What Are Payment Applications: Unlock Seamless Transactions

Imagine being able to handle all your transactions with just a few taps on your smartphone. Sounds convenient, right?

That’s exactly what payment applications offer you. They are revolutionizing the way you manage your money, making payments faster, easier, and more secure than ever before. But what exactly are these payment applications, and why should you care? You’ll discover everything you need to know about these digital tools that are changing the financial landscape.

We’ll unpack how they work, why they’re essential for your financial ease, and how they can enhance your everyday life. Stick around, because understanding payment applications might just transform the way you think about spending and saving.

Payment Applications Overview

Payment applications help people send and receive money. They work on phones and computers. Many people use them every day. These apps make buying things easy. Users can pay in stores or online. Some apps allow splitting bills with friends. This can be fun during dinner. Security is important in these apps. They keep your money safe. Apps often have passwords or fingerprints for safety. This helps protect your account. Many apps offer different ways to pay. You can use a credit card or bank account. Some apps even use digital wallets. They store money like a wallet in your pocket. Payment applications are fast. Sending money takes just seconds. This is quicker than traditional methods. Many users enjoy the speed and ease of these apps. Payment apps are popular worldwide. People in many countries use them. They help make payments simple and fast.

Types Of Payment Applications

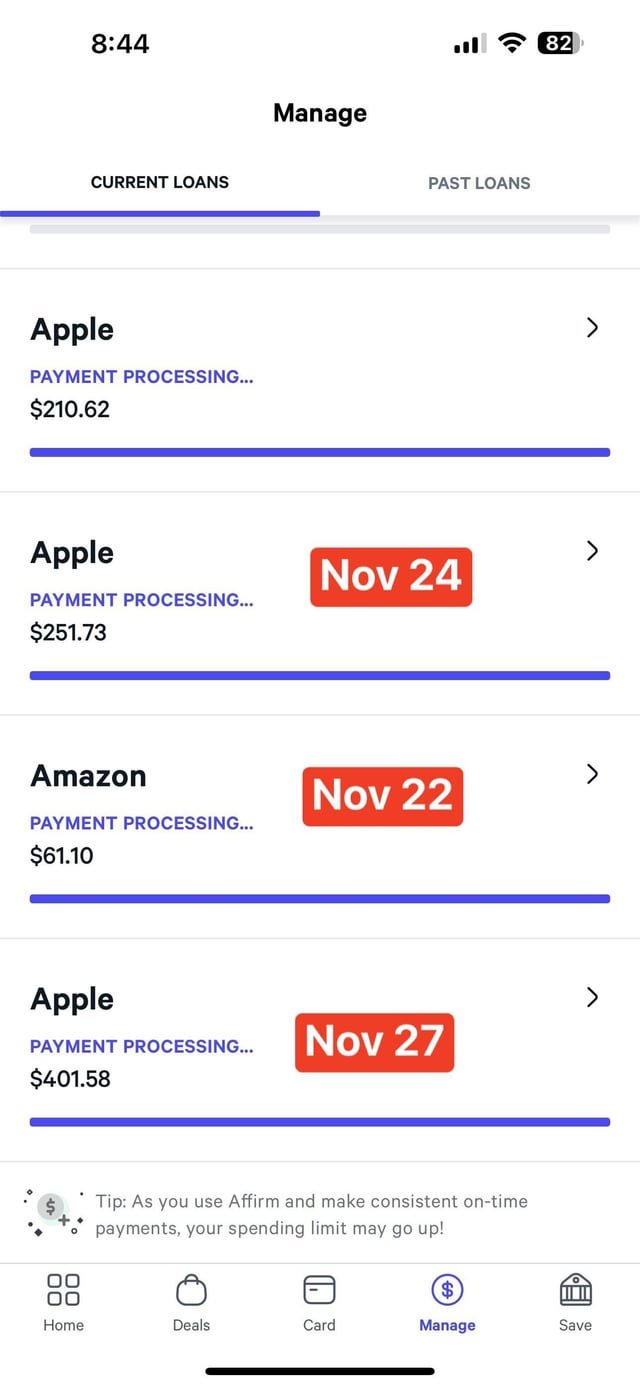

Mobile payment apps let you pay with your phone. They are schnell and easy. You can use them in stores or online. Examples are PayPal and Apple Pay. These apps help you buy things without cash. No need to carry a wallet. Just tap your phone to pay.

Online payment gateways help you pay on websites. They keep your money safe. Gateways like Stripe and PayPal are popular. They let you shop online quickly. You can pay with a card or a bank account. Many people use them every day.

Peer-to-peer payment platforms let you send money to friends. They are simple to use. Apps like Venmo and Cash App are common. You can split bills or pay for dinner. No need for cash or checks. Just your phone and an app.

Key Features Of Payment Apps

Payment apps use strong Sicherheitsmaßnahmen to keep your money safe. They have passwords Und PINs. Some apps use fingerprints oder face scans for extra security. Your data is kept Privat. They use Verschlüsselung to protect information. Security is very important in these apps.

Payment apps are easy to use. They have einfach Und clear designs. You can easily find what you need. Buttons Und icons are big and bright. Instructions are easy to follow. Even kids can use them. Everything is very benutzerfreundlich.

Many payment apps support multiple currencies. You can use dollars, euros, oder yen. This is good for people who travel. You don’t need to worry about Wechselkurse. The app does it for you. It makes life easy for everyone.

Benefits Of Using Payment Apps

Payment apps are very einfach to use. You can pay quickly with just a few taps. No need to carry cash or cards anymore. You can pay from anywhere at any time. Simple and fast.

These apps offer strong Sicherheit features. Your money is kept sicher with encryption. Personal information is also protected. Less risk of theft or fraud. Feel sicher with every transaction.

Using payment apps can save Geld. Many apps have no zusätzliche Gebühren. Discounts and offers are also available. You can track Ausgaben easily. Manage your budget better.

Challenges In Payment Applications

Payment apps face many security threats. Hackers try to steal your money. They use tricks to get your information. This can cause big problems. Your data must stay safe. Strong passwords help protect you. Be careful with your information.

Sometimes apps don’t work right. Technische Störungen can happen. Payments might not go through. This can be very annoying. People need a working app. Glitches make users unhappy. Fixing them is important.

Payment apps must follow rules. This is called Einhaltung gesetzlicher Vorschriften. Rules keep things fair and safe. Breaking them can cause trouble. Companies need to know the rules. This helps avoid problems. It’s important to stay updated.

Future Trends In Payment Technology

AI and machine learning are changing payment apps. These tools make payment systems smart. They learn from user actions. This helps in making quick decisions. Fraud can be detected faster. It improves security. User experience becomes better.

Blockchain technology is making payments safe. It offers a transparent way to track transactions. Kryptowährungen are gaining trust. More people use them for payments. This tech reduces the need for banks. It lowers transaction fees.

Biometrische Authentifizierung makes payments secure. Fingerprints and face scans are used. This stops unauthorized access. Users find it easy and quick. Passwords are less needed. Security is improved greatly.

Choosing The Right Payment App

People have different needs and preferences. Some want schnell transactions. Others care about niedrige Gebühren. It’s important to think about what you need. Do you shop online a lot? Or maybe you split bills with friends often? These questions help in picking the best app for you. Make a list of what you need most. This helps in making the right choice.

Sicherheit is very important in payment apps. Check if the app has strong encryption. Look for apps that use Zwei-Faktor-Authentifizierung. This adds an extra layer of safety. Also, read reviews about app security. People share their experiences online. This gives insight into how safe the app is.

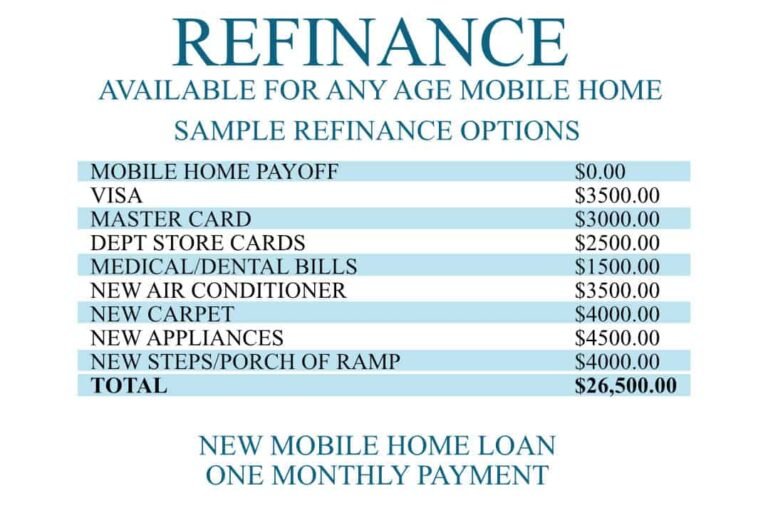

Many apps have Gebühren Und charges. Some apps charge for sending money. Others have fees for currency exchange. It’s smart to compare these costs. Choose an app with fees that fit your budget. Some apps offer frei transactions for certain uses. This can save money over time. Always read the fee details carefully.

Häufig gestellte Fragen

What Are Payment Applications Used For?

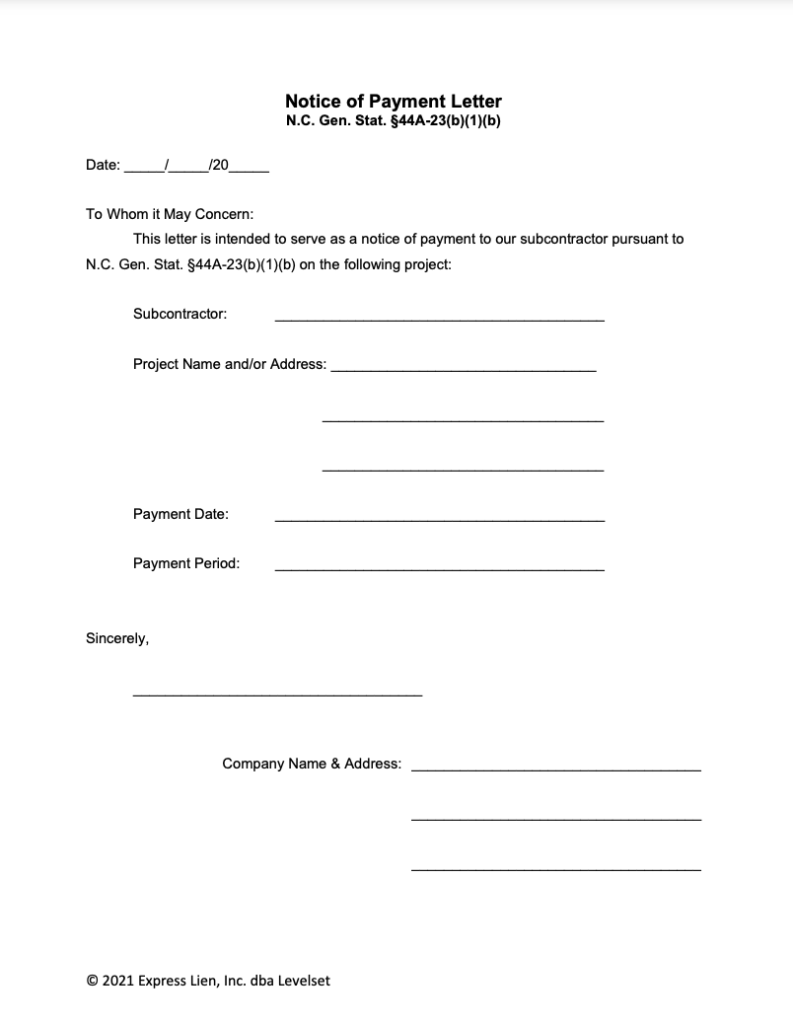

Payment applications facilitate financial transactions between buyers and sellers. They provide a secure platform to transfer money. Users can pay bills, transfer funds, and purchase goods or services. These applications are designed to simplify online and in-person payments. They enhance the convenience and speed of monetary transactions.

How Do Payment Applications Work?

Payment applications connect users to their bank accounts or credit cards. They securely process transactions by encrypting data. Users can initiate payments by entering the recipient’s details. The application verifies the transaction details before processing. Funds are then transferred to the recipient’s account, completing the transaction.

Are Payment Applications Secure?

Yes, payment applications are generally secure. They use encryption to protect users’ financial information. Many apps offer additional security features like two-factor authentication. This helps prevent unauthorized access. However, users should always ensure they are using reputable applications. Regularly updating the app can also enhance security.

Can Payment Applications Be Used Internationally?

Yes, many payment applications support international transactions. They allow users to send money across borders. However, some apps may charge fees for international transfers. Exchange rates can also affect the final amount received. It’s advisable to check the app’s policies before initiating international payments.

Abschluss

Payment applications simplify transactions for both businesses and users. They offer secure and convenient ways to manage money. Users enjoy quick payments without the need for cash. Businesses benefit from faster processing and reduced errors. These apps also provide detailed transaction records.

This makes budgeting and tracking expenses easier. As technology advances, payment apps will likely become more integrated. They are essential tools in our digital world. Understanding their features can enhance your financial management. So, explore different payment apps. Find one that suits your needs.

Embrace the ease and security they bring to everyday transactions.