Can I Transfer Money from Netspend to a Bank Account? Easy Steps

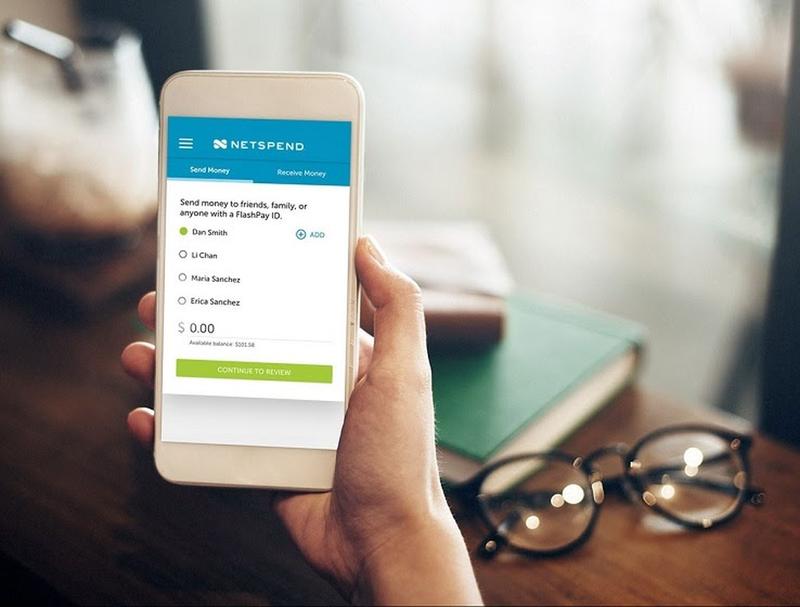

Wondering how to transfer money from your Netspend account to your bank account? You’re not alone.

Many people like you are looking for clear, easy steps to manage their finances efficiently. Imagine the convenience of moving your funds with just a few clicks, making it easier for you to manage your money and plan for the future.

In this blog post, we’ll guide you through the process, breaking it down into simple steps that anyone can follow. You’ll discover tips and tricks to make the transfer smooth and hassle-free. So, if you’re ready to take control of your finances, keep reading. Your journey to seamless money management starts here!

Netspend Overview

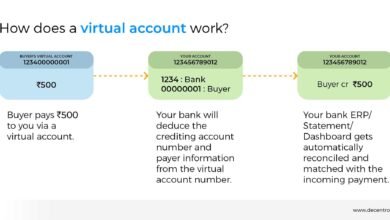

Netspend allows users to transfer money to a bank account with ease. The process involves linking your bank account to Netspend. Once connected, funds can be moved electronically, offering convenience and flexibility for managing finances.

Netspend Overview Are you familiar with Netspend? It’s a popular prepaid debit card service that provides an alternative to traditional banking. This service is perfect for those who want a simple way to manage their money without the hassle of bank accounts. With Netspend, you can load money onto a card and use it almost anywhere. It’s like having cash in your pocket but with more security and flexibility. Many people find it useful for budgeting because you can only spend what’s on the card. ###How Does Netspend Work?

Netspend offers a straightforward process. You load money onto your prepaid card through direct deposit, bank transfer, or cash reload. Once the funds are on your card, you can use it to make purchases, pay bills, or withdraw cash from ATMs. ###Benefits Of Using Netspend

Netspend provides several benefits that might appeal to you. It offers the convenience of direct deposit, meaning you can receive your paycheck or government benefits directly to your card. This can save you a trip to the bank and help you access your funds faster. There’s also no credit check required to sign up, making it accessible to more people. Plus, Netspend offers tools to help you manage your money, like transaction alerts and budgeting tips. ###Is Netspend Right For You?

Consider what you need from a financial tool. If you value easy access to your funds and the ability to control spending, Netspend might be a good fit. It’s important to review any fees associated with the card, like monthly charges or ATM fees. Does the flexibility and control of a prepaid card align with your financial goals? Think about how you handle your finances and whether a prepaid card can support your needs effectively. ###Transferring Money From Netspend To A Bank Account

Transferring money from Netspend to a bank account is a feature some users may need. While not as straightforward as a traditional bank transfer, it can be done. It usually involves using a third-party service or setting up a transfer with Netspend’s customer support. Ensure you understand any fees or limitations before initiating a transfer. It’s always a good idea to check Netspend’s official resources or reach out for assistance if needed. Have you had any experiences with Netspend or other prepaid cards? What did you find most useful or challenging? Your insights could be valuable to others considering this financial tool.

Benefits Of Transferring To A Bank Account

Transferring money from a Netspend account to a bank account offers many advantages. It provides increased control over finances and access to wider banking services. Understanding these benefits can help make informed decisions about financial management.

Financiële zekerheid

Bank accounts offer enhanced security features. Your funds are protected by federal insurance. This reduces the risk of losing money due to unforeseen events.

Gemak

With a bank account, managing finances becomes easier. You can pay bills online or set up automatic payments. This saves time and reduces stress.

Access To More Services

Bank accounts provide access to various financial services. You can apply for loans or credit cards. A bank account can also help build a credit history.

Better Money Management

Tracking spending is simpler with a bank account. Banks offer tools to monitor transactions and budgets. This helps in planning and saving efficiently.

Lagere kosten

Netspend may have transaction fees. Transferring funds to a bank account can reduce these costs. Banks often have fewer fees for regular services.

Ease Of Transfers

Transferring money between accounts is straightforward. Bank transfers often occur quickly. This ensures funds are available when needed.

Verhoogde toegankelijkheid

Bank accounts can be accessed from various platforms. Mobile apps and online banking offer flexibility. This makes managing money convenient anytime, anywhere.

Setting Up Your Netspend Account

Transferring money from Netspend to a bank account is simple. Start by logging into your Netspend account. Then, follow the instructions to link your bank account for easy transfers.

Creating A Netspend Account

Start by visiting the Netspend website. Click on the “Sign Up” button. Fill in your personal details. This includes your name, address, and contact number. You will also need to provide a valid email address. Once you submit, wait for your confirmation email. Follow the instructions in the email to activate your account. Now your account is ready for use.Uw bankrekening koppelen

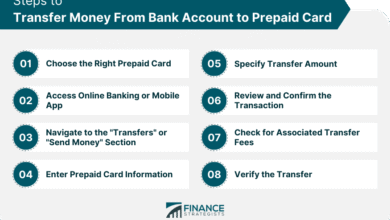

Log into your Netspend account. Navigate to the “Add Bank” section. Enter your bank account details. This includes your account and routing numbers. Double-check for accuracy. Submit your information for verification. Your bank might require a small test transaction. This confirms the connection. Once verified, you can transfer money easily.Steps For Transferring Money

Transferring money from your Netspend account to a bank account is simple. Follow these steps to ensure a smooth transfer process. This guide will help you navigate the process efficiently.

Accessing The Netspend App

Begin by opening the Netspend app on your smartphone. Ensure you have the latest version installed. Sign in using your credentials. You need a stable internet connection for this process.

Het initiëren van de overdracht

Once logged in, locate the transfer section. Tap on “Transfer Money” to start. Select the option to transfer to your bank account. Input the amount you wish to transfer. Make sure it does not exceed your available balance.

Bevestiging van overdrachtsgegevens

Review the transfer details carefully. Double-check the bank account number. Ensure the amount is correct. Confirm the transfer by tapping “Submit” or “Confirm.” Wait for a confirmation message from Netspend.

Transfer Fees And Limits

Transferring money from a Netspend account to a bank account involves understanding fees and limits. These factors can affect how much you transfer and how often. Grasping these details ensures you make the most of your financial transactions. Let’s dive into the specifics.

Understanding Fees

Transferring money isn’t always free. Netspend may charge a fee for each transfer you make. This fee can vary based on the amount you transfer. Knowing the exact fee helps you plan your finances better. Always check the latest fee details before making a transfer. This avoids unexpected costs.

Daily And Monthly Limits

Netspend sets daily and monthly limits for transfers. These limits ensure the safety and security of your account. Exceeding these limits may result in declined transactions. Understanding these limits helps you schedule your transfers accordingly. Always review these limits before initiating a transfer. This ensures seamless financial management.

Problemen met veelvoorkomende problemen oplossen

Transferring money from Netspend to a bank account is usually smooth. Yet, some users face hiccups. Understanding common issues helps resolve them quickly. This guide explores frequent problems and offers solutions.

Failed Transactions

Failed transactions can frustrate users. First, check your account balance. Ensure there are enough funds for the transfer. Next, verify account details. Mistakes in account numbers cause failures. Double-check each digit.

Also, check transaction limits. Netspend and banks have daily limits. Exceeding these limits results in a failed transaction. If issues persist, contact customer support for help. They can provide specific guidance.

Vertraagde overdrachten

Transfers might take longer than expected. This delay often depends on bank processing times. Some banks take a few business days to process transfers. Check with your bank for their processing schedule.

Network issues can also cause delays. Ensure a stable internet connection when initiating transfers. If delays continue, reaching out to Netspend support can provide clarity. They can check for any system issues causing delays.

Security Tips For Safe Transfers

Transferring money from Netspend to a bank account involves careful steps. Ensure account details are correct to prevent errors. Use secure networks to protect your financial information during the transfer process.

Transferring money from a Netspend account to a bank account can be a convenient way to manage your funds. However, ensuring the security of your transactions is crucial. With cyber threats continually evolving, how can you protect your hard-earned money? Here are some essential security tips to keep your financial transfers safe and sound. ###Protecting Your Account

Start by securing your Netspend account with a strong, unique password. Avoid using easily guessed words or numbers, like your birthday or “password123”. A mix of letters, numbers, and symbols works best. Always log out after completing your transfer, especially on shared or public computers. This simple step can prevent unauthorized access. Consider enabling two-factor authentication if available. This adds an extra layer of security by requiring a second form of verification, usually a text message or email code. ###Recognizing Fraudulent Activity

Stay vigilant for any unusual activity in your account. This could be unexpected transactions, notifications you didn’t set up, or login attempts from unfamiliar devices. Be wary of phishing emails that mimic legitimate companies to steal your information. Genuine organizations will never ask for your password or personal details via email. Report any suspicious activity to Netspend immediately. Quick action can prevent further issues and protect your funds. Have you ever caught a scam before it cost you? Your vigilance can make all the difference. By implementing these security practices, you can transfer money with confidence and peace of mind. Remember, staying informed and cautious is your best defense against fraud.

Alternatives To Netspend Transfers

Transferring money from Netspend to a bank account isn’t the only option. Various alternatives exist, offering flexibility and convenience. Discover simple methods to manage your finances effectively. Explore options that suit your needs and preferences.

Using Direct Deposits

Direct deposits offer a straightforward way to transfer funds. Many employers and government agencies support direct deposits. You can have your paycheck or benefits sent directly to your bank. This method ensures timely and secure transactions. Direct deposits remove the hassle of manual transfers. Set it up once, and enjoy seamless fund transfers.

Exploring Other Transfer Services

Other transfer services provide more choices for moving money. Services like PayPal, Venmo, or Cash App are popular. These platforms facilitate easy transfers to bank accounts. They offer user-friendly interfaces and quick processing times. Some may have fees, so check before using them. Choose a service that aligns with your financial habits.

Veelgestelde vragen

How Can I Transfer Money From Netspend To A Bank Account?

To transfer money from Netspend to a bank account, log into your Netspend account. Select “Send Money” and enter your bank details. Follow the prompts to complete the transfer. Ensure your bank information is accurate to avoid transaction errors. Transfers may take a few business days.

Are There Fees For Transferring Money From Netspend?

Netspend may charge fees for transferring money to a bank account. Check their fee schedule for detailed information. Fees can vary based on the transfer method and amount. Always review the fee details before initiating a transaction to avoid unexpected charges.

How Long Do Netspend Transfers Take?

Netspend transfers to a bank account typically take one to three business days. Processing times can vary based on the bank and transfer method used. It’s best to check with Netspend and your bank for precise timing. Plan ahead for any urgent transfers to ensure timely completion.

Can I Transfer Money Internationally With Netspend?

Netspend primarily supports domestic transfers within the United States. For international transfers, consider alternative services like PayPal or Western Union. Always confirm with Netspend for any updates on international transfer capabilities. Using a specialized service may be more efficient for overseas transactions.

Conclusie

Transferring money from Netspend to a bank account is simple. Follow the steps outlined above. Ensure your bank account is linked properly. Double-check all details to avoid errors. The process is secure and convenient. Many users find this transfer method useful.

It’s essential to manage your finances wisely. Keep track of your transactions for better control. Always contact customer support for help if needed. Understanding the process makes money transfers easy. Enjoy the peace of mind that comes with efficient banking.