Transfer Money from Business Account to Personal Account: Essential Tips

Managing finances can sometimes feel like walking a tightrope, especially when balancing your business and personal accounts. You might find yourself wondering if transferring money from your business account to your personal account is the right move.

Is it legal? Is it smart? Is it simple? These questions might keep you up at night, but don’t worry—we’ve got the answers you need. Imagine a world where your financial transitions are smooth, clear, and stress-free. You deserve to feel confident about every dollar you earn and move.

This blog post is designed to guide you through the process with ease. You’ll learn the steps to make transfers without a hitch, understand the legal considerations, and discover how to keep everything organized for both your peace of mind and your accountant’s approval. Let’s dive into how you can effectively manage these transfers while keeping your business and personal finances in harmony. Ready to transform your financial management experience? Keep reading!

Juridische overwegingen

Transferring money from a business account to a personal account demands careful attention to legal regulations. Ensure proper documentation and adhere to tax laws to avoid complications. Consult legal experts to maintain compliance and safeguard your finances.

Transferring money from your business account to your personal account can be a routine part of managing your finances. However, it’s important to understand the legal considerations involved. These considerations ensure you’re not only staying compliant but also optimizing your financial strategy. Let’s dive into the critical aspects you need to keep in mind.Belastingimplicaties

When you move money from your business account to your personal account, there can be significant tax consequences. This transaction might be seen as income, which could affect your personal tax obligations. You should clearly understand how these transfers impact your taxable income and consult with a tax professional if necessary. Consider how this affects your business deductions. Transferring too much money could inadvertently reduce the amount you can claim as business expenses. This balance is crucial for minimizing your tax liability. Have you ever wondered how such transfers could trigger audits? Consistent large transfers without clear documentation can raise red flags with tax authorities. It’s wise to keep detailed records of these transactions to justify them if questioned.Naleving van regelgeving

Regulatory compliance is another critical factor when transferring funds between accounts. Depending on your business structure, there might be rules governing how and when you can transfer money. For example, corporations often have stricter guidelines than sole proprietorships. You might need to document these transfers in your business records. This documentation helps ensure transparency and compliance with any legal requirements. Keeping clear records can protect you from potential legal issues down the line. Have you considered how these transfers might affect your business’s financial health? Regularly moving large sums to your personal account could impact your business’s liquidity. It’s essential to strike a balance to ensure your business continues to operate smoothly. Understanding these legal considerations can make your financial management more effective. Taking the time to get it right not only safeguards your business but also helps avoid unnecessary complications with tax authorities and regulatory bodies.

Appropriate Methods

Transferring money from a business account to a personal account requires careful consideration. It’s essential to use appropriate methods to ensure compliance and avoid issues. Here are some effective ways to manage these transfers.

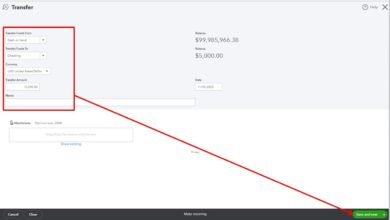

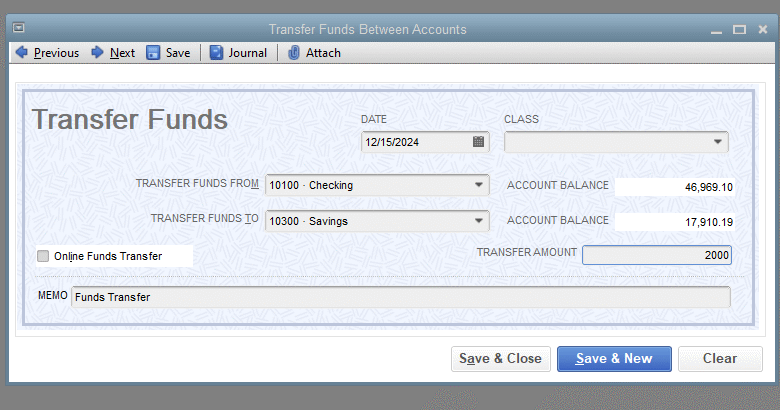

Direct Transfer

A direct transfer involves moving funds straight from the business account to your personal account. This method is simple and quick. Ensure accurate records to avoid confusion. Keeping detailed documentation helps clarify the purpose of each transfer.

Owner’s Draw

Owner’s draw is another common method for transferring money. Business owners can withdraw funds for personal use. This approach suits sole proprietors and partnership firms. It’s crucial to record each draw accurately. This ensures proper accounting and tax compliance.

Salary Payments

Some business owners pay themselves a salary from the business account. Salary payments provide a structured way to manage personal finances. This method simplifies tax filings and provides predictable income. Proper documentation of salary payments is important for transparency.

Administratie bijhouden

Accurate record keeping is essential for transferring money from a business account to a personal account. It ensures transparency and compliance with financial regulations. Proper documentation helps track each transaction and maintains clarity in financial dealings.

Documentation Practices

Keep detailed records of each transfer. Include date, amount, and purpose in your documentation. Store these records in a secure and accessible location. Use digital tools to organize and retrieve information easily. This simplifies the process during audits or reviews.

Tracking Transfers

Create a system to track all transfers. Use spreadsheets or accounting software for accuracy. Record each transfer immediately to avoid errors. Regularly review records to ensure they are up-to-date. This practice helps identify patterns and discrepancies quickly.

Consulting Professionals

Consulting professionals guide businesses in transferring money from business accounts to personal accounts efficiently. They ensure compliance with tax laws and regulations. This helps avoid penalties and financial issues.

Financial Advisors

Financial advisors can be your guiding light in understanding the nuances of transferring funds. They can help you assess the impact on your personal financial goals. Imagine having a clear roadmap for your finances without the stress of uncertainties. A financial advisor can provide specific strategies tailored to your situation. They might suggest setting up a separate savings account for tax liabilities. This ensures that you’re not caught off guard during tax season. Have you ever thought about the long-term impact of transferring large sums? Financial advisors can help you see the bigger picture. They can offer insights into how these transfers affect your investment portfolio or retirement plans.Accountants

Accountants play a crucial role in ensuring your transactions are compliant with tax laws. They can identify potential pitfalls in transferring funds from your business to personal accounts. This helps you avoid costly mistakes. Imagine you’re planning to transfer a significant amount for a personal project. An accountant can help you structure the transfer in a tax-efficient manner. They can advise on strategies such as timing the transfer to minimize tax liabilities. Accountants can also offer advice on record-keeping. Proper documentation is key to avoiding issues with tax authorities. Keeping detailed records of transfers ensures you’re always prepared for audits or inquiries. Consulting professionals isn’t just about avoiding mistakes. It’s about empowering yourself with knowledge to make informed decisions. Have you considered how much peace of mind you could gain from their expertise?Common Mistakes

Transferring money from a business account to a personal account seems simple. Many business owners make common mistakes during this process. These errors can lead to financial issues and even legal problems. Understanding these mistakes helps avoid them and ensures smooth financial operations.

Mixing Personal And Business Funds

One major mistake is mixing personal and business funds. This can blur financial boundaries. It makes tracking expenses and income difficult. Accurate bookkeeping becomes a challenge. This mixing can lead to confusion during tax season.

Separate accounts help maintain clear financial records. It ensures each transaction is easy to track. This separation simplifies accounting tasks. It also provides a clear financial picture of the business. Maintaining distinct accounts safeguards against financial mismanagement.

Ignoring Tax Liabilities

Another common mistake is ignoring tax liabilities. Some business owners overlook tax implications of fund transfers. This oversight can result in unexpected tax bills. Properly documenting each transfer is crucial. It helps in understanding tax liabilities better.

Consulting with a tax professional can prevent costly errors. They provide insights into tax obligations related to fund transfers. This ensures compliance with tax laws. Being aware of tax duties helps in avoiding penalties. Accurate tax records are essential for any business.

Veelgestelde vragen

How Do I Transfer Money To My Personal Account?

To transfer money, log into your business account online or through the bank app. Select the transfer option, input your personal account details, and confirm. Ensure you comply with any bank policies regarding such transfers. Always keep records for future reference and tax purposes.

Is It Legal To Transfer Business Funds Personally?

Yes, it’s legal to transfer funds from a business to a personal account. However, you must ensure it complies with tax regulations and business policies. Document the reason for the transfer, especially if it’s a salary or dividend. Consult with a financial advisor to avoid any legal complications.

What Fees Are Involved In Transferring Funds?

Fees vary depending on your bank’s policy. Some banks charge a nominal fee for inter-account transfers, while others may offer free services. Check with your bank to understand the fee structure. It’s important to compare costs if you frequently transfer funds between accounts.

Are There Limits On Transfer Amounts?

Yes, banks may impose limits on the amount you can transfer. These limits vary depending on the bank and your account type. It’s important to check these limits with your bank to avoid any transaction issues. Contact your bank to understand the specifics of your account’s limits.

Conclusie

Transferring money from a business account to a personal account requires care. Follow legal guidelines to avoid issues. Keep records of all transactions for clarity. Separate accounts help in managing finances better. Consult a financial advisor if unsure. Clear understanding ensures smooth and compliant transfers.

This practice safeguards your business integrity. Always prioritize transparency and legality in every transaction. With careful planning, you can maintain financial health. Stay informed and make smart decisions. Your business and personal finances will benefit from it.