¿Qué es un ISV en pagos?: Desbloqueo de conocimientos clave

Are you navigating the complex world of payments and wondering what an ISV is? You’re not alone.

In the fast-paced realm of financial transactions, understanding the role of an Independent Software Vendor (ISV) can give you a competitive edge. Whether you’re a business owner looking to streamline your payment processes or a tech enthusiast eager to learn more about the ecosystem, knowing what an ISV does and how it impacts the payment landscape is crucial.

This article breaks down the concept of ISVs in payments into simple, digestible insights. By the end, you’ll gain clarity on how ISVs can revolutionize the way you handle transactions, ultimately enhancing your business’s efficiency and customer satisfaction. Ready to unlock the potential of ISVs in payments? Let’s dive in!

Defining Isv In Payments

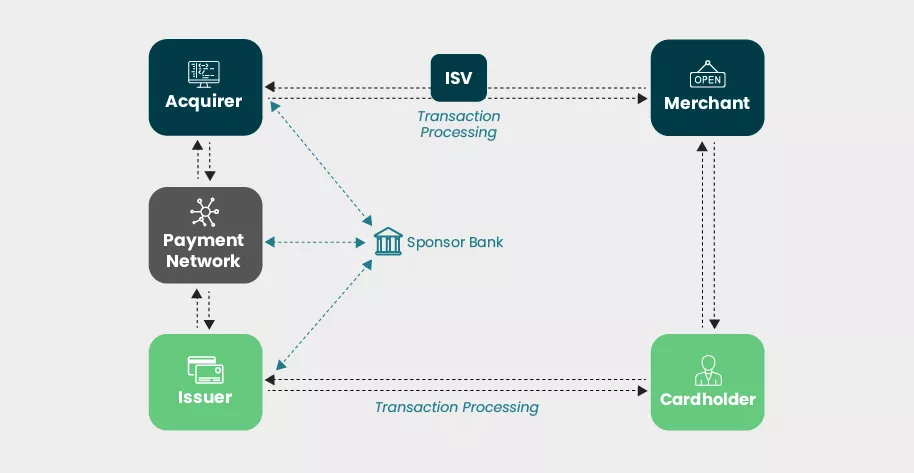

ISV stands for Independent Software Vendor. It is a company that makes software. This software helps manage procesos de pago. Many businesses use ISV products. They help make payments easy and safe. ISVs offer solutions for credit card processing. They also support online payments.

ISVs work with payment gateways. This helps secure payments. They also ensure transactions are smooth. Businesses pick ISVs for their expertise. They trust ISVs to handle complex payment systems. ISVs bring innovation to payment management. They offer tools for eficiencia y exactitud.

Many ISVs provide custom solutions. These solutions fit specific needs. Businesses appreciate this flexibility. ISVs help save time and reduce errors. With ISVs, businesses can improve their sistemas de pago. This leads to better customer satisfaction.

Role Of Isvs In Payment Processing

Independent Software Vendors (ISVs) play a key role. They create software for businesses. This software helps with procesamiento de pagos. ISVs connect businesses with payment gateways. This helps businesses take payments easily. ISVs offer tools to make transactions secure. They help keep customer data safe. Businesses can use ISV software to manage payments. This makes payments simple and fast. ISVs often offer custom solutions for different needs. They understand what each business requires. ISVs are important for online shops. They make sure payments are smooth.

ISVs also help with integration. Their software works with other business tools. This saves time for businesses. It makes operations better. ISVs provide apoyo for their software. They help solve problems. Businesses rely on ISVs for efficient payment systems. Without them, payment processing would be hard.

Benefits For Businesses

Streamlined operations help businesses save time. Less time on tasks. More time for customers. Payment tasks become easy. No need for many systems. Everything in one place. This makes work simple.

Un enhanced customer experience is important. Happy customers come back. Fast payments make them happy. They don’t like waiting. Quick checkout is key. Easy payments help them smile.

Mayor seguridad keeps money safe. No one wants to lose money. ISVs protect it. They stop bad people. Safe payments build trust. People feel good. They know their money is safe.

Challenges Faced By Isvs

ISVs must follow strict leyes y normas. Payments need to be seguro y legal. New laws can appear suddenly. Keeping up is hard. Penalties for mistakes are serious. ISVs must stay informed. Educación helps prevent errors. Compliance is a constant effort.

Making systems work together is tough. Different systems need comunicación. Software must be compatible. Errors can occur during integration. Fixing them takes time. Testing is crucial before launching. Complex systems need careful planning. Expert help is often needed.

Many ISVs fight for attention. New companies emerge often. Prices vary widely. Quality must stay high. Innovation is key to stand out. Customer demands change fast. ISVs must adapt quickly. Unique features attract users.

Trends In Isv Payment Solutions

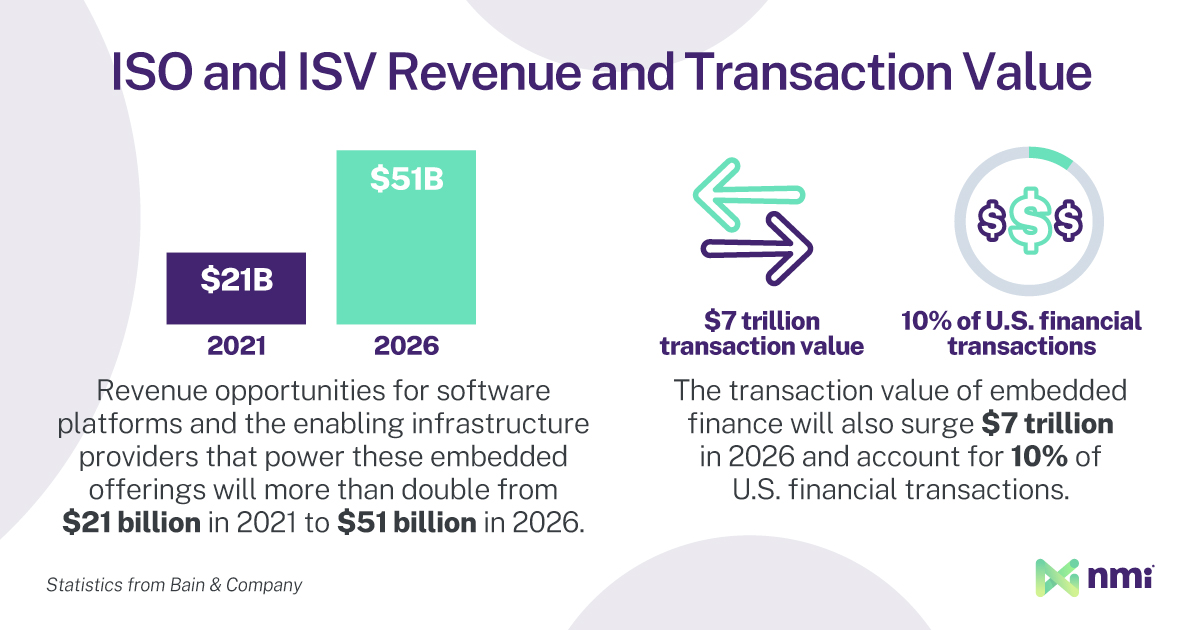

Many Independent Software Vendors (ISVs) are using cloud technology. This helps them provide fast and scalable payment solutions. Businesses enjoy using these solutions because they are easy to update. They also offer secure data storage. Cloud systems mean less need for physical space. This means more room for other important things.

People love paying with their phones. ISVs are creating better mobile payment options. These options are quick and safe. Mobile payments let customers buy things anytime. They also make shopping fun and easy. Businesses see more customers choosing mobile payments every day.

ISVs use data analytics to help businesses. They collect and study data. This helps find patterns and trends. Businesses learn what their customers like. They can then offer better services. Analytics help businesses make smart decisions. This keeps customers happy and loyal.

Choosing The Right Isv Partner

Understanding Independent Software Vendors (ISVs) in payments helps businesses streamline transactions. These partners integrate software solutions, enhancing payment processes efficiently. Choosing the right ISV involves assessing compatibility, support, and innovation, ensuring seamless payment operations.

Assessing Technical Capabilities

Technical skills are very important. Your ISV partner should have good software knowledge. They must understand payment systems. This helps in smooth operations. Check if they use modern technology. Ask about their coding skills. Ensure they can handle complex tasks. Their team should be skilled and experienced.

Evaluating Customer Support

Customer support is crucial. Your partner should offer fast help. Their team must be friendly. They should solve problems quickly. Check their support hours. Make sure they offer 24/7 help. Ask about their support channels. Do they offer phone, email, and chat? Good support builds trust.

Considering Scalability

Scalability is key for growth. Your ISV partner should handle growing needs. They must support more transactions. Check if their system can expand. Ask about their future plans. Ensure they can adapt to changes. Their solution should be flexible. Growth should be easy with them.

Preguntas frecuentes

What Is An Isv In Payments?

An ISV, or Independent Software Vendor, develops software solutions for various industries. In payments, they create specialized applications for processing transactions. These solutions integrate with payment gateways, enhancing business operations. ISVs provide tailored software that meets specific merchant needs, ensuring seamless transactions and improved customer experiences.

They play a vital role in modern payment ecosystems.

How Do Isvs Benefit Payment Processing?

ISVs streamline payment processing by providing customized software solutions. They integrate seamlessly with existing systems, enhancing efficiency. These solutions offer advanced features, like analytics and reporting, to optimize business performance. By partnering with ISVs, businesses gain access to cutting-edge technology, improving transaction speed and security.

This leads to better customer satisfaction and increased profitability.

Why Choose An Isv For Your Business?

Choosing an ISV offers tailored solutions that meet unique business needs. They provide expertise in specific industries, ensuring customized payment processing. ISVs enhance operational efficiency, offer advanced features, and improve security. Partnering with an ISV allows businesses to stay competitive by utilizing the latest technology, leading to improved customer experience and increased revenue.

How Do Isvs Ensure Payment Security?

ISVs prioritize payment security by implementing advanced encryption and fraud prevention measures. They comply with industry standards, like PCI DSS, to protect sensitive data. Regular updates and monitoring ensure ongoing security. By integrating secure payment solutions, ISVs help businesses minimize risks, safeguard customer information, and maintain trust.

This ensures a safe transaction environment.

Conclusión

ISVs play a crucial role in payment processing. They help businesses connect software with payment systems. This integration makes transactions smoother and more efficient. Understanding ISVs can improve your business operations. It can also enhance customer experiences. Choosing the right ISV is important for success.

Always consider your business needs first. Evaluate different ISVs carefully. Make sure they align with your goals. The right choice can simplify payments. It can also boost your business growth. Keep learning about ISVs and their benefits. Stay informed and make wise decisions for your business.