¿Puedes usar dos tarjetas de crédito en línea?

Conduciendo por el mundo de online payments can be a bit tricky, especially when it comes to using multiple credit cards. While some shoppers might find it convenient to split their payments, the reality is that most retailers and payment platforms don't readily accommodate this practice. Before you attempt to use two cards, it's essential to understand the nuances involved, including potential limitations and consideraciones de seguridad. So, what are your options if you're looking to maximize your purchases without running into roadblocks?

Comprender las opciones de pago

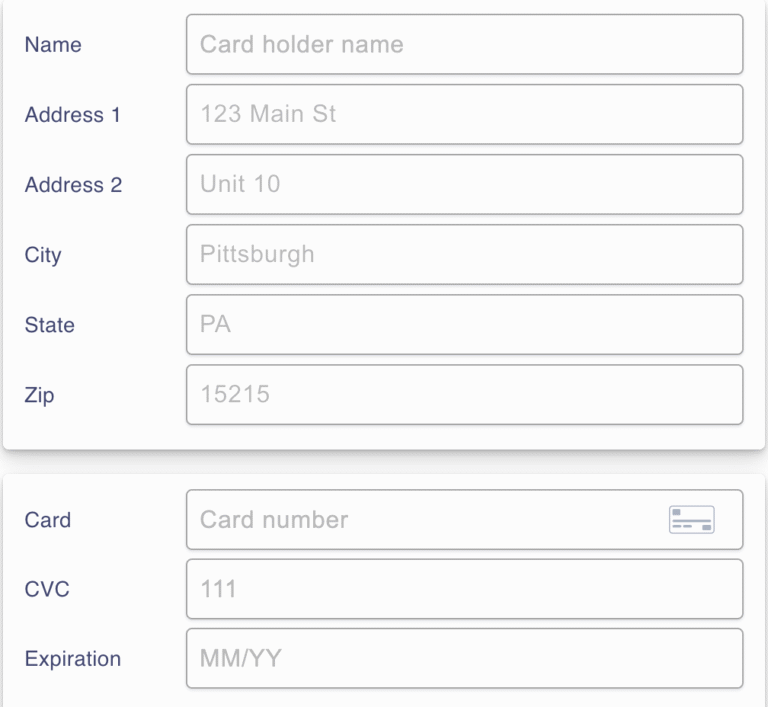

When shopping online, it's essential to know the different payment options available, as they can influence your overall experience and seguridad. Most retailers accept credit and debit cards, but some also offer alternatives like PayPal, Apple Pay, or even cryptocurrency. Each option comes with its own level of security; for instance, using PayPal adds a layer of protection, as your card details aren't shared directly with the retailer. Additionally, consider using tarjetas virtuales provided by some banks for added anonymity. Always verify the website has HTTPS in its URL before entering any payment information. Understanding these options not only enhances your shopping experience but also helps safeguard your financial information against potential fraud.

Retailer Policies on Multiple Cards

Many online retailers have specific policies regarding the use of multiple credit cards for a single transaction, so it's important to check their guidelines before attempting to split your payment. Some retailers may allow it, while others might not. Here are a few things to keep in mind:

- Opciones de pago: Not all platforms support multiple cards at checkout.

- Límites de transacciones: Some retailers may have minimum or maximum amounts for card usage.

- Preocupaciones de seguridad: Splitting payments might raise red flags for fraud detection systems.

Payment Processor Capabilities

¿Cómo hacer? procesadores de pagos handle transactions involving multiple credit cards? Most standard payment processors don't support splitting payments directly between two cards. When you attempt this, the system usually prompts you to choose one card for full payment. Some retailers may offer partial payment options through their custom interfaces, but this isn't universal.

If you want to use two cards, you might consider making separate transactions or checking if the retailer allows it. Always verify that the payment processor you're using is seguro y conforme with safety standards, such as PCI DSS. Protecting your información financiera is vital, so look for processors with encryption and fraud protection measures in place. This way, you can shop confidently, knowing your data is safe.

Benefits of Using Two Cards

Using two credit cards can offer you greater flexibility in managing your finances and maximizing rewards. By strategically using both cards, you can enhance your purchasing power and protect your financial interests. Here are some benefits to evaluate:

- Reward Optimization: Different cards may offer better rewards for various categories, like groceries or travel.

- Emergency Backup: If one card gets declined or lost, you've got a secondary option ready.

- Utilización del crédito: Spreading purchases across two cards can help keep your credit utilization ratio lower, benefiting your credit score.

Limitaciones y desafíos

While having two credit cards can offer advantages, it also comes with limitations and challenges that you should consider before proceeding. For starters, not all online merchants allow you to split payments between two cards, which could limit your purchasing flexibility. Additionally, using multiple cards can complicate your budgeting and tracking expenses, making it easier to overspend. Security concerns also arise, as managing more accounts means more opportunities for fraud or unauthorized transactions. You'll need to stay vigilant about monitoring both cards for suspicious activity. Finally, juggling multiple due dates can increase the risk of pagos atrasados, leading to late fees and potential damage to your credit score. It's crucial to weigh these factors carefully before deciding.

Tips for Splitting Payments

When splitting payments across two credit cards, it's essential to check if the online merchant supports this option during checkout. Many retailers may not allow this feature, so verify before proceeding. Here are some tips to keep in mind:

- Verify Merchant Policies: Always read the payment guidelines on the website.

- Use Total Amounts: Clearly allocate the total amount you want to charge to each card.

- Monitor Transactions: Keep track of your purchases to confirm both charges appear correctly on your statements.

Alternatives to Using Two Cards

If splitting payments isn't feasible, consider other options like using a billetera digital o planes de financiación a manage your purchases more effectively. Digital wallets, such as PayPal or Apple Pay, allow you to store multiple cards securely and make transactions without revealing your card details to merchants. This adds an extra layer of security to your purchases.

Alternatively, financing plans offered by retailers can help you break down larger expenses into pagos mensuales manejables. Just be sure to read the terms carefully and understand any interest rates involved. Both options can enhance your purchasing experience while keeping your seguridad financiera in mind, allowing you to shop confidently without the need for multiple credit cards.

Managing Credit Card Rewards

Managing credit card rewards effectively can enhance your shopping experience, especially when you're using two cards for online purchases. To maximize your benefits, consider the following strategies:

- Know Your Rewards: Familiarize yourself with the rewards structure of each card and use them accordingly.

- Combine Offers: Look for promotions that allow stacking rewards or cashback from both cards.

- Track Expirations: Keep an eye on expiration dates for points or cashback to guarantee you don't lose out.

Future Trends in Online Payments

Several emerging technologies are reshaping the landscape of online payments, making transactions faster, safer, and more convenient for consumers. One significant trend is the rise of autenticación biométrica, like fingerprint and facial recognition, which adds an extra layer of security. Additionally, billeteras digitales are gaining traction, allowing you to store multiple payment methods securely in one place. Criptomonedas are also being integrated into e-commerce, providing anonymity and security for those who prefer it. Furthermore, artificial intelligence is helping detect transacciones fraudulentas in real-time, enhancing your safety. As you navigate these advancements, staying informed about the latest security measures can help you make secure online purchases confidently. Embracing these trends will likely streamline your shopping experience while keeping your information protected.