What is a Short Payment: Understanding the Basics

Have you ever opened your bank statement and noticed something amiss with a payment? Maybe the amount was slightly off or just didn’t match what you expected.

If this scenario sounds familiar, you might have encountered a “short payment. ” This term can leave you scratching your head, wondering why the full amount wasn’t transferred. But don’t worry—you’re not alone, and there’s a simple explanation behind it.

Understanding what a short payment is can save you time, money, and a great deal of frustration. Imagine having the power to catch these discrepancies before they disrupt your financial plans. Intrigued? Read on to unlock the secrets behind short payments and how they can affect your financial transactions.

Definition Of Short Payment

A short payment happens when less money is paid than owed. It can be due to a mistake or a disagreement. Sometimes, bills are not clear. This causes confusion and results in short payments. Businesses often deal with these issues. They need to fix them quickly. A short payment can affect cash flow. It is important to track payments regularly. Ensuring correct amounts is crucial. Communication can help solve short payment issues. Always check your invoices carefully. Clear billing reduces these problems.

Common Causes

Sometimes the numbers on invoices don’t match up. This can lead to a short payment. Missing items or incorrect amounts cause confusion. Double-check every detail before sending invoices. This helps avoid mistakes.

Prices can change, but invoices must reflect these changes. Old prices on invoices confuse buyers. Always update prices in documents. Accurate pricing is crucial for payments.

Problems with services or products affect payments. Faulty goods or poor services lead to disputes. Customers may pay less if unhappy. Quality checks prevent these issues.

Contracts must be clear. Misunderstandings cause payment problems. Both parties should agree on terms. Review contracts carefully. This avoids disputes over payments.

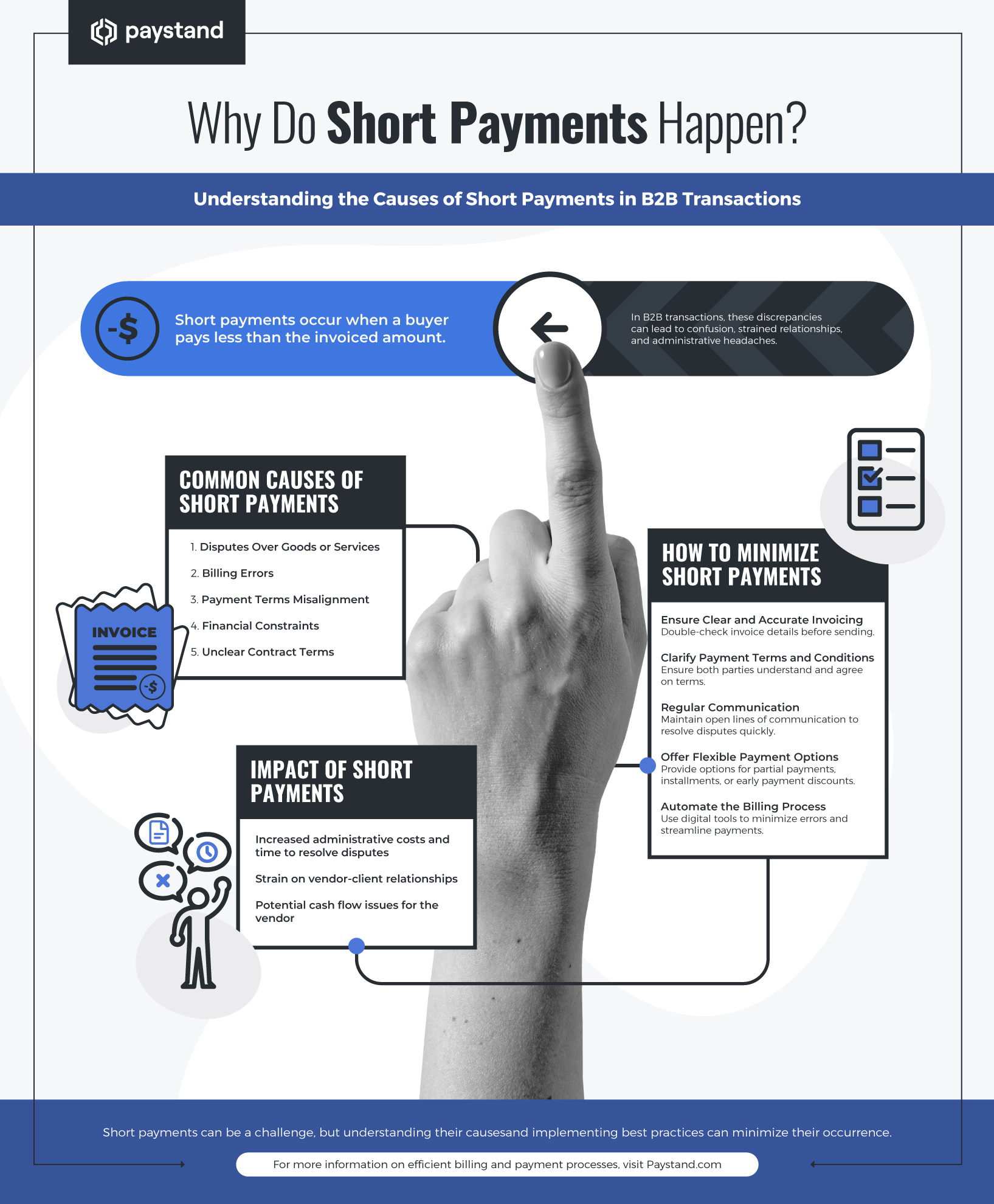

Impact On Businesses

Cash flow challenges can trouble small businesses. Short payments make it hard to pay bills. Money comes in slowly. This can stop growth and hurt plans.

Accounting complications arise with short payments. Keeping track gets messy. Mistakes happen. This causes stress for the finance team. Fixing errors takes time.

Customer relationship strain is another issue. Trust is very important. Short payments can break this trust. Customers might feel upset or ignored. This can make them go to other businesses.

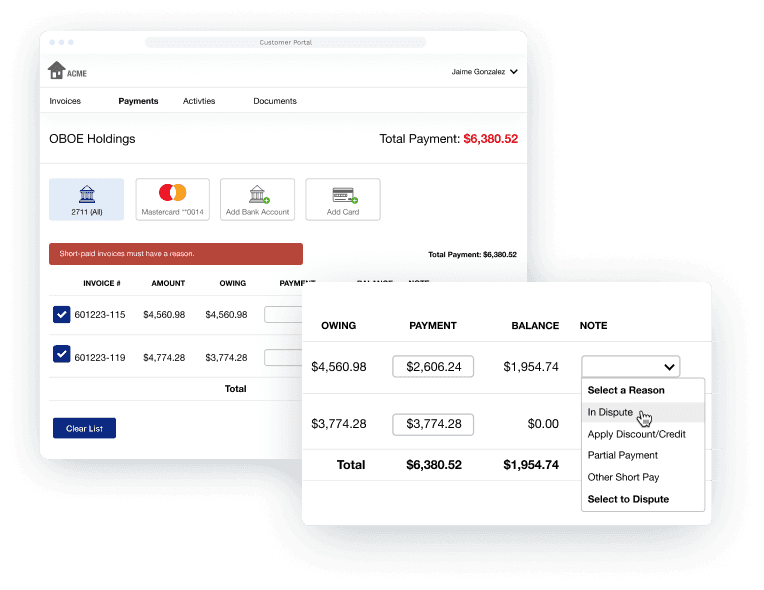

Handling Short Payments

Short payments happen for many reasons. Mistakes in invoicing often lead to short payments. Misunderstandings about agreed prices are common. Errors in quantity calculations can also occur. Kommunikation problems between buyer and seller might cause issues. Technical glitches in payment systems can result in short payments. Identifying the exact cause is crucial. It helps in finding a solution.

Clear communication is vital. Discuss the problem openly with the payer. Ask questions to understand their side. Explain your point clearly and calmly. Listen to their concerns carefully. Resolve misunderstandings through effective conversation. Being polite helps. It makes communication smooth. E-Mail can be useful. It keeps records of all exchanges.

Prepare before starting negotiations. Understand what you want. Be firm, but fair. Offer solutions that benefit both sides. Suggest a payment plan if needed. Highlight the importance of settling the issue. Compromise is often necessary. Remain respectful during talks. Aim for a win-win outcome.

Prevention Strategies

Invoices must show the right amount. Check prices and quantities. Mistakes can lead to short payments. Make sure all details are correct. The invoice should match the order.

Bedingungen must be simple. Everyone should understand payment rules. List all fees. Say when payment is due. This helps avoid confusion. Share these terms with every customer.

Check accounts often. Look for unbezahlte Rechnungen. Discuss any problems with customers. This keeps the payment process smooth. Stay in touch to solve issues quickly.

Rechtliche Hinweise

Contractual obligations are key in handling short payments. Every contract sets rules. These rules guide how payments should be made. Ignoring these rules can lead to trouble. Parties must follow the terms agreed upon. If they don’t, conflicts arise.

Verschieden dispute resolution options exist. Mediation offers a peaceful way to solve issues. It’s quicker and less costly than court. Arbitration involves a neutral party deciding the outcome. Both methods aim to settle disputes without lengthy battles.

Legal recourse is the last resort. When disputes can’t be settled, legal action may be needed. Lawyers can help navigate this path. Courts decide the final outcome. This process can be long and expensive. Understanding legal rights is crucial.

Häufig gestellte Fragen

What Does Short Payment Mean?

A short payment occurs when a buyer pays less than the full invoice amount. This can result from disputes, errors, or discounts. It requires reconciliation to resolve discrepancies and ensure accurate financial records. Businesses must address short payments promptly to maintain good relationships with customers and ensure financial accuracy.

How Do You Handle Short Payments?

To handle short payments, first identify the reason for the discrepancy. Communicate with the customer to resolve any issues. Adjust the invoice if necessary, and ensure accurate record-keeping. Implement clear payment terms and dispute resolution processes to prevent future short payments.

Prompt resolution maintains customer relationships and financial accuracy.

Why Do Short Payments Happen?

Short payments happen due to invoice disputes, errors, or applied discounts. Customers may disagree with charges or find discrepancies. Sometimes, they deduct discounts or allowances. It’s crucial to identify the cause of short payments promptly. Addressing these issues helps maintain healthy customer relationships and ensures accurate financial management for businesses.

Can Short Payments Affect Cash Flow?

Yes, short payments can affect cash flow by reducing expected income. This may lead to difficulties in meeting financial obligations. Regular short payments can strain business resources. It’s important to address them promptly to maintain healthy cash flow. Implementing effective credit control and resolution procedures can mitigate cash flow issues.

Abschluss

Understanding short payments is crucial for managing finances effectively. Businesses often encounter them. They can impact cash flow. Knowing their causes helps in preventing issues. Solutions include prompt communication with clients. Ensure correct invoices and payment terms. This reduces disputes.

Tracking these payments aids in maintaining financial health. It also builds trust with partners. Use this knowledge to handle short payments better. It benefits both individuals and businesses. A proactive approach can make a significant difference. Keep learning about financial terms.

Knowledge empowers you to manage money wisely. Stay informed and improve your financial stability.