¿Idaho exige pagos de impuestos estimados?: Guía esencial

Are you wondering if Idaho requires you to make estimated tax payments? Navigating the world of taxes can be confusing, and the rules can vary from state to state.

Understanding your obligations is crucial to avoid penalties and keep your finances in check. In this blog post, we’ll break down everything you need to know about Idaho’s estimated tax payment requirements. Whether you’re a business owner, freelancer, or simply trying to stay ahead of your tax game, this guide is tailored just for you.

Stick around, and you’ll discover the essential steps to ensure you’re compliant and stress-free when tax season rolls around.

Estimated Tax Payments Basics

Idaho requires estimated tax payments for those who expect to owe at least $1,000 in state taxes. Individuals should pay quarterly to avoid penalties. Keep track of income changes to ensure accurate payments.

What Are Estimated Tax Payments?

Estimated tax payments are amounts paid to the government. These payments are for taxes owed on income. Income not subject to withholding. This includes earnings from self-employment, interest, dividends, and rent. Paying estimated taxes helps avoid penalties. It also helps prevent a big tax bill at the end of the year.

Who Needs To Pay Estimated Taxes?

Individuals who do not have taxes withheld must pay estimated taxes. This includes self-employed workers. Also, people with significant investment income. Farmers and fishermen often need to pay. Retirees with pension income might also need to pay. Not paying estimated taxes can lead to penalties. It’s important to calculate and pay on time.

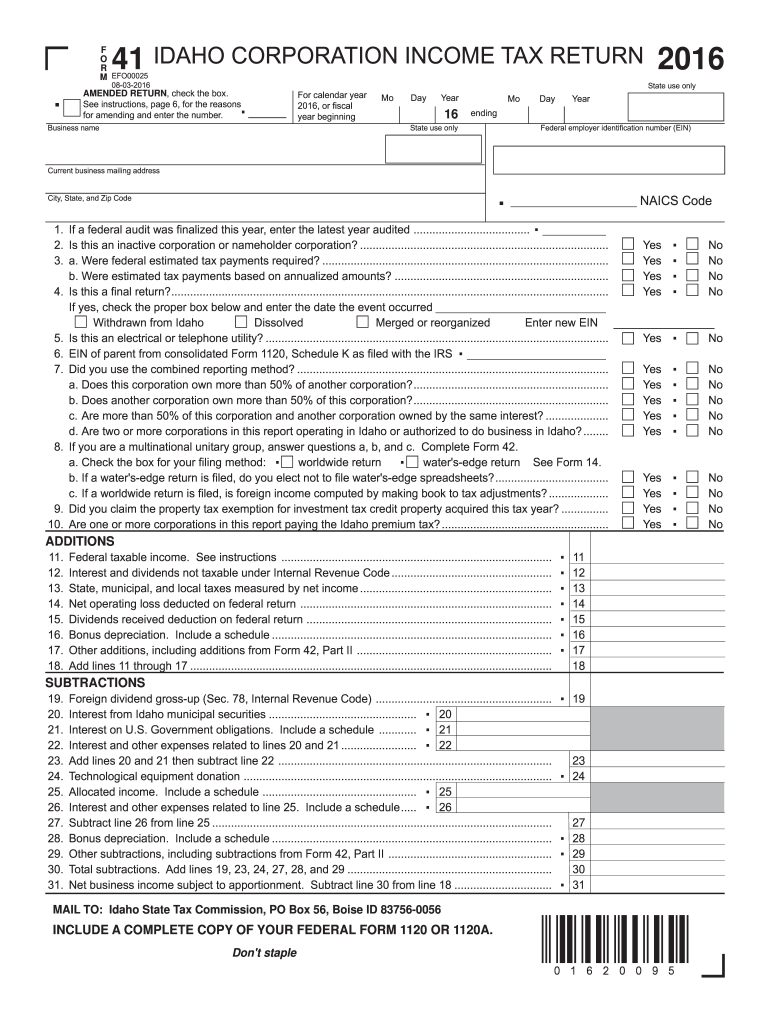

Idaho Tax Laws

Idaho has specific rules for estimated tax payments. Residents must pay these taxes if they expect to owe $50 or more. The payments help avoid large bills at year’s end. Paying taxes on time is very important. It helps prevent penalties and interest charges. Idaho tax forms can guide you through the process.

Idaho tax laws differ from federal rules. State taxes focus on local income. Federal taxes cover all U.S. income. Both require estimated payments, but the amounts may differ. Federal rules use different brackets and deductions. Always check both federal and state guidelines. This ensures correct payments and compliance.

When To Make Payments

Taxpayers in Idaho often make payments in quarters. The schedule is easy to follow. This helps manage obligaciones fiscales. It is important to know the due dates. Missing these can lead to penalties. Planning ahead can help avoid stress. Keep track of income and expenses.

Due Dates In Idaho

| Quarter | Fecha de vencimiento |

|---|---|

| First Quarter | April 15 |

| Second Quarter | June 15 |

| Third Quarter | September 15 |

| Fourth Quarter | January 15 |

Each date is important. Mark them on your calendar. Stay organized and avoid surprises. Pay on time to keep things smooth.

Calculating Your Payments

Idaho residents may need to make estimated tax payments if they expect to owe $1,000 or more. These payments help taxpayers avoid penalties. Calculating your payments accurately ensures you stay compliant with state tax laws.

Estimating Income And Deductions

Income estimation is crucial. Predict your earnings for the year. Include wages, dividends, and business profits. Consider all income sources. Deductions reduce taxable income. Common deductions include mortgage interest and medical expenses. Charitable donations also count. Calculate deductions carefully.

Using Irs Form 1040-es

Form 1040-ES helps estimate tax payments. It guides you step-by-step. Use it to avoid underpayment penalties. Enter income and deductions on the form. Follow the instructions closely. It calculates estimated taxes. Pay attention to deadlines. Quarterly payments are required. Stay organized and file on time.

Penalties And Interest

Idaho requires estimated tax payments to avoid penalties and interest. Missing these payments can lead to extra charges. Make sure to pay quarterly to stay compliant.

Consequences Of Underpayment

Underpaying taxes can lead to penalties. Idaho charges a fee for not paying enough. Interest adds up too. This makes the amount bigger. Paying late can cause more issues. It is important to pay on time. This helps avoid extra costs.

Avoiding Penalties

Pay taxes regularly to avoid fees. Keep track of payments. Plan ahead to make sure you have enough money. This helps in staying clear of fines. Use tools to remind you. This keeps you on the right track.

Filing Methods

Idaho lets people pay taxes online. This way is fast and easy. Taxpayers can use the state’s website. They can also use third-party services. Online payments are safe and secure. Many people choose this method. It’s simple and saves time. Tax forms can be filled online too. This avoids paperwork. Tarjetas de crédito or bank transfers can be used. Electronic funds transfer is another option. Payments are processed quickly. Confirmación is sent after payment. This ensures peace of mind.

Some people prefer paying taxes the old way. Cheques can be mailed to the tax office. Money orders are also accepted. These methods are reliable. People can visit local offices to pay. This allows direct contact with staff. Face-to-face help is available. Forms can be filled by hand. This takes more time than online. But some people like it. It feels more personal. Ingresos are given after payment. This provides proof of payment.

Special Considerations

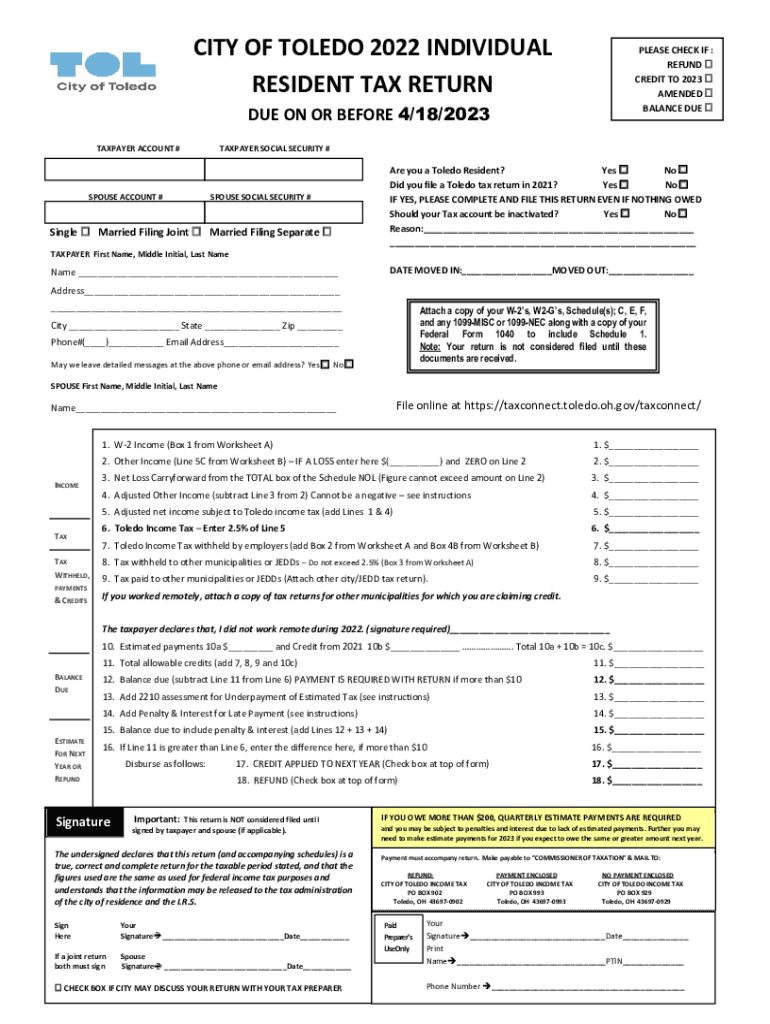

Self-employed individuals in Idaho need to pay estimated taxes. They often do not have taxes withheld from their income. This means they must plan and pay taxes on their own. Failure to pay on time might lead to penalties.

Para retirees and pensioners, estimated tax payments may be necessary. Many retirees receive income from pensions or investments. These sources might not withhold taxes automatically. Retirees must calculate their tax due and pay it quarterly.

Both groups should keep track of their income. Regularly check if they owe taxes. Paying estimated taxes helps avoid surprises at tax time.

Resources For Taxpayers

Many tools can help with tax calculations. Online tax calculators are simple to use. Enter your income and expenses. Get an estimate quickly. Some calculators even suggest deductions. This saves both time and effort. Apps on your phone can also be handy. They guide you step by step. This ensures you don’t miss anything important. These tools make tax season less scary. They are there to help and guide you.

Sometimes, taxes can get confusing. profesionales de impuestos are there to help. You can find them in your local area. They have the right knowledge. They make sure your taxes are correct. CPAs and tax advisors are examples. They often offer advice and answers. It’s best to reach out if you’re unsure. They can save you from mistakes. They are trained to handle complex situations. This keeps you stress-free during tax time.

Preguntas frecuentes

Do Idaho Residents Make Estimated Tax Payments?

Yes, Idaho residents need to make estimated tax payments if they expect to owe $200 or more in taxes. These payments help taxpayers avoid penalties by paying taxes throughout the year. Generally, self-employed individuals, retirees, or those with significant investment income need to make these payments.

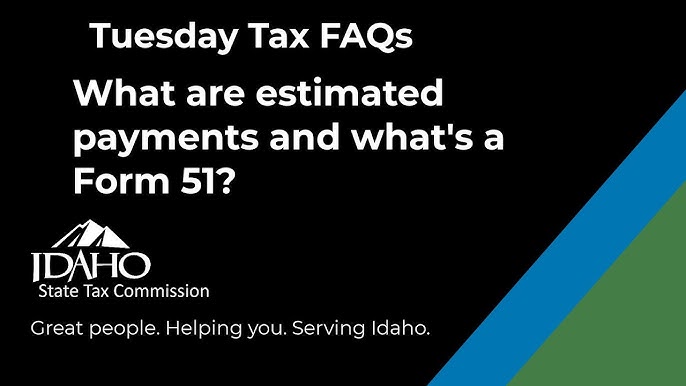

How Often Are Estimated Taxes Paid In Idaho?

Estimated tax payments in Idaho are due quarterly. The deadlines are April 15, June 15, September 15, and January 15 of the following year. It’s important to meet these deadlines to avoid potential penalties and interest on underpaid taxes.

Are There Penalties For Not Paying Estimated Taxes In Idaho?

Yes, failing to pay estimated taxes in Idaho can result in penalties. If you underpay or miss a deadline, you may incur interest charges. The Idaho State Tax Commission calculates penalties based on the amount underpaid and the duration of the delay.

How Do I Calculate Idaho Estimated Tax Payments?

To calculate Idaho estimated tax payments, estimate your total income, deductions, and credits for the year. Use Form 51 to compute your expected tax liability. Divide this amount by four to determine your quarterly payment. The Idaho State Tax Commission provides resources and guidelines for accurate calculations.

Conclusión

Idaho does require estimated tax payments in certain cases. Understanding this helps avoid penalties. Check your income sources and tax obligations carefully. Use available resources to stay informed. Consult a tax professional if needed. They can provide personalized guidance. Timely payments ensure you stay compliant.

It also reduces stress during tax season. Good planning now can save headaches later. Stay proactive to manage your taxes effectively. This keeps your financial situation stable and secure.