¿Qué es una ISO en pagos?: Desbloqueo de conocimientos clave

Imagine you’re at a bustling store, ready to make a purchase. You hand over your card, and within seconds, the transaction is complete.

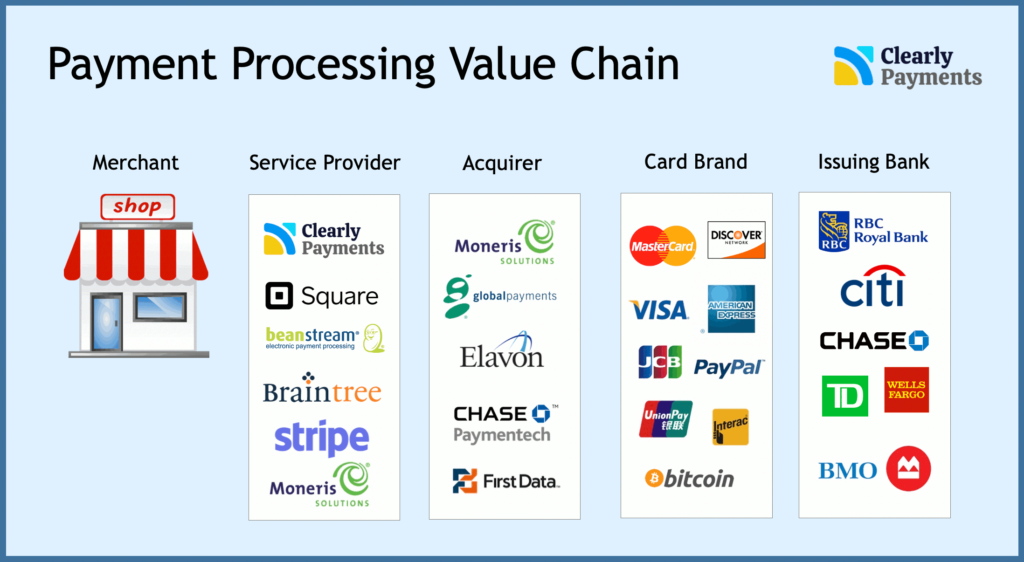

Behind this seamless process is a complex network of systems, one of which is the ISO in payments. But what exactly is an ISO, and why should you care? Understanding the role of Independent Sales Organizations (ISOs) could unlock a new perspective on how money moves in the digital age.

Whether you’re a small business owner looking to streamline transactions or a curious consumer eager to understand the technology behind the swipe, this article will reveal the hidden mechanics that keep the wheels of commerce turning smoothly. Dive in, and discover how ISOs impact your financial world every day.

Iso In Payment Processing

ISO stands for Independent Sales Organization. It helps businesses accept payments. ISOs work with banks and card networks. They provide services to merchants. ISOs offer payment terminals and software. They handle transactions securely. Businesses can increase sales with ISO help. ISOs have contracts with banks. They ensure smooth payment processing.

ISOs also offer support. They help with problemas técnicos. They train staff on payment systems. Merchants get tools to track sales. ISOs help with fraud prevention. They keep customer data safe. Businesses get reports on transactions. This helps in making better decisions.

Choosing a good ISO is important. Businesses should check their services. It’s crucial for smooth operations. ISOs play a key role in payments. They make transactions fast and easy.

Role And Functions

ISOs help businesses accept payments. They work with merchants to set up credit card processing. This helps shops and stores run smoothly. ISOs offer tools for better payment options. They ensure that merchants have the right technology. They also help with billing and statements. Their role is to make sure merchants have easy payment solutions.

ISOs make sure every transaction is safe. They help transfer money from the customer to the shop. This process must be fast and secure. ISOs manage the payment flow. They ensure that every transaction is approved quickly. This helps businesses get their money without problems. They play a key role in making payments easy.

ISOs must follow rules and laws. They ensure that payments are legal y safe. Compliance means meeting the required standards. ISOs help merchants understand these rules. This keeps businesses out of trouble. They ensure that all payments follow the right guidelines. This is very important for trust.

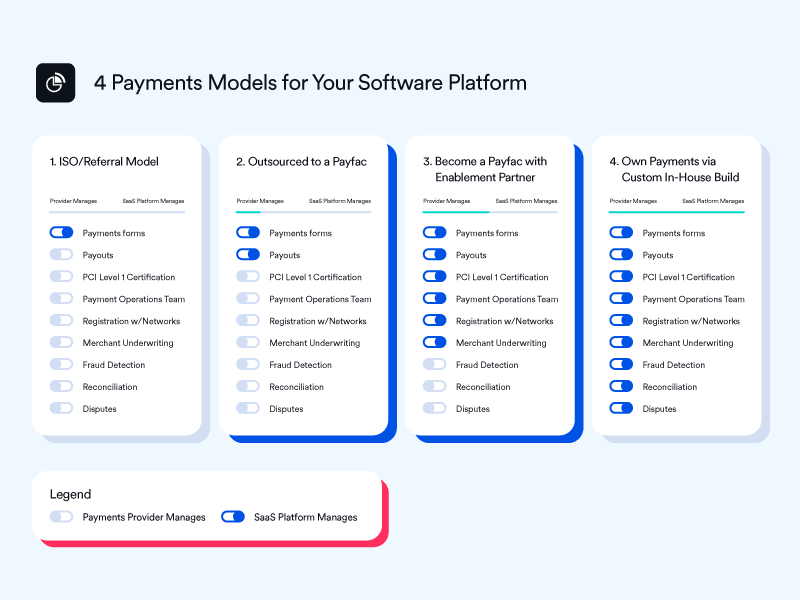

Types Of Isos

Registered ISOs are approved by banks. They follow strict rules and get licenses. These ISOs handle money transactions safely. They work directly with payment networks. This ensures security and trust. Businesses rely on these ISOs for smooth payment processing. They help keep payments safe and reliable.

Unregistered ISOs do not have approval from banks. They might not follow all rules. These ISOs can still help with payments. But they might not be as safe. Some businesses use them for quicker setup. They are often less expensive. Yet, there can be riesgos involved. Trust is important when choosing an ISO.

Benefits For Merchants

Streamlined payment solutions help merchants handle transactions easily. No more complex steps. Payments go through quickly. This saves time and effort. Merchants can focus on their business.

Enhanced security measures protect both merchants and customers. Payments are safe. Sensitive data stays private. This builds trust. Customers feel secure when they shop.

Cost efficiency is a big advantage. Lower fees mean more savings. Merchants can use these savings for other needs. It helps in growing their business.

Desafíos enfrentados

ISO in payments face many rules. They must follow strict laws. These laws change often. This makes work hard and confusing. New laws come fast. Understanding and adapting is tough. Big fines come if rules are broken. So, staying updated is crucial.

Technology changes quickly. Keeping up is a challenge for ISOs. They need new tools and systems. This costs money and time. Staying ahead is important. Falling behind can mean losing clients. Many ISOs work hard to stay updated.

Competition is fierce. Many companies want to be the best. This means better services and lower costs. ISOs must offer great value. They need to keep clients happy. Standing out is hard. Many work tirelessly to be the best.

Choosing The Right Iso

Every ISO offers different services. Some provide procesamiento de pagos. Others focus on Atención al cliente. Check if they offer prevención del fraude. Look for tools to manage your transactions. Ensure they have a sistema seguro. Services should fit your business needs.

An ISO’s reputation is crucial. Find reviews from other businesses. Check their track record. Talk to their clients if possible. Good reputation means trustworthiness. Avoid ISOs with many complaints. A strong reputation indicates servicio confiable.

ISOs have different fee structures. Some charge cuotas mensuales. Others have tarifas de transacción. Understand all costs involved. Hidden fees can surprise you. Compare fees between ISOs. Choose one that fits your budget. Transparent fees show honesty.

Future Trends

An ISO in payments acts as a bridge between merchants and payment processors. This organization helps businesses accept card payments efficiently. Future trends show increased reliance on ISOs due to rising digital transactions.

Digital Payment Innovations

Digital payment methods are growing fast. teléfonos inteligentes make it easy to pay. Many people use apps for payments now. This is changing how we buy things. New ideas come up every year. Contactless cards are popular. They are quick and safe. QR codes are also used a lot. You can scan them to pay. These changes make shopping easier. People spend less time at the counter.

Impact Of Fintech

Fintech companies are leading the way. They offer new payment solutions. Old banks are trying to catch up. Fintech makes payments simple. Apps let you pay with your phone. They also keep your money safe. More people trust these apps now. Fintech is changing the payment industry. Payment processes are quicker and safer. This helps businesses grow.

Evolving Consumer Preferences

Consumidores want easy payment options. They love using apps and cards. Cash is not used as much now. People like seguro and fast payments. Online shopping is growing. Many people buy things from their phones. They look for stores with easy payment methods. This trend is growing every year. Businesses must adapt to these changes.

Preguntas frecuentes

What Does Iso Mean In Payments?

An ISO in payments refers to an Independent Sales Organization. ISOs partner with banks to facilitate merchant services. They help businesses process credit card payments. ISOs act as intermediaries between merchants and payment processors. They play a crucial role in the payments industry.

How Do Isos Benefit Merchants?

ISOs provide merchants with payment processing solutions. They offer competitive rates and streamlined services. ISOs handle the setup and maintenance of payment systems. They also provide customer support and technical assistance. This allows merchants to focus on their business operations.

Are Isos Regulated In The Payments Industry?

Yes, ISOs are regulated entities in the payments industry. They must comply with industry standards and guidelines. ISOs are often subject to audits and oversight by banks. Compliance ensures secure and reliable payment processing services. It helps maintain trust between merchants and their customers.

How To Choose The Right Iso For My Business?

Choosing the right ISO involves evaluating your business needs. Consider the fees, services, and support offered. Look for ISOs with a good reputation and strong partnerships. Ensure they provide the necessary security and compliance. Comparing multiple ISOs can help you make an informed decision.

Conclusión

Understanding ISOs in payments simplifies financial transactions. They play a key role. ISOs help businesses process payments smoothly. They ensure secure and efficient transactions. Choosing the right ISO boosts business growth. It enhances customer satisfaction and loyalty. Businesses need to evaluate ISO options carefully.

Consider services, fees, and support. This knowledge empowers better decisions. It brings improved payment solutions. Stay informed about ISOs. It benefits your business in the long run. Remember, smooth payments lead to happy customers. Happy customers return. And returning customers mean success.

Keep learning and adapting. That’s the secret to thriving in today’s market.