Are you looking to move funds from your Netspend card to your bank account with ease? You’re not alone!

Whether it’s for managing your finances better or simply needing your money in one place, transferring funds efficiently is crucial. Imagine the peace of mind knowing your money is exactly where you need it, ready for your next transaction. In this guide, you’ll discover a straightforward, stress-free process to make this transfer happen.

We’ll show you how to do it without any hassle, ensuring you stay in control of your finances. Keep reading to unlock the simple steps and tips that can streamline your financial management today.

What Is Netspend?

Netspend is a popular financial service provider in the United States. It offers prepaid debit cards that help manage money efficiently. Many people use Netspend cards for daily transactions. These cards provide a convenient way to spend and save.

Netspend is a company that offers prepaid debit cards. These cards are not linked to a bank account. Users load money onto the card before spending. This prepaid system helps avoid overspending.

Netspend cards are widely accepted. You can use them at stores, online, and for bill payments. They are a great choice for individuals who prefer not to use traditional banks.

Netspend also provides budgeting tools. These tools help track spending and manage money better. Users receive alerts for transactions, which helps maintain control over finances.

Security is a priority for Netspend. They offer protection against unauthorized purchases. This keeps your money safe and secure.

Benefits Of Using Netspend

Netspend cards are simple to use. They don’t require a credit check. This makes them accessible to many people. Users can reload cards easily at various locations.

Netspend offers rewards for using their card. Users earn cash back on certain purchases. This adds value to every transaction.

Mobile access is another benefit. Users can manage their account via the Netspend app. This provides convenience and flexibility.

How Netspend Differs From Traditional Bank Accounts

Netspend cards are prepaid, unlike bank accounts. You load funds before spending. This helps control spending and avoid debt.

Traditional bank accounts often have fees. Netspend cards have straightforward fee structures. Users can choose plans that suit their needs.

Netspend does not require a credit history. This is beneficial for individuals with limited credit. It offers financial freedom without traditional banking barriers.

Benefits Of Transferring To Bank

Transferring money from a Netspend card to a bank account offers convenience and security. It simplifies financial management by consolidating funds into one place, making it easier to track expenses and savings. This process also enhances accessibility, allowing for easier transactions and withdrawals.

Transferring money from your Netspend card to a bank account offers numerous advantages. As someone who recently made this switch, I can attest to the increased financial flexibility it provides. Whether it’s for better money management or unlocking additional banking services, moving funds to a bank account can be a game changer for your finances.

###

Improved Money Management

Keeping all your funds in one place can simplify tracking your spending. When your money is in a bank account, you can easily monitor transactions using banking apps or online platforms. This consolidation helps in budgeting effectively and avoiding overspending.

###

Access To Better Banking Features

Banks often offer features like auto-pay, savings accounts, and investment options that a prepaid card might not. Once your money is in a bank, you can set up automatic bill payments, reducing the risk of missing due dates. Additionally, you can earn interest on your savings, which isn’t possible with a Netspend card.

###

Enhanced Security

Banks typically provide greater security measures compared to prepaid cards. With features like fraud monitoring and account alerts, your money is better protected. Plus, your deposits are insured, offering peace of mind that your funds are safe.

###

Greater Financial Flexibility

Need to pay rent or make a large purchase? Having funds in a bank account makes it easier to write checks or make transfers. This flexibility can be crucial for handling everyday expenses or unexpected costs.

###

Building Credit And Financial Health

Did you know that having a bank account can help build your credit? Some banks offer credit-building loans or secured credit cards to account holders. Over time, responsible use of these services can improve your credit score.

Reflect on how these benefits could change your financial landscape. Is it time to consider transferring your funds to a bank account for a more secure and flexible future?

Necessary Preparations

Transferring money from your Netspend card to a bank account requires careful preparation. These steps ensure a smooth and hassle-free transaction. Let’s explore the necessary preparations you need.

Check Account Details

Accurate account details are crucial. Verify your bank account number and routing number. Double-check these details to avoid errors. Mistakes can delay your transaction.

Ensure Sufficient Balance

Your Netspend card must have enough funds. Check your balance before transferring money. Insufficient funds may lead to transaction failures. Confirm your balance to proceed confidently.

Linking Netspend Card To Bank Account

Linking your Netspend card to a bank account is a straightforward process. It allows you to easily transfer money, manage funds, and keep track of your finances. This connection provides convenience and flexibility. You can move money between accounts with a few clicks. Understanding the steps involved in this process is essential. This guide will help you navigate the linking process smoothly. Let’s explore how to link your Netspend card to your bank account.

Using Netspend Online Account

Start by accessing your Netspend online account. Log in using your credentials. Once inside, locate the transfer options. They are usually found in the main menu. Look for the option that mentions linking a bank account. Follow the instructions provided on the screen. The process is intuitive and user-friendly.

You may need to enter your bank account details. This includes the account number and routing number. Make sure to double-check these details for accuracy. Incorrect information can lead to errors. After entering the details, confirm the link. Your accounts will be connected securely.

Direct Bank Linking

Another method involves direct bank linking. Contact your bank for assistance. They can guide you through the setup. Some banks offer online tools for linking accounts. Use these tools for a quick setup.

Ensure you have your Netspend card information ready. Banks might ask for specific details. Provide the necessary information as requested. This might include your card number and expiration date. Keep this information secure during the process. Once linked, transferring funds becomes easy.

Executing The Transfer

Transferring money from a Netspend card to a bank account is straightforward. Log in to your Netspend account, select the transfer option, and follow the on-screen instructions to complete the transaction. Ensure your bank account details are accurate to avoid delays.

Executing the transfer from your Netspend card to a bank account can seem daunting. Yet, with the right steps, it becomes a straightforward process. You can choose to transfer online or through the Netspend mobile app. Both methods offer convenience and ease of use. Let’s explore each method to help you decide the best approach for your needs.

Initiating Transfer Online

Start by visiting the Netspend website. Log into your account using your credentials. Once inside, locate the transfer option. It’s usually under the ‘Move Money’ section. Click on it to proceed.

Enter the amount you wish to transfer. Make sure your bank details are correct. Double-check to avoid errors. This step is crucial for a successful transfer.

Verify all details before confirming the transfer. The website will guide you through each step. Follow instructions carefully. The process usually takes a few business days.

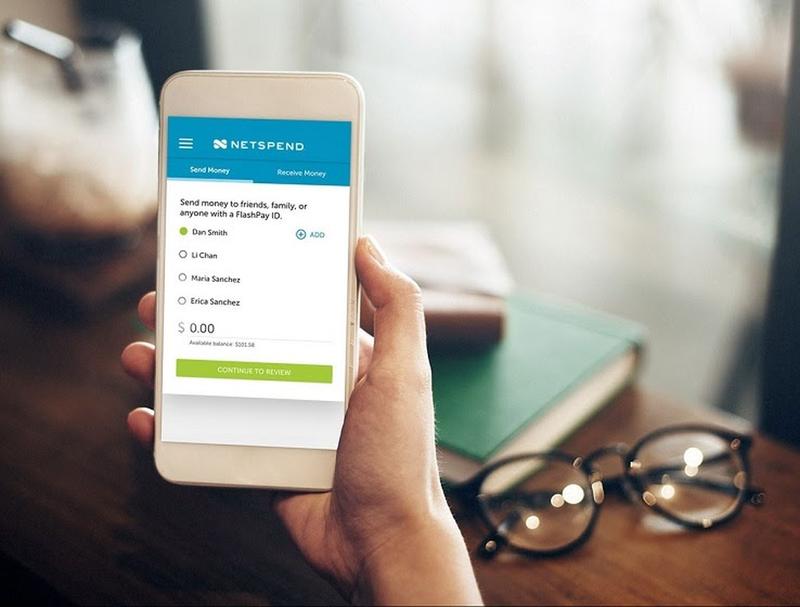

Using Netspend Mobile App

Download and open the Netspend app on your smartphone. Log in using your account details. The app interface is user-friendly. Navigate to the ‘Move Money’ section.

Select the option to transfer money to a bank account. Enter the desired amount. Ensure your bank information is accurate. The app allows you to save details for future transfers.

Review all information before hitting the transfer button. The app provides step-by-step guidance. Notifications will update you on the transfer status. Transfers via the app are convenient and quick.

Potential Fees And Limitations

Transferring money from a Netspend card to a bank account might involve fees. These charges vary based on the method used. Some banks may also have limitations on transfer amounts. Always check terms before proceeding to ensure a smooth transaction.

Transferring money from your Netspend card to a bank account is a convenient way to manage your finances. But before you proceed, understanding potential fees and limitations is crucial. You wouldn’t want unexpected charges eating into your transferred funds or limits hindering your transaction plans. Let’s explore what you should know about fees and transfer limits.

Understanding Transfer Fees

When transferring money from your Netspend card to a bank account, fees can vary. Netspend might charge a transfer fee, which could be a flat rate or a percentage of the transfer amount. Check the latest fee schedule on the Netspend website or contact customer service for accurate details.

Some users have noticed fees can add up quickly. If you frequently transfer small amounts, these charges can become costly over time. Would you prefer to pay a small fee on every transaction or handle one larger transfer with a bigger fee?

Daily And Monthly Limits

Netspend cards come with daily and monthly transfer limits. These limits might restrict how much you can move to your bank account in a single day or month. Knowing these limits helps you plan larger purchases or bill payments efficiently.

Imagine needing to transfer money urgently, only to find out you’ve hit your daily limit. It’s not just frustrating; it could also impact your financial plans.

Always review your account terms or contact Netspend support to verify these limits. This way, you can schedule your transfers without any hitches. Would adjusting your transfer frequency or amount help you stay within these limits while managing your finances better?

In navigating these fees and limits, you gain control over your financial transactions. Understanding them can lead to smarter and more strategic money management.

Troubleshooting Common Issues

Transferring money from a Netspend card to a bank account can sometimes present challenges. Understanding common issues helps ensure smooth transactions. Here, we address typical problems and solutions.

Failed Transfer Reasons

Transfers might fail for various reasons. Incorrect account details often cause errors. Double-check your bank account number and routing number. Ensure they match the details provided by your bank.

Insufficient funds can also lead to failed transfers. Verify your Netspend card balance before initiating a transfer. Check for any pending transactions that might affect the available balance.

Technical glitches can disrupt transfers as well. Always use a reliable internet connection. Try accessing your account from a different device or browser if issues persist.

Customer Support Contact

If problems continue, reaching out to customer support is helpful. Netspend offers multiple ways to get assistance. Phone support is available for immediate help. Have your account details ready when you call.

Email support provides detailed assistance. Describe your issue clearly for efficient resolution. Expect a response within a few business days.

Netspend’s online chat is another option. Quick answers to common questions are provided. Chat with a representative during business hours for real-time support.

Tips For Secure Transactions

Transferring money from your Netspend card to a bank account is convenient. But, ensuring secure transactions is essential. Following a few tips can protect your financial information. It can also help you avoid common pitfalls. This guide provides practical advice for safe transfers.

Protecting Personal Information

Keep your card details confidential. Avoid sharing your account information with others. Use secure internet connections for transactions. Public Wi-Fi can be risky. Always check the URL for security symbols like a lock icon. This indicates a secure website. Choose strong passwords for your accounts. Use a mix of letters, numbers, and symbols. Change your passwords regularly. This adds an extra layer of security.

Recognizing Fraudulent Activity

Watch for unusual transactions. Check your account statements often. Report any suspicious activity immediately. Be cautious of emails asking for personal information. These could be phishing attempts. Always verify the sender’s identity. Don’t click on unknown links. They might lead to harmful websites. Educate yourself about common scams. Staying informed is the best defense.

Frequently Asked Questions

How Do I Link My Netspend Card To A Bank?

To link your Netspend card, log into your online account. Navigate to the “Transfer Money” section. Enter your bank account information. Follow the prompts to verify your account. Once verified, you can transfer funds easily.

What Is The Transfer Limit From Netspend To Bank?

The transfer limit varies based on your account type. Typically, you can transfer up to $2,500 per day. Check your account terms for specific details. Ensure your bank account is verified before initiating transfers.

How Long Does A Netspend Transfer Take?

Transfers usually take 1-3 business days. The exact time depends on your bank’s processing schedule. Ensure both accounts are verified for faster transfers. Always check your transaction history for confirmation.

Are There Fees For Transferring From Netspend?

Netspend may charge a small fee for transfers. Fees can vary based on the transfer amount. Review your account terms for specific fee details. Always check for any applicable charges before transferring funds.

Conclusion

Transferring money from a Netspend card to a bank account is simple. Follow the steps provided to make transactions smoothly. Understanding each step is key. Check your balance before you proceed. Ensure your bank details are correct. Mistakes can lead to delays.

This process saves time and effort. Enjoy the convenience of digital banking. It’s safe and efficient. Remember, technology makes life easier. Stay informed about your finances. Manage your money wisely. Feel confident with your transactions. Practice makes perfect. Happy banking!