Cómo cancelar mi tarjeta de crédito One

Podrías pensar cancelar su tarjeta Credit One Es un fastidio, pero no tiene por qué ser complicado. Antes de iniciar el proceso, es importante tener en cuenta algunos pasos clave para garantizar que todo salga bien. Conviene revisar su... estado de la cuenta, pagar cualquier saldo restantee incluso canjear tus puntos de recompensa. Pero, ¿qué sucede después de contactar con el servicio de atención al cliente para confirmar la cancelación? Entender las implicaciones para tu... puntuación crediticia y cualquier detalle final es esencial, así que exploremos lo que necesitas saber a continuación.

Evalúe sus motivos de cancelación

Antes de ti cancelar su tarjeta de créditoEs importante tomarse un momento para evaluar las razones por las que lo hace. ¿Está... luchando con la deuda, o quieres simplifica tus finanzasConsidere si las comisiones y tasas de interés de la tarjeta superan sus beneficios. Si no está satisfecho con las recompensas o el servicio al cliente, eso también es válido. Sin embargo, piense en su... puntuación crediticiaCancelar una tarjeta puede reducir su saldo si se trata de una de tus cuentas más antiguas. Evalúa si planeas solicitar préstamos o hipotecas pronto, ya que esto podría afectar tu solvencia. Al comprender tu motivación, puedes tomar una decisión más informada y acorde con tus necesidades. objetivos financieros y garantiza tu seguridad en la gestión de tus finanzas.

Verifique el estado de su cuenta

Después de reflexionar sobre los motivos de la cancelación, es importante que revises tu estado de la cuenta Para garantizar que toma una decisión informada, comience iniciando sesión en su cuenta en línea o revisando sus estados de cuenta más recientes. Busque cualquier cargos pendientes, puntos de recompensao servicios de suscripción vinculados a su tarjeta. Asegúrese de que no haya transacciones pendientes que podrían afectar su saldo. Además, verifique la fecha de vencimiento de su próximo pago para evitar cargos por mora. Comprender el estado de su cuenta le ayuda a evitar sorpresas y le asegura estar completamente al tanto de sus obligaciones. Es fundamental tener una idea clara de sus situación financiera Antes de proceder con el proceso de cancelación, podrá proteger su historial crediticio y su salud financiera.

Pague su saldo

Es fundamental liquidar el saldo total antes de cancelar la tarjeta de crédito para evitar deudas persistentes y posibles intereses. Esto no solo le ayudará a mantener su salud financiera, sino que también simplifica el proceso de cancelación. Aquí tiene una breve lista de verificación para guiarle:

| Pasos para liquidar su saldo | Notas importantes |

|---|---|

| Revisa tu saldo actual | Asegúrese de saber el monto total adeudado. |

| Realizar un pago | Utilice su método de pago preferido. |

| Confirmar pago recibido | Verifique su cuenta para asegurarse de que esté procesada. |

| Contactar con atención al cliente | Si tienes preguntas o inquietudes. |

Canjear puntos de recompensa

Mucha gente pasa por alto la importancia de canjeando sus puntos de recompensa Antes de cancelar una tarjeta de crédito, estos puntos pueden agregar un valor significativo a sus finanzas generales. Antes de proceder con la cancelación, tómese un momento para revisar su cuenta en busca de cualquier... recompensas acumuladasEstos puntos pueden canjearse por devolución de efectivoTarjetas de regalo o beneficios de viaje que podrían mejorar tu situación financiera. No desperdicies estos beneficios.

Asegúrese de revisar el políticas de vencimiento asociados con sus recompensas; algunos puntos pueden vencer poco después del cierre de la cuenta. Al canjear sus puntos, puede maximiza tus beneficios Y asegúrate de aprovechar al máximo tu tarjeta de crédito antes de despedirte. Es un paso sencillo que puede marcar una gran diferencia.

Contactar con atención al cliente

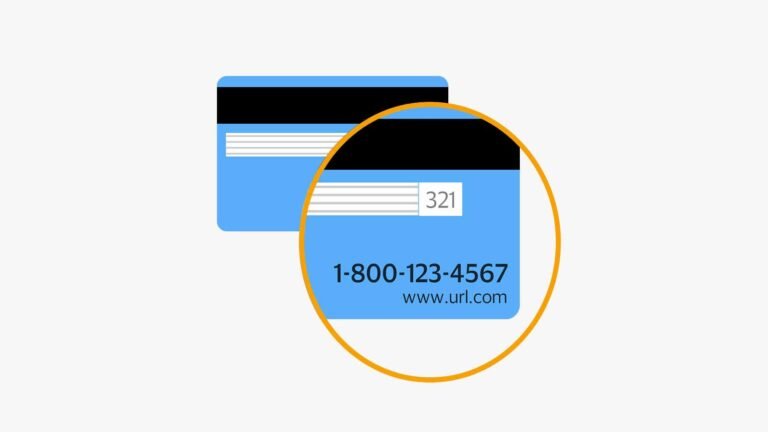

Una vez que haya canjeado sus puntos de recompensa, el siguiente paso es Contactar con atención al cliente Para iniciar el proceso de cancelaciónPuede comunicarse con ellos llamando al número que aparece en el reverso de su tarjeta o a través de su sitio web oficial. Cuando se comunique con un representante, asegúrese de tener su... información de la cuenta a manoEsto ayudará a agilizar el proceso y garantizará que su solicitud se gestione eficientemente. Indique claramente que desea... cancelar su tarjeta Credit One y preguntar sobre cualquier paso necesario o tarifas potencialesEs importante mantener la calma y ser educado durante la conversación, ya que esto puede facilitar una cancelación más fluida. Recuerde que documentar su comunicación le brindará tranquilidad para futuras consultas.

Confirmar detalles de cancelación

Después de haber solicitado cancelar su tarjeta de créditoEs fundamental confirmar los detalles de la cancelación con el representante de atención al cliente. Asegúrese de solicitar confirmación de que su cuenta está efectivamente cerrada y pregunte sobre cualquier... saldo restante o tarifasEs importante verificar la fecha de cancelación, ya que esto puede afectar su ciclo de facturación y cualquier cargo potencial. Solicite una correo electrónico o carta de confirmación Para sus registros, le garantizamos que tiene prueba de la cancelación. Esta documentación puede ser importante si surge algún problema posteriormente. Por último, no dude en preguntar sobre los pasos finales que deba seguir para... cerrar completamente su cuenta y Proteja su información financieraLa claridad en estos detalles puede ayudarle a evitar complicaciones futuras.

Monitorea tu informe crediticio

Es fundamental revisar su informe crediticio regularmente después de cancelar una tarjeta de crédito para garantizar que no haya cambios inesperados ni errores que afecten su puntaje crediticio. Vigilar su crédito de cerca le ayudará a mantener su seguridad financiera.

A continuación se indican cuatro pasos clave a seguir:

- Comprobar errores:Revise su informe para detectar inexactitudes o cuentas no autorizadas.

- Sigue tu puntuación:Controle cualquier cambio en su puntaje de crédito luego de la cancelación.

- Revisar el estado de la cuenta:Confirme que la cuenta cancelada refleje el estado correcto.

- Manténgase informado:Regístrese para recibir alertas que le notifiquen sobre cambios significativos en su informe de crédito.