What is a Payment Id: Unlocking Transaction Secrets

Are you tired of puzzling over financial transactions and wondering where your money is going? You’re not alone.

When you make a payment online or receive money from a friend, you might have noticed a unique string of numbers or letters attached to the transaction. This is your Payment ID, a crucial piece of information that ensures your payments are tracked accurately and securely.

But what exactly is a Payment ID, and why is it so important for you to understand? Dive into this article to uncover the mystery behind Payment IDs and discover how mastering this simple concept can make your financial life easier and more secure. Stick with us, and you’ll soon be navigating your transactions like a pro, with confidence and peace of mind.

Payment Id Basics

A Payment Id is a unique code or number. It helps track transactions. Every transaction has its own Payment Id. This helps find and verify payments easily. The main purpose is to ensure security. It prevents mistakes in handling money. Businesses use Payment Ids to keep records clear.

There are many types of Payment Ids. Each has a special use. Order Ids track online buys. Invoice Ids show bills. Transaction Ids link to bank moves. These Ids make payment tracking easy. They keep everything organized. People can know the status of their payments quickly.

How Payment Ids Work

Payment Ids help in tracking money. They make sure money goes to the right place. Each transaction has a unique Payment Id. This Id links to one specific action. It acts like a unique code. Businesses use it to manage payments. Payment Ids are like a fingerprint for each transaction.

Role In Digital Transactions

In digital transactions, Payment Ids are very important. They make online payments safe. They help keep track of every transfer. No two Payment Ids are the same. This uniqueness helps to avoid confusion. It ensures money goes to the right account.

Integration With Payment Systems

Payment Ids integrate with many systems. They work well with banks and apps. This integration makes payments fast. It also makes them secure. Systems can easily read and use these Ids. This helps in smooth transactions.

Benefits Of Using Payment Ids

Payment Ids make payments safe. They give each payment a unique code. This code keeps your money safe from bad guys. People cannot steal your money easily. It’s like a secret code that only you know. Payment Ids help make sure your money goes to the right place. Banks trust these codes.

Payment Ids help you track your money. Each payment has a special number. This number helps you see where your money goes. You can know if a payment is missing. It is like having a map for your money. Keeping track of payments is easy with these Ids. They make your money journey clear.

Payment Ids In Different Industries

Payment Ids help track online purchases. Every order gets a unique Payment Id. This ID is like a digital receipt. It helps customers check their orders. It also helps businesses manage payments. Sicherheit is a big reason for Payment Ids. They keep transactions safe. They make shopping easier. Customers can find their orders quickly. Businesses can solve problems fast. Payment Ids are important for Vertrauen Und Sicherheit.

Banks use Payment Ids to track money. Payment Ids keep records clear. They help find Transaktionen easily. Banks use them for Sicherheit. They protect your money. Payment Ids help avoid mistakes. They make banking simple. Customers see their payment history. Banks check payments with Genauigkeit. Payment Ids are crucial for safe banking. They help make banking reliable.

Challenges And Limitations

Payment IDs simplify transaction tracking but can confuse users unfamiliar with digital payments. Mistakes in entering IDs lead to transaction errors, causing delays. Understanding its function is crucial for smooth financial operations.

Privacy Concerns

Payment IDs can cause privacy issues. They may expose user data. Hackers might see this data. This is a big worry. People want their data safe. Payment systems should protect user info. Stronger security measures are needed.

Users must trust the system. Trust is important. Without it, users feel unsafe. Feeling unsafe is bad. It stops people from using payment systems.

Technical Barriers

Not all systems use Payment IDs. This can cause confusion. Some systems are old. Old systems might not work well. They can be slow or break.

New systems need updates. Updates can be hard. Not everyone knows how to update. This makes it tricky. A simple guide can help. Guides should use easy words.

Future Of Payment Ids

A Payment Id is a unique identifier for transactions in the digital world. It ensures secure and accurate processing of payments. As technology evolves, these identifiers will play a crucial role in simplifying and securing online transactions.

Technological Innovations

Payment Ids are changing fast. New technology makes them better. Sicherheit is stronger now. People trust online payments more. Mobile Apps use Payment Ids. This makes shopping easy. Blockchain helps too. It keeps Payment Ids safe. Digitale Geldbörsen are popular. They use Payment Ids to pay. Fast and simple. Artificial Intelligence helps in tracking. It finds and fixes problems. Payment Ids are smart now. They learn from data. Innovation brings new ideas.

Potential Market Growth

Payment Ids are growing fast. More people use them every day. Online shopping increases. Payment Ids make it easy. Small businesses benefit too. They reach more customers. Payment Ids have a big market. Banken Und companies invest in them. They see the future. Global trade uses Payment Ids. They make things quick and safe. People like easy payments. The market will keep growing. Payment Ids are here to stay.

Häufig gestellte Fragen

What Is A Payment Id Used For?

A Payment Id is used to identify transactions. It ensures payments are correctly allocated to your account. This unique identifier is crucial for tracking transactions. It helps in resolving any payment-related issues quickly. Businesses and individuals often use it for enhanced financial management.

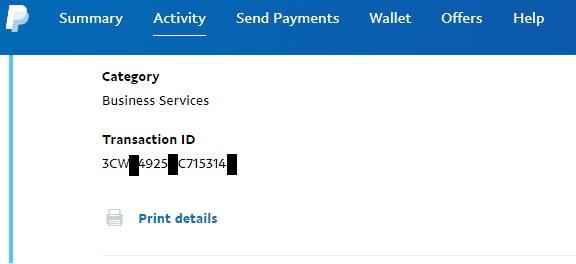

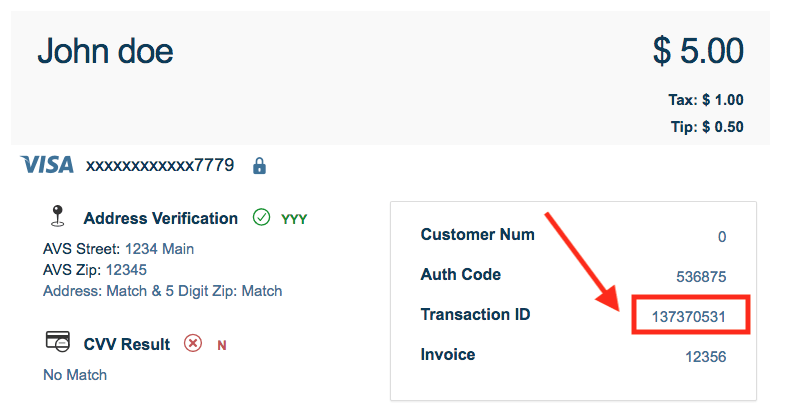

How Do I Find My Payment Id?

You can find your Payment Id on your transaction receipt. It’s usually provided during the payment process. Check your email confirmation or bank statement for the Id. Some online payment platforms display it in your account dashboard. Always keep it secure for future reference.

Can A Payment Id Be Reused?

No, a Payment Id is unique to each transaction. Reusing a Payment Id can lead to errors. It ensures every transaction is distinct and traceable. Financial institutions generate new Payment Ids for each payment. Always verify your Payment Id for accuracy.

Is A Payment Id Secure?

Yes, a Payment Id is secure and unique. It helps protect your transaction details. Financial institutions use encryption to safeguard your Payment Id. This ensures unauthorized access is prevented. Always keep your Payment Id confidential to maintain security.

Abschluss

Understanding a Payment ID simplifies online transactions. It acts as a unique identifier. This ID ensures payments reach the correct destination. It reduces errors and confusion. Businesses benefit by tracking transactions easily. Customers enjoy a smoother payment experience. No more wondering where your money went.

Now, you know how vital a Payment ID is. It keeps your transactions clear and organized. So, next time you make a payment, remember its importance. Embrace the ease it brings to online payments. Stay informed and make your transactions seamless and secure.