Can You Write off Car Payments for Doordash: Tax Tips

Are you a dedicated DoorDash driver wondering if you can write off your car payments? You’re not alone.

Many gig economy workers are constantly searching for ways to maximize their earnings while minimizing expenses. The good news is, understanding tax deductions can significantly impact your bottom line. By the end of this article, you’ll discover whether your car payments can be a valuable tax deduction.

Stay tuned to potentially unlock savings that could ease your financial burden and make your DoorDash hustle even more rewarding. Let’s dive into the details and see how you can make the most of your efforts.

Tax Deductions For Doordash Drivers

DoorDash drivers can save money through tax deductions. Car expenses are deductible. This includes gas, repairs, and maintenance. Versicherung costs can be deducted too. The mileage you drive for deliveries is important. Keep track of this carefully. Use an app or notebook to record miles.

Car payments are not directly deductible. Instead, Abschreibung of your car can be. Depreciation is about the car losing value over time. Calculating depreciation can be complex. You may need help from a tax expert. Belege aufbewahren for all car-related expenses. This will help during tax season.

Car Expenses And Write-offs

Drivers can write off eligible car expenses for Doordash. Fuel costs are allowed. Oil changes can be written off too. Don’t forget about car repairs. Insurance payments are eligible. Car loan interest is included. Lease payments can also be written off. Keep receipt records for all expenses. This helps during tax time.

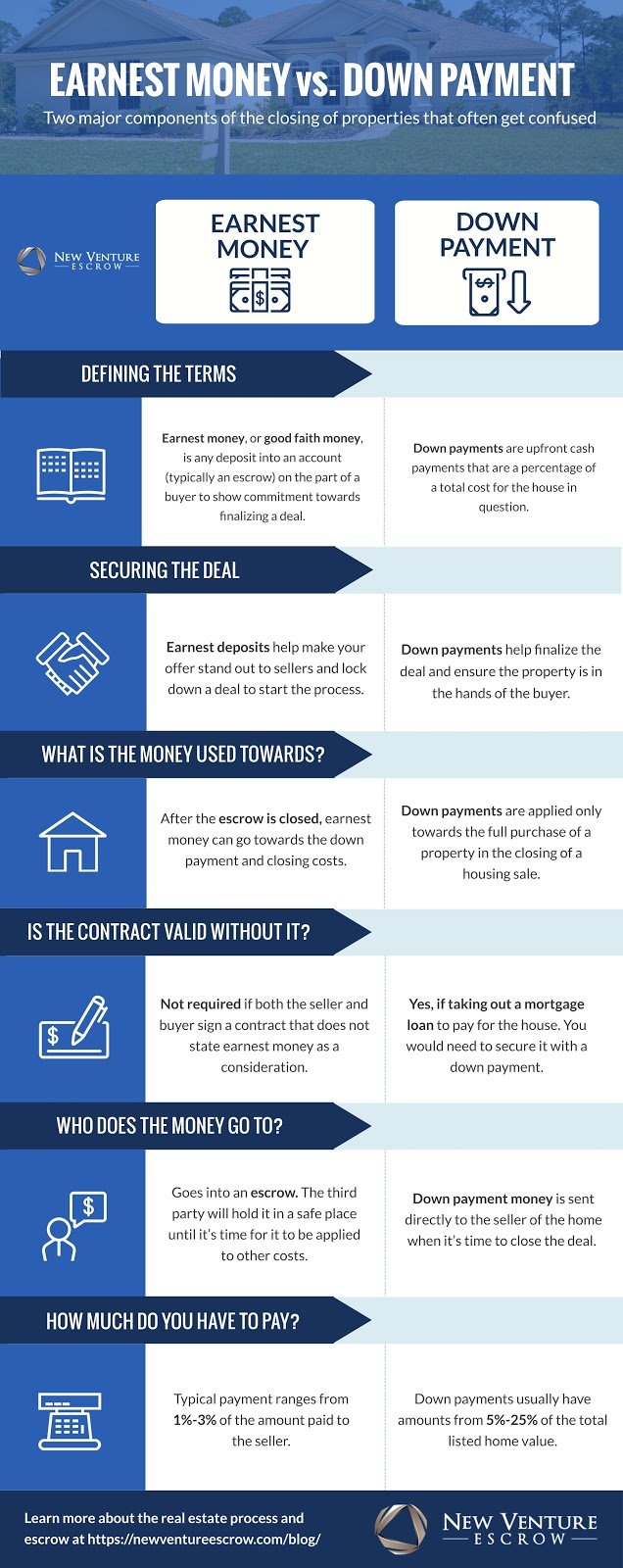

Use either standard mileage oder actual expenses method. Standard mileage gives a set rate per mile. This is easier. Actual expenses need receipts. You must track each cost. Fuel, repairs, and insurance add up. Choose the best method for your needs. Calculating both helps decide. Mileage method might be simpler. Expense method could be more accurate.

Understanding Car Payments

Car payments include principal and interest. The principal is the car’s cost. Interest is the extra money you pay. You pay this to the lender. Only interest might be deductible. This depends on your work. It is important to know the difference.

Cars lose value over time. This is called Abschreibung. Depreciation affects your car’s worth. It is not part of the loan payment. But it can be a tax consideration. You might write off depreciation. This helps reduce tax bills. It’s a way to save money.

Record Keeping For Deductions

Keeping track of miles is important for drivers. Use a mileage log. Record every trip. This helps with tax deductions. Apps can make tracking easy. Always update the log. Make sure to include date and miles. Don’t forget to note the reason for the trip. This helps prove your expenses. Save logs safely. They are useful for tax time.

Keep all receipts from car expenses. This includes gas and repairs. Store them in a safe place. Use folders or boxes. Digital copies work too. Scanning receipts is smart. Use a phone app to save them. Receipts help with tax deductions. They prove what you spent. Make sure receipts are clear. Check they have the date and amount. This keeps your records correct.

Häufige Fehler, die Sie vermeiden sollten

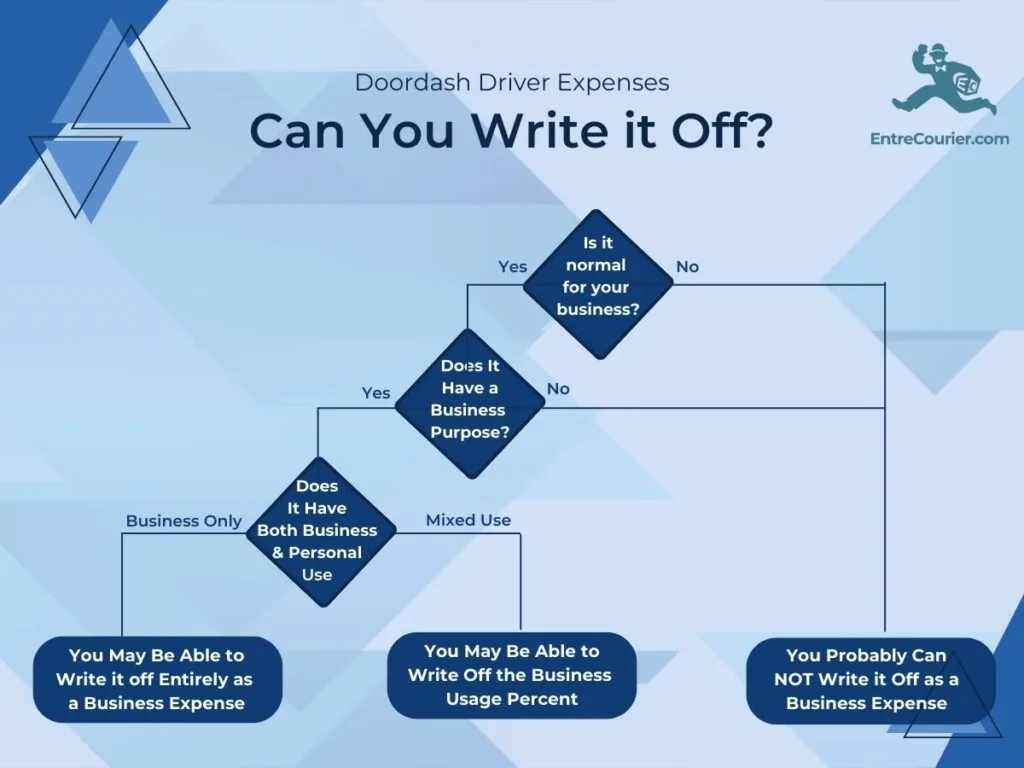

Many people think they can deduct all their car expenses. This is not true. Only business-related expenses can be deducted. Personal trips do not count. Keep track of your miles carefully. Use a log or an app. This helps you avoid mistakes. Accurate records are very important. They show the real business use of your car. The IRS checks these records. Wrong numbers can lead to problems. Always be honest about your deductions. It is better to be safe than sorry.

Self-employment tax is often forgotten. This tax is for people who work for themselves. It includes Social Security and Medicare taxes. Many drivers think only about income tax. But self-employment tax is important too. It can be a big amount. Always plan for this tax. Set aside money for it. This helps you avoid surprises. Paying taxes on time is crucial. It keeps you out of trouble. Being prepared is the key.

Maximizing Tax Savings

Tax software can help track expenses easily. Many programs offer user-friendly options for delivery drivers. They can calculate deductions automatically. This saves time and reduces error. Some software also offers tips for extra savings. You can find programs that fit your needs online. Try free trials before buying.

Tax professionals know the rules well. They give advice based on your work. Consulting them can help find hidden savings. They check all deductions for accuracy. This avoids penalties. Finding a professional nearby is easy. Many offer consultations over phone or online. Their guidance can ease tax worries.

Häufig gestellte Fragen

Can You Deduct Car Payments For Doordash?

You cannot directly deduct car payments. Instead, you can deduct business-related expenses like mileage. Use the IRS standard mileage rate or actual expenses method. Keep accurate records to ensure compliance.

How Do I Write Off Car Expenses For Doordash?

To write off car expenses, track your mileage and choose between standard mileage or actual expenses. Use the method that maximizes deductions. Keep detailed records to support your claims.

Are Gas Expenses Deductible For Doordash Drivers?

Yes, gas expenses are deductible if you use the actual expenses method. Alternatively, you can use the IRS standard mileage rate, which includes gas costs. Accurate record-keeping is essential for claiming deductions.

What Records Should I Keep For Tax Deductions?

Keep detailed records of mileage, gas receipts, maintenance, and other car-related expenses. Record both business and personal use. Use apps or spreadsheets for accuracy. This documentation supports your tax deductions.

Abschluss

Navigating tax deductions for DoorDash can be tricky. Car payments aren’t deductible, but expenses like gas and maintenance are. Keeping clear records helps. A mileage log is essential for precise claims. Understand your expenses to maximize your deductions. Consult a tax professional if unsure.

This ensures you’re not missing out on potential savings. Stay informed. Always keep up with the latest tax rules. Being organized makes tax time less stressful. Remember, every penny saved counts. Make smart financial decisions to benefit your delivery business.