Have you ever wondered if you can transfer money from your American Express card to your bank account? You’re not alone.

Many people like you are looking for ways to manage their finances more flexibly. Imagine the convenience of having the funds from your Amex card available directly in your bank account, ready to be used however you wish. This idea alone can spark a sense of financial freedom and control.

Before you dive in, you might have questions: Is it possible? How does it work? And most importantly, how can you ensure it’s done safely and efficiently? These are common concerns, and understanding the process can empower you to make informed decisions. We’ll uncover the possibilities and limitations of transferring money from your Amex to your bank account. We’ll guide you through the steps, exploring the nuances and offering tips to maximize your benefits. Ready to unlock the potential of your Amex card? Let’s delve into the details and discover how you can make the most of your financial resources.

Amex Card Features

American Express, commonly known as Amex, offers various card features. These features enhance user convenience and financial management. Amex cardholders enjoy unique benefits tailored to diverse needs. Let’s explore some key Amex card features.

Exclusive Rewards Program

Amex cards provide access to an exclusive rewards program. Cardholders earn points on every purchase. These points can be redeemed for travel, shopping, or gift cards. The program offers flexibility and value for everyday spending.

Robust Security Features

Security is a priority for Amex. The cards include advanced fraud protection systems. Users receive alerts for suspicious activities. This ensures peace of mind and protection against unauthorized transactions.

Flexible Payment Options

Amex cards offer flexible payment options. Cardholders can choose to pay in full or in installments. This flexibility helps manage monthly budgets efficiently. It provides financial control and ease.

Access To Exclusive Events

Amex cardholders gain access to exclusive events. These include concerts, dining experiences, and sporting events. Members enjoy special ticket offers and early access. It’s a unique benefit enhancing the card’s value.

Global Customer Support

Amex offers excellent global customer support. Representatives are available 24/7 to assist cardholders. Whether home or abroad, help is always just a call away. This reliable support adds to the card’s appeal.

Travel Benefits

Travel benefits are a highlight of Amex cards. Cardholders receive travel insurance and assistance services. Benefits include lost luggage protection and travel accident insurance. These features offer security during trips.

Transfer Options Available

Money transfers from Amex to a bank account are possible through cash advances or third-party services. These options vary in fees and processing times. Always check the terms before proceeding.

Transferring money from your American Express (Amex) card to a bank account can be a seamless process if you understand the options available. Whether you’re looking to pay off bills, support family, or simply move funds for better management, knowing your transfer choices will empower you to manage your finances effectively. Let’s dive into the various transfer options you can explore.

Using Online Platforms

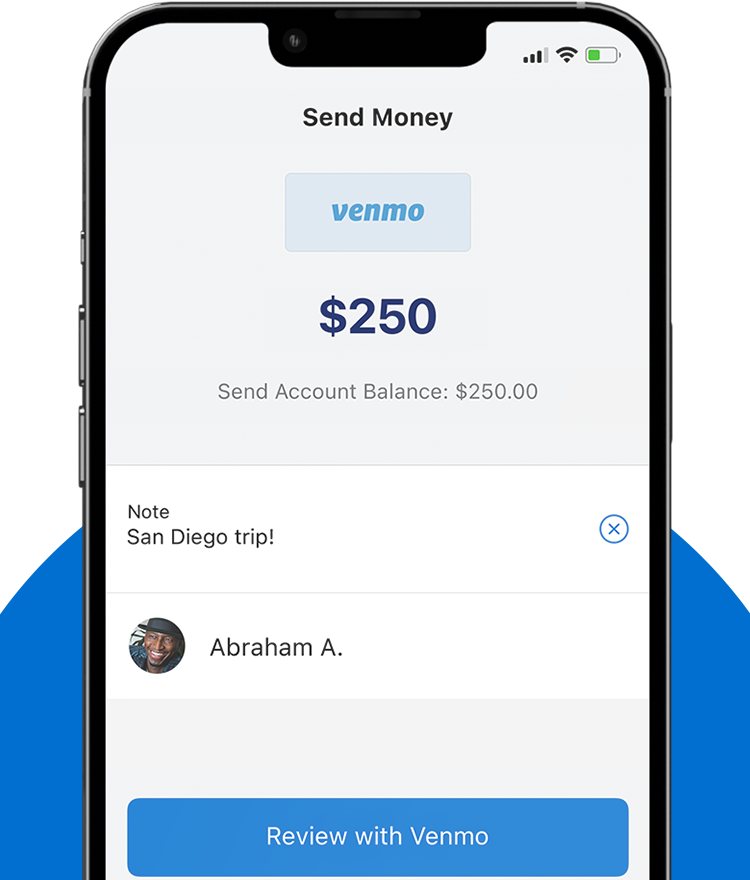

Online platforms like PayPal or Venmo offer a convenient way to transfer money from your Amex card to a bank account. These services allow you to link your Amex card and bank account, facilitating quick transfers with just a few clicks.

Have you ever been in a situation where you needed funds urgently? Using these online platforms can save you from stressful moments, providing a quick solution when you need it most. Just ensure your Amex card and bank account are linked correctly to avoid any hitches.

Direct Transfer Via Amex App

The Amex app itself can be a handy tool for transferring funds directly to your bank account. It provides a user-friendly interface where you can manage your finances effortlessly. This option is perfect for those who prefer to keep things simple and straightforward.

Imagine receiving a surprise bill—using the Amex app, you can swiftly transfer the necessary funds without breaking a sweat. It offers peace of mind, knowing you have control at your fingertips.

Utilizing Third-party Services

Third-party services like Western Union or MoneyGram offer another alternative for transferring money from Amex to a bank account. They can be particularly useful if you’re transferring funds internationally.

This might sound familiar if you’ve ever needed to send money abroad. These services can be a lifesaver, offering reliability and speed for international transfers. Always verify the fees involved, though, to avoid unexpected costs.

Considerations For Transfer Fees

It’s crucial to factor in any transfer fees that might be associated with moving funds from your Amex card to a bank account. Different platforms and services have varying fee structures.

Have you ever thought about how these fees can add up over time? Keeping a close eye on them ensures you make informed decisions, saving you money in the long run. Compare options to find the most cost-effective solution for your needs.

Security Measures

Security should always be a priority when transferring money. Ensure that whichever method you choose, it offers robust security measures to protect your personal and financial information.

Do you remember the last time you worried about online security? Choosing secure transfer options can alleviate those concerns, giving you confidence in your transactions. Look for platforms with strong encryption and security protocols.

By exploring these transfer options and considering key factors like fees and security, you can efficiently move money from your Amex card to your bank account, ensuring your financial needs are met smoothly and securely.

Using Amex For Bank Transfers

Transferring money from an Amex card directly to a bank account isn’t possible. You can use third-party services or withdraw cash using your Amex card to deposit into your bank. Always check fees and terms before proceeding with any transactions.

Thinking about transferring money from your American Express (Amex) card to a bank account might not be your usual approach, but it’s worth considering. Whether it’s for personal needs or to manage cash flow, knowing your options can be a game-changer. Let’s dive into how you can use your Amex card for bank transfers.

Direct Transfer Methods

One straightforward way is to use cash advances. You might not know this, but Amex allows cash advances, which can be transferred to your bank. Be cautious: this often comes with high fees and interest rates.

Some people use balance transfers. You transfer a balance from your Amex to another credit card that allows direct deposit into your bank. It’s crucial to check the terms, as fees can add up quickly.

Using Third-party Services

Third-party services can be a handy alternative. Services like PayPal or Venmo can link your Amex card and bank account. You can transfer funds from your Amex to your bank via these platforms, usually with lower fees than direct methods.

Consider using peer-to-peer platforms. These services allow you to pay a friend with your Amex, who then transfers the money to your bank. While unconventional, it can be a creative solution if you trust the person.

Are you comfortable with digital wallets? They often provide a seamless way to transfer funds. However, always ensure the service is reputable and secure.

Have you tried any of these methods? Each option has its pros and cons, depending on your needs and comfort level with technology. How will you decide which method works best for you?

Steps For Online Transfers

Transferring money from your American Express card to a bank account is simple. Understanding the process ensures a smooth experience. Here are the steps for online transfers to get you started. Follow these guidelines to move your funds easily and securely.

Setting Up Bank Accounts

First, ensure your bank account is linked to your Amex account. Log into your American Express online portal. Navigate to the account settings section. Click on the option to manage linked accounts. Add your bank account details. Ensure you input the correct bank account number and routing number. Double-check for any mistakes to avoid transfer errors.

Initiating The Transfer

Once your bank account is set up, initiate the transfer. Log into your American Express online account again. Go to the transfer funds section. Select the linked bank account from the list. Enter the amount you wish to transfer. Review the details to confirm accuracy. Click on the transfer button to proceed. You will receive a confirmation of the transaction. Wait for the funds to appear in your bank account. It usually takes a few business days.

Fees And Charges

Transferring money from Amex to a bank account involves understanding fees and charges. Each transaction may have different costs. Always check current fees before transferring to avoid surprises.

Transferring money from your American Express account to a bank account can be straightforward, but understanding the fees and charges involved is crucial. These costs can impact the total amount you transfer, making it essential to know what to expect. By being aware of the potential fees, you can make informed decisions and avoid unexpected surprises.

Understanding The Fees

Before initiating a transfer, it’s important to know what fees you might face. American Express may charge a fee for transferring funds to your bank account. This fee can vary based on the type of card you hold or the specific terms of your account.

Check your cardholder agreement or contact customer service for specifics. Being proactive can save you from unwanted surprises.

Comparing Charges Across Platforms

Have you ever wondered how Amex fees compare to other platforms? It’s a smart move to compare charges if you frequently transfer money. Some digital wallets might offer lower fees or even free transfers.

Assessing these options can ensure you’re not overpaying. Consider the frequency of your transactions and the amounts involved.

Additional Costs To Consider

Beyond the fees Amex charges, your bank might also impose costs. It’s worth checking if your bank charges for receiving electronic funds. Even small charges can add up over time.

Think about how these additional costs affect your overall budget. Are there ways to minimize them?

Tips To Minimize Fees

Looking for ways to reduce fees? One strategy is to consolidate transfers. Instead of multiple small transactions, consider a single larger one if possible.

Additionally, some promotions might waive transfer fees. Keeping an eye out for such offers can be beneficial.

Have you experienced unexpected charges in the past? Share your experiences in the comments to help others avoid similar pitfalls.

In the end, understanding and managing fees can lead to smarter financial decisions. How do you plan to optimize your transfers?

Transfer Timeframes

Transferring money from an American Express card to a bank account involves specific steps and timeframes. Typically, this process requires linking the card to your bank account. Once linked, transfers can take a few business days depending on the bank’s processing time.

Transferring money from your American Express card to your bank account involves understanding the transfer timeframes. It’s crucial to know how long the process will take, as it can impact your financial planning. Whether you need to make a quick purchase or cover a bill, timing is everything. Let’s dive into the specifics.

###

Understanding Standard Transfer Times

When you initiate a transfer from your Amex card to your bank account, the standard timeframe usually ranges from 1 to 3 business days. Some transfers may happen faster, while others might take longer. It’s always important to check the specific terms with your provider.

Why does it take that long? It’s all about processing and verification. Each transaction goes through several checks to ensure security and accuracy. This might seem like a hassle, but it ensures your money reaches the right destination safely.

###

Factors Affecting Transfer Speed

Several factors can influence how quickly your money moves from Amex to your bank. Are you transferring during a holiday period? Expect delays. Bank policies and procedures can also play a role. Some banks process transactions faster than others.

Moreover, the type of account you have can impact the speed. Premium accounts often enjoy expedited services. Knowing these factors can help you plan transfers more effectively.

###

How To Speed Up The Process

Want to get your money faster? Consider transferring funds early in the day. Banks tend to process transactions at the end of their business hours, so initiating a transfer in the morning can sometimes speed things up.

Another tip is to avoid transfers on weekends or bank holidays. These days typically see slower processing times. Planning ahead can save you from unnecessary waiting.

###

What To Do When Transfers Are Delayed

Occasionally, transfers might take longer than expected. If this happens, don’t panic. Check your transfer status online or contact customer service for updates. They can provide insights into any technical issues or delays.

Have you ever experienced a delayed transfer? Reflecting on past experiences can help you better anticipate and manage future transactions.

###

Ensuring Smooth Transactions

To ensure your transfers go smoothly, double-check all the details before confirming. Incorrect information can result in delays or failed transactions. Precision in these matters is key.

As you navigate these timeframes, ask yourself: how can you better plan your finances around transfer times? Being proactive in understanding these elements can empower your financial decisions.

Security Considerations

Transferring money from Amex to a bank account involves important security steps. Checking encryption and authentication protocols ensures safe transactions. Always verify the bank’s security measures before sharing personal information.

Transferring money from your American Express account to your bank account might seem like a straightforward task. Yet, it’s crucial to prioritize security during this process. This ensures your funds and personal information remain safe. But how can you ensure your transactions are secure? Let’s explore some important security considerations.

###

Understanding Encryption

Encryption plays a pivotal role in safeguarding your financial transactions. It converts your data into a code to prevent unauthorized access. Always check that your connection to any financial website is secure. Look for ‘HTTPS’ in the web address. This indicates encryption is active, protecting your information from prying eyes.

###

Two-factor Authentication

Adding an extra layer of security is always a smart move. Two-factor authentication requires two forms of identification before granting access. This could be a password and a text message code. You may have experienced this while signing into your email or social media accounts. Using it for financial transactions can significantly reduce the risk of unauthorized access.

###

Regular Account Monitoring

Keep an eye on your account activity. Regular checks can help you spot suspicious transactions early. Set up alerts for any large transactions or changes to your account settings. This proactive approach keeps you informed and ready to act if something seems off.

###

Secure Devices And Networks

Are you using a secure device and network? Ensure your device is updated with the latest security software. Avoid using public Wi-Fi for financial transactions. These networks can be easily compromised. Instead, opt for your mobile data or a secure home network.

###

Recognizing Phishing Attempts

Phishing attempts are everywhere, trying to trick you into revealing personal information. Be cautious of emails or messages requesting sensitive information. Always verify the sender’s authenticity before responding. Remember, financial institutions will never ask for your password or PIN via email.

###

Trusting Reliable Sources

When transferring money, use trusted sources and services. Research the service providers you’re using. Check reviews and ratings to ensure they’re reliable. This reduces the risk of falling victim to scams or unreliable services.

###

Engaging With Customer Support

Don’t hesitate to contact customer support if you have security concerns. They can provide guidance and support to ensure your transaction is secure. Asking questions and seeking clarification can prevent costly mistakes.

In the end, security is about being vigilant and informed. Have you ever faced a security scare while transferring money? Share your experiences and tips in the comments below. Your insights could help others navigate these waters safely!

Common Issues And Solutions

Transferring money from your American Express (Amex) card to a bank account can be tricky. Users often face various issues during this process. Understanding common problems and their solutions helps ensure a smooth transfer experience.

Failed Transfers

One common issue is a failed transfer. This can occur for several reasons. Insufficient funds in your Amex account may cause failures. Make sure your account has enough balance before initiating a transfer.

System errors may also lead to failed transactions. These are temporary and usually resolve within a few hours. If the issue persists, contact Amex customer support for assistance.

Account Verification Problems

Account verification problems can delay or stop money transfers. Ensure your Amex account details match your bank account information. Even a small mistake can cause verification issues.

Keep your contact information updated. Sometimes, Amex needs to contact you for verification. Make sure your phone number and email address are correct. This prevents unnecessary delays.

Alternatives To Direct Transfers

Sending money from Amex to a bank account directly isn’t possible. Consider using third-party services for this task. Options like PayPal or Venmo can help transfer funds efficiently.

Transferring money from your American Express card to a bank account isn’t a straightforward process like some other transactions you might be used to. But don’t worry—there are several alternatives to direct transfers that can help you manage your finances effectively. Whether you’re looking for convenience, speed, or flexibility, these options can cater to different needs and preferences.

Using Payment Apps

Payment apps are a great way to transfer funds indirectly. Apps like PayPal, Venmo, and Cash App allow you to link your Amex card and make transactions seamlessly. You can send money to a friend or family member’s account, and they can then transfer it to their bank account.

Think of it as a creative workaround. It’s straightforward, quick, and many apps offer low or no fees for certain transactions. Have you ever tried sending money for dinner using Venmo? It’s that simple. Just remember to check if your app supports Amex before proceeding.

Cash Advances

Cash advances are another option, albeit one that comes with costs. You can withdraw cash using your Amex card at ATMs, and then deposit it into your bank account. It’s a viable choice if you need cash urgently, but be aware of the fees and interest rates associated with cash advances.

I once found myself needing immediate funds during a travel mishap, and a cash advance came to my rescue. It’s not the cheapest solution, but it’s good to know this option exists for emergencies. Have you considered the cost versus convenience in financial decisions? This could be a factor worth considering.

Exploring these alternatives can help you find the best method to suit your needs. Whether it’s the ease of using payment apps or the immediacy of cash advances, knowing your options can empower you to make informed decisions.

Frequently Asked Questions

How Do I Transfer Money From Amex To Bank?

Transferring money from Amex to your bank typically involves using Amex’s cash advance feature. You may need to set up a link to your bank account. Fees can apply, and limits may exist. Contact Amex customer service for specific instructions tailored to your account.

Can Amex Cardholders Send Money Directly To Banks?

Amex cardholders can use cash advances to send money to banks. Direct transfers are not generally available for Amex cards. Fees and interest rates apply, so it’s wise to understand the costs involved. Check with Amex for detailed information on your card’s capabilities.

Are There Fees For Transferring Money From Amex?

Yes, transferring money from Amex usually incurs fees. These can include cash advance fees and interest rates. It’s important to review your card’s terms and conditions. Contacting Amex’s customer service can provide clarity on specific fees applicable to your account.

What Are The Limits For Amex Transfers To Banks?

Amex transfer limits depend on your card type and account status. Cash advances generally have daily and monthly limits. Checking with Amex for your specific card’s limits is recommended. Ensure you understand these limits before proceeding with any transaction.

Conclusion

Transferring money from Amex to a bank account is straightforward. You just need to follow the right steps. First, check if your Amex card supports transfers. Then, connect your bank account through the Amex app or website. Follow the prompts to complete the transfer.

Always verify details to avoid errors. This ensures your money reaches the right destination. Remember, it’s important to read the terms and conditions. Understanding fees and limits helps manage expectations. Keep these tips in mind for a smooth experience. Enjoy the convenience of managing your funds efficiently.