Transfer Money from Joint Account to Individual Account Tax Tips

Ever wondered what happens when you transfer money from a joint account to an individual account? You might think it’s simple, but there are some tax implications you need to consider.

Imagine having peace of mind, knowing you’re making the best financial decisions without any hidden surprises. If you’re curious about how to navigate the transfer process smoothly and stay on the right side of tax regulations, you’re in the right place.

By the end of this article, you’ll have a clear understanding of what to watch out for and how to avoid common pitfalls. Ready to make informed decisions with your money? Let’s dive in!

Understanding Joint And Individual Accounts

Managing finances can often feel like navigating a maze, especially when it comes to understanding the differences between joint and individual accounts. Whether you’re sharing an account with a partner or looking to switch funds to your personal account, it’s crucial to grasp the nuances of each type. This knowledge not only empowers you to make informed decisions but also ensures that you aren’t caught off guard when tax season rolls around. So, what sets these accounts apart, and how can they impact your financial strategy?

Differences Between Joint And Individual Accounts

Joint accounts are shared between two or more people, typically spouses or business partners. This setup means that all parties have access to the funds and can make transactions. It’s like sharing a cookie jar; you both can take a cookie whenever you want.

Individual accounts, on the other hand, are solely owned by one person. You have complete control over your funds. Think of it as having your own private stash of cookies—no one else can dip into it.

While joint accounts offer shared responsibility, they also mean shared liability. If your partner makes a mistake, you might have to deal with the consequences. Individual accounts offer privacy and control, but lack the convenience of shared access.

Benefits And Drawbacks Of Joint Accounts

Joint accounts can simplify bill payments and budgeting. With everything pooled together, managing household expenses becomes a breeze. You don’t have to worry about who’s paying for what.

However, joint accounts can also lead to potential conflicts. If you and your partner have different spending habits, this might cause friction. Imagine discovering your savings depleted because your partner went on a shopping spree.

Another drawback is the risk of taxes. Money transferred from a joint account to an individual one might trigger tax implications. Are you prepared for the tax man knocking on your door?

Consider your personal experiences with financial management. Have you ever faced challenges with joint accounts, or do you prefer the autonomy of an individual account? Understanding these differences helps you plan effectively.

Whether you’re enjoying the benefits of shared finances or relishing the independence of a personal account, knowing the ins and outs is key. How do you navigate the complexities of joint and individual accounts in your financial journey?

:max_bytes(150000):strip_icc()/joint-brokerage-accounts-7497852-final-cd591b0b058c49b684536ade5c193289.png)

Reasons For Transferring Funds

Transferring money from a joint account to an individual account can help manage personal finances and simplify tax reporting. It ensures clear ownership of funds, reducing potential tax complications. This process can also aid in organizing finances for individual expenses and investments.

Personal Financial Goals

Achieving personal financial goals often requires a focused approach. You might want to save for a new car, a vacation, or a significant investment. Transferring money from a joint account to your individual account can provide better control over your funds, allowing you to track progress more efficiently. Have you ever felt that financial independence could drive your ambitions further?Joint accounts are commonly used to manage shared expenses such as household bills or mortgage payments. However, there may be instances where transferring funds to individual accounts makes sense. Perhaps you’ve decided to take charge of specific expenses or need clarity in financial responsibilities. Clear boundaries can help prevent misunderstandings and ensure that each party knows their financial commitments.

Legal And Tax Considerations

Legal and tax considerations can play a significant role in financial decisions. Transferring money from a joint account to an individual account might be necessary due to tax planning or changes in legal circumstances, like a divorce or separation. Consulting a financial advisor can offer insights into potential implications, ensuring that your financial decisions align with legal requirements. Have you considered how legal changes might impact your financial strategies? Understanding these reasons can guide you in making informed decisions about your financial future. Whether driven by personal goals, the need for clarity in shared expenses, or legal considerations, transferring funds is a choice that can align with your unique circumstances.Tax Implications Of Transfers

Transferring money from a joint account to an individual account can feel like a simple task. However, understanding the tax implications of these transfers is crucial to ensure you’re not caught off guard by any unexpected tax liabilities. Whether you’re managing finances with a partner or planning for future expenses, knowing the tax landscape can save you from potential pitfalls.

Gift Tax Rules

Did you know transferring money from a joint account to an individual account might trigger gift tax rules? If you’re transferring a substantial amount to someone, the IRS may view this as a gift. Each year, there’s an exclusion limit; anything above that could be subject to tax. Imagine transferring money to a child for their college fund, thinking it’s a simple gesture, only to realize it needs to be reported as a gift. Always check the current annual exclusion limit to avoid surprises.

Income Tax Considerations

It’s common to wonder if money transferred from a joint account to an individual account might affect your income tax. Generally, transferring funds between accounts doesn’t count as income. But, if the transferred money is from earned interest or dividends, it could impact your taxable income. Picture this: you receive interest from a joint savings account and decide to move it to your personal checking account. That interest is still taxable, so keep an eye on those statements.

Rapportagevereisten

Ensuring proper reporting is essential for tax compliance. Some transfers might require you to fill out specific forms, especially if they exceed certain amounts. Have you ever wondered if you need to report a transfer to the IRS? It can be a daunting thought, but knowing when and how to report can ease the process. Make sure to review IRS guidelines or consult a tax professional to keep your records straight.

Understanding these aspects of tax implications can make your financial decisions smoother and more informed. Have you ever faced a situation where you were unsure about the tax consequences of a money transfer? How did you handle it? Sharing your experiences can help others navigate similar challenges.

Strategies For Minimizing Taxes

Transferring money from a joint account to an individual account can impact taxes. Understanding strategies for minimizing taxes is crucial. This helps ensure smooth financial transitions without unexpected tax burdens. Here are some effective strategies to consider.

Utilizing Gift Tax Exemptions

Gift tax exemptions can be a valuable tool. Each year, individuals can gift a certain amount tax-free. This helps in reducing taxable transfers. Use this exemption to minimize tax liabilities. It allows money transfers without triggering tax consequences.

Splitting Transfers Over Time

Splitting transfers over time can be strategic. Instead of transferring a large sum at once, spread it out. Smaller, gradual transfers can help avoid exceeding tax thresholds. This approach can ease the financial burden. It may also prevent unnecessary tax expenses.

Consulting With A Tax Professional

Consulting with a tax professional provides clarity. They offer personalized advice tailored to your situation. Tax professionals understand the latest tax laws. Their expertise can help navigate complex tax systems. They assist in making informed decisions on money transfers.

Juridische overwegingen

Transferring money from a joint account to an individual account involves key tax considerations. Understanding potential tax implications is crucial to avoid unexpected liabilities. Ensure compliance with legal regulations to safeguard financial interests during the transfer process.

Transferring money from a joint account to an individual account might seem straightforward. However, there are legal considerations you should be aware of. Understanding these aspects can save you from potential pitfalls and ensure you manage your finances wisely. Let’s dive into some critical areas you should consider.Understanding Joint Account Agreements

Joint account agreements spell out the rules and responsibilities for account holders. Before moving funds, ensure you understand what you agreed to when you opened the account. You might recall a time when you signed a joint account agreement with a family member or partner. Remember how you both agreed on how the funds could be used? It’s crucial to revisit those terms. Are there any restrictions on withdrawing funds? Knowing these details can prevent disputes and maintain trust between account holders. If you’re unsure, consult your bank or a legal expert to clarify any uncertainties.Potential Impact On Estate Planning

Transferring money from a joint account can have implications on your estate plan. This is particularly important if the account holder passes away. Have you considered how this might affect the inheritance process? A joint account typically passes to the surviving account holder. This might disrupt your estate planning intentions. To avoid complications, ensure your estate plan reflects your current financial situation. Keep your beneficiaries informed about your decisions. It’s worth having a conversation with a financial advisor to align your estate plan with your goals. Navigating the legal waters of joint and individual accounts can be complex. Yet, with careful planning and communication, you can manage these transitions smoothly and avoid unintended consequences.Practical Steps For Transferring Money

Transferring money from a joint account to an individual account can be simple. Knowing the right steps ensures a smooth process and avoids tax issues. Follow these steps to make sure your transfer is seamless.

Documenting The Transfer

Start by documenting every detail of the transfer. Write down the date, amount, and reason for the transfer. Keep a copy of any communication between account holders. This documentation protects you in case of any tax inquiries.

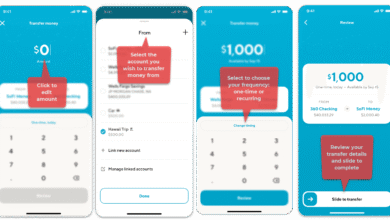

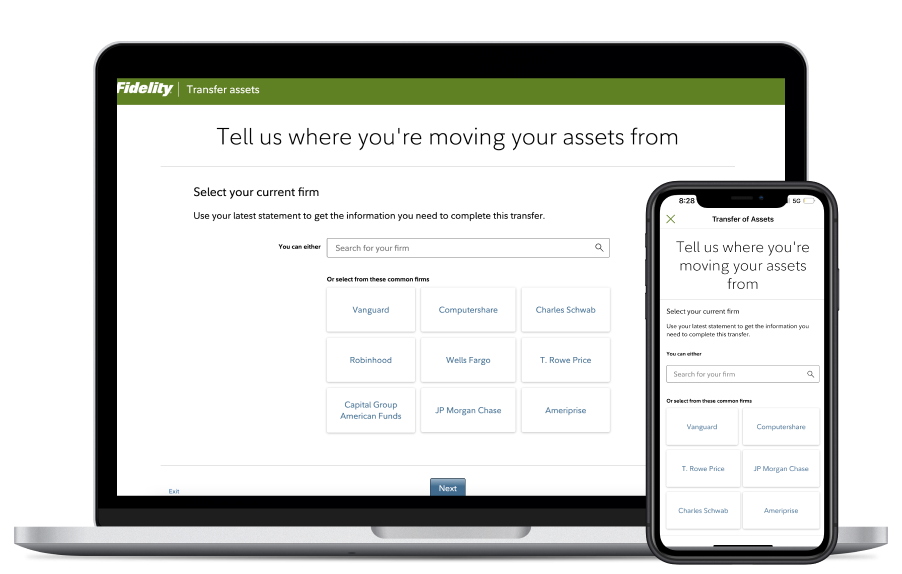

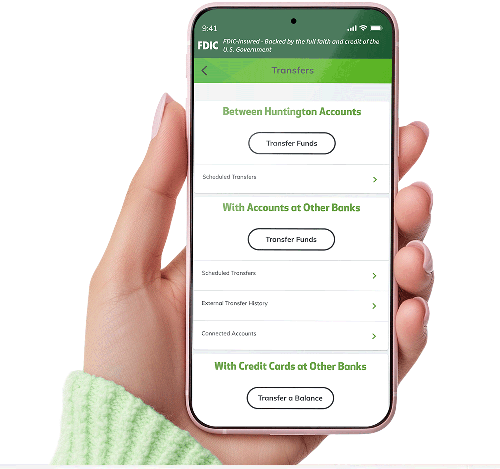

Choosing The Right Transfer Method

Choose a transfer method that suits your needs. Online banking is fast and convenient. Visit your bank for in-person transfers if you prefer. Each method has its own benefits. Ensure the chosen method is secure and reliable.

Keeping Records For Tax Purposes

Keep all records related to the transfer for tax purposes. Store receipts, bank statements, and any relevant documents safely. These records help during tax filing and audits. Good record-keeping prevents tax complications.

Common Mistakes To Avoid

Transferring money from a joint account to an individual account might cause tax issues. Careful handling helps avoid unexpected tax consequences. Ensure proper documentation to prevent misunderstandings or potential audits.

Transferring money from a joint account to an individual account can be a straightforward process, but many people overlook key details that can lead to unexpected tax implications. By understanding common mistakes, you can avoid unnecessary hassles and save yourself both time and money. Let’s dive into some typical pitfalls and how you can steer clear of them.Ignoring Tax Consequences

A common mistake people make is ignoring the tax consequences of transferring funds from a joint account to an individual account. While it might seem like a simple transfer, you could be subject to gift tax if the amount exceeds certain limits. Consider this: You and your spouse jointly own an account, and you transfer a significant amount to your individual account. If you don’t account for the potential gift tax implications, you might face a hefty tax bill later. Always check the latest tax rules and consult with a tax advisor to ensure you’re not blindsided by taxes you didn’t anticipate.Overlooking Legal Agreements

Another frequent oversight is overlooking the legal agreements tied to joint accounts. Before making any transfers, review the account’s terms and conditions. Suppose the joint account has specific stipulations about withdrawals or transfers that require both parties’ consent. Ignoring these can lead to legal disputes or frozen accounts. Make sure you understand the legal framework to avoid any uncomfortable surprises. Discuss with the other account holder and get all necessary approvals before proceeding.Failing To Keep Accurate Records

Keeping accurate records of all transfers is not just a good practice—it’s essential. Failing to maintain proper documentation can lead to confusion, especially during tax season. Think about the last time you had to prove a transaction to a bank or tax authority. Without clear records, you might struggle to justify or explain your actions. Create a habit of recording each transaction with details such as the date, amount, and purpose. This simple step can save you countless hours and headaches down the line. Are you ready to make your transfer without these common mistakes? Remember, a little preparation can prevent a lot of trouble. What steps will you take to ensure a smooth and error-free transfer?

Veelgestelde vragen

How Do You Transfer Money From A Joint Account?

To transfer money from a joint account, log in to your online banking. Select the joint account and initiate a transfer to your individual account. Ensure you have the necessary account details ready. Confirm the transaction and verify if any fees apply.

Are There Tax Implications For Transferring Funds?

Transferring money from a joint to an individual account may have tax implications. It depends on the amount and jurisdiction. Consult a tax advisor to understand potential tax liabilities. Ensure compliance with local tax laws to avoid penalties.

Can Both Account Holders Access Funds After Transfer?

After transferring funds, only the remaining balance is accessible to both joint account holders. The transferred amount is solely available to the individual account holder. Ensure both parties agree to the transfer to prevent disputes.

Is It Safe To Transfer Money Online?

Yes, transferring money online is generally safe when using secure banking platforms. Ensure your bank uses encryption and follow security protocols. Avoid sharing login details and monitor your accounts for unauthorized transactions.

Conclusie

Navigating money transfers between accounts can be confusing. Knowing the tax rules helps. It ensures smooth transactions and avoids surprises. Joint accounts offer benefits, but tax implications vary. Always check regulations before transferring funds. Consult experts if unsure about tax duties.

This prevents legal issues. Secure your finances and peace of mind. Stay informed and make smart decisions. Remember, financial clarity is key to successful management. Keep track of all transactions for future reference. Plan wisely and maintain compliance with tax laws.

Knowledge empowers informed choices.