Do You Need a Down Payment for a Construction Loan: Essential Insights

Are you dreaming of building your perfect home but feeling a bit overwhelmed by the financial jargon surrounding construction loans? You’re not alone.

One of the biggest questions you might be asking is: “Do you need a down payment for a construction loan? ” Understanding this can be the key to turning your dream home into a reality. Imagine having a clear path forward, knowing exactly how much you need to save and how to position yourself financially.

This knowledge can ease your anxiety and put you in control of your home-building journey. Dive into this article to find out everything you need to know about down payments for construction loans, and you’ll be one step closer to building the home you’ve always wanted.

Understanding Construction Loans

Construction loans are special loans for building houses. They help with costs for materials and labor. These loans have different types. Construction-to-permanent loans turn into a regular mortgage after building. Stand-alone construction loans need separate financing after construction. Each loan has unique features. It is important to know these features before choosing.

Construction loans offer flexible options. They often require a Anzahlung. Down payments help secure the loan. Interest rates might be higher than regular loans. Payments are usually interest-only during construction. These loans need careful planning. Good planning helps avoid problems.

Role Of Down Payment

Down payments are wichtig in construction loans. They show your commitment to the project. Lenders feel more secure when you make a down payment. It reduces the risk for them. A bigger down payment can mean better loan terms. This means lower interest rates or easier approval.

Down payments can affect loan approval. Lenders check your financial stability. A down payment shows you have savings. It can improve your chances of getting the loan. If you have a large down payment, lenders might approve your loan quicker. They might also offer better conditions.

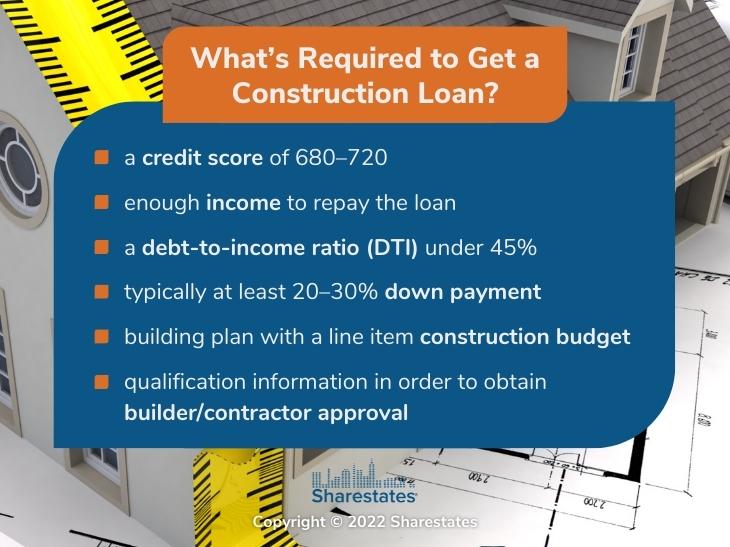

Typical Down Payment Requirements

Most people need a Anzahlung for a construction loan. The standard amount is about 20% of the total cost. This means if your construction project costs $100,000, you might need $20,000. The bank wants to see that you have a stake in the project.

Several things can change how much down payment you need. Your Kreditwürdigkeit is important. A higher score can mean a smaller down payment. The type of property also matters. Building a home might need more money upfront compared to other projects. The lender’s policies can vary. Some might ask for more, others less. It’s good to check with different lenders.

Alternatives To Traditional Down Payments

Using land as equity can help with construction loans. The land you own can act like a down payment. Lenders may accept land if its value is high. This means you might not need extra cash upfront. Land must be free from any debts. It helps if the land is already paid for. The more valuable the land, the better. This way, land becomes a useful asset for loans.

Personal assets can also be used for construction loans. These assets include savings or valuable items. Savings accounts with money are helpful. Even jewelry or vehicles can be considered. Lenders look at these as a form of payment. Personal assets must be owned by you alone. They should be easy to prove as yours. These assets can reduce the need for cash payments. Using assets is a smart option for many.

Financial Preparation Tips

Save money for a construction loan. It’s very important. Start by setting aside small amounts. Do this every week or month. Over time, your savings will grow. Keep track of your expenses. Cut back on things you don’t need. This helps your savings increase faster. Having savings shows lenders you are serious. It makes them trust you more. Always aim to save extra for unexpected costs. These might pop up during construction.

A good credit score is important. Pay bills on time. This helps your score a lot. Try to pay off any debts. Even a little at a time helps. Keep credit card balances low. Don’t open too many new accounts. Each new account can lower your score. Check your credit report often. Look for mistakes. Fix them quickly. A better score can lead to better loan terms.

Working With Lenders

Need a down payment for a construction loan? Most lenders do require it. Typically, expect to provide 20% upfront. This helps secure the loan and shows commitment to the project. Some lenders might offer different terms, so explore options carefully.

Choosing The Right Lender

Picking the right lender is key. Forschung each lender’s terms and conditions. Some lenders may offer better Zinssätze. Others might have niedrigere Gebühren. Check if the lender is familiar with construction loans. This can make the process smoother. Erfahrung in this area is vital. It can impact your loan approval. Compare different lenders carefully. Ask questions. Make sure you understand their policies. This can save you money and stress. A good lender can be a valuable partner.

Negotiating Terms

Terms can vary greatly. Interest rates Und down payments are important. You might negotiate a lower rate. This can lead to big savings. Down payment requirements can differ. Some lenders ask for more. Others might need less. Discuss what you can afford. Be clear about your budget. Klare Kommunikation helps avoid misunderstandings. It’s good to get terms in writing. This prevents future issues. Verhandlung is a vital skill. It can make a big difference in your loan deal.

Mögliche Herausforderungen

Common Pitfalls in construction loans can be tricky. Some lenders require high down payments. This can be hard for many. Delays in construction may also occur. Weather or supply issues can cause these delays. Such setbacks increase costs. This affects your budget. Another pitfall is changing plans. Altering designs mid-project adds expenses. Overspending can happen quickly. It is crucial to stay on track. Not doing so can lead to financial strain.

How to Overcome Hurdles is important to learn. Planning helps a lot. Budgeting well prevents overspending. Save extra money for unexpected costs. Keep communication open with your builder. This avoids misunderstandings. Choose a reliable lender. They provide clear terms. A strong plan ensures less stress. Stick to your budget and timeline. This makes the loan process smoother.

:max_bytes(150000):strip_icc()/basics-of-construction-loans-315595_final-c0f70269da9347709bd6327c9e242f60.png)

Future Trends In Construction Financing

New loan ideas help borrowers. Flexible payment plans are one idea. These plans let people pay less money at the start. Another idea is interest-only loans. People pay only interest first. This makes the loan easier to handle. Some loans use digitale Werkzeuge. These tools make the process fast. They also make it simple. Borrowers like this speed and ease.

Market changes affect loan terms. Interest rates may go up or down. This changes how much money people pay. Housing prices can rise fast. This means loans need to be bigger. Banks may change rules. They might ask for more information. These changes can make loans harder to get. Borrowers need to stay informed.

Häufig gestellte Fragen

What Is A Construction Loan Down Payment?

A construction loan down payment is an upfront cost. It is typically required by lenders to secure the loan. The amount can vary, but it often ranges from 20% to 25%. This helps lenders mitigate risk and shows the borrower’s financial commitment.

How Much Down Payment Is Needed For Construction Loans?

Down payments for construction loans usually range from 20% to 25%. The exact amount depends on the lender and project specifics. This percentage may vary based on credit score, loan type, and project cost. It’s essential to check with individual lenders for precise requirements.

Why Do Lenders Require Down Payments For Construction Loans?

Lenders require down payments to reduce financial risk. It ensures the borrower has a stake in the project. A substantial down payment demonstrates financial stability and commitment. It also protects lenders in case of default, as it lowers the loan-to-value ratio.

Can I Use Land As A Down Payment?

Yes, land can often be used as a down payment. If you own the land outright, its value can contribute to the required down payment. This can significantly reduce the cash needed upfront. It’s important to discuss this option with your lender.

Abschluss

Understanding construction loans can feel complex. A down payment is often required. It shows your commitment to the project. Lenders usually ask for 20% or more. This helps reduce their risk. Always check loan terms carefully. They vary by lender and project type.

Saving for a down payment can ease the process. It demonstrates financial responsibility. Consider speaking with a loan officer. They can offer tailored advice. Proper preparation makes securing a loan smoother. Remember, informed decisions lead to successful projects.