Imagine you’ve just received a payment in your PayPal account. You’re excited, but now you’re wondering how to get that money into your bank account where it can be more readily used for your everyday needs.

You’re not alone in this curiosity. Many people find themselves asking, “Can I transfer money from PayPal to my bank account? ” The answer is yes, and it’s simpler than you might think. We’ll guide you through the process of transferring funds from PayPal to your bank, ensuring that you can access your money when you need it.

You’ll learn how to navigate PayPal’s interface with ease, avoid common pitfalls, and make the most of your funds. Whether you’re new to PayPal or just looking for a refresher, we promise you’ll come away with the confidence to manage your money effortlessly. Keep reading, and take the first step towards mastering your financial transactions today.

Understanding Paypal Transfers

PayPal has revolutionized how we handle online transactions. It’s a secure way to send and receive money globally. But transferring money to your bank account can be confusing. Understanding how PayPal transfers work is crucial. This guide will help you navigate the process.

How Paypal Transfers Work

PayPal offers an easy method to move funds. You can transfer money to linked bank accounts. The process is straightforward. Log in, select your bank, and initiate the transfer. You can do this from a computer or mobile device.

Setting Up Your Bank Account

To transfer funds, first link your bank account. Ensure your bank details are accurate. You can add this information in the account settings. PayPal will verify your bank with small deposits. Confirm these amounts to complete the setup.

Steps To Transfer Money

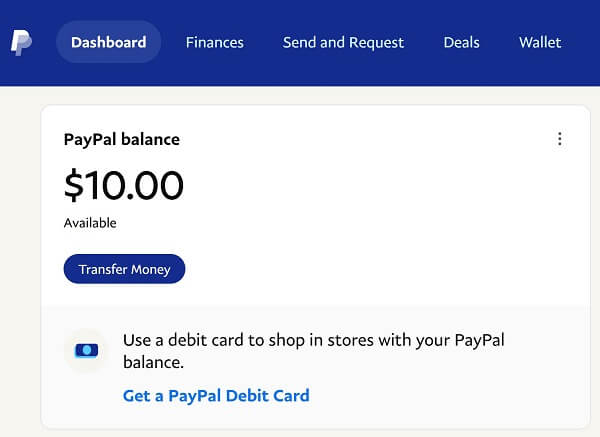

Transferring money from PayPal is simple. Start by logging into your account. Select ‘Transfer Money’ or ‘Withdraw Funds.’ Choose your bank account from the list. Enter the amount you wish to transfer. Confirm the transaction. A confirmation email will be sent to you.

Transfer Time And Fees

Understanding transfer time is important. Transfers usually take 1-3 business days. PayPal offers instant transfers for a fee. Fees vary depending on the transfer speed. Check PayPal’s website for current fees and options.

Security is a top priority for PayPal. They use encryption to protect your data. Always check for suspicious activity. Enable two-factor authentication for extra safety. Keep your password secure and unique.

Linking Your Bank Account

Transferring money from PayPal to your bank account is a straightforward process. Connect your bank details to your PayPal account securely. After linking, you can move funds with a few clicks, ensuring easy access to your money.

Linking your bank account to PayPal is essential for smooth transactions. This connection allows you to transfer funds seamlessly. It also ensures secure and quick access to your money. Here, we guide you through the simple steps. Follow these to link your bank account effectively.

Steps To Link

First, log in to your PayPal account. Find the “Wallet” section on the main menu. Click it. Next, look for the “Link a bank account” option. Select it to proceed. You may need your bank account number and routing number. Enter these details carefully. Then, review the information to ensure accuracy. Finally, click “Link Bank” to complete this step.

Verification Process

After linking, the verification process begins. PayPal deposits two small amounts into your bank account. This usually takes a few business days. Check your bank statement for these deposits. Once you see them, log back into PayPal. Go to the “Wallet” section again. Find your linked bank account. Click on “Confirm bank” to proceed. Enter the exact amounts deposited. This confirms your ownership. Your account is now verified and ready for use.

Initiating A Transfer

Transferring money from PayPal to a bank account is straightforward. Log into your PayPal account, select ‘Transfer Money’, and choose your bank. Follow the prompts to complete the transfer securely.

Transferring money from PayPal to your bank account is a straightforward process, but knowing how to initiate it is key to ensuring a smooth transaction. Whether you’ve just sold a rare collectible online or received a payment from a freelance gig, moving your funds to your bank account can be a crucial step in managing your finances. Are you ready to start this transfer? Let’s walk through it together.

###

Logging Into Paypal

Start by accessing your PayPal account. Use your email and password to log in through the PayPal website or mobile app.

Once logged in, you’ll find yourself on the dashboard, where you can see your balance and recent activities.

Keeping your login credentials secure is important. You don’t want to share them with anyone else.

###

Selecting Transfer Option

Look for the option to transfer money. You’ll typically find this under the “Wallet” section or in the dropdown menu of your balance.

The interface is user-friendly, so you won’t need to spend much time searching.

Don’t rush; make sure you click the correct option to avoid any errors.

###

Choosing Bank Account

Now, select the bank account to which you want to transfer funds. You’ll see a list of linked accounts if you have added them earlier.

Choose wisely; double-check the account details to ensure it’s the right one.

If your bank account isn’t linked yet, this is a perfect opportunity to do so.

Adding it involves a few simple steps, and it will save you time in future transactions.

Transferring money from PayPal to your bank account doesn’t need to be a daunting task. By following these steps, you can manage your finances efficiently. What’s stopping you from initiating your transfer today?

Transfer Fees And Costs

Transferring money from PayPal to your bank account involves fees. Understanding these costs is crucial. It helps avoid unexpected deductions from your funds. PayPal offers clear guidelines on transfer fees. They vary based on the transaction type. Domestic and international transfers have different fee structures. Here’s what you need to know.

Domestic Transfers

Domestic transfers usually have lower fees. PayPal charges a small percentage of the amount. This fee is deducted before the money reaches your bank account. The exact percentage depends on the payment method used. Transfers via debit cards might incur higher costs. Always check PayPal’s fee table for updated rates. It ensures you know how much you will receive.

International Considerations

International transfers often incur higher fees. PayPal applies a currency conversion fee. This fee is added to the regular transaction fee. Different countries have varying fee rates. It’s important to review PayPal’s fees for international transactions. Currency fluctuations might affect the final amount received. Ensure you have all the necessary details before transferring money internationally.

Timeframe For Transfers

Transferring money from PayPal to your bank account is simple and usually takes 1-3 business days. This process can vary depending on your bank’s processing time. Always check your bank’s policies for any additional delays.

Transferring money from PayPal to your bank account can be a smooth process if you understand the timeframe involved. Knowing how long it takes for your funds to reach your bank account can help you plan your finances better. Whether you’re transferring a small amount or a substantial sum, timing can be everything. Let’s dive into the specifics to give you a clearer picture of what to expect.

###

Standard Processing Times

Typically, a standard transfer from PayPal to your bank account takes about 1 to 3 business days. This timeframe can vary depending on your bank’s processing times and whether you initiated the transfer during a weekday or over the weekend.

Imagine it’s Friday evening, and you need funds for a weekend trip. Initiating a transfer at that time could mean waiting until the following Tuesday for the money to appear in your account.

Some users have shared that their transfers completed faster, especially if their bank has a strong link with PayPal. However, always plan for the full 3 days to avoid any surprises.

###

Expedited Transfers

If you need your money faster, PayPal offers an expedited transfer option. With this, funds can be in your bank account within minutes, but it comes with a small fee.

Consider this option if you have an unexpected expense or need immediate access to your cash. The fee might be worth the peace of mind when time is of the essence.

However, be aware that not all banks support this feature, so it’s important to check if your bank is eligible. If your bank is on board, this can be a lifesaver in urgent situations.

Understanding these timeframes helps you manage your expectations and finances efficiently. Have you ever been caught off guard by transfer times? How did it impact your plans? Being prepared can make all the difference.

Troubleshooting Common Issues

Transferring money from PayPal to a bank account is straightforward. Ensure your bank is linked to PayPal. Initiate the transfer by selecting “Transfer Money” and following the prompts.

Transferring money from PayPal to your bank account should be straightforward, but sometimes things don’t go as planned. Whether you’re new to PayPal or a seasoned user, encountering issues can be frustrating. Understanding the common problems and knowing how to fix them can save you time and stress. Let’s dive into some troubleshooting tips to help you navigate these hiccups.

###

Failed Transfers

Failed transfers can happen, leaving you wondering where your money went. The first thing to check is if your bank account information is correct on PayPal. A simple typo can derail the entire process.

Have you ever checked your bank balance expecting a transfer, only to find it missing? It’s not uncommon. Ensure your bank allows electronic transfers from PayPal, as some banks have restrictions.

Another common reason for failed transfers is insufficient funds. If you’re trying to transfer more money than available in your PayPal balance, the transfer will fail. Double-check your PayPal balance before initiating a transfer.

###

Account Verification Problems

Account verification issues are another roadblock. Is your bank account verified on PayPal? Without verification, you can’t transfer money to your bank account.

Start by ensuring that you’ve linked your bank account correctly. PayPal usually sends small deposits to verify your account. Check your bank statement for these deposits and enter the amounts on PayPal to complete verification.

Have you ever skipped the verification step because it seemed unnecessary? It might seem like a hassle, but it’s essential for security and functionality. Complete these steps to avoid future disruptions.

If you’ve recently updated your bank information, re-verification might be needed. Have you updated your bank details recently? If so, you might need to go through the verification process again to ensure seamless transfers.

By addressing these issues, you can ensure smoother transactions and fewer headaches. What steps will you take to troubleshoot your PayPal transfer problems?

Security Measures

Transferring money from PayPal to a bank account is convenient. Yet, ensuring its security is crucial. Understanding security measures helps you protect your funds. This section explores key strategies for safeguarding your transactions. Learn to recognize potential threats. Keep your online financial activities safe and secure.

Protecting Your Account

Strong passwords are essential. They keep your account safe. Use a mix of letters, numbers, and symbols. Avoid using obvious words. Change your password regularly. Two-factor authentication (2FA) adds another security layer. It requires a second step to log in. This could be a text message or email code.

Always log out after using PayPal. Especially on shared devices. Do not save login details on public computers. Regularly monitor your account activity. Check for any unauthorized transactions. Report suspicious activity immediately.

Recognizing Fraud

Phishing emails try to trick you. They look like real PayPal messages. Never click on links in suspicious emails. Always log in directly through PayPal’s website.

Be cautious of fake websites. They may imitate PayPal’s design. Check the URL carefully. It should always start with “https://”. Never share personal information with unknown sources. Scammers often ask for it. PayPal will never request sensitive details via email.

Stay informed about common scams. Educate yourself to recognize them. Awareness is key to prevention. Protect your money and personal information with vigilance.

Alternative Transfer Methods

Transferring money from PayPal to a bank account is straightforward. But, there are other ways to access your funds. Some methods offer faster or more convenient options. Let’s explore a couple of these alternative methods.

Paypal Debit Card

The PayPal Debit Card provides instant access to your PayPal balance. You can use it like any regular debit card. Withdraw cash at ATMs or make purchases directly. It eliminates the need to transfer funds to your bank account first. This method is ideal for everyday spending.

Third-party Apps

Several third-party apps facilitate easy money transfers. Venmo, owned by PayPal, is one such app. It links directly to your PayPal account. You can send money to friends or transfer funds to your bank. Another app, TransferWise, offers international money transfers. Both apps provide an alternative to traditional bank transfers.

Frequently Asked Questions

How Do I Transfer Money From Paypal To My Bank?

To transfer money from PayPal to your bank account, log into PayPal, navigate to “Wallet,” and select “Transfer Money. ” Choose “Transfer to your bank account” and follow the prompts. Ensure your bank account is linked. Transfers usually take 1-3 business days to complete.

Are There Fees For Transferring From Paypal To Bank?

Transferring money from PayPal to your bank account is generally free. However, if you opt for an instant transfer, PayPal charges a small percentage fee. It’s best to check PayPal’s latest fee structure to ensure there are no surprises.

How Long Does Paypal To Bank Transfer Take?

Standard transfers from PayPal to your bank account typically take 1-3 business days. Instant transfers are faster but incur a fee. Transfer times may vary depending on your bank’s processing times and PayPal’s service availability.

Can I Cancel A Paypal Transfer To Bank?

Once initiated, you cannot cancel a PayPal transfer to your bank account. It’s crucial to double-check details before confirming. If you encounter issues, contact PayPal support for assistance. They might be able to help, depending on the status of the transfer.

Conclusion

Transferring money from PayPal to your bank is simple. Follow steps carefully to ensure success. First, check your bank details on PayPal. Then, select the transfer option. Confirm the amount you wish to send. Funds usually take a few days to appear.

You can track the transfer in PayPal. Always ensure your bank is linked properly. Double-check for any fees involved. Regular transfers keep your finances smooth. Enjoy seamless money management with PayPal. Keep your transactions secure and easy. Your bank account will thank you.

Remember, managing money wisely is key.