¿Es el depósito de garantía lo mismo que el pago inicial? Diferencias clave

Are you planning to buy a home and finding yourself tangled in a web of unfamiliar terms? You’re not alone.

Two phrases that often cause confusion are “earnest money” and “down payment. ” At first glance, they might seem interchangeable, but they serve very different purposes in the home-buying process. Understanding the distinction between the two is crucial for making informed financial decisions and ensuring a smooth transaction.

This article will unravel the mysteries behind these terms, providing clarity and confidence as you step closer to owning your dream home. Don’t let confusion stand in the way of your new beginning—read on to discover what sets earnest money apart from a down payment.

Concept Of Earnest Money

Earnest money is a small amount paid to show you are serious. It is like a promise. It tells the seller, “I want to buy your house.” The dinero goes into a special account. This shows you really mean it. If you change your mind, you might lose the money. But if the deal goes through, the money counts toward the house. Not the same as a depósito. A down payment is much bigger. It is part of the total price. Earnest money is just to hold the house. Think of it as a token of good faith. It keeps the deal safe for both sides.

Purpose Of Earnest Money

Earnest money shows the buyer’s seriousness. It tells the seller the buyer means business. This money is like a promise. It tells the seller that the buyer will not back out easily. Without earnest money, sellers might not trust the buyer. It is like a small part of the total payment.

If a buyer changes their mind, they might lose this money. But if the sale goes through, the earnest money becomes part of the payment. It keeps both sides honest and fair. This small amount can make a big difference. It is not the same as a down payment. Down payment is a big amount, while earnest money is a small start.

Role Of Down Payment

A depósito is money you pay when buying a home. It shows the bank you are serious. The bank wants you to pay some money first. This money is not a loan. It comes from your pocket. It also helps you get a smaller loan. If you put down more money, you might get a better deal. A big down payment can lower your pagos mensuales.

It protects the bank if you don’t pay back. If you can’t pay, the bank can sell the house. They use the down payment to cover costs. Always save for a down payment. It makes home buying easier. You might need less money to borrow.

Purpose Of Down Payment

A depósito is money you give when buying a house. It shows you are serious about the purchase. Banks like to see this. They want to know you have some money. The down payment makes the loan smaller. This helps you owe less. You also pay less interest over time.

Bigger down payments are better. They can help you get better loan terms. Sometimes, you need at least 20% of the house price. This helps you avoid extra costs. These extra costs are called private mortgage insurance. Always plan how much you can pay. Save money for this big step.

Key Differences

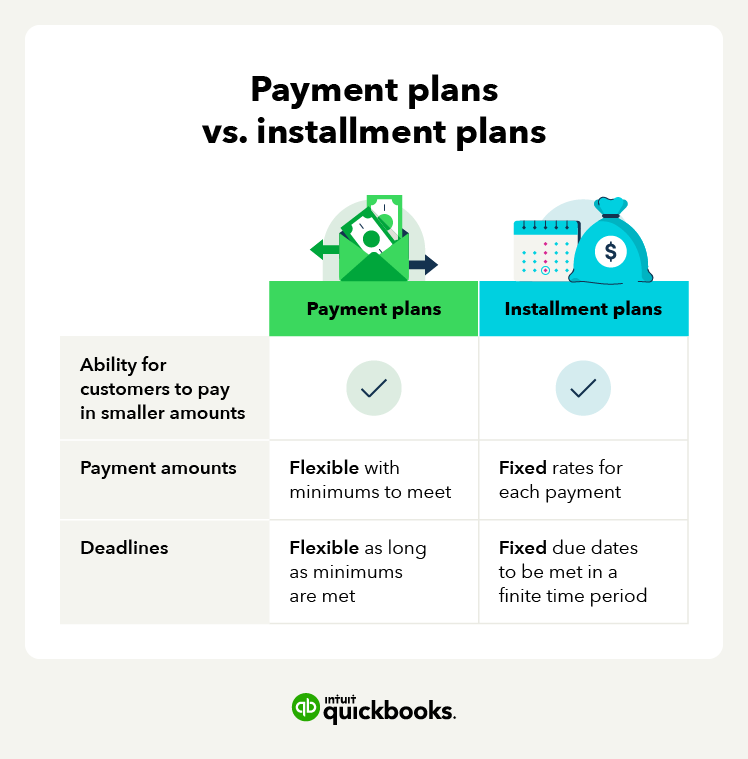

Earnest money is paid early in the buying process. It shows the buyer is serious. The down payment is made later, usually at closing. This is when the home becomes yours.

The amount for earnest money is often 1-3% of the home’s price. The down payment is usually much larger. It can be 10-20% or more of the price.

Earnest money might be refundable. It depends on the deal and contract terms. The down payment is not refundable. This money goes directly toward buying the home.

Earnest money does not lower closing costs. It’s separate from those fees. The down payment can affect these costs. It reduces the total amount financed.

Impact On Buyers

Earnest money is not the same as a down payment. Earnest money shows you are serious about buying. It is a small amount. Down payment is much larger. It is part of the total price. Both need planificación cuidadosa. You must save money for both. This affects your budget. You cannot spend too much elsewhere. Think about your gastos mensuales. Plan wisely.

Earnest money gives you a stronger position. Sellers see you are committed. This can help in negotiations. A good offer includes earnest money. It might lead to better terms. Higher earnest money can make your offer stand out. Sellers may prefer your offer. It shows you are ready to buy. Negotiation becomes easier. You have more power in talks.

Impact On Sellers

Understanding earnest money and down payment is vital for sellers. Earnest money shows a buyer’s serious intent and can impact negotiations. Down payments confirm financial readiness, influencing the seller’s confidence in closing the deal.

Garantía de seguridad

Earnest money offers a strong security assurance for sellers. This money shows that buyers are serious. Sellers feel safe with earnest money. It reduces the risk of buyers backing out. Sellers can trust the buyer’s commitment. This assurance helps in smoother transactions. They know the buyer is not just browsing.

Market Confidence

Earnest money boosts market confidence. Sellers see it as buyer’s trust in the deal. It reflects stability in the real estate market. This confidence can lead to quicker sales. Sellers prefer buyers with earnest money. It creates a positive environment for both parties. Buyers and sellers benefit from this confidence.

Conceptos erróneos comunes

Many people think earnest money y depósito are the same. But they are not. Earnest money shows you are serious about buying a home. It is a small amount paid to the seller. The down payment is larger. It helps you buy the home. Mixing these terms can cause confusion. It’s important to know the difference. Understanding both helps in smart home buying.

Earnest money and down payment have different rules. Earnest money comes with a contract. It binds the buyer and seller. Breaking this contract can lose your earnest money. Down payment is a part of the loan process. It is paid at closing. Both have legal importance. Knowing these details is key. It can save money and stress.

Tips For Homebuyers

Earnest money shows your serious interest in buying a house. It’s like a promise to the seller. This money is not the same as the down payment. Keep it safe and don’t spend it. If you change your mind, you might lose the earnest money. Check the contract to know what happens to it. Ask your agent for help. They will guide you. Make sure you understand all rules. This way, you will avoid surprises. Always stay informed. Being smart with your money is key.

The down payment is bigger than earnest money. It helps reduce loan size. Save money early. This makes buying easier. Talk to banks for advice. They can tell you the best options. Budget wisely and cut extra costs. This helps save more. Ask family for tips. They might have good ideas. Stay focused on your goal. Every dollar counts. Smart planning leads to happy buying.

Preguntas frecuentes

What Is Earnest Money In Real Estate?

Earnest money is a deposit made to show a buyer’s commitment. It’s usually held in escrow. It protects the seller if the buyer backs out. This amount is typically 1-3% of the home’s price. It’s credited towards the purchase once the sale is finalized.

How Does Earnest Money Differ From A Down Payment?

Earnest money is a good faith deposit, while a down payment is part of the home’s purchase price. Earnest money is refundable under certain conditions; down payment is not. The down payment is paid at closing, whereas earnest money is paid when the offer is accepted.

Is Earnest Money Refundable If The Deal Falls Through?

Earnest money is refundable if the contract allows it. Common scenarios include failed inspections or financing issues. If the buyer backs out without a valid reason, the seller may keep it. Always review the terms in the purchase agreement for specific conditions.

Can Earnest Money Be Used As A Down Payment?

Yes, earnest money can be applied towards the down payment. It reduces the amount due at closing. Once the sale is finalized, the earnest money deposit is credited to the buyer. Ensure this is clearly stated in the purchase agreement.

Conclusión

Earnest money and down payment are not the same. Earnest money shows your buying intent. It’s like a deposit. Down payment is part of the total purchase price. It helps secure your loan. Both are crucial in buying a home.

Understand their roles for a smoother transaction. Always consult a real estate expert. Make informed decisions. Your home-buying journey will be less stressful. Remember, knowledge is power in real estate deals. Stay informed and plan wisely.