Imagine you’ve made a purchase using Affirm and now you’re wondering if you can transfer money from Affirm to your bank account. You’re not alone.

Many people find themselves in this situation, curious about the flexibility and control they have over their finances. You’re about to discover the surprising facts and practical steps that can make this process smooth and straightforward. Keep reading, because understanding this could open up new possibilities for managing your money more effectively.

Whether you’re planning a big purchase or just want to streamline your finances, knowing how to handle your funds with Affirm is crucial. Let’s dive into the details you need to know.

Understanding Affirm

Transferring money from Affirm to a bank account isn’t a direct feature they offer. Affirm focuses on providing installment loans for purchases, so funds typically remain within your account for specific transactions. Always explore their terms and conditions for the latest updates.

Understanding Affirm

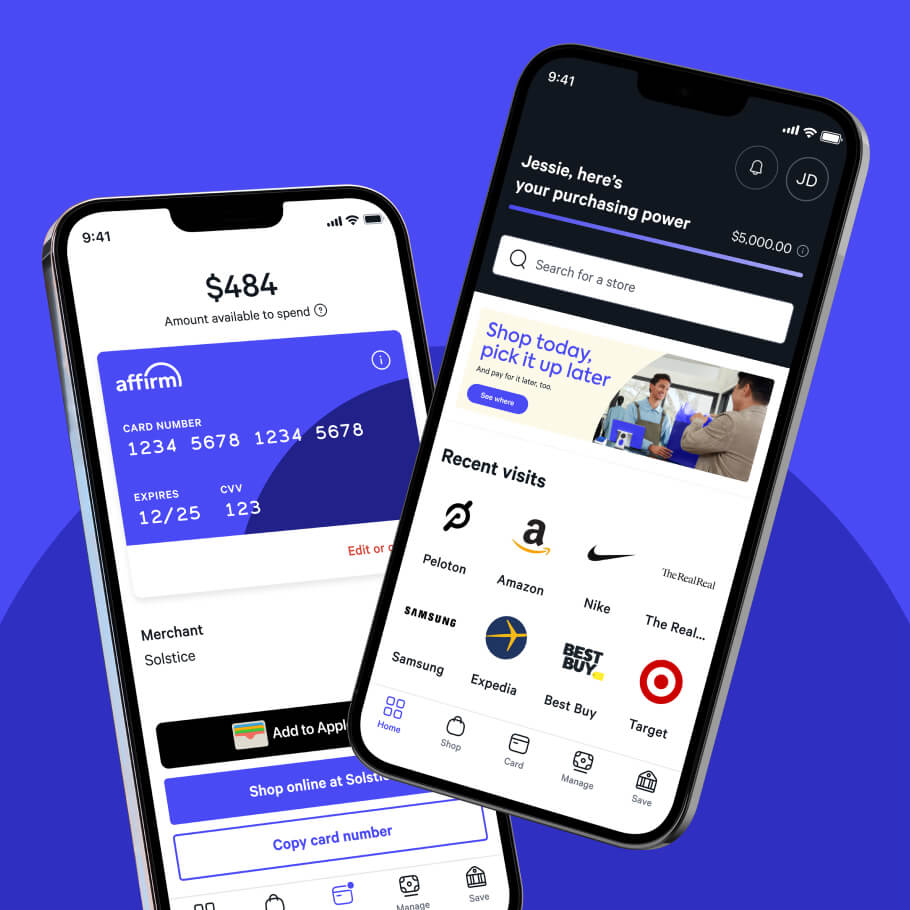

Affirm is reshaping the way people think about buying now and paying later. It’s a financial technology company that allows you to purchase items and pay for them in installments. But how well do you understand its features and benefits? Let’s break it down.

###

What Is Affirm?

Affirm is a service that splits your purchase into smaller, manageable payments. Whether you’re buying a new gadget or booking a vacation, you can pay over time instead of all at once. This flexibility can make your financial planning easier.

###

How Does Affirm Work?

Affirm partners with many online retailers to offer a seamless checkout experience. When you choose Affirm at checkout, you’ll apply for a loan right there. The application is quick, and you get a decision in seconds. You can then select the payment plan that fits your budget.

###

Benefits Of Using Affirm

Affirm offers transparency in its terms. You know exactly what you’ll pay upfront—no hidden fees. It also doesn’t impact your credit score with a hard inquiry when you check your eligibility. This means you can explore your options without worrying about damaging your credit.

###

Potential Drawbacks

While Affirm is convenient, it’s important to consider the interest rates. They can be higher than traditional credit cards, depending on your creditworthiness. Always compare the total cost of using Affirm against other payment options. This way, you ensure you’re making a financially sound decision.

###

Personal Experience With Affirm

I once used Affirm to buy a laptop I desperately needed for work. Paying in installments made it possible for me without stretching my budget. It was a relief to manage the cost over several months without any surprises. Have you ever been in a similar situation where spreading payments helped you out?

###

Is Affirm Right For You?

Ask yourself about your financial priorities. Do you prefer paying upfront or managing smaller payments over time? Your answer will guide whether Affirm aligns with your needs. Consider your spending habits and financial goals before making a choice.

###

Exploring Other Options

Affirm is just one of many buy-now-pay-later services. Are you aware of others like Klarna or Afterpay? Compare their features and terms to find the best fit for your lifestyle. Being informed empowers you to make decisions that benefit your financial health.

Setting Up Your Affirm Account

Easily manage payments with Affirm by setting up your account. Direct money transfers to your bank aren’t possible. Affirm focuses on financing purchases and making payments simple.

Setting up your Affirm account is the first step to effortlessly manage your purchases and possibly transfer funds to your bank account. Whether you’re new to Affirm or just need a refresher, you’ll find that the process is straightforward and user-friendly. Let’s dive into the essential steps to get you started on the right track.

###

Creating An Affirm Account

To begin, visit the Affirm website or download the mobile app. You’ll need to provide some basic information like your phone number and email address. This process is quick and ensures that your account is secure and personalized.

Once your information is verified, you’ll be prompted to create a password. Make it strong yet memorable, as this will be your key to accessing your account. A tip: use a mix of letters, numbers, and symbols to enhance security.

Have you ever thought about what makes a password truly secure? Consider using a password manager to keep track of your credentials safely.

###

Linking Your Bank Account

After creating your account, the next step is to link your bank account. This is crucial if you plan to transfer money from Affirm to your bank.

Navigate to the settings section within your Affirm account. Look for the option to add a bank account and follow the prompts. You’ll need your bank’s routing number and your account number.

Why is this important? Linking your bank account not only allows for money transfers but also offers a seamless way to make payments.

Ensure that the details you enter are accurate. A small mistake could delay your transactions. Once linked, Affirm will sometimes perform a small verification transaction to confirm everything is set up correctly.

Does your bank account show a small unexpected transaction? It’s just a test from Affirm to ensure everything is connected properly.

Setting up your Affirm account and linking your bank account is straightforward and essential for managing your finances with ease.

Transferring Money From Affirm

Affirm is a popular financial service known for its “buy now, pay later” model. Many users wonder about transferring money from Affirm to their bank accounts. This task is feasible, but understanding the process is vital.

Eligibility Criteria For Transfers

Not everyone can transfer funds from Affirm. You need an active Affirm account. Your account must be in good standing. Ensure there are no pending transactions. The transfer option requires a linked bank account. This account must be verified by Affirm.

Steps To Initiate A Transfer

Begin by logging into your Affirm account. Navigate to the “Account” section. Locate the “Transfer Funds” option. Click on it to start the process. Enter the amount you wish to transfer. Confirm the details are correct. Select your linked bank account as the destination. Follow the on-screen prompts to complete the transfer. You will receive a confirmation email once done.

Common Issues And Solutions

Transferring money from Affirm to your bank account is usually straightforward. However, like any financial transaction, it can come with its own set of challenges. Understanding common issues and their solutions can save you time and stress. Let’s dive into two prevalent concerns: transfer delays and verifying account details.

Transfer Delays

Have you ever eagerly awaited a bank transfer, only to find yourself refreshing your account balance every few minutes? Transfer delays can be frustrating, but knowing why they happen can ease your worries. Affirm transfers typically take 1-3 business days, but delays might occur due to bank processing times or high transaction volumes.

Imagine planning a weekend getaway, only to find your funds are stuck in transit. To avoid this, plan your transfers ahead of time. It’s always a good idea to initiate transfers early in the week, allowing for any unforeseen delays. If your transfer seems stuck, check your Affirm account for any notifications or updates.

Verifying Account Details

Double-checking your account details may seem trivial, but it’s vital. A single typo in your bank account number can reroute your funds into oblivion. You might have entered your account details in a hurry, thinking “I’ve done this a million times,” but even seasoned pros can make mistakes.

Before confirming a transfer, take a moment to review your bank information. Are you using the correct routing number? Is your account number accurate? If Affirm prompts you to verify details, heed the warning. You’ll save yourself a headache later.

Encountering a verification issue? Contact Affirm’s customer support immediately. They can assist in resolving discrepancies and ensure your funds reach the right destination. It’s always better to ask questions and clarify than to assume everything is fine.

Have you faced any unexpected hurdles while transferring money? Reflecting on your experiences can help you anticipate and prevent future issues. Remember, patience and vigilance are your best allies in navigating financial transactions.

Security Measures

Transferring money from Affirm to a bank account involves secure processes. Affirm ensures your personal data stays protected. Follow the steps carefully to complete the transaction safely.

Transferring money from Affirm to your bank account can feel a bit daunting, especially if you’re concerned about security. It’s important to understand the security measures in place to protect your finances. Knowing these can give you peace of mind and confidence as you manage your money.

###

Protecting Your Information

Affirm takes the security of your information seriously. They use encryption to keep your data safe, making it nearly impossible for hackers to access your personal details.

You may not see the encryption happening, but it’s like a digital vault protecting your information. Additionally, Affirm follows strict privacy policies to ensure your data is not shared without your consent.

Have you ever wondered if your password is strong enough? Creating strong, unique passwords for your accounts adds an extra layer of security.

###

Recognizing Fraudulent Activities

Recognizing fraudulent activities is crucial. Affirm uses advanced monitoring systems to detect unusual activities in your account.

Receiving an alert about a transaction you didn’t make can be scary. In such cases, acting quickly to secure your account can prevent potential financial loss.

Stay informed about common scams. If something seems off, trust your instincts and verify before proceeding.

What steps do you take to ensure your online transactions are safe? Engaging actively in your security can make a difference.

By understanding these security measures, you can confidently transfer money from Affirm to your bank account. Your financial well-being is a priority, and having these insights helps you stay in control.

Frequently Asked Questions

Can I Transfer Funds From Affirm To My Bank?

Yes, you can transfer funds from Affirm to your bank account. Simply link your bank account in the Affirm app. Once linked, you can initiate a transfer. Transfers may take a few business days to complete. Make sure your bank details are correct to avoid delays.

How Long Does Affirm Bank Transfer Take?

Affirm bank transfers typically take 1-3 business days to process. However, this can vary based on your bank’s policies. Weekends and holidays may extend processing times. Ensure all bank details are accurate to avoid delays. Always check your bank for specific processing times.

Are There Fees For Transferring Money From Affirm?

Transferring money from Affirm to your bank is generally free. Affirm does not charge fees for standard transfers. However, check with your bank for any applicable incoming transfer fees. Always review Affirm’s terms for any potential changes in fee structures.

What Is The Minimum Transfer Amount From Affirm?

Affirm does not specify a minimum transfer amount in their terms. However, ensure your balance covers the desired transfer. Always check for any updates in Affirm’s policy regarding minimum transfer limits. Contact Affirm support for precise information related to your account.

Conclusion

Transferring money from Affirm to a bank account is straightforward. Understand the process first. Follow the steps carefully to ensure success. It’s important to keep track of details. Always double-check information for accuracy. Mistakes can slow down transfers. You want your money safe and secure.

Look for guidance if needed. Affirm offers resources to assist users. Make use of them if unsure. With the right approach, transferring funds becomes simple. Stay informed and make smart financial choices. Your financial wellness matters. Keep learning and stay empowered in managing your money.