You're ready to transfer money from your Health Savings Account (HSA) to your bank account, but you're not sure where to start. You've got a good chunk of money set aside for medical expenses, and now you need to access it. First, you'll need to review your HSA account details to guarantee you meet the minimum transfer threshold. But that's just the beginning – you've also got to choose a transfer method, initiate the process, and verify the transfer is complete. But don't worry, with a little guidance, you'll be on your way to accessing your funds in no time…

Review HSA Account Details

To initiate a transfer from your HSA to a bank account, you'll need to first review your HSA account details, including the account balance, available funds, and any outstanding claims or pending transactions. This step guarantees you have a clear understanding of your account's current state, allowing you to make informed decisions. Verify that your account balance is sufficient to cover the transfer amount, and review any outstanding claims or pending transactions that may impact your available funds. You should also confirm your account information, such as your name, address, and account number, to prevent errors during the transfer process. Accuracy is essential to guarantee a smooth and secure transfer.

Check Eligibility for Transfer

Before initiating the transfer, you'll typically need to confirm whether your HSA account is eligible for a transfer to a bank account, guaranteeing compliance with IRS regulations and your HSA administrator's policies. To verify eligibility, review the following:

- Your HSA account balance meets the minimum threshold for transfer, if applicable

- You've had no recent changes to your HSA account information

- Your HSA administrator allows transfers to bank accounts

- You're not subject to any account restrictions or holds

Verifying eligibility will help prevent transfer delays or penalties. Confirm you review your HSA account details and administrator's policies before proceeding with the transfer.

Choose a Transfer Method

With eligibility confirmed, you can proceed to select a suitable method for transferring funds from your HSA to a bank account, considering factors such as processing time, potential fees, and administrative requirements. You'll need to weigh the trade-offs between electronic fund transfers (EFTs), checks, and wire transfers. EFTs are generally the fastest and most cost-effective option, but may require setup through your HSA administrator's online platform. Checks can be mailed directly to you or your bank, but may incur fees and take longer to process. Wire transfers are often the most expensive option, but can be expedited for an additional fee. Consider discussing the options with your HSA administrator or a financial advisor to determine the most secure and efficient method for your situation. This guarantees your transfer is processed smoothly.

Initiate the Transfer Process

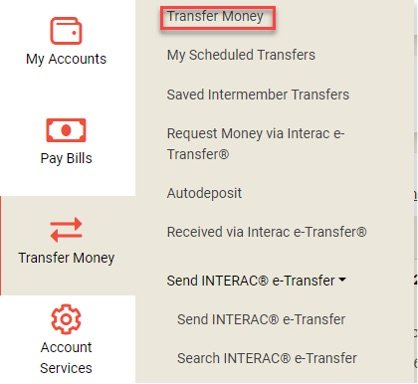

Your transfer method selected, you'll now need to initiate the transfer process through your HSA administrator's online platform, over the phone, or via a paper request form, depending on their specific requirements. Be prepared to provide your bank account details, including the account number and routing number. To guarantee a smooth transfer, double-check that your account information is accurate.

Some key points to keep in mind:

- Review your HSA account balance to guarantee sufficient funds.

- Verify your bank account is eligible to receive HSA transfers.

- Confirm any potential transfer fees associated with your HSA or bank account.

- Understand the processing time for your chosen transfer method.

Verify the Transfer Completion

Once you've initiated the transfer process, you'll need to monitor your bank account to confirm that the funds have been successfully transferred from your HSA. This typically takes 3-5 business days, depending on the processing time of your custodian and bank. You can verify the transfer completion by checking your bank account statement online or via the mobile app. Look for a deposit corresponding to the amount you transferred from your HSA. Alternatively, you can contact your bank's customer service to confirm the transfer. It's crucial to verify the funds are deposited accurately and securely. If there's an issue, notify your HSA custodian immediately. By verifying the transfer completion, you'll guarantee the security and accuracy of the transaction.