It's interesting that you're wondering about transferring money from Zelle to Cash App, just as many others are doing the same. You might be surprised to know that it's possible, but not directly. You'll need to take a few extra steps to make it happen. You can start by linking your Zelle account to a debit card that's associated with your bank account. Then, use Zelle to send the money to that account. But what happens next, and are there any potential hiccups to be aware of? That's where things can get a bit more complicated.

Link Zelle to Debit Card

To initiate transfers from Zelle to Cash App, you'll first need to link your Zelle account to a debit card, which will act as a bridge between the two services. You'll want to use a debit card that's already linked to your bank account to guarantee seamless transactions. Open your Zelle app, navigate to the 'Card' or 'Settings' section, and follow the prompts to add your debit card. You may need to enter your card details and verify the card through a series of security checks. Once your debit card is linked, you'll be able to use it as a funding source for your Zelle transfers, ultimately allowing you to move money into your Cash App account. Always prioritize using a secure and trusted debit card.

Send Money to Bank Account

With your debit card linked to Zelle, you're now ready to send money to your bank account, which will ultimately allow you to transfer those funds to Cash App. To do this, open the Zelle app and navigate to the 'Send' or 'Send Money' tab. Enter the amount you want to transfer, and select your linked debit card as the funding source. Choose your bank account as the recipient, and confirm the transaction details. Zelle will process the transfer, and the funds will be deposited into your bank account. This step guarantees that your money is safely transferred to your bank account, making it accessible for future transactions, including transferring to Cash App. Monitor your accounts to verify the successful transfer.

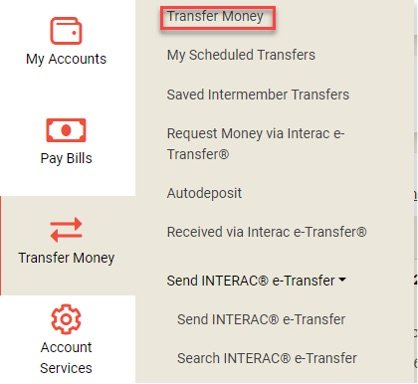

Add Bank Account to Cashapp

Your bank account, now loaded with the funds transferred from Zelle, needs to be linked to Cash App to facilitate the final transfer. To add your bank account to Cash App, you'll need to follow these steps. First, open the Cash App and navigate to the 'Balance' tab. Next, tap on 'Add Bank' and select your bank from the list of available options. You'll then be prompted to enter your bank account credentials, including your account number and routing number. Once you've entered this information, Cash App will verify your account and link it to your profile. You'll receive a confirmation notification once the linking process is complete. This secure process guarantees the safe transfer of your funds from Zelle to Cash App.

Fund Transfer Limits and Fees

What are the fund transfer limits and fees associated with moving money from Zelle to Cash App, and how do they impact your transactions? When you transfer money from Zelle to Cash App, you'll need to be aware of the limits and fees imposed by both services. Zelle's daily transfer limit is $500, while Cash App's is $2,500. Exceeding these limits may result in transfer delays or cancellations. Additionally, your bank or credit union may charge a small transfer fee, typically between $0.50 to $2.00. Cash App also charges a 1.5% fee for instant transfers. You'll want to factor these fees into your transactions to avoid any unexpected charges. Being aware of these limits and fees will help you make informed decisions when transferring funds.

Potential Delay or Transfer Issues

Transferring money from Zelle to Cash App isn't always instantaneous, and you may encounter delays or issues that prevent your funds from being credited to your Cash App account immediately. This can be frustrating, especially if you need the money right away.

| Issue | Solution |

|---|---|

| Insufficient funds | Check your Zelle account balance and try again |

| Incorrect recipient info | Double-check the recipient's Cash App details |

| Network issues | Try transferring funds again when the network is stable |

| Transfer limits exceeded | Check your Zelle transfer limits and try again within the allowed limits |

| Technical issues | Contact Zelle or Cash App support for assistance |

Alternative Money Transfer Options

Several alternatives to Zelle offer seamless integration with Cash App, allowing you to move funds conveniently when Zelle isn't an option. You can consider the following options:

- Venmo: As a peer-to-peer payment service, Venmo allows you to link your Cash App account and transfer funds directly.

- PayPal: With PayPal, you can link your Cash App account and transfer funds, although fees may apply.

- Bank Transfer: You can also transfer funds from your bank account to Cash App using the app's built-in banking feature.

These alternatives provide a secure and efficient way to transfer funds to Cash App when Zelle is not an option. By exploring these options, you can find a method that suits your needs and guarantees a smooth transfer process.

Keeping Your Transfers Secure

When transferring funds to Cash App, securing your transactions is essential, so you'll want to take a few key precautions to safeguard your financial information and prevent unauthorized access. You'll need to verify the recipient's information and confirm you're using a secure connection.

| Security Measure | Why It Matters |

|---|---|

| Enable Two-Factor Authentication (2FA) | Adds an extra layer of security to prevent unauthorized log-ins |

| Use a strong and unique password | Protects your account from hacking attempts |

| Keep your Cash App and device software up-to-date | Confirms you have the latest security patches and features |

| Be cautious of phishing scams | Prevents fraudulent access to your account and financial information |