Which of the Following is Not a Transfer Payment: Unveiled

Have you ever wondered about the money that flows through our economy without the exchange of goods or services? These are known as transfer payments.

They play a crucial role in supporting individuals and stabilizing economies. But here’s the twist: not everything that looks like a transfer payment actually is one. Can you spot the difference? Understanding what qualifies—and what doesn’t—can make a big difference in how you perceive economic policies and personal finance.

Stick around as we unravel this financial mystery and reveal the surprising answer. You might just find that your understanding of money takes on a whole new dimension.

Transfer Payment Definition

Transfer payments are Geld given by the government. They are meant to help people. Social Security is a transfer payment. It is for older people. Unemployment benefits are also transfer payments. They help people without jobs. These payments do not need to be paid back. They are not for buying goods or services. Grants for education are another example. They help students learn. People get these payments based on need. Transfer payments help the economy. They give money to people who need it.

Transfer payments are important. They help make life better for many. The government uses them to support citizens. These payments can change lives.

Types Of Transfer Payments

Government benefits help people who need money. They come from the government. Transfer payments are gifts, not for work. They help old people, sick people, and poor people.

Social Security payments go to older adults. They get money every month. This helps them live when they do not work. Social Security is very important. It helps millions of people.

Unemployment benefits give money to people without jobs. The government pays for this. People can buy food and pay bills. Unemployment benefits help until they find work.

Subsidies help companies make products. They lower costs for them. This makes products cheaper for us. Subsidies help farmers and businesses. They keep prices low.

Characteristics Of Transfer Payments

Transfer payments are non-reciprocal. This means one party gives, but gets nothing back. Beispiele include social security and unemployment benefits. These payments help people in need. They do not require work in return. Gifts from family also fit this category. They are given without expecting anything back. Transfer payments help reduce poverty. They support those who cannot work. People receive them without any service or product in return. This is a key feature of such payments.

Transfer payments boost the economy. They put money in people’s hands. More spending leads to more business. Businesses then hire more workers. This creates a cycle of growth. Economies rely on these payments. They help balance wealth. They support those who have less. Transfer payments can also stabilize a shaky economy. They act as a safety net. This helps during hard times like recessions. In short, they are crucial for economic health.

Examples Of Transfer Payments

Pensions are money given to people who are retired. The government or employers give this money. It helps old people who do not work anymore. They use this money to pay for their living costs. Pensions are important for retired people.

Welfare programs help people who do not have enough money. The government provides these programs. They give money or services to people in need. Welfare programs support those who cannot support themselves.

Food stamps help people buy food. The government gives these to people who need help. They can use food stamps at stores to get groceries. This helps families have enough to eat.

Identifying Non-transfer Payments

Wages and salaries are earned from working. People work to earn these. They are not gifts. These payments are for services. Workers provide services to earn them. They are not free money. People earn them by working hard.

Investment income comes from money invested. People earn this from their savings. It grows over time. It is not a free gift. People choose to invest. They earn money for their choices. This is not a transfer payment.

Business revenue comes from selling goods or services. Companies earn this money. They sell things to people. This is not a free gift. Businesses work to earn it. They make products or provide services. Revenue is earned, not gifted.

:max_bytes(150000):strip_icc()/transferpayment.asp-final-a9ac07eebc3844129517fcc92b68a95d.png)

Häufige Missverständnisse

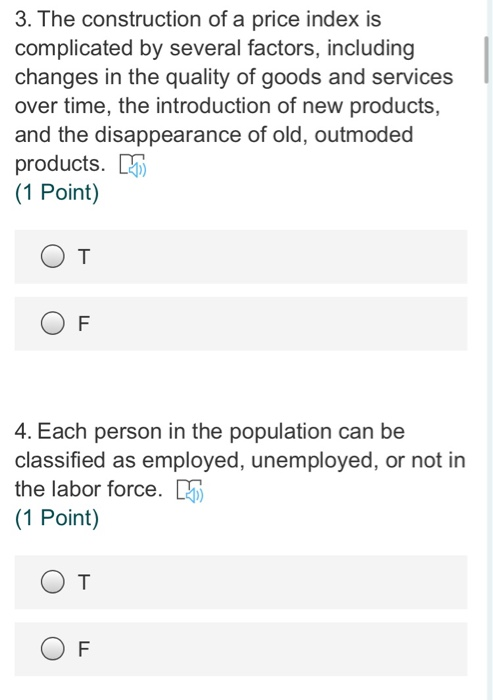

Scholarships help students pay for school. They are not transfer payments. Transfer payments are money the government gives without getting anything back. Scholarships need students to study hard. They get money because they do well. This makes scholarships different. Transfer payments don’t need work back from people. Scholarships need effort Und achievement. Transfer payments are like help from the government. Scholarships are rewards for doing good in school.

Tax refunds are not transfer payments. People get tax refunds when they pay too much tax. Refunds are getting money back that is yours. Transfer payments are free money from the government. Tax refunds are not like this. They come from what you already paid. This makes them different. Tax refunds are a return of your own money. Transfer payments are given to help people. Tax refunds are not a gift. They are a correction of what you paid.

Economic Role Of Transfer Payments

Transfer payments are money given by the government. They help people with low income. Zahlungen wie unemployment benefits Und social security are transfer payments. They help reduce income inequality. People with less money get more support. This helps them live better lives. It makes society fairer. People get equal chances to succeed.

Transfer payments also boost economic demand. When people get money, they spend more. This spending helps businesses grow. It creates more jobs for people. Higher demand means more goods and services are needed. The economy becomes stronger. Businesses can sell more products. People can buy more things they need.

Häufig gestellte Fragen

What Is A Transfer Payment?

A transfer payment is a redistribution of income without goods or services in return. It includes social security, unemployment benefits, and welfare. These payments are made by the government to individuals or other governments. Transfer payments aim to support economic stability and assist those in need.

How Are Transfer Payments Different From Other Payments?

Transfer payments differ because they do not involve a direct exchange of goods or services. Unlike salaries or sales, these payments are non-reciprocal. They provide financial assistance, primarily from government sources. This support helps stabilize the economy and offers aid to individuals, without a market transaction.

Is A Salary Considered A Transfer Payment?

No, a salary is not a transfer payment. It is compensation for services rendered by an employee. Salaries involve a direct exchange of labor for money. Transfer payments, conversely, do not require service or goods in return. Salaries are part of the labor market, unlike transfer payments.

Why Are Transfer Payments Important?

Transfer payments are crucial for economic balance and social welfare. They provide financial support to individuals in need, such as the unemployed or elderly. These payments help reduce poverty and inequality. By offering economic assistance, they contribute to social stability and economic resilience.

Abschluss

Understanding transfer payments is crucial for financial literacy. These payments help redistribute wealth without involving goods or services exchange. Examples include pensions, unemployment benefits, and social security. But not all transactions fall under transfer payments. Recognizing the difference aids in better financial management.

It helps in making informed economic decisions. Clear comprehension can lead to smarter budgeting. It allows for a better grasp of how economies function. Stay informed, and enhance your financial knowledge for future success. With this understanding, navigate your finances more effectively.

Keep learning and adapting for financial well-being.