Can You Dispute an Ach Payment: Expert Insights

Imagine checking your bank account and spotting a mysterious charge that you didn’t authorize. Your heart skips a beat as you wonder what to do next.

Could it be a mistake, or something more concerning? In this digital age, where ACH (Automated Clearing House) payments are common, these situations can happen more often than you’d like. But here’s the good news: you have the power to take control and dispute an ACH payment.

Whether it’s a simple error or a fraudulent transaction, understanding how to navigate this process is crucial. Let’s dive into what you need to know to protect your hard-earned money and ensure your financial peace of mind. Ready to reclaim control over your finances? Keep reading to uncover the steps you need to take.

Ach Payments Explained

ACH Payments are electronic bank transfers. They move money from one account to another. ACH stands for Automated Clearing House. This system handles bulk transactions. Payments can be sent to pay bills or receive salaries. Businesses and people use ACH for safe transfers. It is faster than paper checks. It is also cheaper than wire transfers. ACH is widely used in the United States. It helps banks process transactions smoothly.

ACH transactions start with a request. A sender asks their bank to transfer money. The bank collects all requests. Then, it sends them to the ACH network. The ACH network processes these requests. After processing, the money moves to the receiver’s bank. The receiver’s bank updates their balance. This process usually takes one to three days. Transactions are secure and reliable. They help businesses run smoothly. ACH makes everyday money transfers easy.

Common Issues With Ach Payments

Sometimes, money leaves your account without your approval. This is called an unauthorized transaction. It can happen if someone steals your account details. Always check your bank statements. Report any unknown charges right away. Quick action is important. It helps stop further loss.

Mistakes can happen with ACH payments. You may send the wrong amount. Or, you might send money to the wrong person. Always double-check details before sending. Correcting errors quickly is key. Contact your bank if you spot a mistake. They can help fix it.

A duplicate payment means sending the same payment twice. This can drain your account. Check your payment history often. Make sure each payment is right. Contact your bank if you find duplicates. They can assist in reversing the extra payment.

Disputing An Ach Payment

Disputing an ACH payment is sometimes necessary. This happens if you spot an error. Maybe money was taken without your permission. Or the amount is wrong. Another reason could be duplicate charges. It’s important to act fast. Banks have time limits. Don’t delay in reporting the issue.

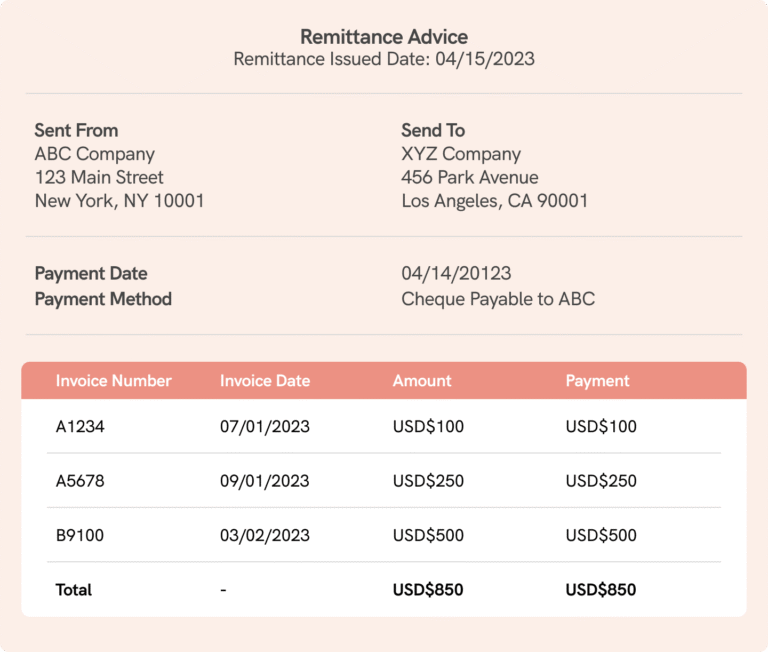

Contact your bank first. Explain the problem clearly. Provide any documents. Banks need details to help you. Next, fill out a dispute form. Some banks offer this online. Ask for help if you need it. Follow up to ensure progress. Keep copies of all communication. Patience is key during this process.

Role Of Financial Institutions

Banks must ensure safe transactions. They check the details of every ACH payment. They verify the sender and receiver information. Banks keep records for future reference. They handle customer complaints about ACH payments. Security is their top priority. Banks must monitor transactions for fraud. They must inform customers about any issues. Banks must act fast when a dispute arises. They help resolve disputes quickly.

Customers must check their account statements. They need to report unauthorized transactions. Customers should keep payment receipts. They must contact the bank for disputes. Providing correct information is vital. Customers should know their rights. They need to act swiftly in case of errors. Communication with the bank is key. Customers must follow bank procedures for disputes.

Timeframes And Deadlines

Disputing an ACH payment must follow strict time limits. Act quickly within 60 days after the transaction. The bank needs this time to process your dispute. Missing the deadline can make it harder to recover your money. Always keep records of your transactions. These records help when filing a dispute.

Delays in disputing can cause serious problems. Funds may be harder to recover. Your account might face extended fees. Always check your bank statements regularly. This helps catch errors early. Fast action can save time and money.

Legal Protections For Consumers

Consumers have the right to dispute ACH payments, offering a layer of protection against unauthorized transactions. Contact your bank promptly to start the dispute process, ensuring your financial security. This legal safeguard helps maintain trust in digital payment systems.

Regulation E Overview

Regulation E protects electronic payments. It gives rights to consumers. Consumers have rights to dispute transactions. They must do this quickly. Time limits are important. Consumers have 60 days to report errors. Banks must investigate within 10 days. They must fix errors soon. If banks need more time, they get 45 extra days. Banks must notify consumers of findings. Consumers are not responsible for unauthorized payments. Unauthorized payments are payments not made by the account holder.

Rights And Obligations

Consumers must report errors fast. Reporting errors starts the process. They must give details of the error. Banks will check the error report. Banks must act on valid errors. They must refund money if the error is real. Consumers should keep bank records. Records help prove errors. Banks must follow Regulation E rules. Rules protect consumer rights. Consumers should know their rights. Knowing rights helps in disputes. Regulation E is important for consumer safety.

Expert Tips For Successful Dispute

Start by collecting all documents related to the payment. Include bank statements and transaction IDs. Keep records of emails or messages with the payee. Take screenshots if necessary. Evidence is key.

Always stay calm when talking to the bank. Use clear and simple words. Explain the issue step by step. Ask questions if you don’t understand. Listen carefully to their advice. Write down what they say. It helps.

Preventing Future Ach Issues

Keeping an eye on your account helps spot unusual changes. Check your bank statements often. This can catch mistakes quickly. If you see something wrong, report it fast. This keeps your money safe. Your bank can help if you act quickly.

Alerts can tell you about changes in your account. They can warn you about low balances. You can get a message when money goes in or out. This way, you know what is happening with your money. Alerts help you avoid surprises. They keep you informed.

Frequently Asked Questions

What Is An Ach Payment Dispute?

An ACH payment dispute occurs when a transaction is challenged. It can be due to errors or unauthorized charges. Customers must notify their bank to initiate the dispute process. Timely reporting is essential to resolve the issue efficiently. Banks follow specific protocols to investigate and rectify the dispute.

How Do I Dispute An Ach Payment?

To dispute an ACH payment, contact your bank immediately. Provide transaction details and the reason for the dispute. Banks typically have a specific form or procedure for disputes. Acting quickly helps ensure a timely resolution. Keep a record of all communications and any related documentation.

How Long Does An Ach Dispute Take?

An ACH dispute usually takes 30 to 60 days to resolve. The timeframe can vary based on the complexity of the issue. Banks are required to investigate and respond within a reasonable period. Maintaining open communication with your bank can help expedite the process.

Can I Stop An Ach Payment?

Yes, you can stop an ACH payment before it processes. Contact your bank to request a stop payment order. Provide details like the transaction amount and payee. There may be fees associated with this service. Act quickly to prevent the payment from being completed.

Conclusion

Navigating ACH payment disputes can seem daunting, but it isn’t impossible. Knowing your rights and options is key. Act promptly when you notice an error. Contact your bank immediately for assistance. They can guide you through the dispute process. Keep detailed records of all communications.

This helps in resolving the issue efficiently. Remember, patience and persistence are crucial. Stay informed about your financial transactions. Understanding the process empowers you to protect your funds. If needed, seek professional advice. They can provide valuable support in complex cases.

Your financial security is important. Take action to safeguard it.