Ria Money Transfer Business Account: Boost Your Transactions

Are you looking for a reliable solution to streamline your international transactions? If so, you’ve landed in the right place.

Welcome to the world of Ria Money Transfer Business Account – a game-changer for businesses seeking efficient and cost-effective ways to manage their global money transfers. Imagine a platform that not only simplifies your payment processes but also enhances your business’s financial agility.

With Ria, you can unlock a realm of possibilities, ensuring your business operations run smoother than ever. Curious about how this can transform your financial strategies? Dive into our comprehensive guide to discover the powerful benefits and insights that a Ria Money Transfer Business Account can offer you. Keep reading to unveil how this tool can become your business’s best ally.

Benefits Of A Ria Business Account

Choosing the right money transfer service is crucial for businesses. Ria Money Transfer offers a business account with many benefits. These features can help streamline financial operations. They also ensure a seamless and secure transaction process.

Faster Transactions

Time is money for any business. Ria Money Transfer provides faster transactions. This means less waiting time for your funds. With speed, you can manage cash flow better. It also helps in meeting urgent payment needs without delay.

Competitive Exchange Rates

Getting the best value is vital in money transfers. Ria offers competitive exchange rates. These rates help in reducing transfer costs. You can save more with every transaction. This means more money stays within your business.

Enhanced Security Features

Security is a top priority in financial transactions. Ria ensures enhanced security features for business accounts. Your transactions and data remain protected. This gives peace of mind with each transfer. Safe and secure transactions lead to trust and reliability.

Setting Up A Ria Business Account

Setting up a Ria Money Transfer Business Account can boost your financial operations. It enables efficient international money transfers. This account suits businesses of all sizes. It helps manage transactions securely and reliably. Understanding the setup process is crucial. It ensures smooth account activation.

Eligibility Criteria

Businesses must meet specific criteria for a Ria Business Account. They should operate legally. Having a valid business license is essential. The business must have a registered physical address. This ensures compliance with regulatory standards. It should also have a bank account. This account must be in the business name.

Vereiste documentatie

Proper documentation is needed to open a Ria Business Account. Business registration documents are necessary. Provide proof of address with a utility bill. A bank statement may be required. Include identification for authorized signatories. A valid ID like a passport or driver’s license is needed. This confirms their authority over the account.

Account Activation Process

The account activation process is straightforward. Submit the application online. Attach all required documents. Ria reviews the application. They verify the provided information. Approval typically takes a few days. Once approved, the account is active. Begin transferring money internationally with ease.

Managing Your Ria Business Account

Managing your Ria Money Transfer Business Account involves keeping track of transactions and ensuring secure transfers. Regularly monitor your account to maintain smooth operations and handle customer needs efficiently. Simplifying processes improves service quality and builds customer trust.

Online Platform Features

The Ria online platform is user-friendly. Access your account anytime with ease. Track transactions and view your history. Use advanced security features for safe transfers. The platform allows multiple user access, perfect for team collaboration. Real-time updates keep you informed. Manage funds and monitor activity in one place.Mobile App Functionality

Ria’s mobile app provides convenience. Transfer money on the go. Check your balance in seconds. The app is compatible with all smartphones. Enable notifications for instant alerts. The app’s interface is simple and intuitive. Manage your account without hassle. Secure access ensures your data is safe.Opties voor klantenondersteuning

Ria offers reliable customer support. Contact them via phone or email. Support is available 24/7. Get help with any account issues. Skilled representatives assist with queries. Live chat offers immediate responses. Access FAQs for quick solutions. Your satisfaction is their priority.Maximizing Transaction Efficiency

In today’s fast-paced business environment, maximizing transaction efficiency isn’t just a luxury—it’s a necessity. Whether you’re managing payroll, supplier payments, or international transactions, the right tools can make a world of difference. Ria Money Transfer Business Account offers solutions designed to streamline your financial operations, allowing you to focus on growth rather than logistical headaches.

Automated Payment Solutions

Imagine your financial operations running on autopilot. Automated payment solutions with Ria Money Transfer simplify your transaction processes, giving you more time to focus on strategic business decisions. By setting up recurring payments, you eliminate manual errors and ensure timely transactions. It’s like having a reliable assistant who never sleeps.

Bulk Transfer Options

Handling multiple payments can be overwhelming. Ria Money Transfer Business Account’s bulk transfer options allow you to send money to multiple recipients at once, saving you time and effort. This feature is perfect for paying employees or vendors simultaneously. Think of it as sending one email to multiple recipients instead of individual messages.

Tracking And Reporting Tools

How often do you lose track of payments? With comprehensive tracking and reporting tools, you gain full visibility over your transactions. Monitor the status of your transfers and generate detailed reports with ease. This transparency not only helps in budgeting but also in identifying trends for smarter financial decisions.

As you navigate the complexities of business finance, ask yourself: Are you maximizing efficiency to its fullest potential? The tools at your disposal can transform the way you manage transactions. With Ria Money Transfer Business Account, every step is designed to enhance productivity and ensure peace of mind.

Cost-effective Strategies

Cost-effective strategies are essential for businesses using Ria Money Transfer. Managing transfer expenses can boost profits and operational efficiency. Here, we’ll explore methods to minimize costs.

Understanding Fee Structures

Grasp the fee structures of Ria Money Transfer. Know the charges for different transfer amounts. Compare costs with other services. This helps in making informed decisions. Choose the best option for your business needs.

Reducing Transfer Costs

Opt for batch transfers instead of multiple individual transactions. This can lower overall fees. Schedule transfers during low-demand periods. This may reduce costs further. Monitor exchange rates to transfer at favorable times.

Leveraging Discounts And Promotions

Stay updated on Ria’s discounts and promotional offers. These can significantly cut transfer costs. Subscribe to Ria’s newsletter for exclusive deals. Follow their social media channels for real-time updates. Maximize savings by utilizing available promotions.

Compliance And Regulatory Considerations

As you venture into the world of international money transfers with a Ria Money Transfer Business Account, understanding compliance and regulatory considerations is crucial. Navigating these aspects ensures your business stays on the right side of the law while building trust with your clients. Let’s dive into the essential compliance elements that will guide your business transactions securely and efficiently.

Adhering To International Standards

International standards are the backbone of global financial transactions. They ensure your transfers are recognized and respected worldwide. Imagine the confidence your clients feel knowing your business complies with these standards. It’s not just about ticking boxes; it’s about ensuring smooth transactions across borders.

Stay updated on the latest regulations. The financial world is dynamic, and standards evolve. Regular training and consultations with legal experts can keep your business ahead. This proactive approach minimizes risks and maintains your credibility.

Anti-money Laundering Measures

Anti-Money Laundering (AML) measures are non-negotiable in the money transfer industry. They’re your shield against illegal activities. Implementing robust AML protocols protects your business and clients. Think of it as a security system for your financial transactions.

Consider integrating advanced technology to spot suspicious activities. Automation can enhance your monitoring capabilities. A friend who runs a similar business shared how using AI tools significantly reduced fraud attempts. Could your business benefit from such innovations?

Data Privacy Regulations

Data privacy is not just a buzzword; it’s a vital aspect of your business operations. Protecting client information is a trust-building exercise. When clients feel their data is secure, they’re more likely to choose your services over competitors.

Develop a comprehensive data protection policy. Involve your team in regular training sessions. A colleague once mentioned that after a data breach, their business saw a dip in client trust. Don’t let this be your story; prioritize data security.

How are you safeguarding your client data today? Reflect on your current practices and consider necessary improvements. Your proactive steps can make all the difference in maintaining a solid reputation.

Case Studies And Success Stories

Ria Money Transfer Business Account has helped many businesses. They streamline transactions globally. Companies across industries are reaping benefits. They share inspiring case studies and success stories. These real-world applications demonstrate the power of efficient money transfers.

Businesses Boosting Transactions

Many businesses have increased their transaction volumes. They use Ria Money Transfer Business Accounts. A small retail chain doubled its customer base. It was able to offer international payment options. This broadened its reach and attracted new customers.

A logistics company improved its cash flow. It reduced delays in receiving payments from clients abroad. This efficiency allowed them to invest in better infrastructure. Resulting in enhanced service delivery.

Real-world Application Examples

Consider a tech startup expanding into Asia. They faced challenges with cross-border payments. Using Ria Money Transfer, they simplified this process. They saved time and reduced transaction costs.

A non-profit organization funds projects in different countries. They needed a reliable transfer method. Ria Money Transfer ensured timely disbursements. Projects continued without financial interruptions.

Lessons Learned From Industry Leaders

Industry leaders emphasize understanding local markets. They recommend using reliable transfer partners like Ria. This ensures smooth transactions and customer satisfaction.

Learning from these leaders, businesses can avoid common pitfalls. They can focus on growth and innovation. Choosing a trusted money transfer service is crucial. It can impact a company’s global operations significantly.

Veelgestelde vragen

What Are The Benefits Of A Ria Business Account?

A Ria Money Transfer business account offers competitive rates and fast transactions. It enhances global reach with extensive network connections. Businesses can enjoy secure transfers and efficient customer support. Utilizing a Ria business account can streamline financial operations and improve overall transaction experience.

How To Open A Ria Business Account?

Opening a Ria business account is straightforward. Visit Ria’s official website and complete the registration form. Provide necessary business documents for verification. Once approved, you can start managing transfers and transactions efficiently. For assistance, contact Ria customer support.

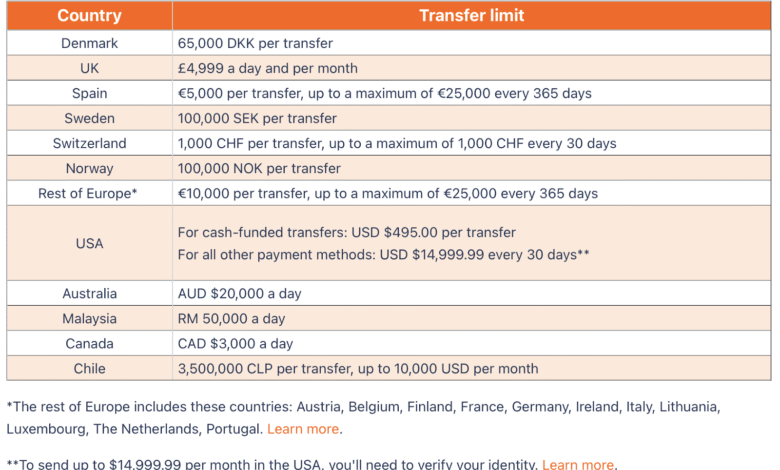

Can Businesses Transfer Large Amounts With Ria?

Yes, Ria Money Transfer allows businesses to transfer large amounts securely. They offer competitive exchange rates and ensure transactions are completed swiftly. For high-value transfers, businesses can benefit from Ria’s extensive global network. Contact their support for specific limits and detailed procedures.

Is Ria Suitable For International Business Transfers?

Ria is ideal for international business transfers due to its vast network. It offers competitive exchange rates and fast processing times. Businesses can efficiently manage global transactions, ensuring reliability and security. Ria’s services are designed to support international business needs effectively.

Conclusie

Ria Money Transfer Business Account offers a seamless experience for businesses. It simplifies international transactions, enhancing efficiency and speed. Businesses can enjoy competitive rates and reliable service. The platform ensures security, safeguarding your financial data. Its user-friendly interface makes managing transfers easy.

Many businesses trust Ria for their cross-border needs. Flexible options cater to different business sizes and requirements. Starting with Ria can improve your global financial operations. Consider Ria for your next business transfer. It could be the smart choice for your company.

Explore how Ria can fit into your business strategy today.