Which of the Following Payment Methods Amortizes a Loan: Discover the Best Options

Are you feeling overwhelmed by the complexities of loan repayments? You’re not alone.

Figuring out which payment method best suits your needs can be daunting. However, understanding how each option works can empower you to make smarter financial decisions. We’ll cut through the jargon and explain which of the following payment methods actually amortizes a loan.

By the end, you’ll have a clear grasp of how you can manage your debt more effectively, saving you time, money, and stress. Ready to take control of your financial future? Let’s dive in and unravel the mystery of loan amortization.

Loan Amortization Basics

Amortization helps you pay off a loan in small parts over time. Each payment includes interest and a part of the principal. This way, the loan gets smaller each month. Over time, interest becomes less, and principal becomes more. At the end, the loan is completely paid off. The most common way is to have fixed monthly payments. This keeps payments steady. It also makes it easier to plan your budget. But not all loans use this method. Some loans may have different payment plans.

Fixed-rate Mortgages

Fixed-rate mortgages offer stable payments every month. This means you pay the same amount until the loan is done. You can plan your money better. No surprises in your budget. This helps many families feel safe about their house payments. They can know exactly what to expect. That’s a big relief for many.

These loans are good for langfristige Planung. You know how much you pay each month. This helps you save for other things. Like vacations or college. It makes it easy to plan for the future. You can focus on other goals. Your house payment will not change. This stability is why many people choose fixed-rate loans.

Adjustable-rate Mortgages

Adjustable-rate mortgages often start with low interest rates. These rates make monthly payments smaller. Buyers find them attractive due to this initial cost. The low rates last for a set period. Usually, this period is 5 to 7 years. During this time, payments are more affordable. Borrowers save money early on. This helps when budgets are tight. But the situation can change.

After the initial period, rates can go up. This means monthly payments increase. Borrowers might face financial strain. It’s important to plan for this. Sudden hikes can surprise homeowners. Preparing for adjustments is wise. Some people may refinance their loan. Others might sell their home. Rate changes can affect housing stability. Consider risks before choosing this mortgage.

Interest-only Loans

Interest-only loans offer lower initial payments. This can help families save money early on. The principal does not decrease during this time. Only interest is paid monthly. This makes it attractive for short-term plans. Families can use the extra money for other needs. But, future payments can be much higher.

Der loan balance remains the same for a long time. This is because no principal is paid off. It can lead to higher costs overall. Borrowers might face bigger payments later. This can be risky if not planned well. Understanding these impacts is crucial.

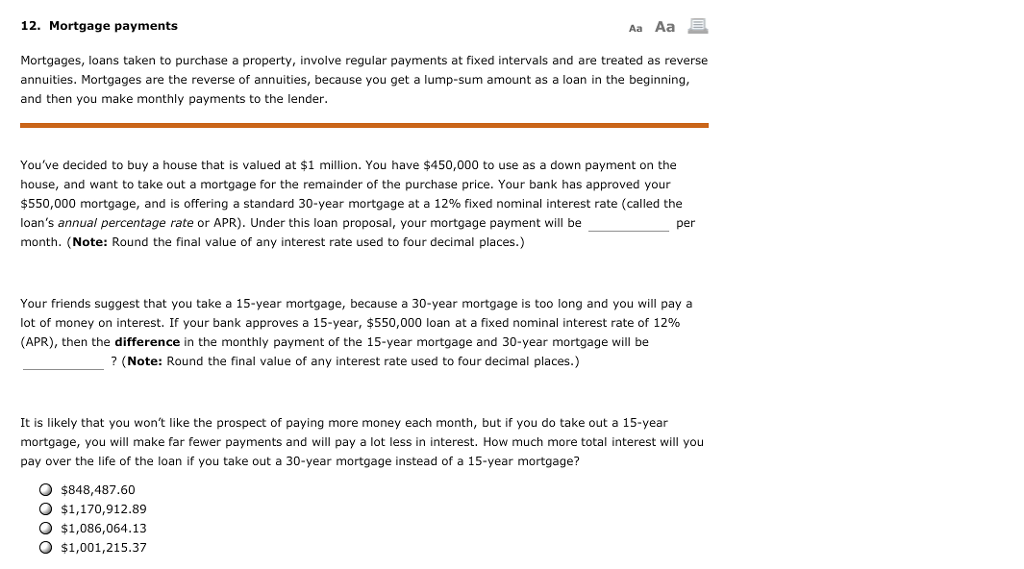

Balloon Payment Loans

Balloon payment loans can be affordable at the start. Monthly payments are low. This helps with short-term budgets. Many people can manage these payments. They seem easy and simple.

At the end, a big payment is due. This is the balloon payment. It can be hard to pay. Some people find it difficult. They may need to save a lot. This can be stressful. Planning is very important.

:max_bytes(150000):strip_icc()/amortized_loan.asp-final-23646fe3883e4f87902df8207a750e0a.png)

Biweekly Payment Plans

Biweekly payment plans help to pay off loans faster. Payments are made every two weeks. This means 26 payments in a year. Extra payments reduce the loan balance. It speeds up the repayment process.

Biweekly plans lower interest costs over time. More payments mean less interest. The loan balance reduces quickly. Paying less interest saves money. Biweekly payments are a smart choice.

Extra Principal Payments

Extra principal payments can shorten the loan term. Paying more each month reduces the loan faster. It helps you pay off the loan early. This means fewer payments over time. The loan ends sooner. You save money on interest.

Extra payments change the loan length. Paying more reduces the number of months. You finish paying the loan earlier. This is a smart choice to save time and money. It shortens the loan period.

Making extra payments saves on interest costs. Less interest means more money stays with you. Interest is a fee for borrowing. Paying less interest saves you money. Extra payments cut down this fee. You save a lot over the loan’s life.

:max_bytes(150000):strip_icc()/balloonloan.asp-final-adc4ed58300e4c13a8497d3afd9fd46d.png)

Choosing The Right Payment Method

Setting clear finanzielle Ziele is important. Goals help in choosing the best payment method. Some people want to pay off loans fast. Others prefer smaller payments over time. Understanding your needs can guide you well.

Everyone has a different risk tolerance. Some people are fine with higher risks. Others prefer safer methods. Knowing your comfort level with risk is key. It helps in picking a suitable payment plan. Choose what feels right for you.

Häufig gestellte Fragen

What Does Amortizing A Loan Mean?

Amortizing a loan involves gradually paying off the principal and interest. Payments are scheduled in equal installments. This method reduces the debt over time. It ensures the loan is fully paid by the end of the term. It’s commonly used for mortgages and car loans.

How Does A Fixed-rate Loan Amortize?

A fixed-rate loan amortizes through equal monthly payments. Each payment reduces both principal and interest. Over time, more of each payment goes toward the principal. This method offers predictable payments. It’s ideal for budgeting and financial planning.

Why Choose Amortizing Loans For Debt Management?

Amortizing loans simplify debt management with consistent payments. They reduce debt steadily over time. Predictable payments help in budgeting. They make it easier to plan finances. This method ensures full repayment by the loan term’s end.

What Is The Benefit Of Amortization Schedules?

Amortization schedules offer a clear repayment plan. They detail each payment’s allocation to principal and interest. This transparency helps in financial planning. Borrowers can track debt reduction over time. It aids in managing finances efficiently.

Abschluss

Choosing the right payment method is crucial for loan amortization. Each option offers different benefits and challenges. Fixed payments provide consistency. Adjustable payments offer flexibility. Interest-only payments reduce early costs. Understand your financial goals. Consider your budget. Make an informed decision.

This ensures manageable payments over time. Seek advice if needed. Financial experts can help clarify choices. The right method can ease financial stress. Plan carefully to enjoy peace of mind. Your journey to loan repayment will be smoother. Remember, informed choices lead to financial stability.