Transfer Money from Stripe to Bank Account: Quick Guide

Imagine running your business and seeing your hard-earned money sitting in your Stripe account, just waiting to be transferred to your bank. You know the funds are yours, but the process of moving them might seem daunting.

You’re not alone in feeling this way. Many business owners share your concern about how to efficiently transfer money from Stripe to their bank accounts. This article will guide you through the process with simple, step-by-step instructions. You’ll discover how easy and secure it can be to access your funds whenever you need them.

Ready to take control of your finances? Let’s dive in and make transferring your money as straightforward as possible.

Setting Up Your Stripe Account

Start transferring money from Stripe to your bank easily by setting up your account. Connect your bank details in minutes. Enjoy a seamless process for moving funds directly to your bank account.

Setting up your Stripe account is essential. It ensures smooth money transfers. Stripe is known for its ease of use. It lets businesses handle payments efficiently. Before transferring money, a Stripe account must be set up correctly. This involves creating an account, verifying your identity, and linking your bank account. Each step is crucial for a seamless experience.Een account aanmaken

Start by visiting Stripe’s official website. Click on the signup button. Fill in your details. Provide your name, email, and password. Make sure your password is strong. Once done, click on ‘Create account’. You will receive an email. It confirms your registration. Click the link in the email. It activates your account.Uw identiteit verifiëren

Stripe needs to know you. It requires identity verification. This keeps your account secure. Provide your personal details. Upload necessary documents. A government ID is often needed. Verification takes a few minutes. Stripe will notify you. Once verified, you can proceed.Uw bankrekening koppelen

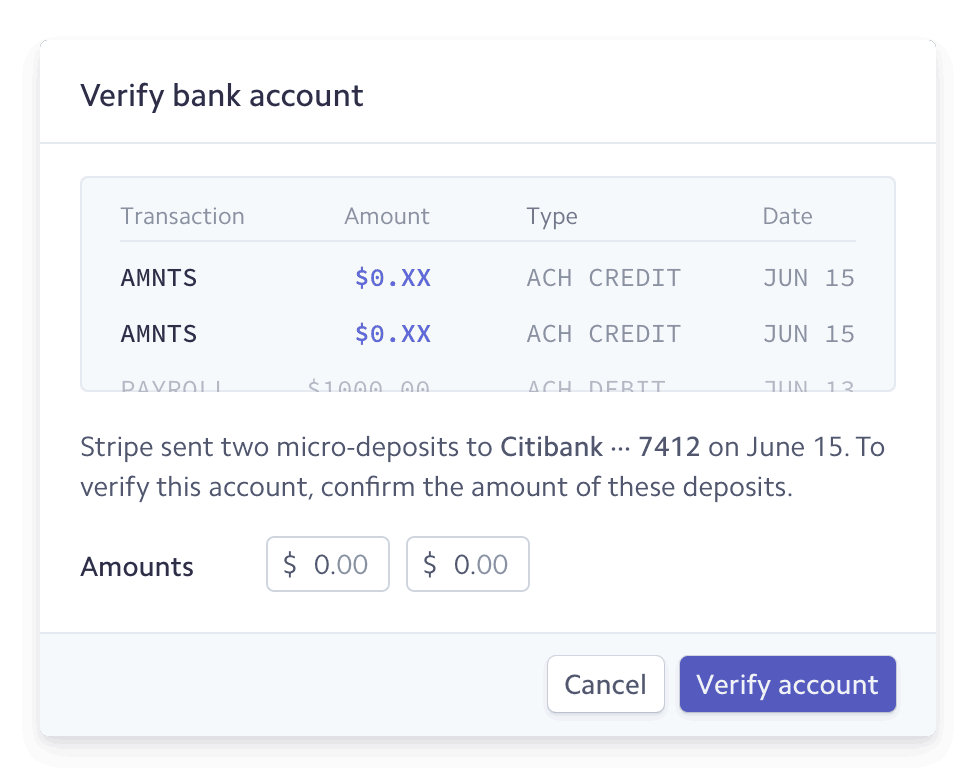

Linking your bank account is important. It allows direct transfers. Go to your Stripe dashboard. Select ‘Payments’. Choose ‘Bank Accounts’. Enter your bank details. Provide account and routing numbers. Double-check the information. Stripe will send small deposits. Check your bank statement. Enter the deposit amounts in Stripe. This confirms your bank account. Now, you’re ready to transfer money.

Understanding Stripe Payouts

Stripe makes it easy to accept online payments. But how do you get your money? Understanding Stripe payouts is key. This process involves several steps and rules. Let’s break it down.

Payout Schedule

Stripe doesn’t transfer money instantly. Your funds follow a payout schedule. This schedule varies by country and business type. Some businesses receive daily payouts. Others may wait a few days. Check your dashboard for your specific schedule.

Minimum Balance Requirements

Stripe requires a minimum balance before payouts. This amount ensures coverage for refunds or disputes. The balance needed depends on your business and location. Keep track of your balance to avoid delays.

Valutaconversie

Stripe handles multiple currencies. But conversions can affect your payout. When money is converted, fees may apply. The conversion rate can also change your final amount. Be aware of these factors if you accept international payments.

Een overdracht initiëren

Transferring money from Stripe to a bank account is simple and quick. Log into your Stripe dashboard. Select the desired amount and initiate the transfer to your bank. Funds usually arrive within a few business days, making it a convenient option for business owners.

Accessing The Dashboard

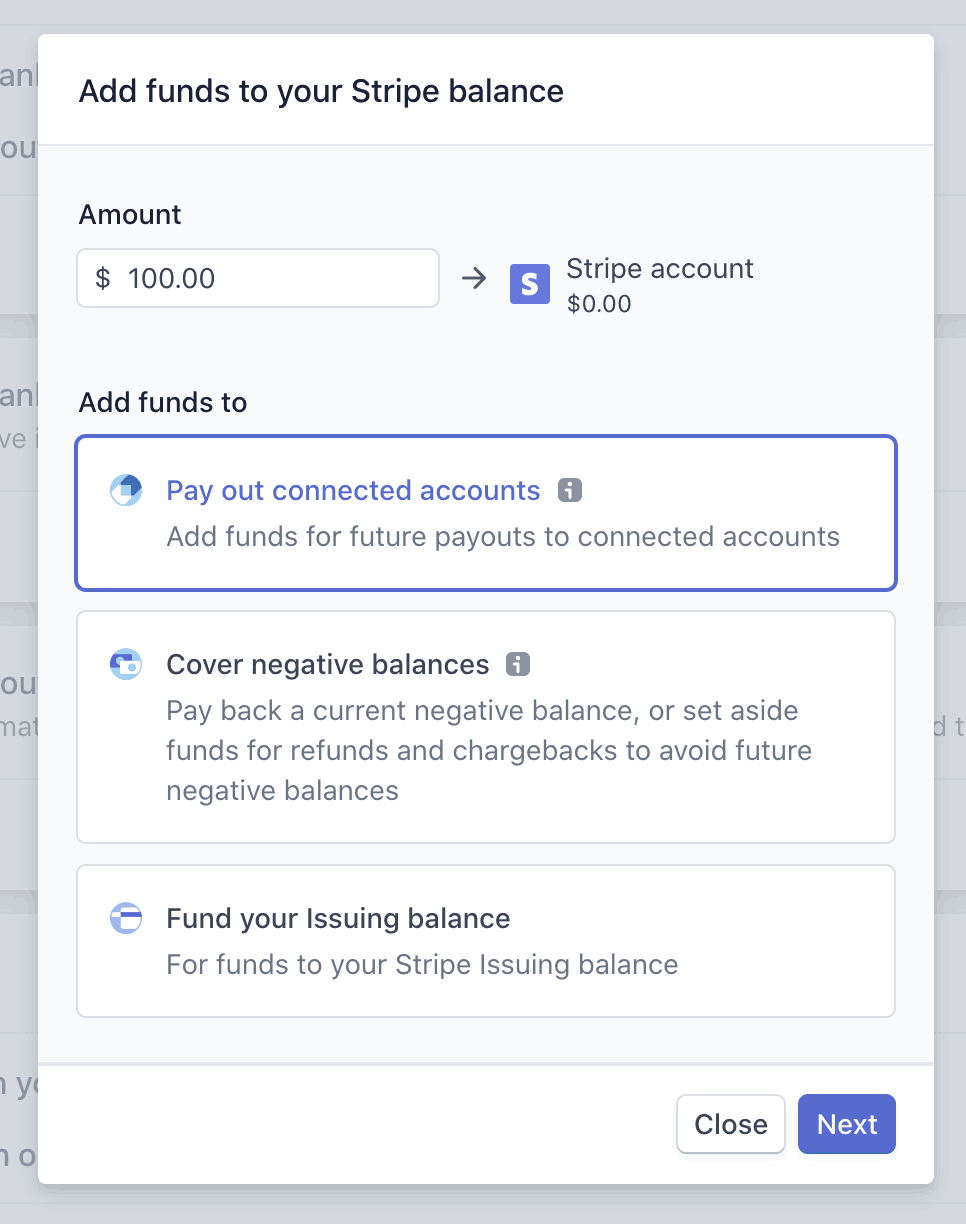

First things first, head over to your Stripe account. Logging in should feel as routine as checking your email. Once inside, you’ll find the dashboard—the heart of your financial operations. It’s designed to be user-friendly, offering a snapshot of your transactions and balances. Can you see your total earnings just waiting to be transferred?Selecting The Payout Option

Now, let’s talk about getting your money moving. Look for the “Payouts” section on the dashboard; this is your gateway to transferring funds. Clicking on it opens up options for scheduling and managing your payouts. Imagine this as choosing the route your funds will take to reach you—efficient and secure.Overdrachtsgegevens invoeren

Here’s where precision counts. You’ll need to input your bank account details accurately. This includes your account number and routing number. Double-checking these details is crucial; a small typo can delay your transfer. Have you ever had that moment of hesitation before hitting ‘send’, just to ensure everything is spot on? Once everything is set, confirm the transfer and watch the magic happen. Your funds are now on their way, ready to support your next venture or simply to celebrate your business achievements. Whether you’re doing this for the first time or the hundredth, each transfer brings a sense of accomplishment.

Monitoring van overdrachtsstatus

Transferring money from Stripe to a bank account requires monitoring the transfer status closely. This process ensures funds are safely and accurately moved. Regular checks help confirm successful completion, providing peace of mind for users.

Transferring money from Stripe to your bank account can feel like a milestone in managing your business finances. But once you’ve initiated the transfer, how do you ensure everything is on track? Monitoring transfer status is crucial to avoid unnecessary delays and ensure your funds are accessible when you need them. Tracking your payouts and resolving issues promptly can make a world of difference in maintaining cash flow and peace of mind.Tracking Payouts

Stripe offers an intuitive dashboard where you can track your payouts. You can view the status of each transfer, from processing to completed, all in one place. A personal tip: Set up email notifications for real-time updates. This way, you’ll know immediately when a payout is initiated and when it lands in your bank account. Consider setting calendar reminders for expected transfer dates. This keeps your financial planning aligned and helps you anticipate any discrepancies early.Resolving Common Issues

Sometimes transfers can hit a snag. This might be due to incorrect bank details or a temporary hold on your account. Double-check your bank information regularly to ensure accuracy. If a transfer is delayed, review Stripe’s notifications for any alerts or messages that might point to the issue. This helps you address problems swiftly and get your funds moving again. Have you ever wondered why some transfers are faster than others? Factors like bank holidays or time zones can affect transfer speeds. Understanding these can help you set realistic expectations.Contact opnemen met de ondersteuning

If issues persist, reaching out to Stripe’s support can be your lifeline. Their customer service is known for responsiveness, helping you resolve issues efficiently. Before contacting support, prepare your account details and any error messages received. This will streamline the support process. Have you ever felt stuck waiting for a response? Try reaching out via multiple channels—email, live chat, or even social media—for quicker assistance. Monitoring your transfer status isn’t just about watching numbers move; it’s about ensuring your business operates smoothly and without financial hiccups. By tracking payouts, resolving issues, and knowing when to contact support, you empower yourself with control over your financial transactions. How do you monitor your transfers, and have you found strategies that improve your process? Share your insights!Ensuring Secure Transactions

Transferring money from Stripe to a bank account ensures secure transactions. Stripe offers encryption to protect your financial data. This process is straightforward and reliable, providing peace of mind.

Beveiligingsfuncties

Stripe offers robust security features designed to protect your financial information. One of these features is encryption, which ensures that your data is kept private during transactions. Stripe also uses tokenization, replacing sensitive card details with unique identifiers, making it difficult for hackers to access your information. Another key security measure is two-factor authentication (2FA). By enabling 2FA, you add an extra layer of security that requires a second form of identification. This could be a text message code or a mobile app notification, adding an extra hurdle for potential fraudsters. ###Tips voor fraudepreventie

Preventing fraud starts with being vigilant. Always verify the recipient’s details before initiating a transfer. A simple mistake can lead to significant losses. Double-checking account numbers and names can save you from potentially costly errors. Consider setting up notifications for all transactions. These alerts can keep you informed of any unusual activity in real-time. If something seems off, act quickly to prevent unauthorized access. Avoid using public Wi-Fi when accessing your Stripe account. Public networks can be a playground for hackers looking to steal your information. Use a secure connection to keep your data safe. ###Regular Account Monitoring

Regularly monitoring your account is a proactive way to ensure security. Set aside time each week to review your transactions and account activities. This habit helps you spot any discrepancies early on. Look for any unauthorized transactions, no matter how small. Even minor unauthorized charges can indicate a larger security issue. Addressing these immediately can prevent further problems. Consider setting up automated reports or alerts for your Stripe account. These can provide insights into your account activity and help you stay on top of your financial security. Incorporating these practices into your routine can significantly enhance the security of your Stripe transactions. What steps will you take today to protect your financial future?Optimizing Transfer Efficiency

Optimizing transfer efficiency from Stripe to a bank account can save time and money. Efficient transfers ensure your funds reach the bank swiftly and smoothly. This process involves careful planning and strategic handling of fees. It also means leveraging currency benefits to your advantage. Let’s explore how to streamline this process effectively.

Scheduling Regular Transfers

Setting a consistent transfer schedule helps maintain financial stability. Regular transfers prevent the accumulation of funds in Stripe. This keeps your cash flow consistent and predictable. Choose a schedule that aligns with your business needs. Weekly or monthly transfers are common choices. They provide a reliable rhythm for managing funds.

Managing Transfer Fees

Understanding transfer fees can significantly impact your financial strategy. Stripe charges fees for each transfer to your bank. Monitor these costs to avoid unnecessary expenses. Consider consolidating transfers to minimize fees. Larger, less frequent transfers can be more economical. Always review fee structures before initiating a transfer.

Maximizing Currency Benefits

Currency conversion can affect the final amount you receive. Stripe provides options for handling multiple currencies. Optimize these options to enhance your fund’s value. Monitor exchange rates regularly for favorable conditions. Transfer funds during peak rates for maximum benefit. Currency management ensures you retain more of your earnings.

Veelgestelde vragen

How Do I Transfer Money From Stripe To My Bank Account?

To transfer money from Stripe to your bank account, log into your Stripe dashboard. Navigate to the “Payouts” section. Here, you can initiate a transfer by selecting the amount and confirming your bank details. Ensure your account is verified to avoid delays.

How Long Does A Stripe Transfer Take?

Stripe transfers typically take 7 days for new accounts. For established accounts, it usually takes 2-3 business days. However, bank processing times may vary. Ensure your bank account details are correct to avoid delays.

Are There Fees For Stripe Bank Transfers?

Stripe charges a standard processing fee for transactions. However, there are no additional fees for transferring money to your bank account. Always check Stripe’s official fee schedule for the most accurate information.

Can I Automate Stripe Payouts?

Yes, Stripe allows for automated payouts. You can schedule them daily, weekly, or monthly. Configure your payout settings in your Stripe dashboard under the “Payouts” section. Ensure your account is verified for automation to function smoothly.

Conclusie

Transferring money from Stripe to your bank is simple. Follow clear steps for easy transactions. Regular checks on your Stripe account ensure smooth money flow. Always keep your bank details updated. This prevents errors and delays. Make sure to verify your balance before transferring.

This helps avoid confusion. Knowing these steps makes the process stress-free. Use Stripe’s support if issues arise. They can help with questions. With practice, transferring funds becomes second nature. Secure your financial peace of mind today. Enjoy seamless transfers and better control over your finances.

Stay informed. Stay efficient.