¿Qué sucede si no realiza un pago en Shop Pay? Consecuencias reveladas

Have you ever found yourself in a situation where you missed a Shop Pay payment? You’re not alone, and it’s more common than you might think.

Missing a payment can stir up a whirlwind of questions and concerns. You might wonder about the impact on your credit score, or if there are any hidden fees that could sneak up on you. The good news is, you’re in the right place to find out exactly what happens next.

This article will guide you through the possible outcomes of missing a Shop Pay payment, offering clear insights and practical advice. By the end, you’ll have a clear understanding of the steps you can take to minimize any negative effects. Let’s dive in and unravel the mystery together, so you can regain control and peace of mind.

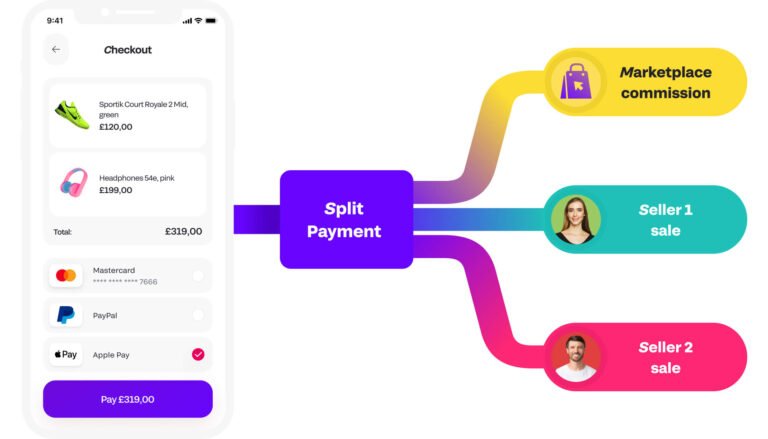

Shop Pay Payment Basics

Shop Pay helps you pay in parts. It splits the total cost. This makes buying easier y affordable. You need to pay on time. Missing a payment can cause trouble. You might pay extra fees. Extra fees mean more money from your pocket. Your puntuación crediticia may go down. A low score makes future loans harder. Remember to check payment dates. Set reminders to pay on time. This keeps your score safe. It avoids extra fees. Shop Pay works best when you follow rules.

Impact On Credit Score

Missing a Shop Pay payment can affect your puntuación crediticia. Companies report late payments to credit bureaus. This can lower your score. A lower score can make it hard to borrow money. Paying on time helps keep your score high. Always try to pay on the due date.

If you miss a payment, check your account. See if you can pay it soon. Contact the company for help. They might offer a payment plan. Paying late fees can add to your costs. Try to avoid them.

Late Fees And Penalties

Missing a Shop Pay payment can lead to cargos por pagos atrasados. These fees make your total bill bigger. Sometimes, you might see extra penalties too. These penalties hurt your wallet. Your credit score may drop too. A lower score is not good. It can affect future loans. You might pay higher interest rates. Shop Pay may charge interest on unpaid amounts. This interest grows over time. The more you wait, the more you pay. Always check the terms before you agree. Some plans have stricter rules. Paying late can cause stress. It’s best to pay on time. This keeps your score safe. Remember, late payments can hurt. Try to set reminders to pay. This helps avoid extra costs.

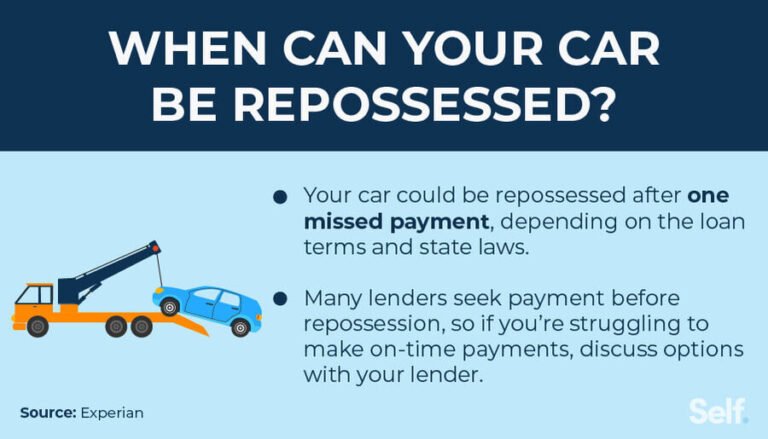

Potential Legal Actions

Missing a Shop Pay payment can lead to cuestiones legales. Companies might send cartas de advertencia first. If ignored, they could take acción legal. This might include court orders to pay what is owed. Legal fees might also be added. It’s important to check your payment plan. Always try to pay on time. This helps avoid problema.

Late fees can make the debt bigger. Some may even contact a lawyer. It’s better to communicate early. Solve problems before they get worse. Kids can understand this too. Paying bills is important. It keeps things easy and simple.

Effects On Future Purchases

Missing a Shop Pay payment can make future shopping hard. Stores may not allow you to use Shop Pay again. You might have to pay with a different method.

Your account could show a warning sign. Other payment services might also notice. It is important to pay on time.

Keeping a good payment history helps. It makes buying things smoother next time. Paying late can cause extra fees. Avoiding these fees saves money.

Communication From Shop Pay

Missing a Shop Pay payment alerts their team. They reach out to you quickly. You might get an email or a call. This is to remind you about the missed payment. It’s important to respond soon. They may offer help. Help can be in the form of advice or options. This can include setting up a new payment plan. Or discussing any issues you face. Communication is key. It’s important to keep the lines open. Shop Pay wants to help. They aim to keep your account in good standing. Missing payments can lead to late fees. These fees can add up. Staying in touch helps avoid this. Always check your emails for updates.

Options For Resolution

Missing a Shop Pay payment can lead to late fees or account suspension. Options for resolution include contacting customer support or adjusting your payment plan. It’s essential to act quickly to avoid further complications and ensure your account remains in good standing.

Payment Plans

Missing a Shop Pay payment can be stressful. Planes de pago offer a way out. You can divide your amount into smaller parts. Pay these parts over time. Flexible plans make payments easier. They fit into your budget. Shop Pay aims to help you with manageable options. Choose what suits you best. Stay on track with your payments.

Negotiation Tactics

Negotiation tactics can help if you miss a payment. Talk to the service provider. Explain your situation clearly. Ask for a possible solution. They might offer a new payment schedule. This can ease your burden. Honest communication is key. Be open about your needs. Reach a mutual agreement. Aim for a win-win situation.

Tips For Avoiding Missed Payments

Make a list of all your monthly expenses. This helps track where money goes. Divide your income into needs, wants, and savings. Needs are things like food and rent. Wants are extras like movies or games. Save a bit from each paycheck. This builds a cushion for emergencies. Use apps to track spending. They show where you spend most. Review your budget often. Adjust if things change. A good budget reduces stress and worry.

Use calendars to mark payment dates. Set alerts a few days before due dates. This gives time to prepare. Use phone alarms as reminders. Many apps offer reminders for bills. Emails can also remind you. Always check your messages. Write payment dates on a big calendar at home. This keeps everyone in the loop. Missed payments can lead to extra fees. Stay ahead with reminders.

Preguntas frecuentes

What Are The Consequences Of Missing A Shop Pay Payment?

Missing a Shop Pay payment may lead to late fees or penalties. Your credit score could be affected if not addressed promptly. It’s important to contact Shop Pay customer service for assistance and possible payment arrangements.

Can I Reschedule A Shop Pay Payment?

Yes, you can often reschedule a Shop Pay payment through their app or website. It’s best to act quickly and adjust the payment date before the due date to avoid additional fees.

Will My Credit Score Be Affected By Missing A Payment?

Yes, missing a Shop Pay payment can negatively impact your credit score. Late payments are usually reported to credit bureaus. It’s crucial to make payments on time to maintain a healthy credit score.

How Can I Avoid Missing Shop Pay Payments?

To avoid missing payments, set up automatic payments or reminders. Regularly review your payment schedule and ensure adequate funds in your account. Contact Shop Pay if you foresee any payment challenges.

Conclusión

Missing a Shop Pay payment might affect your financial health. Stay informed about potential fees and credit impacts. Prioritize your payments to avoid complications. Consider setting reminders for due dates. This can help manage your obligations better. Communicate with Shop Pay if issues arise.

They may offer solutions. Keep track of your spending habits. This ensures future payments are made on time. Financial discipline is key. Protect your credit score and financial standing by staying proactive. Always aim to fulfill your payment agreements promptly.