¿Cuándo vence el pago inicial para una casa de nueva construcción? Momento clave

Buying a new construction home is an exciting venture, promising a fresh start in a space that’s entirely yours. But as you navigate through floor plans and finishes, a crucial question arises: When is your down payment due?

Understanding this timing is key to planning your finances and ensuring a smooth purchase process. Knowing exactly when you need to have your funds ready can alleviate stress and help you feel more in control. This article will guide you through the timeline of down payments for new construction homes, ensuring you have all the information you need right at your fingertips.

Dive in to learn more about this important step in your home-buying journey and prepare yourself for a seamless experience.

Down Payment Basics

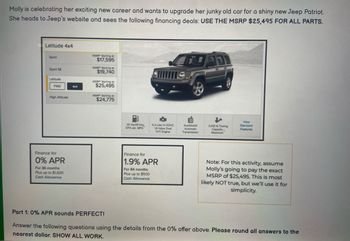

A depósito is the first payment for a new home. It is a part of the total home price. This payment shows that you are serious about buying. It is usually a percentage of the home’s price. A common down payment is 20%. Some people may pay less, like 5% or 10%. The more you pay upfront, the less you borrow.

Down payments are very important in buying a home. They reduce the amount you need to borrow. This means less interest in the long run. A higher down payment can make loans easier to get. It shows lenders you can save money. If your down payment is low, you might pay extra fees. These are called mortgage insurance fees. Paying a bigger down payment can avoid these fees.

New Construction Home Purchase

Buying a new construction home is different. Traditional homes are ready to move in. New construction homes need time to build. Buyers must wait longer. Down payment timing varies. Builders set their rules. Sometimes, payments are due early. Other times, they are due later.

Buyers need to know the builder’s rules. Understand the payment plan. Make sure funds are ready. Read contracts carefully. Know the timeline. Plan for changes. Construction can have delays. Stay flexible. Be prepared for surprises. Communication with the builder is key.

Timing Of Down Payment

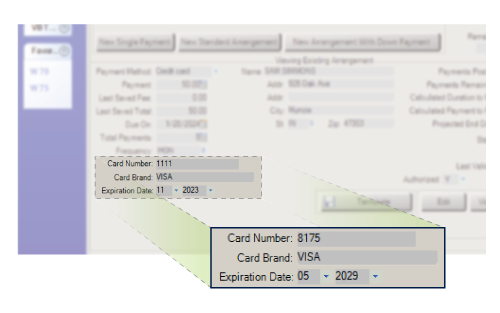

El depósito inicial is usually due when you sign the contract. This deposit shows you are serious about buying the home. It can range from 1% to 3% of the home’s price. Make sure to check the builder’s rules on deposits. Some builders might ask for more.

Payments often match key steps in building. These are called milestones. First is the foundation. Next is when the framing is up. Then comes the roof and walls. Each step shows progress in building your home. Builders may ask for payments at each step. This keeps the project moving forward. Check your contract for exact details.

Factors Influencing Down Payment Timing

Builders have different rules for down payments. Some want payment before building starts. Others ask for money at different stages. It’s important to know these rules early. Understanding builder policies helps plan better.

Loan terms affect when you pay. Some loans need payments early. Others allow later payments. It’s crucial to check loan conditions before deciding. These rules can change how you manage money.

Negotiating Down Payment Terms

Builders often set the depósito requirements. It’s important to understand their terms. Some builders might ask for 20% of the total cost. Others might request a different percentage. Understanding these terms is key. Builders may offer planes de pago flexibles. This can be helpful for buyers. Discussing payment options can lead to better terms. Always ask about any hidden fees. These might add up to the total cost.

Real estate agents can be very helpful. They know how to talk to builders. They can help negotiate better terms. Agents understand the market well. They guide buyers through the process. An agent can explain términos complejos. This makes the process simpler. They ensure fair deals for buyers. Agents help with paperwork too. This saves time and reduces stress.

Financial Planning Tips

Planning for a new home needs a clear budget. Start by checking your current savings. Then, look at monthly income and expenses. List essential costs like food, transport, and bills. This helps find what you can save each month. Set a savings goal for your home down payment. Avoid spending on extras. Save more by cutting non-essential buys.

Keep track of your savings progress. Use a notebook or app. Having a budget plan makes saving easier.

Understand the payment schedule for your new home. Know when each payment is due. Builders often ask for payments at different stages. It’s important to be ready for these. Check the contract for payment dates. Plan your finances so you don’t miss any payment. Missing payments can cause stress and extra fees.

Talk to your builder if you need clarity. Being organized helps keep your home dream on track.

Potential Challenges

Delays in Construction can create confusion. Home buyers might feel stressed. Builders sometimes face unexpected problems. Bad weather can slow down work. Materials might arrive late. These factors can push back deadlines. Buyers should plan for possible changes. Flexibility is key during this time. Staying in touch with builders helps. Regular updates can ease worries.

Changing Financial Conditions is another concern. Economic shifts can affect interest rates. Rates might go up or down. This impacts monthly payments. Planning budgets becomes tricky. Future expenses may change unexpectedly. Buyers need to be aware of these risks. Consult financial advisors for guidance. Staying informed can protect buyers.

Legal And Contractual Considerations

A purchase agreement is a legal paper. It tells the rules of buying a home. The depósito amount and due date are in this paper. You must read it carefully. It is important to understand each part. Ask questions if confused.

Protecting your money is important. Use the agreement to keep your interests safe. It tells what happens if something goes wrong. Make sure all promises are in the contract. A lawyer can help explain tricky parts. This way, you know your money is safe.

Preguntas frecuentes

When Is Down Payment Due For New Construction Home?

The down payment is usually due at contract signing. This ensures your commitment to the purchase. However, specific timelines can vary. Builders might have different requirements. Always check your contract for exact details. It’s important to discuss with your builder or lender.

How Much Is The Down Payment For New Construction?

The down payment typically ranges from 5% to 20% of the home’s price. The exact amount depends on your lender’s requirements. Builder-specific terms might also affect this. Always consult with your lender for accurate details. Your financial situation can also influence the down payment amount.

Can I Negotiate The Down Payment Terms?

Yes, negotiating down payment terms is possible with some builders. Builders might offer flexibility depending on market conditions. It’s beneficial to discuss your options. Your negotiation might also include other incentives. Always communicate with your builder about potential adjustments.

What Happens If Down Payment Is Late?

If your down payment is late, you might face contract cancellation. Some builders offer grace periods. However, it’s crucial to communicate any delays. Penalties or loss of incentives could also occur. Always strive to meet the agreed deadlines.

Conclusión

Understanding when the down payment is due is crucial. It helps in planning finances better. For new construction homes, timing can vary. It’s often required at contract signing. Sometimes later, depending on the builder’s policy. Contact your builder for exact details.

This ensures no surprises during the process. Preparing early is always a good idea. Consult with your financial advisor too. They can provide guidance tailored to your situation. Having clear information makes home buying smoother. And less stressful. So, stay informed and proactive.

Your dream home awaits!