Have you ever glanced at your financial statements and stumbled upon the term “Unapplied Cash Bill Payment Expense”? You might have wondered what it means and why it matters to your business.

This phrase can seem a little daunting at first, but it holds the key to understanding some of the nuances in your financial health. Unapplied cash can impact your cash flow and your understanding of where your money is going.

By the end of this article, you’ll not only grasp what unapplied cash bill payment expense is but also how it plays a crucial role in your accounting practices. Dive in, and discover how gaining clarity on this topic can empower you to make smarter financial decisions for your business.

Unapplied Cash In Accounting

Unapplied cash is money not linked to an invoice or bill. It sits in a company’s account. This cash can confuse many people. It might make accounts look wrong. Businesses must track where this cash goes. They need to apply it to the right place. Mistakes can happen if it stays unapplied. Accurate records are important. They help keep the business healthy.

Unapplied cash happens in various situations. Sometimes, a customer pays too much. Or they pay without a clear invoice number. Maybe a payment gets lost. It could be a refund that isn’t needed. Businesses see this often. Tracking and correcting are key. Employees need good skills to manage it. Proper systems help too. They reduce errors and confusion. It’s part of daily work for many.

Bill Payment Process

Start by gathering all bills that need payment. Check due dates. Decide on a payment method. Use online banking for quick payments. Choose manual payment if preferred. Keep track of payment details. Note the amount and date paid. Verify payment completion. Ensure no errors occurred. Adjust records accordingly. This prevents future confusion.

Forgetfulness can cause late payments. This leads to fees. Organizing bills may be hard. Some bills go missing. Creating a payment schedule helps. Setting reminders is useful. Mistakes happen in amounts or dates. Double-check entries to avoid errors. Unapplied cash creates problems. It confuses records. Correcting these issues takes time. Be careful with calculations. Accuracy is key.

Understanding Expenses

Expenses are costs for running a business. Fixed expenses stay the same, like rent. Variable expenses change, like electricity bills. Direct expenses are linked to making products, like raw materials. Indirect expenses are not directly linked, like office supplies.

Businesses keep track of expenses. This helps in making budgets. Unapplied cash is money received but not assigned to a bill. It must be tracked carefully. Good accounting avoids mistakes. Accurate records help in making good decisions.

Unapplied Cash Bill Payment Expense

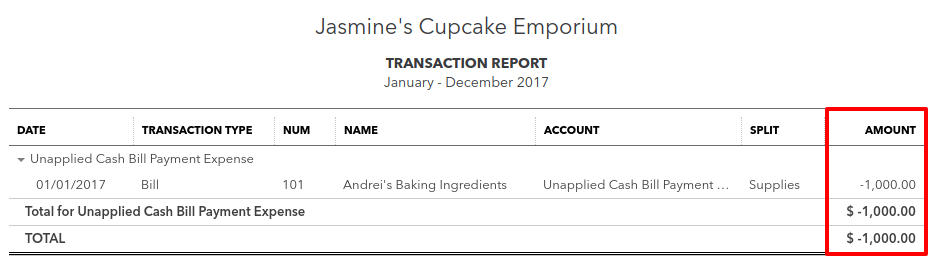

Unapplied Cash Bill Payment Expense is confusing. It shows money paid but not linked to any bill. This happens when a company pays cash to a vendor. The cash does not match any invoice. So, it stays unapplied. Businesses use this for tracking payments better. It helps find errors. It ensures that all payments match invoices. This process is important. It avoids payment mistakes. It keeps records clean and accurate. Every company needs this to manage cash flow.

These expenses affect financial statements. They show as expenses in the books. They can change profit numbers. The balance sheet lists unapplied cash as a liability. This means the company owes this amount. It can confuse investors. They might think bills are unpaid. It’s crucial to fix this soon. It helps keep reports clear. It ensures all bills are paid correctly. This makes financial reports reliable. It builds trust with stakeholders.

Causes Of Unapplied Cash

Mistakes happen during payment processes. Errors often cause unapplied cash. This happens when payments don’t match invoices. This can confuse records. Incorrect entries mean money is not applied right. Payments can be lost or misplaced. This affects business accounts. It is crucial to double-check entries. Regular audits can help find these errors. Training staff can also reduce mistakes.

Delays in handling invoices create problems. Payments may come in before invoices. This leaves money unapplied. Businesses should process invoices quickly. Timely processing helps avoid issues. Use systems that alert for invoice delays. Automation can also speed up processes. Keeping everything on time is key. It ensures payments are correctly applied. This helps maintain clear and accurate records.

Managing Unapplied Cash

Organizing unapplied cash is crucial. Start with a clear process for tracking payments. Ensure that each payment is logged accurately. Match payments with invoices quickly. This reduces errors. Regular checks help maintain accuracy. Communication with clients is vital. They should know if payments are missing details. Set up reminders for pending bills. This keeps you updated. Training staff on cash management is beneficial. Make sure everyone knows the process. This helps in handling cash properly.

Use software to manage unapplied cash. Many programs offer automated tracking. This saves time. Cloud-based systems are accessible from anywhere. Choose software with user-friendly interfaces. This makes tasks easier. Integration with existing tools is helpful. It streamlines operations. Ensure the software has security features. Protecting financial data is important. Regular updates keep the system running smoothly. Consider customer support options when choosing software. Help should be available when needed.

Implications For Businesses

Unapplied cash can confuse business accounts. It shows money as unpaid. This affects financial reports. Reports show less profit. They seem less healthy. Businesses need clear records. They must track every payment. This helps keep accounts right.

Managing cash flow is crucial. Unapplied cash makes it tricky. Money might be there but not counted. This can cause cash flow problems. Businesses must fix unapplied cash. They need to link payments to bills. This gives a clear picture. It helps see real cash available.

Frequently Asked Questions

What Does Unapplied Cash Bill Payment Mean?

Unapplied cash bill payment refers to funds received but not yet matched with specific invoices. This situation can occur when payments are received before the corresponding invoices are processed. Properly applying these funds is essential for accurate financial records and avoiding discrepancies in accounts.

Regular reconciliation helps manage unapplied cash effectively.

How To Identify Unapplied Cash In Accounting?

To identify unapplied cash, review your accounting software or reports for unmatched payments. These payments will appear without corresponding invoices. Analyzing the aging report can help pinpoint unapplied amounts. Regular audits of accounts receivable and payable ensure that all transactions are accurately recorded and applied correctly.

Why Does Unapplied Cash Occur In Businesses?

Unapplied cash occurs when payments are received without clear invoice allocation. This can happen due to timing differences between payment receipt and invoice processing. It might also result from customer payment errors or incomplete documentation. Regularly updating and reconciling accounts can help minimize unapplied cash occurrences.

How To Resolve Unapplied Cash Quickly?

To resolve unapplied cash, match payments with appropriate invoices promptly. Review payment details and consult with customers if necessary. Utilize accounting software tools to automate matching processes. Regularly update records and conduct reconciliations to ensure all cash is correctly applied and financial statements are accurate.

Conclusion

Understanding unapplied cash bill payment expense is crucial for financial clarity. It helps keep records accurate and organized. Businesses can manage finances better with this knowledge. Avoid confusion by properly allocating payments. This ensures smooth cash flow and accurate bookkeeping.

Clear records make financial decision-making easier. They also help avoid potential errors. Always review transactions regularly. Stay informed and in control of your business finances. Use this knowledge to maintain financial health. Proper handling of unapplied cash ensures smoother operations.

Keep your records straight and your business thriving.