Imagine a world where you never have to worry about multiple payments, late fees, or juggling due dates. Sounds like a dream, right?

“A Single Payment” could be the game-changer you’ve been waiting for. This concept promises to simplify your financial life, giving you peace of mind and more time to focus on what truly matters. We’ll delve into the benefits of making just one payment for all your bills, subscriptions, or services.

We’ll explore how it can streamline your finances, reduce stress, and even save you money in the long run. Are you curious to find out how this approach could transform your financial habits? Read on to discover the secrets behind the power of a single payment and how you can leverage it to your advantage.

The Concept Of Single Payment

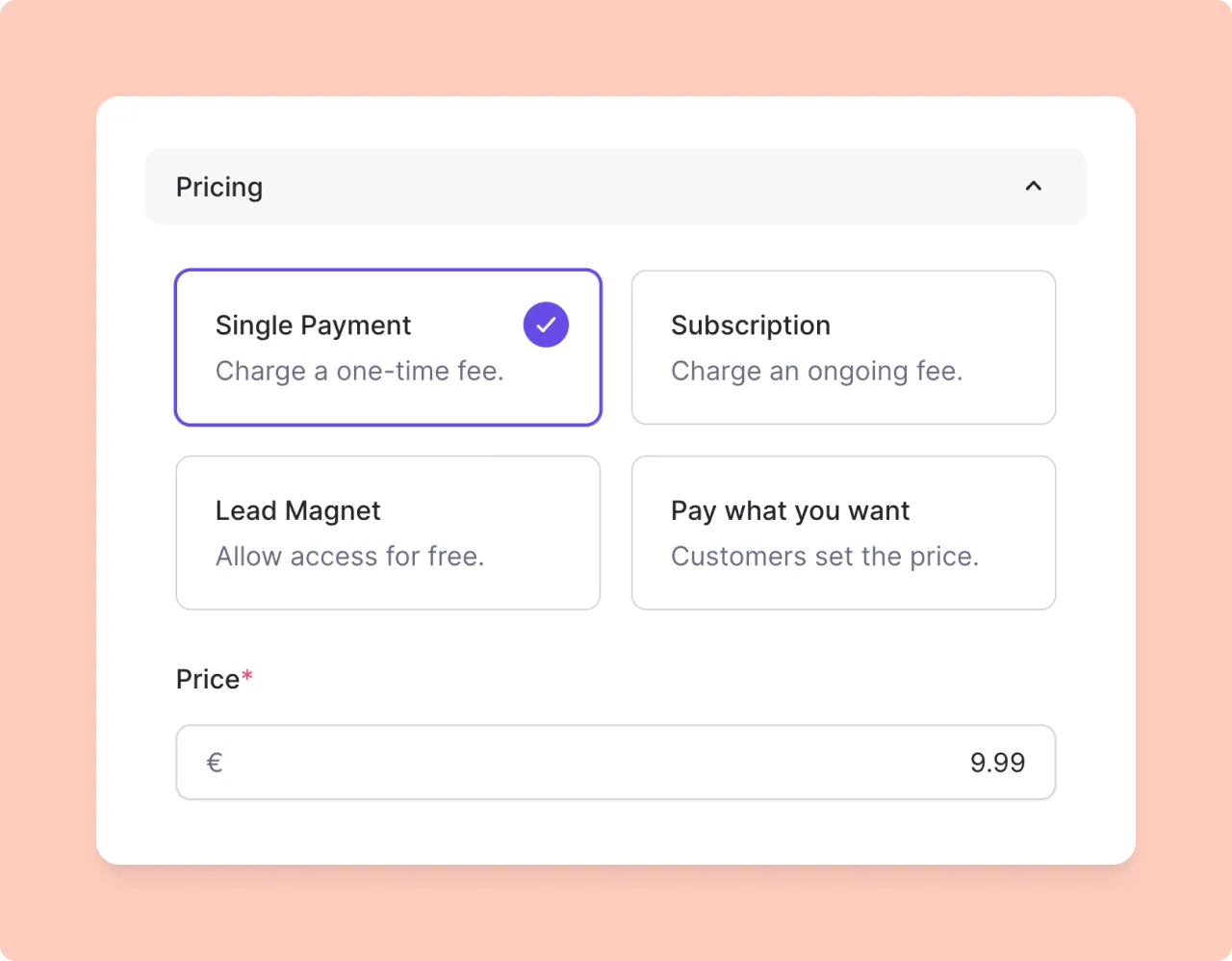

A single payment is a one-time transaction. You pay the full amount at once. No monthly or yearly fees. This is simple and easy. You buy something, and you pay right away. No need to worry about future payments.

Single payments are great for budgeting. You know exactly what you spend. No surprise bills later on. Many people like single payments. It’s clear and straightforward. You pay, and it’s done.

Businesses use single payments for big items. Cars, houses, or electronics. It’s a common way to pay. Many stores offer single payment options. It’s a popular choice for shoppers. Simple and direct.

Benefits Of Single Payment Systems

Single payment systems make buying easy. You can pay in one step. This means no need to fill out long forms. Just click and pay. Fast and simple. These systems save you time. You can shop more quickly. No waiting in long lines.

Keeping your money safe is important. Single payment systems use strong security. Your information stays private. These systems use encryption. This makes it hard for others to see your details. You can feel safe while shopping.

Single payment systems can save you money. They often have lower fees. This means more money stays with you. Businesses also save money. They don’t need extra staff for payments. Everyone saves with these systems.

Technological Advancements

Blockchain is like a digital notebook. It keeps records safe and clear. No one can change them. Cryptocurrency, like Bitcoin, is digital money. It’s fast and easy to use. People trade without banks. This makes things cheaper and quicker.

Mobile payments make buying things super easy. Just tap your phone. It’s quick and safe. You don’t need cash or cards. Many people use apps like Apple Pay. These apps store your card details safely. Shopping is now faster than ever.

Artificial Intelligence, or AI, helps in many ways. It learns from data. AI makes apps smarter. It helps in making payments secure. Fraud detection is better with AI. AI checks if payments are real or fake. This keeps your money safe.

Impact On Consumers

A single payment method helps more people access financial services. It is easy to use and understand. This payment system gives people without bank accounts a chance. Everyone can buy and sell with ease. Security is a key benefit. People feel safe using it. It opens doors for many. Access to money becomes fairer for all.

Managing money becomes simpler with one payment method. People track their spending easily. Control over finances improves greatly. Users see where their money goes. They plan their budgets better. Saving money becomes easier. Spending habits change positively. This method helps people stay within their limits.

The user experience is smooth and straightforward. Single payment systems are user-friendly. Everyone can learn to use them fast. People enjoy making payments without confusion. Simple steps make transactions quick. Users do not need to remember many passwords. Convenience is a big advantage. It makes daily life easier for many.

Challenges And Considerations

Many rules govern payments. Companies must follow these rules. It can be hard. Different countries have different laws. This adds more complexity. Staying compliant is important. Breaking rules can lead to fines. Businesses need experts to help them.

People care about their privacy. Sharing payment details worries them. Data breaches are scary. Companies need to protect customer data. Using strong security is key. Trust is built when data is safe. People feel better when they know their data is safe.

New payment methods take time to catch on. People like what they know. Change is hard. Businesses must show the benefits. Easy use is important. Customers need to see value. If they do, they might try new ways. Without it, they stick to old methods.

Future Of Single Payment Systems

Single payment systems are growing fast. People want simple ways to pay. Digital wallets are now popular worldwide. Contactless payments are common in stores. Mobile apps help people pay easily. Many countries adopt new payment technologies. Security is crucial for users. Companies focus on protecting data. Innovation drives new payment solutions.

New technology can change payment systems. Blockchain offers secure options. Cryptocurrencies might change how we pay. Artificial intelligence helps detect fraud. Regulations may affect payment methods. Governments can introduce new rules. Consumer behavior also influences changes. People may prefer cashless options. Economic shifts impact payment choices. Companies must adapt quickly.

Single payments will evolve. Businesses need new strategies. Consumers will expect faster transactions. Privacy concerns may grow. Companies must address these issues. Global markets will be more connected. Payment systems must be flexible. Technology will keep advancing. Adaptation is key for success.

Frequently Asked Questions

What Is A Single Payment?

A single payment is a one-time transaction made to settle a debt or purchase. It involves paying the full amount at once, rather than in installments. This method is often used for convenience and to avoid ongoing payment obligations.

How Does Single Payment Work?

A single payment works by transferring the total amount to the recipient in one transaction. This can be done through various payment methods, including bank transfers, credit cards, or digital wallets. The transaction is completed when the recipient receives the full payment.

What Are Benefits Of Single Payment?

The benefits of a single payment include simplicity and convenience. It eliminates the need for ongoing payments, reducing administrative tasks. Additionally, it can help avoid interest charges associated with installment payments. It’s an efficient way to settle transactions quickly.

Is Single Payment Better Than Installments?

Single payment can be better than installments if you have sufficient funds. It avoids interest charges and simplifies the payment process. However, installments may be preferable if budget management is a priority. The choice depends on financial circumstances and personal preferences.

Conclusion

A single payment simplifies your financial life. No more juggling multiple bills. It reduces stress and saves time. Budgeting becomes easier with one consistent amount. You’ll have better control over your finances. Planning for the future becomes clearer. This approach suits many lifestyles.

It’s straightforward and hassle-free. Consider this option for a more organized financial plan. You might find it surprisingly effective. Start small, and see the difference. Enjoy the peace of mind it brings. With a single payment, managing money feels less overwhelming.

A smart choice for simplifying your financial journey.