Cómo transferir dinero a Bielorrusia

You're about to send money to Belarus, but where do you start? First, you'll need to choose a método de transferencia confiable, such as online services like TransferWise or PayPal, which often offer competitive exchange rates and lower fees. But that's not all – you'll also need to guarantee compliance with Belarusian currency regulations and verify the recipient's bank details. You'll want to take into account velocidad de transferencia, medidas de seguridad, and total costs, too. But before you proceed, there's one vital aspect to take into account – one that can make or break the security of your transaction.

Understanding Belarusian Currency Rules

When transferring money to Belarus, you'll need to be aware of the country's strict currency regulations, which are enforced by the National Bank of the Republic of Belarus. You'll want to guarantee compliance to avoid any issues or penalties. The Belarusian ruble (BYN) is the local currency, and there are restrictions on foreign currency transactions. Individuals can hold foreign currency, but there are limits on its use. You'll need to declare foreign currency exceeding $10,000 upon entry and exit. Additionally, currency exchange is only allowed through licensed banks and exchange offices. To transfer money safely, you must understand these regulations. Familiarize yourself with the rules to guarantee a smooth and secure transaction. This knowledge will help you avoid any potential risks or complications.

Elegir un método de transferencia

Several options are available to you for transferring money to Belarus, and the most suitable method depends on factors such as transfer amount, speed, and fees. You can opt for servicios de transferencia de dinero en línea, like those offered by specialized companies. These services usually provide tipos de cambio competitivos, lower fees, and faster transfer times compared to traditional banks. Alternatively, you can use a tarjeta de débito prepaga or a money transfer app. When choosing a transfer method, it is crucial to take into account the recipient's access to the funds, as well as the security and reliability of the transfer method. Look for services that offer medidas de seguridad robustas, transparent fees, and a clear track record of successful transfers. Always research the provider thoroughly to guarantee your money is safe.

Banks That Transfer to Belarus

You'll find that major banks, such as those with a significant international presence, offer money transfer services to Belarus, although their fees and exchange rates may not be as competitive as those of specialized online transfer services. These banks include Citibank, Deutsche Bank, and UniCredit. When using a bank to transfer money, make sure you understand the costos asociados, incluido tarifas de transferencia y márgenes de tipo de cambio. Compare rates among banks and services to get the best option. Also, confirm that the recipient's bank in Belarus can receive international transfers. Verify the SWIFT/BIC code and the recipient's account information before initiating the transfer to prevent errors or delays. Reliable banks prioritize transacciones seguras y confiables, brindándole tranquilidad.

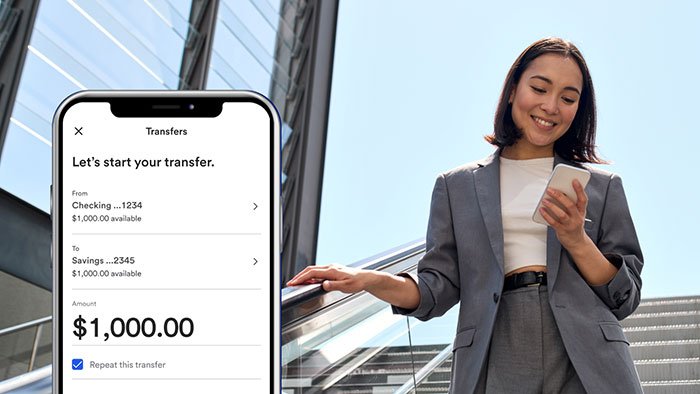

Servicios de transferencia de dinero en línea

Numeroso servicios de transferencia de dinero en línea, such as TransferWise, PayPal, and WorldRemit, offer tipos de cambio competitivos y tarifas más bajas compared to traditional banks for transferring money to Belarus. When using these services, you'll typically need to create an account, provide identification, and link a payment method. You can then enter the recipient's details and initiate the transfer. Most online services provide tracking and updates on the transfer's status. They also often have medidas de seguridad robustas in place, such as encryption and two-factor authentication, to protect your information and funds. Be sure to research and choose a reputable service that is autorizado y regulado by a government agency, such as the Financial Conduct Authority (FCA) in the UK.

Tarifas y cargos por transferencia

Transfer fees and charges for sending money to Belarus can vary considerably depending on the proveedor de servicios, método de pago, and transfer amount. You'll need to check with your chosen provider to determine the exact fees associated with your transfer. Some providers may charge a flat fee, while others may charge a percentage of the transfer amount. Additionally, you may incur fees for using a credit or debit card, or for servicios de traslado acelerado. You should also be aware of any intermediary or correspondent bank fees that may be applied. When comparing providers, consider the total cost of the transfer, including all fees and charges, to guarantee you're getting the best deal. Carefully review the Términos y condiciones before initiating the transfer.

Getting the Best Exchange Rates

To maximize the amount of Belarusian rubles your recipient receives, comparing tipos de cambio among providers is essential, as even slight variations can greatly impact the total value of your transfer. You'll want to look for providers that offer competitive exchange rates and low margins. A lower margin means less of your money is being taken as profit, resulting in more rubles for your recipient. When comparing rates, make sure to check if the provider offers a tasa de mercado medio, which is the wholesale exchange rate that banks use. Some providers may also offer a best-rate guarantee or a rate-matching service, which can give you added peace of mind. Always review the provider's exchange rate policies before initiating a transfer.

Transfer Speed and Reliability

Once you've secured a tipo de cambio competitivo, consider how quickly and reliably your money will reach its destination in Belarus, as the timing of your transfer can be just as important as the amount you're sending. Look for transfer services that offer flexible delivery options, such as same-day or next-day transfers. You'll also want to check the service's reliability by reviewing customer feedback and ratings. A reliable service should have a good track record of delivering funds on time and in full. Additionally, check if the service provides updates on the transfer's progress, so you can stay informed about the status of your transfer. This will give you peace of mind and help you plan accordingly.

Sending Money Securely Online

Asegurando su transacciones en línea is essential when sending money to Belarus, so you'll want to look for services that utilize cifrado robusto, autenticación de dos factores, y lucha contra el blanqueo de capitales protocols to protect your funds. Confirm the service you choose uses cifrado de extremo a extremo, such as SSL or TLS, to safeguard your personal and financial data. You should also opt for two-factor authentication to add an extra layer of security to your transactions. Additionally, verify that the service complies with anti-money laundering regulations to minimize the risk of your funds being intercepted or frozen. By taking these precautions, you can rest assured that your online transactions are secure and your money will reach its intended recipient in Belarus safely.