Can I Use Credit Card for Car down Payment: Smart Tips

Are you thinking about buying a car and wondering if you can use your credit card for the down payment? You’re not alone.

Many people consider this option for its convenience and potential rewards. But is it really a good idea? Before you swipe your card, it’s crucial to weigh the benefits and drawbacks. This decision can impact your finances more than you might realize.

You’ll discover the ins and outs of using a credit card for a car down payment. You’ll learn about potential pitfalls and how to make the most informed choice for your financial health. Stick around to find out if this payment method is right for you and how it could affect your car-buying experience.

Benefits Of Using A Credit Card For Down Payment

Using a credit card for a car down payment can be beneficial. You can earn rewards and cash back on your spending. Many cards offer points or cash back on purchases. This way, you gain extra benefits while paying. Some cards have special bonuses for large purchases. This makes using your card even more rewarding.

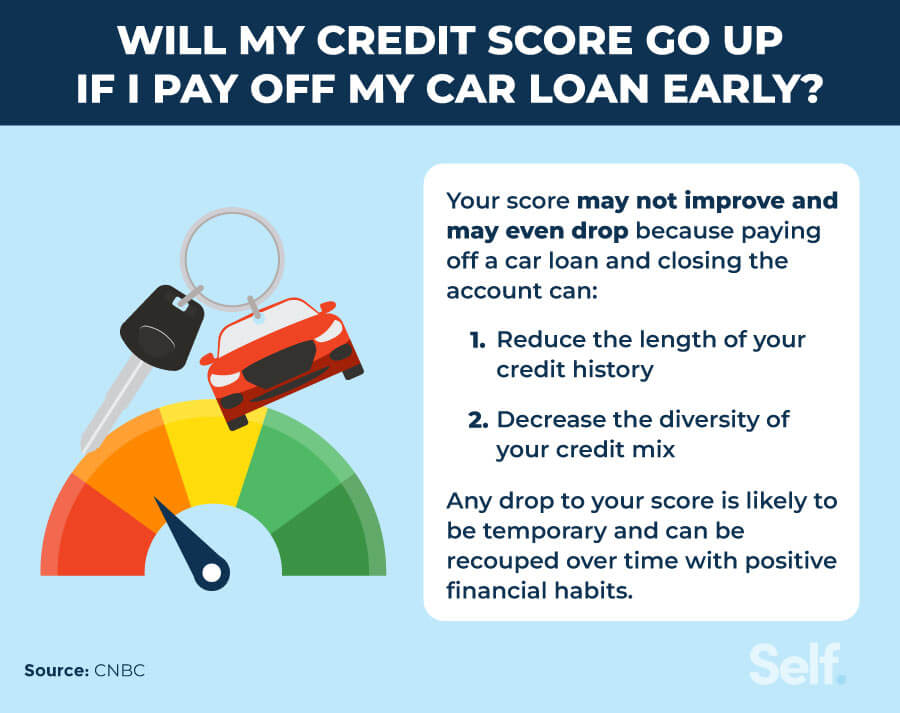

Paying with a credit card helps build credit history. It shows you can manage money well. Regular payments improve your credit score. A good score helps in future loans. Credit history is important for financial success. Using your card wisely benefits you in the long run.

:max_bytes(150000):strip_icc()/Heres-how-get-car-no-down-payment_final-1c94e62ad4644532a18289cf826f6cce.png)

Risks Involved

Interest rates on credit cards are usually high. Using a card for car down payment can lead to huge costs. If not paid quickly, interest adds up. Fees might also apply. These make the total payment even bigger. It’s vital to know all charges before using a credit card.

Impact on credit score can be serious. Large purchases increase credit use. This may lower your score. A poor score makes loans hard to get. It can also raise interest on future loans. Paying off the card fast helps. This keeps your score safe.

Factors To Consider

Credit card limits can be a big factor. The limit must cover the down payment. Some credit cards have low limits. This might not be enough for a car down payment. Always check your card limit first. Exceeding the limit can cause problems. Like extra fees. Or a declined payment. Keep your credit utilization low. This helps your credit score.

Dealers have their own rules. Some might not take credit cards. Others may charge extra fees. This can be for credit card processing. Always ask the dealer first. Know their payment policies. Be sure they allow credit card payments. This helps to avoid surprises. And makes the buying process smooth.

Smart Strategies For Payment

Use your credit card for a car down payment. But, pay off the balance quickly. This helps avoid high interest costs. Paying off fast keeps your credit score safe. It shows you are responsible. Banks like that. It makes it easier to get loans later. Always keep track of payments. Missing payments can hurt your credit score.

Choose a card with introductory offers. Some cards offer zero interest for a few months. This means you pay no extra money on top. It’s a smart way to save money. But remember, check the offer’s end date. After that, the regular interest rate will apply. Choose wisely. Always read the terms before using the card.

Alternatives To Credit Card Payments

Personal loans can be a good choice for a car down payment. They usually have lower interest rates than credit cards. This means you pay less in the long run. Personal loans also have fixed monthly payments. This makes it easier to plan your budget. Some banks offer quick approval for personal loans. You might get your loan in just a few days. This can be helpful if you need money fast.

Cash is a simple way to pay for a car down payment. You don’t have to worry about interest with cash. Saving up cash can take time, though. But paying with cash means you owe nothing later. This can help you avoid debt. Sellers often appreciate cash payments too. They might even offer a small discount if you pay in cash.

Common Mistakes To Avoid

Ignoring Interest Accumulation: Many people forget about interest on credit cards. This can make payments larger each month. Interest grows quickly. It adds up before you know it. Use cards wisely. Always check your balance. Pay off the card soon.

Exceeding Credit Limit: Going over the credit limit is a bad idea. It can lead to fees. It can hurt your credit score. Credit card companies do not like this. They might stop your card. Always know your limit. Spend within it. Keep track of your spending. This keeps you safe.

Frequently Asked Questions

Can I Pay Car Down Payment With A Credit Card?

Yes, many dealerships allow credit card payments for car down payments. However, it’s essential to check with the dealership first. Using a credit card can offer rewards but also incur interest. Ensure you can pay off the balance promptly to avoid high interest charges.

Are There Fees For Using A Credit Card?

Some dealerships might charge a processing fee for credit card payments. This fee can range from 1% to 3%. It’s crucial to ask about any additional fees before proceeding. This helps you make an informed decision and avoid unexpected costs.

Does Using A Credit Card Affect My Credit Score?

Yes, using a credit card can impact your credit score. It may increase your credit utilization ratio. High utilization can negatively affect your score. Paying off the balance quickly can help maintain a healthy credit score and avoid interest charges.

What Are The Benefits Of Using A Credit Card?

Using a credit card can offer rewards like cash back or points. It also provides a record of the transaction for easy tracking. Additionally, it might offer purchase protection benefits. Always ensure you understand the terms and pay the balance off promptly.

Conclusion

Using a credit card for a car down payment? It depends on your situation. Credit cards offer convenience and rewards. But watch out for high interest rates. Check your card limit and fees. Consider your financial health before deciding. Speak with your dealer about their policies.

Some dealers may not accept cards for large amounts. Plan wisely to manage your debt. Always aim to keep your credit score healthy. Make informed choices to avoid future stress. Balancing your options can lead to smarter financial decisions.