? We’ll explore the ins and outs of using your credit card for Harley payments, helping you navigate the financial landscape with ease and confidence. Stick around—you might discover a new way to handle your finances that could work wonders for you.

Exploring Payment Options

Harley payments are often made by espèces ou vérifier. These are the most common ways to pay. Many people prefer these methods. They feel sécurisé et facile. Banks support these payments too. Some use virements bancaires. Money moves from one account to another. This is safe and fast.

Some people use cartes de crédit for payments. Credit cards can be very handyIls offrent flexibilité. You might pay later with credit cards. Some places allow this method. Online payments are also an option. They are quick and simple. Apps may help with payments too. These methods are becoming popular.

Using A Credit Card

Paying with a credit card can be very pratique. You might earn récompenses ou remboursement. It’s also easier to track spending. But there are some downsides too. Credit cards can have high taux d'intérêt. If you don’t pay off your balance, it can add up. There might be extra frais for using a card. Always check the terms first.

Not everyone can use a credit card for payments. Some places have rules. You need to have a bonne cote de crédit. This shows you can pay back money. Your card must also have enough limite de crédit. This means you have enough money to pay. Always read the petits caractères. This helps avoid surprises later.

Steps To Pay With A Credit Card

Pick a card with low taux d'intérêt. Check if your card allows large payments. Some cards have a limit. Find out your card’s limit before you proceed. Look for cards with récompenses. Rewards can be points or cash back. This way, you benefit from the payment. Check if there are any frais. Some cards charge a fee for large payments.

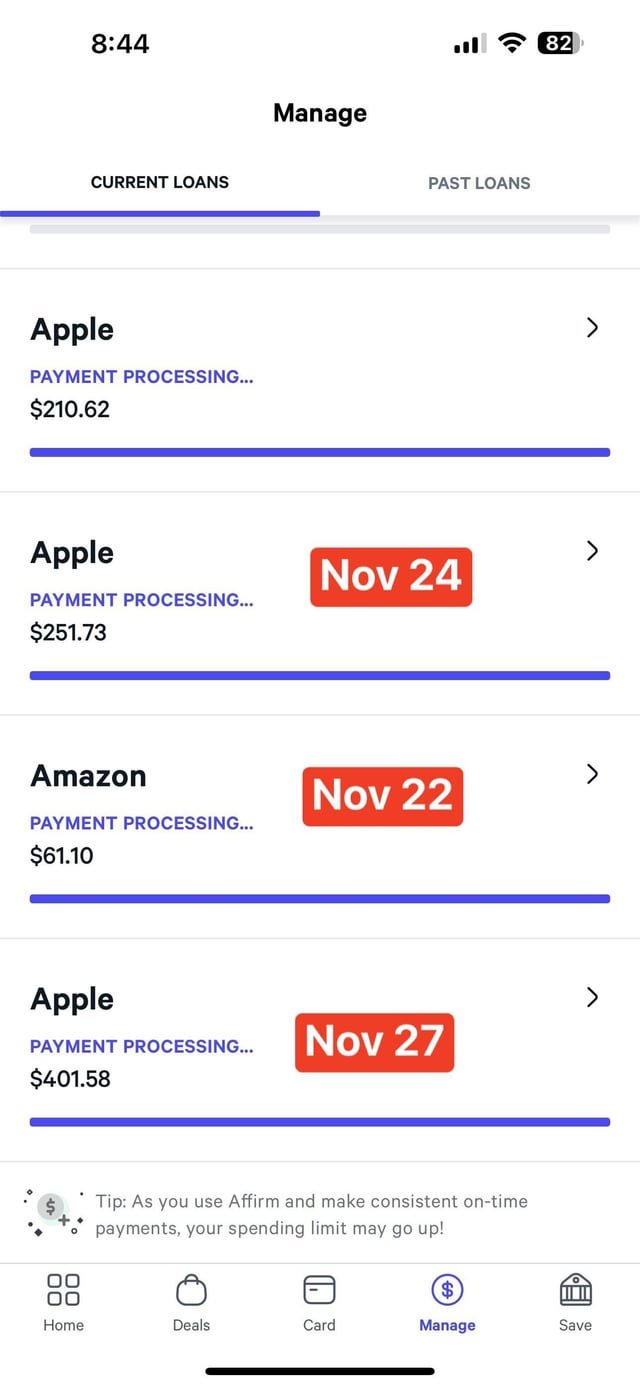

First, log into your Harley account. Go to the payment section. Select credit card as the payment method. Enter your card details carefully. Ensure all numbers are correct. Double-check the expiration date and CVV. Submit the payment. Wait for confirmation. Keep a copy for your records.

Potential Fees And Charges

Paying your Harley payment with a credit card might incur additional fees and charges. It’s important to check if your card issuer applies extra costs. Understanding these potential charges helps in managing your finances effectively.

Taux d'intérêt

Paying Harley payments with a credit card can be costly. Credit cards often have high taux d'intérêt. If you don’t pay off the balance quickly, the cost can add up fast. Even a small amount can grow big. This can make your motorcycle more expensive over time. It’s important to check how much interest your card charges. Compare it to other payment methods. This helps you see which option is best for saving money.

Frais de transaction

Using a credit card for payments might include frais de transaction. These fees can make your bill higher. Some cards charge a fee for each transaction. Others may have a monthly fee. Always read the terms of your credit card. This helps you understand all costs involved. Avoiding surprises is smart. It’s good to know if your card charges extra.

Tips For Managing Payments

Paying with a credit card can be tricky. It’s easy to spend more than you have. Always check your balance before making a payment. Keep track of all your purchases. This helps you avoid overspending. Remember, interest rates can be high. Paying late adds extra charges. Set reminders for payment dates. This helps you stay on track. It’s important to spend wisely.

Some credit cards offer récompenses for spending. You can earn points or cash back. Use these cards for regular purchases. Pay the full amount each month. This way, you avoid interest. Choose cards that match your spending habits. Some offer more points for gas or groceries. Check the terms for earning rewards. Always read the fine print. Enjoy the benefits of smart spending!

Exploring Other Financing Options

Bank loans can help buy a Harley. They often offer lower interest rates. Fixed rates mean you pay the same amount each month. Banks usually require good credit scores. Check with your bank to see if you qualify. Some banks have special loans for bikes. It’s important to compare different banks. Find the best loan for your needs. Ask about frais cachés. Always read the terms carefully.

Dealers offer financing plans too. They might have special deals for new buyers. Sometimes, dealers have partner banks. This can make the process faster. Dealer financing can be easier for people with bad credit. But, interest rates might be higher. Always negotiate the terms before signing. Check if they offer flexible payment plans. Look out for extra charges. It’s smart to ask many questions. Understand what you’re signing up for.

Questions fréquemment posées

Can I Use A Credit Card For Harley Payments?

Yes, you can use a credit card for Harley payments. However, it depends on the dealership’s payment policies. Some dealerships accept credit cards, while others may not. It’s essential to check with your specific Harley dealership. Using a credit card might incur transaction fees.

What Are The Benefits Of Using A Credit Card?

Using a credit card offers several benefits, including convenience and rewards. You can earn points, cashback, or travel miles. It’s also a secure payment method. Additionally, you may enjoy purchase protection and extended warranties. Check your card’s terms for specific benefits.

Are There Any Fees For Using A Credit Card?

Yes, using a credit card for Harley payments may incur fees. Some dealerships charge a processing fee for credit card transactions. This fee typically ranges from 2% to 4% of the payment amount. It’s advisable to confirm any fees with your dealership before proceeding.

How Do Credit Card Payments Affect Interest Rates?

Credit card payments can affect your interest rates if not paid in full. If you carry a balance, you’ll accrue interest on the remaining amount. Interest rates vary by card, often between 15% and 25%. Paying the full amount monthly avoids additional interest charges.

Conclusion

Paying your Harley payment with a credit card is possible. It depends on your lender’s policies. Some lenders accept credit card payments. Others may not. Check with your Harley lender first. Know their payment options and any extra fees. Using a credit card can be convenient.

But be cautious about interest rates. They can add up quickly. Always consider your budget. Choose the best payment method for you. This ensures your financial health. Happy riding and smart spending!