Kan ik geld overmaken naar mijn bankrekening vanaf PayPal: snelle handleiding

Have you ever found yourself with a balance sitting in your PayPal account, wondering how to transfer that money to your bank account? You’re not alone.

Many people use PayPal for its convenience and security, but then face the question of how to move their funds to where they can use them more freely. If you’ve ever felt a bit stuck or confused about this process, don’t worry—you’re about to discover just how simple it can be.

Imagine the relief of knowing exactly what steps to take, and the ease of transferring your money when you need it. By the end of this article, you’ll feel confident and in control of your finances. Let’s dive into the practical steps that will make transferring money to your bank account from PayPal a breeze.

Setting Up Your Paypal Account

Transferring money from PayPal to your bank account is simple. First, link your bank account to PayPal. Then, select “Transfer Money” in your PayPal account to move funds easily.

Setting up your PayPal account is the first step towards smoothly transferring money to your bank account. A well-configured account can streamline transactions, saving you time and hassle. Whether you’re a seasoned user or a beginner, understanding the setup process is crucial for seamless financial management.Uw bankrekening koppelen

To transfer money to your bank account from PayPal, you need to link your bank account. It’s simpler than you might think. Start by logging into your PayPal account. Head to the settings icon, typically found in the top-right corner. Look for the “Link a bank account” option and click it. You’ll need your bank’s routing number and your account number. Once you’ve entered these details, PayPal will initiate a small deposit to verify your account. A common question arises: “Why link a bank account to PayPal?” Linking ensures your funds are easily accessible and secure. Imagine needing to pay a bill or transfer money for an emergency; a linked account makes the process quicker.Verifying Your Account

Verifying your PayPal account is a key step to ensure security and reliability. After linking your bank account, you’ll notice small deposits in your bank account within a few days. Check your bank statement for these deposits—typically two small amounts. Log into PayPal and enter these amounts to confirm your bank account. This step may seem minor, but it reinforces the security of your transactions. Think about this: if you were a potential hacker, you’d need to crack through this verification step to access funds. This added layer of security helps protect your hard-earned money. Have you ever had a transaction fail due to account verification issues? This step ensures that such hiccups don’t happen. By linking and verifying your bank account, you pave the way for easy and secure money transfers. It’s like setting up a strong foundation for a house, ensuring everything else runs smoothly.Steps To Transfer Money

Transferring money from PayPal to a bank account is simple. Start by linking your bank account to PayPal. Then, select the transfer option, enter the amount, and confirm the transaction. Your funds will typically arrive within a few days.

Een overdracht initiëren

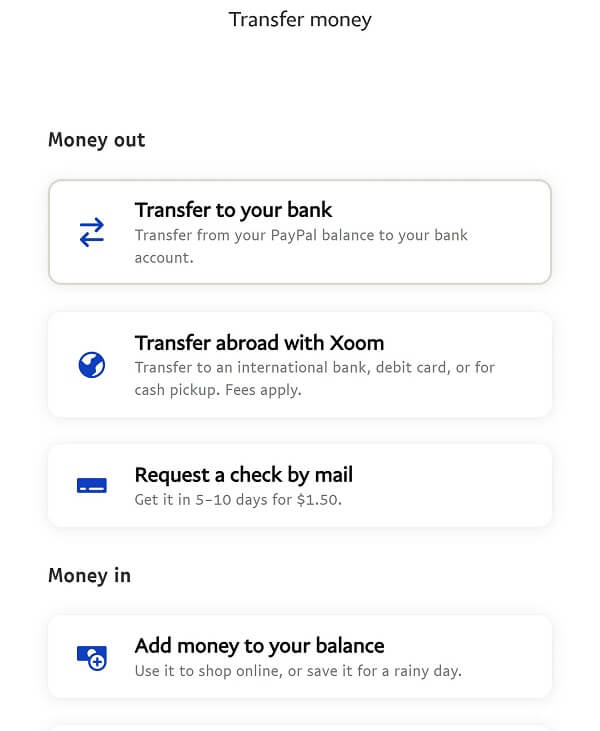

To start a transfer, log into your PayPal account. Look for the “Wallet” section, typically located at the top of your dashboard. This is your gateway to managing funds. Once inside the Wallet, you’ll see your available balance. Click on it to reveal options for transferring money. It’s your chance to move funds to your bank account or make other financial maneuvers. Have you ever wondered about the security of online transactions? PayPal’s step-by-step process ensures your money is safe, with clear instructions that guide you through every click.Choosing Transfer Options

After clicking on your balance, select the “Transfer Money” option. Here, you can decide whether to make an instant transfer or opt for a standard one. Instant transfers are faster but may incur a fee. They’re perfect for urgent needs or last-minute expenses. Imagine needing to pay a bill within hours—instant transfer might be your best friend. Standard transfers are free and typically take 1-3 business days. Ideal if you’re planning ahead and have no rush. It’s a great way to avoid fees while still moving your money efficiently. Which option suits you better? Think about your timeline and budget. This choice can impact your financial planning, so weigh your options carefully. Remember, transferring money is more than just a click; it’s about making informed decisions that align with your financial goals. Whether you choose speed or savings, you’re in control of your money’s journey.Transfer Time And Fees

Transferring money from PayPal to a bank account is simple and quick. Fees vary based on transfer speed; instant transfers cost more than standard ones. Check PayPal for the latest fee details before transferring funds.

Transferring money from your PayPal account to your bank account can be a smooth process, but understanding the timing and fees involved is crucial. Whether you’re planning a big purchase or just moving funds for daily expenses, knowing how long it takes and what it costs can help you make better decisions. Let’s break down the differences between standard and instant transfers to help you choose the best option for your needs.Standaardoverdrachten

Standard transfers from PayPal to your bank account are a popular choice for many users due to their simplicity and cost-effectiveness. Typically, these transfers take 1-3 business days to complete. There are no fees involved, making it a budget-friendly option. Imagine you’re planning a weekend getaway. You initiate a standard transfer on a Wednesday. While the money might not arrive immediately, you’ll likely have it by Friday, just in time for your trip. However, if you’re in a rush, this delay might not work. Have you ever found yourself needing funds urgently? This is where instant transfers come into play.Directe overboekingen

Instant transfers offer speed but come with a small price. These transfers are usually completed within minutes, providing quick access to your money. The convenience fee is typically around 1% of the transfer amount, capped at a few dollars. Picture this: it’s Saturday morning, and you’ve found a great deal online, but your bank account is running low. An instant transfer from PayPal can save the day, allowing you to seize the opportunity without waiting. Think about the times you’ve needed money at the last minute. Would you be willing to pay a small fee for immediate access? It’s a decision many face, balancing cost with convenience. In essence, choosing between standard and instant transfers depends on your urgency and budget. By understanding these options, you can manage your PayPal transfers more effectively and ensure your funds are where you need them, when you need them.Problemen met veelvoorkomende problemen oplossen

Easily transfer money from PayPal to your bank account by linking them. Ensure correct bank details to avoid issues. Contact PayPal support for help if problems arise during the transfer process.

Failed Transfers

Imagine this: You’ve just sold an item online and are eager to get your hard-earned money into your bank account. You initiate the transfer only to receive a notification that it failed. What’s happening here? Failed transfers can occur for several reasons. It might be due to incorrect bank details, insufficient funds, or even temporary technical glitches on PayPal’s side. Double-check your bank account details for any errors. Ensure your PayPal account has enough funds to cover the transfer. If everything seems correct, try initiating the transfer again after a few hours. Sometimes, waiting a bit can resolve unexpected tech issues. Have you ever faced a similar problem? How did you tackle it?Accountbeperkingen

Account limitations can feel like hitting a brick wall. You want to transfer your money, but PayPal has put restrictions on your account. Why does this happen? Limitations often arise due to security concerns. PayPal may require additional verification or documentation from you. This could be due to suspicious activity or simply to ensure the safety of your account. Address these limitations promptly by providing the necessary information or documentation requested by PayPal. This will not only expedite the lifting of restrictions but also ensure smoother transactions in the future. Have you ever had to deal with account limitations? What steps did you take to resolve them? By understanding these common issues and how to troubleshoot them, you can make your PayPal experience smoother and more efficient. Whether it’s verifying your details or waiting out a tech glitch, taking proactive steps can save you time and keep your financial activities uninterrupted.Security Tips

Transferring money from PayPal to your bank account is simple. First, link your bank account to PayPal securely. Then, initiate the transfer by selecting the amount you wish to move. Always verify transaction details to avoid errors.

When transferring money to your bank account from PayPal, security should be your top priority. Ensuring your transactions are safe is crucial to protecting your finances. By following some simple security tips, you can keep your PayPal account secure and your money safe.Protecting Your Account

Start by creating a strong, unique password for your PayPal account. A mix of letters, numbers, and symbols makes it harder for hackers to guess. Avoid using easily guessed words like “password” or sequences like “123456”. Enable two-factor authentication (2FA) for an added layer of security. With 2FA, even if someone gets your password, they won’t be able to access your account without your phone or another verification method. This simple step can significantly reduce the risk of unauthorized access. Regularly update your PayPal app and browser. Keeping your software up-to-date ensures you have the latest security patches. Neglecting this could leave your account vulnerable to attacks.Recognizing Phishing Scams

Phishing scams are a common threat. These scams often involve fake emails or messages that appear to be from PayPal, asking for your login details. Always check the sender’s email address. If it doesn’t look right, it probably isn’t. Avoid clicking on links in emails or messages unless you are sure they are legitimate. Instead, type PayPal’s URL directly into your browser. This prevents you from being redirected to a fake site. Be wary of messages that create a sense of urgency, like “Your account will be closed”. Scammers use this tactic to make you act without thinking. Take a moment to verify the message directly with PayPal through their official channels. Have you ever received a suspicious email claiming to be from PayPal? How did you handle it? Staying vigilant and informed is your best defense against online scams. By integrating these tips into your routine, you can ensure your transactions remain safe and secure.

Alternatives To Paypal

Looking to move your money into your bank account without using PayPal? You’re not alone. Many people are exploring alternatives to PayPal for various reasons, such as seeking lower fees, faster transfers, or just wanting a change. Let’s dive into some of these options and see how they stack up.

Other Payment Platforms

There are numerous payment platforms available, each with its unique features. Venmo, for instance, is a popular choice for those who prioritize social payments among friends and family. It’s simple to use and integrates seamlessly with your bank account.

Square Cash App is another user-friendly platform known for its straightforward interface. It allows quick transfers and even offers a free debit card linked to your Cash App balance, making spending a breeze.

Zelle is integrated with many banks directly, which means you can transfer money almost instantly without needing to set up a separate account. However, it’s primarily geared towards U.S. bank accounts, so international users might not find it suitable.

Comparing Transfer Fees

Fees can quickly add up, so it’s essential to know what you’re getting into. Venmo typically charges a 3% fee for credit card transactions, but transfers from your Venmo balance or bank account are free. This can be a game-changer if you frequently send money.

Square Cash App offers free standard deposits but charges 1.5% for instant transfers. This is something to consider if you often need immediate access to your funds.

Zelle stands out by not charging any fees for transactions, making it a highly attractive option for fee-conscious users. However, this might vary depending on your bank’s policies, so it’s worth checking with your financial institution.

Choosing the right platform depends on your needs. Are you looking for the lowest fees, or is speed your priority? Consider how often you transfer money, and weigh the pros and cons of each option. What works best for someone else might not be the perfect fit for you. Use these insights to make an informed decision that aligns with your financial habits.

Veelgestelde vragen

How To Transfer Money From Paypal To Bank Account?

To transfer money from PayPal to your bank, log into your PayPal account. Click on ‘Transfer Money’ and select ‘Transfer to your bank. ‘ Follow the prompts to complete the process. Ensure your bank account is linked to PayPal for a smooth transaction.

Are There Fees For Transferring Paypal Funds?

Transferring money from PayPal to your bank account is typically free. However, instant transfers may incur a small fee. Always check PayPal’s fee schedule for any updates. It’s advisable to use standard transfers for no-cost transactions whenever possible.

How Long Does Paypal Transfer Take?

Standard transfers from PayPal to a bank account usually take 1-3 business days. Instant transfers are quicker but may incur a fee. The exact time can vary based on your bank’s processing times. Always plan ahead to ensure timely access to funds.

Can I Transfer Paypal Balance To Any Bank?

You can transfer your PayPal balance to most bank accounts. Ensure your bank account is properly linked to PayPal. Some banks may have restrictions, so verify compatibility before transferring. Always keep your bank details updated for successful transactions.

Conclusie

Transferring money from PayPal to your bank is simple and direct. Follow the steps in your PayPal account. Ensure your bank details are correct. Then, initiate the transfer. Usually, it takes a few days to process. You can check the status online.

This method is safe and widely trusted. Many users rely on PayPal for its ease and security. Always double-check any fees involved. Stay informed about your transactions. Feel confident using PayPal for your money transfers. It’s a reliable choice for many.

Your bank account will soon receive the funds.