¿Puedes transferir dinero desde Dasher Direct a una cuenta bancaria fácilmente?

Imagine this: you’ve just finished a busy day of dashing, and your earnings are waiting for you in your Dasher Direct account. Now, the big question is, how do you get those hard-earned funds into your bank account?

You’re not alone in wondering this, and that’s exactly what we’re here to uncover. Understanding how to transfer money from Dasher Direct to your bank account is crucial for managing your finances smoothly and efficiently. This guide will walk you through the process step-by-step, ensuring your money lands safely where you need it.

So, are you ready to take control of your earnings and make every dollar count? Let’s dive in and unlock the potential of your Dasher Direct funds.

Dasher Direct Overview

If you’ve ever dashed for DoorDash, you’ve likely heard of Dasher Direct. It’s a handy tool designed to make managing your earnings smoother and faster. But what exactly is Dasher Direct, and how does it impact your day-to-day life as a Dasher? Let’s break it down.

What Is Dasher Direct?

Dasher Direct is a prepaid debit card specifically for DoorDash drivers. It’s a convenient way to access your earnings quickly without the hassle of waiting for weekly payouts. Imagine finishing your delivery shift and having your earnings available almost instantly.

With Dasher Direct, your earnings are deposited directly onto your card after each dash. This means you can use your money right away for daily expenses or save it for a rainy day. Isn’t it comforting to know that the fruits of your labor are immediately within reach?

Benefits Of Using Dasher Direct

One of the biggest perks of Dasher Direct is instant access to your earnings. No more waiting until the end of the week to get paid. This can be a game-changer if you’re relying on your earnings to cover immediate expenses.

Additionally, Dasher Direct offers cashback rewards on gas purchases. This is particularly useful for Dashers who spend a lot of time on the road. Saving a little on fuel costs can add up over time, leaving more money in your pocket.

How To Sign Up For Dasher Direct

Signing up for Dasher Direct is straightforward. You can apply directly through the DoorDash app. Simply navigate to the ‘Earnings’ section and follow the prompts to enroll.

Once approved, you’ll receive your Dasher Direct card in the mail. Activation is easy, and you’ll be all set to start enjoying the benefits. Why not take advantage of a system designed to make your life easier?

Considerations Before Using Dasher Direct

Before diving in, consider if Dasher Direct aligns with your financial habits. Some drivers prefer direct deposit into their bank accounts for budgeting reasons. Reflect on what works best for you and your financial goals.

It’s also worth noting any fees associated with the card. While many transactions are free, certain activities might incur charges. Always check the fine print to avoid surprises.

Have you ever thought about how quickly accessing your earnings might change your spending habits? It’s a good idea to set a plan to manage your finances wisely.

Linking Dasher Direct To A Bank Account

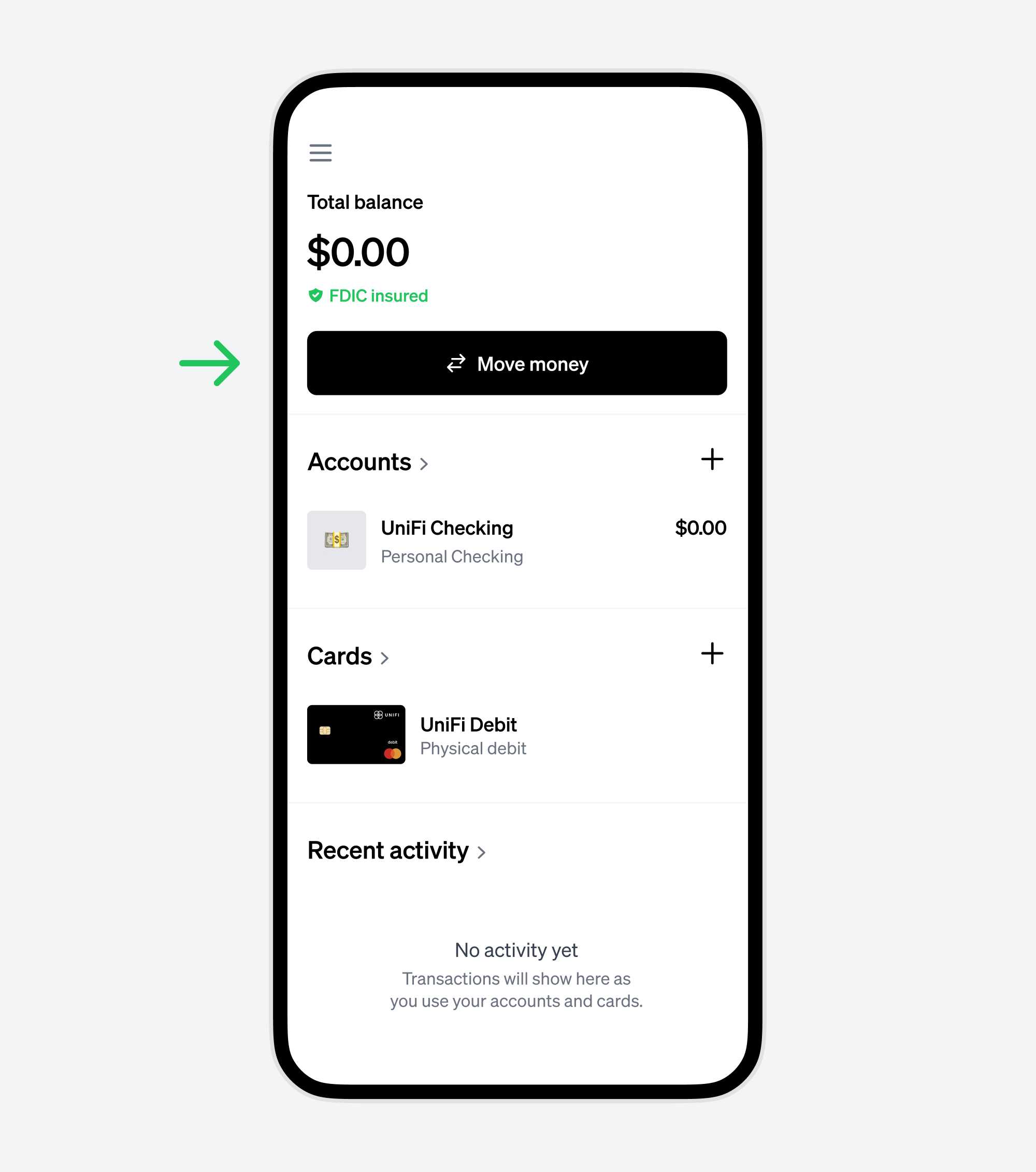

Transferring money from Dasher Direct to a bank account is straightforward. Open the Dasher Direct app, select ‘Transfer,’ and enter your bank details. Funds typically transfer within a few business days.

Linking Dasher Direct to a Bank Account can be a straightforward yet rewarding process, offering greater flexibility in managing your finances. Imagine the convenience of transferring your hard-earned money directly to your bank account, allowing you to use it for bills, savings, or everyday expenses. It’s a simple setup that can make your financial life much easier. But what does it take to get started? Let’s explore the steps and requirements to connect your Dasher Direct account to your bank.Requirements For Linking

Before you dive into linking your accounts, ensure you have everything you need ready. You’ll need your Dasher Direct account credentials and your bank account details, such as the account number and routing number. Make sure your bank supports electronic transfers. Most major banks do, but a quick check can save you time. You’ll also need a stable internet connection to smoothly complete the linking process.Pasos para conectar cuentas

Connecting your Dasher Direct account to your bank is easier than you might think. Start by logging into your Dasher Direct app. Navigate to the ‘Transfer Money’ section, which is often clearly labeled for your convenience. Next, select the option to add a bank account. You’ll be prompted to enter your bank account details. Double-check these numbers to avoid any hiccups in the process. After entering the required information, confirm the connection. Your bank may require a verification step, like confirming a small test deposit. This ensures your accounts are securely linked. By following these simple steps, you can seamlessly transfer funds from your Dasher Direct account to your bank account. Have you considered how this could simplify your financial management? Reflect on the benefits of having easy access to your earnings and take control of your financial future today.Transferring Money Process

Transferring money from Dasher Direct to a bank account is straightforward. Access your Dasher Direct app, select the transfer option, and input your bank details. Funds typically move quickly, ensuring easy access to your earnings.

Iniciando la transferencia

To start the transfer, log into your Dasher Direct app. Navigate to the ‘Transfer’ section, which is usually easy to spot on the main dashboard. Once there, you’ll find a prompt to add your bank account details. Double-check your account and routing numbers to avoid any hiccups. Have you ever experienced the frustration of entering the wrong info? Save yourself the hassle by verifying your details. After your account is linked, select the amount you want to transfer. Whether it’s your entire balance or just a portion, the choice is yours. Confirm the transaction, and you’re good to go!Expected Processing Time

So, how long will it take for the money to hit your bank account? Typically, transfers from Dasher Direct can take one to three business days. This timeframe might vary based on your bank’s processing policies. Have you ever noticed how some banks are quicker than others? If speed is crucial, it might be worth considering an account with faster processing times. Keep in mind that weekends and holidays could delay the process. If you need the funds urgently, it’s always wise to initiate the transfer earlier in the week. Understanding these steps and timelines will help you manage your finances better. What other tips or tricks do you use to ensure smooth money transfers? Share your insights in the comments below!Tarifas y cargos

Transferring money from Dasher Direct to a bank account involves specific fees and charges. Users can expect nominal fees for transactions. Understanding these costs helps manage finances better, ensuring smooth transfers without unexpected deductions.

Transferring money from Dasher Direct to your bank account is a straightforward process, but understanding the fees and charges involved is crucial for managing your finances effectively. As you navigate this process, it’s important to know what costs you might encounter and how to avoid unnecessary fees. So, let’s dive into the details and ensure you’re making the most of every dollar.Potential Costs

When transferring funds from Dasher Direct to your bank account, you may face certain costs. While Dasher Direct strives to keep transactions affordable, there are often fees associated with transferring money. These could be minimal, but they add up over time, affecting your earnings. For instance, some banks charge a fee for receiving transfers, especially if they’re international. The fee amount varies from bank to bank, so it’s important to check with your bank beforehand. You don’t want an unexpected charge to eat into your hard-earned cash. Another potential cost is the currency exchange fee if your bank operates in a different currency. This fee is not always transparent, so make sure you understand the rates before proceeding with the transfer.Avoiding Unnecessary Fees

Avoiding fees requires a bit of foresight and planning. First, ensure your bank account is compatible with Dasher Direct transfers to prevent any issues. Checking account compatibility can save you from surprise fees and delays. You can also minimize charges by choosing the right transfer method. Some options might be cheaper than others, so evaluate your choices carefully. In some cases, using an app or a digital wallet linked to your Dasher Direct account might offer lower fees compared to direct bank transfers. Additionally, timing your transfers strategically can help. Consider transferring larger amounts less frequently instead of multiple smaller transactions. This can reduce the overall fees you pay, making your money go further. Remember, every penny counts. Are you aware of all the fees your bank might impose? Taking the time to understand these details can significantly impact your financial outcomes. Engage with your bank’s customer service to clarify any confusing fee structures. Being proactive in your approach ensures that you aren’t caught off guard, helping you keep more of your earnings in your pocket.Solución de problemas comunes

Transferring money from Dasher Direct to a bank account can be easy. Yet, issues may arise during the process. Understanding these common problems can save time and stress. Let’s explore solutions for these issues.

Transferencias fallidas

Sometimes, money transfers fail unexpectedly. This can happen for several reasons. First, check if your bank account details are correct. Any mistake in the account number or routing number can cause failure.

Next, ensure you have a stable internet connection. Poor connectivity can interrupt the transfer process. Also, verify if there are any issues with Dasher Direct’s service. Sometimes, the service might be temporarily down for maintenance.

If the problem persists, contacting customer support can help. They can provide specific guidance based on your situation.

Transacciones retrasadas

Delayed transactions can be frustrating. Generally, transfers should not take long. Yet, delays can occur due to various reasons.

One common reason is bank processing times. Banks might take time to process incoming transfers, especially on weekends or holidays. Checking with your bank about their processing schedule can provide clarity.

Another reason could be high transaction volumes. During peak times, processing might slow down. Monitoring the status of your transfer can help determine if it’s a temporary delay.

If delays continue, reaching out to Dasher Direct support can be beneficial. They can check for any issues on their end and assist further.

Consideraciones de seguridad

Transferring money from Dasher Direct to a bank account involves security considerations. Keeping your financial information safe is crucial. This process requires understanding how to protect personal details and ensuring secure transactions.

Protección de la información personal

Guard your Dasher Direct account details closely. Use strong, unique passwords that are hard to guess. Avoid sharing your account information with others. Be cautious with emails or messages requesting personal details. These might be phishing attempts. Ensure your devices are protected against malware. Regularly update your security software to prevent unauthorized access.

Secure Transfer Tips

Use secure internet connections for transactions. Avoid public Wi-Fi networks which might be vulnerable. Double-check recipient details before initiating a transfer. Mistakes can lead to lost money. Monitor your account regularly for suspicious activity. Enable two-factor authentication for an extra security layer. This adds protection by requiring more than just a password.

These practices help ensure your money transfers remain safe. Protecting your financial data is vital in today’s digital age.

Métodos alternativos

Transferring money from Dasher Direct to a bank account is possible through a few straightforward methods. Users can link their bank account to Dasher Direct, enabling seamless transfers. Explore this option to manage your earnings efficiently.

Transferring money from Dasher Direct to a bank account can sometimes feel like navigating through a maze. You want to ensure your hard-earned cash gets where it needs to be without hiccups. Fortunately, there are alternative methods to make this process smoother. Whether you’re using technology or direct banking options, understanding these methods can help you manage your finances better.Uso de aplicaciones de terceros

Third-party apps can be lifesavers for transferring funds quickly and efficiently. Many of these apps, like PayPal or Venmo, offer features that allow you to link your Dasher Direct account and your bank account. Imagine this scenario: You’re out for coffee, and a friend picks up the tab. You can easily use a third-party app to transfer money from Dasher Direct to your bank account, then pay your friend back instantly. It’s convenient and saves you the hassle of direct transfers. However, it’s crucial to keep an eye on fees. Some apps charge for transfers, especially if you’re moving large sums. Be sure to review any costs associated before you finalize transactions.Transferencias bancarias directas

If third-party apps aren’t your thing, direct bank transfers are a solid alternative. This method involves moving funds directly from your Dasher Direct account to your bank account, typically using an ACH transfer. Picture this: It’s payday, and you want your earnings safely in your bank. By setting up direct bank transfers, you can automate this process. It saves time and ensures your money is in your account without extra steps. Setting up direct transfers might require a bit of effort upfront, like contacting your bank for details or navigating Dasher Direct’s settings. But once it’s done, you can enjoy seamless transfers without lifting a finger each payday. Have you tried one of these methods? Share your experience or tips in the comments!

Preguntas frecuentes

How Do I Transfer Money From Dasher Direct?

To transfer money from Dasher Direct, log into your Dasher app. Navigate to the ‘Banking’ tab and select ‘Transfer Funds’. Follow the prompts to choose your bank account and enter the transfer amount. Confirm the transaction to complete the transfer.

¿Existen tarifas por transferir dinero?

Dasher Direct typically does not charge fees for transferring money to your bank account. However, some banks might charge a fee for receiving funds. It’s best to check with your bank to understand any potential costs involved.

¿Cuánto tiempo tarda la transferencia?

Transfers from Dasher Direct to a bank account usually take 1-2 business days. The exact time may vary depending on your bank’s processing times. Ensure your bank details are correct to avoid delays.

¿Puedo transferir dinero internacionalmente?

Dasher Direct primarily supports domestic transfers. If you need to transfer money internationally, consider alternative services like PayPal or bank wire transfers. Check with Dasher Direct for any updates on international transfer capabilities.

Conclusión

Transferring money from Dasher Direct to a bank account is straightforward. Follow the steps outlined in the app. Ensure your bank details are correct. This avoids delays or errors. Remember, transfers might take some time. Checking your balance regularly helps.

Stay updated with any app changes. This ensures smooth transactions. Always keep your app secure. Protect your financial information. With these tips, managing your funds is easier. Enjoy the convenience of direct transfers. Stay informed and handle your money wisely.