¿Cuánto será el pago mensual de Molly?: Una guía detallada

Are you curious about how to calculate monthly payments? Maybe you’re in the same boat as Molly, trying to figure out the exact amount she’ll owe each month.

Whether you’re planning a big purchase, considering a loan, or just love numbers, understanding this is vital. Knowing Molly’s monthly payment can shed light on your own financial commitments and help you manage your budget better. Imagine the peace of mind that comes with knowing exactly what you owe and when.

We’ll break down the process and give you the tools you need to calculate your own payments with ease. Dive in and discover how you can take control of your financial future, just like Molly.

Factors Influencing Monthly Payments

El principal amount is the money borrowed. A larger principal means higher payments. Smaller principal, lower payments. It’s simple. This amount is the base of the loan. The principal affects how much you pay monthly.

El tasa de interés is the cost of borrowing money. Higher interest rates increase monthly payments. Lower rates reduce payments. Interest is charged on the principal. It can change over time. Fixed rates stay the same. Variable rates can go up or down.

Loan term is the time to repay the loan. Longer terms mean smaller payments. But, you pay more interest overall. Shorter terms increase monthly payments. Yet, you pay less interest total. Choose wisely based on your budget.

Types Of Loans

Fixed-rate loans have the same interest rate for years. This means Molly’s monthly payment is always the same. No surprises or changes. It is easy to plan a budget with these loans. They are good for people who want a steady payment. Some people feel safer with fixed payments.

Variable-rate loans have interest rates that change over time. Molly’s payment can go up or down. This depends on the market rates. Sometimes, the payment might be low. Other times, it might be high. These loans can be risky. They can be cheaper or more expensive in the long run.

Interest-only loans mean Molly pays only the interest for some years. The loan balance does not get smaller. Payments are smaller at first. Later, payments will be higher. This is because she will then pay the full balance. This type is for those who expect more money in the future.

Calculating Monthly Payments

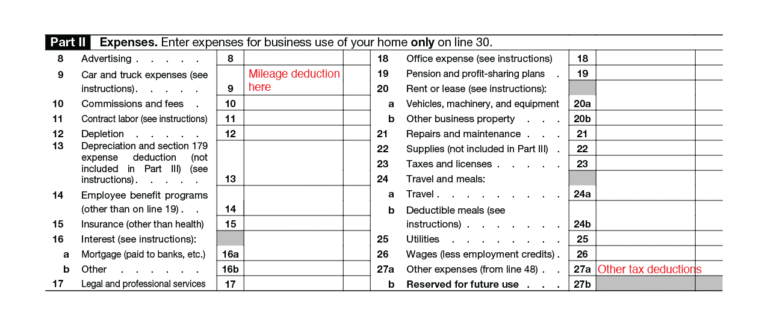

El amortization formula helps to find monthly payments. You need the loan amount, interest rate, and loan term. Plug these numbers into the formula. It calculates how much Molly pays each month. This method breaks down the loan into equal payments. Interest and principal are covered. Simple math makes it work.

Online calculators make it easy to find monthly payments. Enter the loan amount, interest rate, and term. The calculator does the math. It shows the monthly payment amount. No need to do calculations by hand. Saves time and effort. Many websites offer free calculators. They help you understand payments quickly.

Financial software can calculate payments too. It uses data like loan details and interest rates. The software gives the monthly payment amount. It’s easy to use and very accurate. Many people use it for budgeting. It helps in managing finances well. Software tools are very reliable for calculations.

Impact Of Credit Score

Credit scores range from 300 to 850. Scores below 580 are poor. Scores between 580 and 669 are fair. Scores from 670 to 739 are good. Scores from 740 to 799 are very good. Scores above 800 are excellent. Higher scores mean better loan offers.

Interest rates change with your credit score. A high score often leads to low rates. A low score can mean high rates. This affects monthly payments. A low interest rate means less to pay each month. More savings. A high interest rate means more to pay each month. Less savings.

Additional Costs

Insurance premiums are necessary for home protection. These payments cover damages. You pay them every month or year. They add to your costs. Always plan for these payments.

Property taxes are paid to the government. The amount depends on your home value. Taxes can change each year. Always check your tax bill. Include them in your budget.

Private Mortgage Insurance (PMI) is needed if your down payment is small. It protects the lender. PMI increases your monthly costs. It stops when you have enough equity. Understand how PMI works.

Strategies To Lower Payments

Molly can lower her monthly payment by refinancing her loan. Choosing a longer repayment term can also help. Exploring these strategies can ease financial pressure and make payments more manageable.

Refinancing Options

Molly can save by choosing refinancing. It helps get a lower tasa de interés. This means smaller monthly payments. She might also extend the loan period. This spreads the cost over a longer time. Refinancing can reduce stress on monthly budgets. It can be a smart choice for many.

Extra Payments

Paying a bit more each month can help. Extra payments cut down the principal faster. This means less interest over time. It can shorten the loan term too. Even small amounts help. It brings the end closer and saves money.

Loan Modification

Loan modification is another way to ease payments. Lenders might change terms to fit Molly’s needs. This can include lower rates or extended periods. It’s important to check if this option is available. It can be a relief for those struggling.

Budgeting For Loan Payments

Creating a financial plan helps control money. List all sources of income. Write down regular expenses. Include bills, groceries, and rent. Subtract total expenses from total income. This shows extra money each month. Use this for loan payments. Always plan for unexpected costs.

Emergency fund importance is crucial. Save money for emergencies. It helps during tough times. Keep at least three months of expenses saved. This fund protects from debt. It gives peace of mind. Use it for medical bills or car repairs. Never use it for regular expenses.

Debt-to-Income ratio measures financial health. Compare monthly debt to monthly income. Lower ratios are better. It shows you can pay debts. High ratios mean more risk. Aim for a ratio below 36%. Calculate by dividing debt payments by income. It helps in loan approval.

Preguntas frecuentes

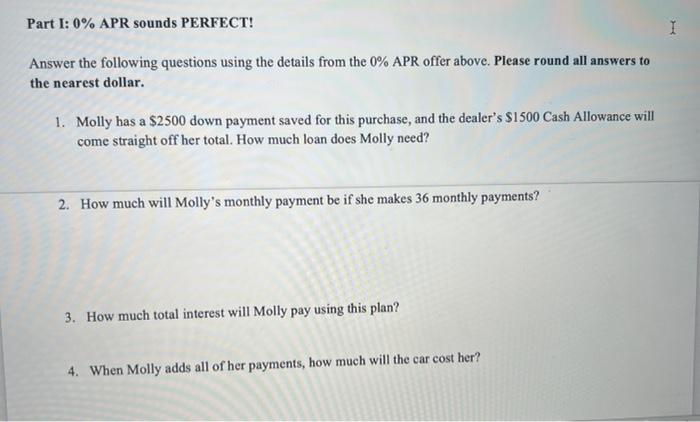

What Factors Affect Molly’s Monthly Payment?

Molly’s monthly payment depends on several factors. These include the loan amount, interest rate, and loan term. Additionally, her credit score and down payment can impact the payment amount.

How Can Molly Calculate Her Monthly Payment?

Molly can use an online loan calculator to estimate her monthly payment. She needs to input the loan amount, interest rate, and loan term. This tool provides a quick and accurate estimate.

Does Loan Term Affect Molly’s Monthly Payment?

Yes, the loan term directly affects Molly’s monthly payment. A longer loan term typically results in lower monthly payments. However, it may lead to higher overall interest costs.

Can Molly Reduce Her Monthly Payment?

Molly can reduce her monthly payment by refinancing her loan. She might also consider extending the loan term or improving her credit score. Making a larger down payment can also help.

Conclusión

Understanding Molly’s monthly payment helps her plan her finances better. She can track expenses and budget wisely. This ensures she meets her financial goals. Calculating payments is crucial for financial security. Knowing exact amounts reduces stress. It offers clarity and peace of mind.

Molly can make informed decisions on spending. This knowledge empowers her to save more. It also helps in avoiding unnecessary debt. Proper planning is key to financial success. By staying informed, Molly can maintain a healthy financial life. Keep these tips in mind for smart financial management.