Was passiert, wenn Sie Ihre Afterpay-Zahlungen nicht leisten: Konsequenzen enthüllt

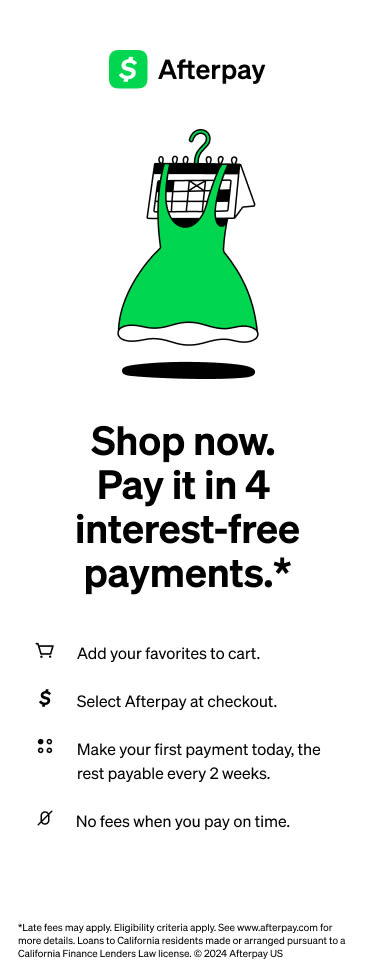

Picture this: You’ve just scored that must-have item online using Afterpay, and it felt like a breeze. No upfront payment, just a simple split over four installments.

But what if, for some reason, you miss a payment? It’s easy to overlook, but the consequences might not be as simple as the initial purchase seemed. Have you ever wondered what actually happens if you don’t pay your Afterpay payments?

Understanding the potential ripple effects on your finances and credit can save you a lot of stress and headaches. Don’t let a small oversight turn into a financial hurdle. Stick around to discover what you need to know to keep your finances on track and avoid unwanted surprises.

Late Fees And Penalties

Not paying Afterpay can lead to Verspätungsgebühren. These fees make the total cost higher. Missing a payment means you might get a penalty. Every missed payment adds more fees. This can be stressful.

Afterpay sends reminders for payments. Reminders help you to pay on time. Paying late affects your credit score. A low credit score is bad. It makes borrowing hard.

Contact Afterpay if you can’t pay. They may offer solutions. Solutions can be payment plans. This helps in avoiding penalties.

Impact On Credit Score

Ignoring Afterpay payments can lead to serious consequences. Your credit score might drop. A bad credit score makes it hard to get loans. It can also make borrowing money more expensive. Lenders see a low score as a risk. They may refuse your loan requests. Your future financial plans could be affected.

Afterpay might report you for non-payment. This report can go to credit bureaus. As a result, your credit report shows missed payments. This can stay on your record for years. Paying on time is important. It keeps your credit score healthy.

Account Suspension

Not paying Afterpay can cause account suspension. Your account may be paused. This means you can’t use it. No new purchases allowed. This will affect your shopping. Paying on time is important. It keeps your account active. You may also face Verspätungsgebühren. Fees increase your debt. It’s not good for your wallet. Your credit score can be hurt. A bad score is hard to fix. Always check your account. Make sure payments are made.

Debt Collection

Missed payments can lead to trouble. Debt collectors might call you. They send letters too. Some collectors can be pushy. It’s their job to get money back. They might charge fees. This makes your debt grow. Ignoring them won’t help. They will keep trying. Your Kreditwürdigkeit can suffer. This score tells if you pay bills on time. A low score means problems later. Loans become hard to get. Renting homes can be tough too. Always try to pay on time. It avoids stress and problems.

Legal Action Risks

Missing Afterpay payments can lead to serious problems. First, they may charge you a Verspätungsgebühr. This makes your bill even bigger. Next, they might report you to a debt collector. Debt collectors call and send letters. They want the money paid back. Sometimes, they even come to your home.

If payments are still not made, Afterpay might take rechtliche Schritte. This means going to court. Court cases can be expensive and take a long time. Losing in court might mean you have to pay more money. This can be very stressful. It’s important to pay on time to avoid these risks.

Difficulty Using Afterpay

Missing payments can cause trouble. Afterpay may stop you from using its service. Your account might be frozen. This means you cannot buy anything more. Paying late can lead to zusätzliche Gebühren. These fees make the total cost higher. Late payments can hurt your credit score.

Shop limits may change. Buying limits can become smaller. You might need to pay more upfront. Some stores may not let you use Afterpay. This can limit your shopping choices. Many people find this frustrating.

Communication with Afterpay helps. Contact them if you face problems. They might offer solutions. Payment plans can help manage costs. Keeping track of payments is important. Avoid missing deadlines. It keeps your account safe. A clear plan reduces stress.

Impact On Future Purchases

Missing Afterpay payments can block future purchases. Konten might get locked. Payment history is crucial. A bad record affects Kreditwürdigkeit. Late fees increase debt. Trust with Afterpay drops. Customers face Einschränkungen. Buying options become limited. It’s hard to use Afterpay again. Pay on time to avoid issues. Good habits help. Behalten Sie den Überblick of due dates. Erinnerungen festlegen for payments. Budget wisely each month. Balance spending with income. Avoid buying more than needed. Smart shopping is key. Planning saves Geld. Future purchases need careful thought. Manage finances well. Responsibility matters in spending.

Kundensupport-Optionen

Afterpay offers hilfreiche Unterstützung for payment issues. You can reach them online. Their website has a contact form. Fill it out for quick help. They also have a FAQ-Bereich. This section answers many common questions. You might find your answer there.

For urgent help, try their chat service. It’s fast and easy to use. You can also email them. This option is good for less urgent issues. Check their support hours first. They may not reply on weekends.

Afterpay’s support team is friendly. They aim to solve problems quickly. Make sure to have your account details ready. This helps them assist you faster.

Häufig gestellte Fragen

What Happens If You Miss An Afterpay Payment?

Missing an Afterpay payment can lead to late fees. These fees vary depending on your purchase amount. Additionally, your Afterpay account might be paused until payments are up-to-date. Consistent missed payments could impact your ability to use Afterpay in the future.

Can Afterpay Affect Your Credit Score?

Afterpay does not report to credit bureaus, so it doesn’t impact your credit score. However, failing to pay can lead to account restrictions. Responsible use of Afterpay ensures no negative consequences on your credit history.

Are There Fees For Late Afterpay Payments?

Yes, Afterpay charges late fees for missed payments. The fee amount depends on your purchase size. Staying on schedule helps avoid unnecessary charges. Ensure your account has sufficient funds to prevent these fees.

What Should You Do If You Can’t Pay Afterpay?

Contact Afterpay immediately if you can’t make a payment. They may offer a temporary solution or payment plan. Ignoring the situation could lead to further financial complications or account restrictions.

Abschluss

Missing Afterpay payments can lead to financial stress. Late fees add up quickly. Credit scores might drop, affecting future credit options. It’s crucial to manage your finances wisely. Set reminders for payments. Consider linking Afterpay to a reliable account. This prevents missed payments.

Seek help if struggling to pay. Contact Afterpay for solutions. They might offer support or flexible plans. Staying informed helps avoid future issues. Responsible payment habits build financial health. Always prioritize your obligations. Peace of mind comes with good financial management.