How to Transfer Money from Virtual Card to Bank Account: Easy Steps

Are you looking to transfer money from your virtual card to your bank account but not sure where to start? You’re not alone.

Many people find themselves puzzled when trying to navigate the digital maze of online finance. The good news is, transferring money from a virtual card to your bank account is easier than you think. Imagine the convenience of having your funds exactly where you need them, without any hassle.

This guide will walk you through the process step by step, ensuring you can confidently manage your money. By the end of this article, you’ll have the knowledge to effortlessly move your funds, saving you time and giving you peace of mind. Let’s unlock the secrets of this simple yet powerful financial tool together.

Virtual Card Basics

Virtual cards offer a modern way to manage money. They’re digital versions of physical cards. You use them for online transactions. They provide convenience and security. No need to carry a physical card. Many people prefer virtual cards for online shopping. They protect your primary account details. These cards are easy to use and manage. Understanding them is crucial for online financial transactions.

What Is A Virtual Card?

A virtual card is a digital card. It works like a regular debit or credit card. But it’s not physical. You use it online or in apps. It has its own unique number. It also has an expiration date and CVV. It’s linked to your bank account or card. You can create one through your bank or payment provider.

Benefits Of Using A Virtual Card

Virtual cards offer many benefits. They help keep your bank details safe. If a website is hacked, your main account stays secure. You can also set spending limits. This helps with budgeting. Some cards are temporary. They expire after a single use. This adds another layer of security. They’re flexible and convenient for online purchases.

How To Obtain A Virtual Card

Getting a virtual card is easy. Many banks offer them. Online payment services provide them too. You log into your account. Then, look for the virtual card section. Follow the instructions to create one. It’s quick and often free. Some providers may charge a small fee. But most do not.

Understanding Virtual Card Fees

Virtual card fees are usually low. Some providers charge a small fee per transaction. Others may charge a monthly fee. Always check with your provider. Read the terms and conditions carefully. Understand any fees before using the card. This helps avoid unexpected charges.

Choosing The Right Platform

Selecting the ideal platform simplifies transferring money from a virtual card to a bank account. Prioritize security features and user-friendly interfaces for a smooth transaction experience. Compare transaction fees and processing times to ensure cost-effective and timely transfers.

Factors To Consider

Consider transaction fees. Some platforms charge high fees, reducing your funds. Check the transfer speed. Some platforms offer instant transfers, while others take days. Security is crucial. Ensure the platform uses encryption to protect your data. Read user reviews to gauge reliability. A platform with positive feedback often indicates good service. Customer support is essential. Choose a platform offering 24/7 assistance for any issues.Top Platform Recommendations

PayPal is popular for its user-friendly interface and security. TransferWise offers low fees and competitive exchange rates. Payoneer is known for fast transfers and global reach. Venmo is ideal for those seeking a simple mobile experience. Each platform has unique features. Weigh the pros and cons to find the best fit for your needs.Linking Virtual Card To Bank Account

Transferring money from a virtual card to a bank account is straightforward. First, log into your virtual card account. Then, select the transfer option and enter your bank details. Finally, confirm the transaction. Funds will usually appear in your bank account within a few business days.

Linking a virtual card to a bank account simplifies money transfers. It allows seamless movement of funds from your virtual card directly into your bank. This process ensures easy access and management of your finances. Understanding the steps involved is crucial for a smooth experience. Let’s break down the necessary information and steps involved.Necessary Information

Before starting, gather all required information. Know your bank account number and routing number. Your virtual card details are essential. Ensure your personal identification matches both accounts. Verify the name on both the bank and virtual card accounts. This ensures the linking process is smooth and error-free.Step-by-step Guide

Linking your virtual card to your bank is simple. Follow these steps: 1. Log into your virtual card account. Go to the settings or account section. 2. Look for the option to add a bank account. Select it. 3. Enter your bank account number and routing number. Double-check for accuracy. 4. Provide any additional required information. This may include personal identification. 5. Confirm the details are correct. Submit the linking request. 6. Check for confirmation from your virtual card provider. They may notify you via email. 7. Once confirmed, test the link by transferring a small amount. This ensures everything works correctly. By following these steps, you can easily link your virtual card to your bank account. This makes transferring money quick and convenient.

Het initiëren van de overdracht

Transferring money from a virtual card to a bank account might sound daunting, but it’s a straightforward process once you know the steps. Whether you’re moving funds for personal use or business transactions, initiating the transfer is the first crucial step. Let’s dive into how you can seamlessly transition your funds from the virtual world into your tangible bank account.

Setting Up Transfer Details

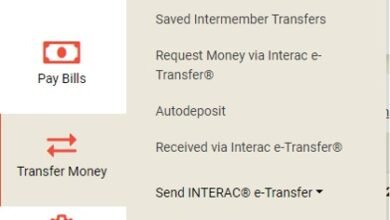

To start the transfer, log into your virtual card account. Look for the option that allows transferring funds to a bank account. It’s usually labeled as “Transfer” or “Send Money”.

Once you’ve located it, you’ll need to enter your bank account details. This typically includes your account number and the bank’s routing number. Double-check these details to avoid mistakes.

Make sure you also specify the amount you want to transfer. Ensure it doesn’t exceed your virtual card balance. If you’re unsure about your balance, check it beforehand to avoid any hiccups.

Confirming The Transaction

After setting up the transfer details, the next step is confirmation. You’ll likely be prompted to review the transaction details before proceeding. This is your chance to verify everything.

Are your bank details correct? Is the transfer amount accurate? Take a moment to ensure all information is spot on. This step is crucial to prevent any errors and delays.

Once you’re confident everything is accurate, go ahead and confirm the transaction. You might receive a confirmation message or email, indicating that your transfer is being processed.

Have you ever found yourself wondering why a simple mistake can lead to transaction delays? It’s often because of incorrect details. Make it a habit to double-check everything.

Initiating a transfer is all about precision. By following these steps, you can ensure your money moves swiftly and safely from your virtual card to your bank account.

Transfer Fees And Charges

Transferring money from a virtual card to a bank account involves specific fees and charges. Understanding these costs helps in planning better. Many platforms charge a small percentage or fixed fee for transactions. Consider these charges before making a transfer to avoid surprises.

Transferring money from a virtual card to a bank account involves certain fees and charges. Understanding these costs is crucial for planning your financial transactions. Different service providers have varied fee structures. Users must be aware of these to avoid unexpected deductions from their funds.Common Fees

Most platforms charge a processing fee for transfers. This fee is usually a percentage of the transfer amount. Some providers also impose a flat fee per transaction. Exchange rates can also affect the total cost if you deal with different currencies. Furthermore, service providers may have additional fees for expedited transfers.Tips To Minimize Costs

Choose a provider with low transaction fees. Compare different platforms before making a decision. Avoid unnecessary currency conversions. If possible, transfer money in the same currency. Opt for standard transfers instead of expedited ones. This can save you extra fees. Set up direct transfers to your bank to minimize intermediary charges. Always read the fine print. Understand all associated fees before initiating a transfer.

Veiligheidsmaatregelen

Transferring money from a virtual card to a bank account involves crucial security measures. These measures ensure your money moves safely and your personal information remains protected. Understanding these security aspects helps prevent unauthorized access and fraudulent activities.

Zorgen voor veilige transacties

Always use a secure internet connection. Avoid public Wi-Fi when transferring funds. Check for a padlock symbol in your browser. This indicates a secure website. Verify the website’s URL. It should start with ‘https’. Use strong passwords for your accounts. Change them regularly to maintain security.

Enable two-factor authentication. This adds an extra layer of protection. Receive alerts for any transaction. Monitor your account regularly. Report suspicious activities immediately. Knowing your bank’s security policies is essential. Keep software and apps updated. This prevents vulnerabilities.

Identifying Fraudulent Activities

Understand common signs of fraud. Unexpected emails asking for personal info can be phishing attempts. Verify sender’s identity before responding. Suspicious transactions should be reported instantly. Monitor your account for unauthorized activity. Familiarize yourself with scams targeting virtual card users.

Educate yourself about identity theft techniques. Stay alert to unusual activities. Regularly check bank statements for discrepancies. Use trusted sources for information. Keep your antivirus software up-to-date. This helps detect and block malicious threats. Protecting your financial data requires vigilance.

Uw overdracht volgen

Transferring money from a virtual card to a bank account can be simple and secure. Start by logging into your virtual card platform and selecting the transfer option. Enter your bank details, confirm the amount, and submit the transaction to complete the process.

Transferring money from a virtual card to a bank account can be straightforward, but ensuring the transfer is successful requires a bit of diligence. Tracking your transfer is crucial to ensure your funds reach their destination safely and promptly. If you’ve ever sent money and felt uncertain about its status, this section will guide you on how to keep tabs on your transfer and understand what to expect during the process.Monitoring van overdrachtsstatus

It’s essential to monitor the status of your transfer. Most platforms provide a transaction history where you can see your transfer’s current status. Look for terms like “Pending,” “Processing,” or “Completed.” These indicators tell you exactly where your money is in the transfer process. Regularly check your email or app notifications for updates. These notifications often contain detailed information about your transfer status.Expected Timeframes

The time it takes for the transfer to complete can vary. Typically, transfers can take from a few hours to several days. Factors like the bank’s processing schedule and the type of virtual card being used can impact the timeline. For instance, if you’re using a virtual prepaid card, it might take longer than a standard debit card. Consider asking yourself: How urgent is the transfer? If time is of the essence, you might want to explore options that guarantee quicker processing. Keeping tabs on your transfer not only provides peace of mind but also ensures you can take prompt action if any issues arise. Have you ever tracked a transfer and found unexpected delays? Share your experiences in the comments below!Problemen met veelvoorkomende problemen oplossen

Transferring money from a virtual card to a bank account can sometimes be tricky. You may encounter various problems that can interrupt the process. These issues can be related to failed transactions or difficulties contacting support. This section will guide you through troubleshooting these common problems. Understanding these can help you avoid delays and ensure a smooth transaction.

Failed Transactions

Transaction failures occur for several reasons. Insufficient funds in your virtual card can be a cause. Double-check your balance before attempting another transfer. Incorrect bank account details can also lead to failure. Ensure all information matches exactly. Some banks might have restrictions on receiving funds from virtual cards. Contact your bank to verify if they allow such transactions. Always check the transaction limit of your virtual card. Exceeding the limit can cause a failure.

Contact opnemen met de ondersteuning

If issues persist, reaching out to support can help. Most virtual card providers have a customer service team. Find their contact information on their official website. When contacting support, provide clear details about your issue. Include transaction dates, amounts, and any error messages received. This information will help them assist you faster. If support is unresponsive, consider reaching out through social media. Many companies respond quickly on platforms like Twitter or Facebook.

Veelgestelde vragen

How Can I Transfer Money From A Virtual Card?

To transfer money from a virtual card to a bank account, first ensure your card supports transfers. Log in to your card provider’s website or app. Navigate to the transfer section, enter your bank details, and specify the amount. Confirm the transaction to complete the process.

Are There Fees For Transferring Money From A Virtual Card?

Yes, many providers charge fees for transferring funds from virtual cards to bank accounts. Fees vary depending on the card provider and the amount transferred. It’s advisable to check your provider’s fee schedule before initiating a transfer to avoid unexpected charges.

How Long Does It Take To Transfer Funds?

Transfer times from virtual cards to bank accounts can vary. Typically, it takes between 1 to 5 business days. Some providers offer instant transfers, but they may come with higher fees. Always check with your provider for specific timelines and any potential delays.

Can I Transfer Money Internationally From A Virtual Card?

Yes, international transfers from virtual cards are possible but may incur additional fees. Ensure your card supports international transactions. You may need to provide extra details for security purposes. Always check the exchange rates and fees before initiating an international transfer.

Conclusie

Transferring money from a virtual card to a bank account is simple. Understand the steps clearly before starting. Always check fees and limits. Choose a reliable service for your transactions. Keep your details secure during the process. Many platforms offer easy transfers.

Ensure your bank supports the transfer method. Double-check all information before confirming. A little patience goes a long way. Mistakes can delay the transfer. With careful planning, you can transfer money smoothly. Happy transferring!