Have you ever sent money through Cash App, only to realize moments later that you might have made a mistake? It’s a sinking feeling, isn’t it?

In a world where digital transactions are becoming the norm, situations like these can leave you feeling anxious and uncertain. You might wonder if your bank can help you dispute that Cash App payment. You’re not alone in this predicament, and understanding your options can provide peace of mind and potentially save your hard-earned money.

This guide will delve into the possibilities of reversing a Cash App transaction through your bank, offering you clarity and actionable insights. Are you ready to regain control over your digital finances? Keep reading to discover what steps you can take when faced with this common dilemma.

How Cash App Transactions Work

Digital wallets store money online. They work with mobile apps. Cash App is one such wallet. It helps to send and receive money easily. People use it for quick payments. No need for cash or checks. Just a phone and internet.

Users link their bank accounts to Cash App. This allows money transfer. It’s done in a few steps. Enter bank details in the app. Then confirm the connection. Now money moves between the bank and Cash App.

Transactions on Cash App are simple. Choose a person to send money to. Enter the amount. Press the send button. The money moves instantly. Both sender and receiver get a notification. Easy and fast.

Common Issues With Cash App Payments

Many people worry about unauthorized transactions on Cash App. It can be scary. Someone might use your account without asking. This can happen if your details are not safe. Always keep your passwords private. If you see something strange, tell your bank right away.

Sometimes, Cash App faces technical glitches. This means the app might not work well. It can freeze or crash. Payments might not go through. This can be frustrating. Always check your app version. Make sure it is up to date for fewer problems.

Sending money to the wrong person is a problem. Recipient discrepancies happen often. Double-check the username before sending money. If you send it to the wrong person, it is hard to get it back. Be careful and confirm before you pay.

Role Of Banks In Disputing Payments

Banks have limited authority over digital transactions. They follow strict rules to manage disputes. Banks rely on transaction records to verify claims. Customers must provide evidence for disputes. Banks can help with chargebacks in certain cases. But not all disputes lead to chargebacks.

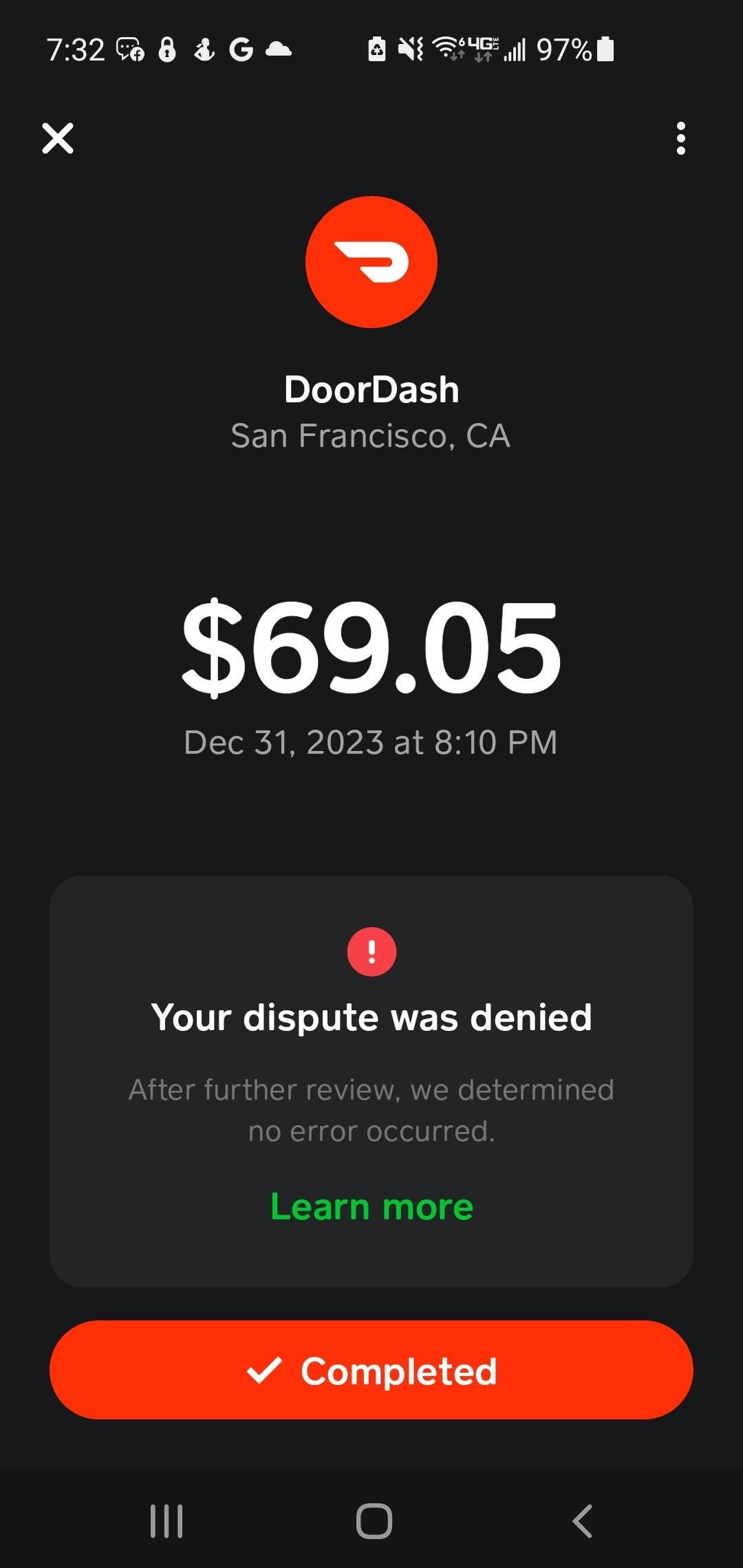

Chargebacks are refunds for disputed payments. Banks start the process after a customer complaint. They review the transaction details carefully. Banks contact the payment service for more information. If valid, the bank gives a refund to the customer. This process can take weeks to complete.

Banks face challenges with digital payments. Fraud is a major concern. Detecting fraud is hard in digital transactions. Sometimes, banks can’t reverse payments. Service agreements limit their actions. Customers must understand these limitations. Patience is key during the dispute process.

Steps To Dispute A Cash App Payment

First, reach out to Cash App Support for help. Open the app and find the support tab. You can chat with an agent. Explain the problem. They might help fix it. This is the first step to solve the issue. Always be polite and clear.

If Cash App can’t help, contact your bank. Tell them about the payment dispute. They may ask for details. Provide all necessary information. The bank might start an investigation. This could take some time. Be patient and follow their guidance.

Sometimes, legal steps are needed. Seek advice if needed. A lawyer can help with complex issues. Understand your rights and responsibilities. This is important for serious cases. Always ensure you have a strong case before proceeding legally.

Preventing Future Payment Issues

Keep your login details safe. Use a strong password. Never share it with anyone. Enable two-factor authentication. It’s an extra layer of security. Always verify the recipient’s details. Double-check before sending money. Be cautious with unknown links and requests. They may be scams. Monitor your device for unusual activities. Keep software updated for better security.

Check your accounts regularly. Look for any strange transactions. Alert your bank if you see anything odd. Keep a record of your payments. It helps track your spending. Set up alerts for large transactions. They notify you quickly. Review your statements monthly. Ensure everything matches your records.

Learn how to use digital payments safely. Follow guides and tips. Practice safe internet habits. Protect your personal information. Teach others about secure transactions. Share knowledge with friends and family. Stay informed about new threats. Keep updated with the latest security news. Awareness helps prevent mistakes.

Alternatives To Disputing Payments

Sometimes, you can ask for a refund directly. Contact the sender or receiver on Cash App. Explain the issue clearly. Be polite and patient. Many people may agree to refund if the reason is valid.

Mediation can help solve problems. A neutral person listens to both sides. They suggest solutions. Arbitration is more formal. An arbitrator makes a decision after hearing both sides. This can be a good choice for serious disputes. It saves time and money.

Some companies offer help with disputes. They act as a third-party. They make sure both sides are heard. These services can provide solutions. They might charge a fee. It can be worth it for a fair resolution.

Frequently Asked Questions

Can Banks Reverse Cash App Transactions?

Banks generally can’t reverse Cash App transactions as they are direct peer-to-peer transfers. Once initiated, these transactions are typically final. However, if you suspect unauthorized activity, report it to your bank and Cash App immediately for potential resolution or investigation.

How Do I Dispute A Cash App Payment?

To dispute a Cash App payment, contact Cash App support through the app. Provide details of the transaction and explain your issue. They may assist in resolving the dispute or investigating unauthorized transactions. Acting quickly increases the chances of a positive outcome.

Can I Get A Refund From Cash App?

Refunds on Cash App depend on the recipient’s cooperation. If they agree, the refund process is straightforward. If not, you may need to dispute the transaction through Cash App support. Timely communication with the recipient can often expedite this process.

What Should I Do If Scammed On Cash App?

If scammed on Cash App, report the transaction immediately through the app. Contact your bank to alert them of potential fraud. Cash App and your bank may investigate, but recovery isn’t guaranteed. Always verify recipient information before transferring funds to avoid scams.

Conclusion

Understanding disputes with Cash App is important for financial peace. Banks can sometimes help, but success varies. Always keep records of transactions. Contact both Cash App and your bank quickly for issues. Knowing your rights makes resolving disputes easier. Stay informed about your bank’s policies.

Protect your account by using strong passwords. Regularly monitor your transactions for any errors. Awareness and quick action can prevent further problems. Remember, it’s crucial to act swiftly and smartly.