How to Get Stop Payment Indicator Removed: Expert Guide

Are you feeling stuck because of a stop payment indicator on your account? This little red flag can cause big headaches, especially when it stands between you and important financial transactions.

Maybe you’ve been denied a loan or faced unexpected challenges when trying to make a payment. Whatever the case, the frustration is real, and you’re not alone. Imagine the relief and freedom of having that pesky obstacle removed. The ability to move forward with confidence and peace of mind is within reach.

In this guide, you’ll discover simple and effective steps to clear that stop payment indicator. You deserve to regain control over your financial life, and we’re here to help you do just that. Keep reading to unlock the secrets of a smoother financial journey.

Understanding Stop Payment Indicators

Stop payment indicators are signs on bank accounts. These signals show a request to halt a payment. It is often due to mistakes or fraud issues. Banken use these indicators to protect account holders. Sometimes people need these indicators removed. Removing them can help in making payments again. This process requires contacting the bank. It is important to explain why the indicator is not needed. Kommunikation with the bank can solve many problems. Always be polite and clear while talking to them. Sometimes a written request is necessary. This helps banks understand the situation better. A quick response from the bank is crucial for smooth transactions. Be patient but persistent.

Reasons For Stop Payment Indicators

Stop payment indicators are often due to versäumte Zahlungen. Banks may block further transactions. Errors in billing can also cause these indicators. Sometimes, betrügerische Aktivitäten leads to a stop. Incorrect account details may trigger it too. Bank policies vary, and some may flag accounts quickly. Kommunikation errors between banks and clients are common. Always check your bank statements. Kontaktieren Sie Ihre Bank if you see a stop. Explain the situation clearly. Resolve any disputes as soon as possible. Providing erforderliche Dokumente helps speed up removal. Always keep records of your transactions. This can prevent future issues.

Beurteilung Ihrer finanziellen Situation

Check your Kontoauszüge every month. See all the deposits and withdrawals. Make sure all entries are correct. Look for any unerwartete Gebühren. If you see a wrong entry, note it down. This helps in understanding your financial health.

Spotting payment errors is crucial. Errors can occur often. Look for duplicate payments or wrong amounts. Check for payments you did not make. Finding these errors early saves you money. Always keep an eye on Transaktionsdetails.

Communicating With Your Bank

Gather all wichtige Dokumente before meeting the bank. You need your Kontoauszug. Show any Zahlungsnachweis if available. Bring your Identifikation card. Have your Kontodetails ready. These will help speed up the process.

Call the bank to schedule a meeting. Ask about the available times. Choose a time that suits you. A morning meeting might be best. It can be quieter. Arrive early for your meeting. This shows you are prepared.

Negotiating Removal Terms

Gather all necessary documents for your case. Organize them neatly. This shows you are serious. Explain why the stop payment needs removal. Be clear and honest. Share any changes in your situation. This might help the bank understand. Ask questions if something is unclear. This shows you care. Thank the bank for their time and help. Being polite goes a long way.

Banks have rules for stop payments. Learn these rules well. This helps you know what to expect. Some banks have fees for these services. Überprüfen your bank’s fee details. Some banks have time limits. Ask about these limits. This helps avoid surprises. Always read the fine print. This keeps you informed.

Alternative Solutions

Removing a stop payment indicator involves contacting your bank. Provide necessary documentation for verification. Address any outstanding issues promptly for resolution.

Setting Up Payment Plans

Setting up a payment plan can help manage debts. Many banks offer plans to pay back owed money. It is important to talk to your bank about options. A good plan can ease stress and remove payment indicators. Paying small amounts regularly is better than not paying at all. Always check your budget before agreeing to a plan. This ensures you can keep up with payments. Plans can be monthly or weekly based on your needs. Sticking to the plan is key to removing payment indicators.

Exploring Loan Options

Exploring loan options might help clear debts faster. Different loans have different terms. Banks and lenders offer various loan choices. Interest rates can vary, so compare them. Lower interest rates save money in the long run. Some loans have flexible payment schedules. These schedules help manage payment better. Speak with a financial advisor to understand loan terms. Loans can give quick relief from financial burdens. Ensure you can repay the loan before taking it.

Preventing Future Occurrences

Removing a stop payment indicator involves contacting your bank and verifying necessary details. Keep records updated to prevent future issues. Regular communication with financial institutions helps maintain a smooth banking experience.

Maintaining Financial Health

Keeping your money safe matters a lot. Regular account monitoring helps. Look at your bank statements often. Spot errors quickly. Fix mistakes before they grow big. Always know how much money you have. This way, no surprise charges happen. Check for any strange activity. Fraud can hurt your savings. Make sure your bills are paid on time. Late payments can add fees. Plan your budget well. Save some money every month. This helps in emergencies.

Regelmäßige Kontoüberwachung

Checking your account often is smart. It tells you what’s happening with your money. Watch for changes in your balance. If something looks wrong, act fast. Call your bank if you see strange charges. This keeps your account safe. Alerts can help you too. Set them up. They will tell you when big changes happen. Bleiben Sie informiert about your account always. This keeps money problems away.

Seeking Professional Help

A financial advisor can help with money problems. They know how banks work. They understand stop payment indicators. These experts offer guidance on removing these indicators. They create a plan just for you. A good advisor listens to your needs. They explain things clearly. They know the steps to take. This can save you time and stress. Finding the right advisor is important. Ask for recommendations from friends. Trust is key in these relationships. Always choose someone with experience.

Legal experts can offer advice on money matters. They know the law well. They can help with stop payment issues. Legal experts review documents. They make sure everything is correct. They can speak on your behalf. This is helpful if there are disputes. They ensure your rights are protected. It’s good to have legal support. It can make the process easier. Always consult someone you trust. A lawyer with experience is best.

Häufig gestellte Fragen

What Is A Stop Payment Indicator?

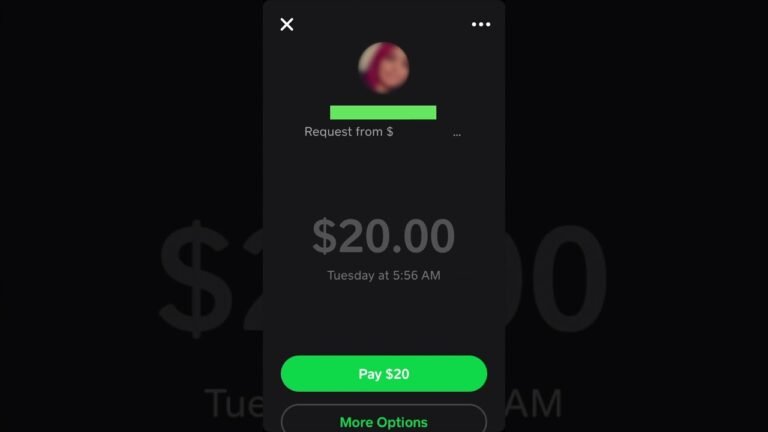

A stop payment indicator is a bank alert preventing a transaction. It usually occurs due to insufficient funds or suspected fraud. Removing it often requires resolving the underlying issue. Contacting your bank’s customer service can provide specific steps to resolve and remove the stop payment indicator.

How Can I Remove A Stop Payment Indicator?

To remove it, contact your bank and resolve the issue. Ensure sufficient funds are available and address any account discrepancies. Follow the bank’s procedures for removal, which may vary. Regular communication with your bank helps expedite the process.

Why Did I Receive A Stop Payment Indicator?

A stop payment indicator can occur for several reasons. Common causes include insufficient funds, suspected fraud, or account discrepancies. Identifying the cause involves reviewing recent transactions and contacting your bank for clarification. Understanding the reason is crucial to resolving the issue effectively.

How Long Does It Take To Remove A Stop Payment?

The removal process varies by bank and situation. Typically, it takes a few business days once the issue is resolved. Prompt communication and action can expedite this timeframe. Always check with your bank for specific details and timelines regarding your account.

Abschluss

Removing a stop payment indicator can feel challenging. But, with the right steps, it’s achievable. Start by contacting your bank. Explain your situation clearly. Provide any required documentation promptly. Stay organized and keep records. This helps track your progress. Be patient and polite during the process.

Persistence often leads to success. Understanding bank procedures is essential. It makes the process smoother. Keep communicating until the issue resolves. Remember, resolving financial issues takes time. But, it’s worth the effort for peace of mind.