Can I Transfer Money from Klarna to My Bank Account: A Guide

Are you wondering if you can transfer money from Klarna to your bank account? You’re not alone.

Many users are curious about how Klarna, a popular buy-now-pay-later service, fits into their financial ecosystem. Imagine the convenience of having instant access to funds when you need them the most. Understanding this process could open up new opportunities for managing your finances more efficiently.

We’ll explore whether Klarna allows such transfers, breaking down the process so you can make informed decisions. Stay with us to uncover the possibilities that could simplify your financial life.

Klarna’s Financial Services

Klarna’s financial services offer diverse payment solutions. It’s popular for online shopping. Users enjoy flexibility and convenience. But can you transfer money from Klarna to a bank account? This blog explores Klarna’s financial services.

Overview Of Klarna

Klarna began in Sweden in 2005. It grew quickly in online payments. Klarna simplifies online shopping. It lets customers buy now and pay later. Klarna partners with many retailers globally. Users can split payments into installments. This allows easier budgeting for purchases.

Payment Options Available

Klarna provides several payment options. Users can pay immediately at checkout. Or choose to pay later. Paying later allows 30 days to pay. This option is interest-free. Installments spread payments over time. It divides the total cost into fixed amounts. Each payment is due monthly. Klarna offers a credit account option. This account is managed through the Klarna app. Money transfers directly from Klarna to a bank account aren’t supported. Users must use Klarna’s payment methods.

Transferring Money From Klarna

Transferring money from Klarna to a bank account is a common query. Klarna is a popular payment service. Many users wonder about its money transfer capabilities. Understanding the process can help manage finances efficiently.

Checking Transfer Possibilities

Klarna’s primary function is as a payment service. It allows users to buy now and pay later. Direct money transfers to a bank account are not its main feature. Users should check their Klarna account for any available options. It’s important to understand what services are offered. This ensures users can make informed financial decisions.

Limitations And Restrictions

Klarna has specific rules regarding money transfers. These rules can limit direct transfers to bank accounts. Users must be aware of these potential restrictions. Each user’s account may have different options available. It’s crucial to review Klarna’s terms and conditions. This helps users navigate the platform effectively. Understanding these limitations can prevent misunderstandings.

Steps To Transfer Money

Transferring money from Klarna to your bank account is simple. Follow these steps to ensure a smooth transaction. Each step is clear and easy to follow. This guide will help you understand the process better. Let’s dive into the steps.

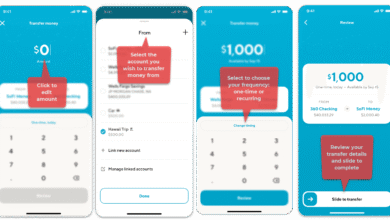

Accessing Your Account

First, log into your Klarna account. Use your registered email and password. If you forget your password, use the reset option. Ensure your internet connection is stable. Navigate to the main dashboard. Here, you can view your account balance and recent transactions.

Een overdracht initiëren

Locate the ‘Transfer Money’ option on the dashboard. Click on it to start the process. Enter the amount you wish to transfer. Make sure the amount is correct. Select your linked bank account as the destination. Double-check the bank account details.

Verification And Confirmation

After entering the details, proceed to the verification step. Klarna might ask for a security code. This code is sent to your registered phone or email. Enter the code to verify your identity. Once verified, review the transfer details again. Click ‘Confirm’ to finalize the transfer. You will receive a confirmation message from Klarna.

Alternatives To Direct Transfers

Transferring money directly from Klarna to your bank account might not be straightforward, but there are several practical alternatives worth considering. These alternatives can help you manage your finances efficiently and ensure you have access to your funds when you need them. Whether you’re looking to use Klarna’s built-in payment options or third-party services, understanding these alternatives can make your financial transactions smoother and more convenient.

Using Klarna’s Payment Options

Klarna offers flexible payment options that can be useful if direct transfers aren’t possible. You can utilize Klarna’s ‘Pay Later’ feature to delay payments, allowing you to manage your cash flow effectively. This can be particularly helpful if you’re waiting for funds to clear in your bank account.

Additionally, Klarna’s ‘Pay Now’ option allows you to pay immediately using linked bank accounts or credit cards. This can be a good way to indirectly transfer funds by settling payments through Klarna, without needing to move money directly to your bank.

Have you ever thought about using Klarna’s gift card options? By purchasing gift cards for popular retailers, you can convert your Klarna balance into tangible goods, effectively using your funds without a direct bank transfer.

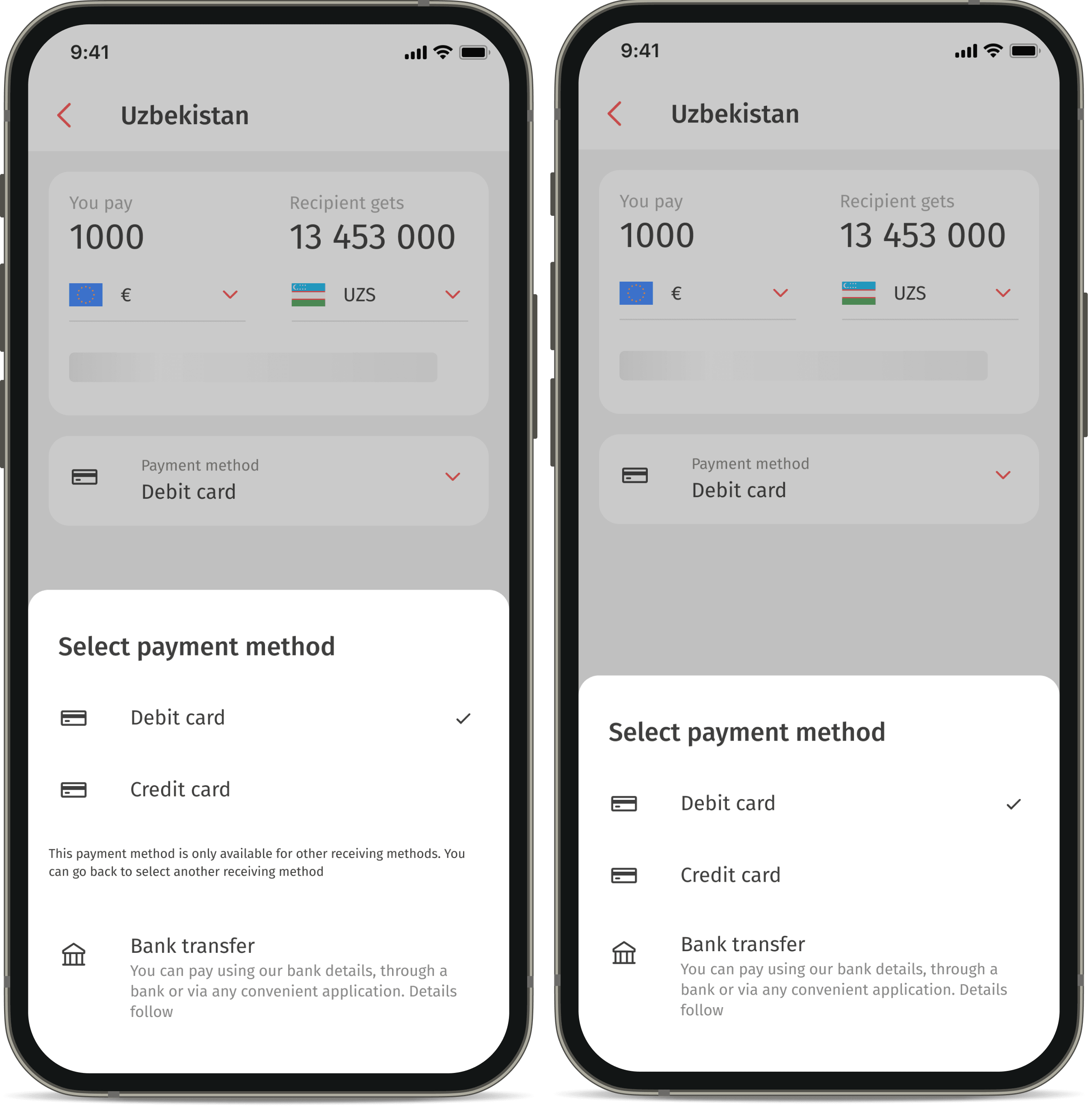

Diensten van derden

If Klarna’s payment options aren’t suitable, third-party services might offer the flexibility you need. Services like PayPal or Venmo can act as intermediaries, allowing you to move money between Klarna and your bank account indirectly.

Consider linking your Klarna account to a service that supports bank transfers. This way, you can move funds into these platforms and then transfer them to your bank account, bypassing direct Klarna transfers.

Have you explored using a digital wallet like Apple Pay or Google Pay? These services can link your Klarna account and your bank, providing a seamless way to manage your finances and make payments effortlessly.

What other creative solutions can you think of to handle your funds? Sometimes, the answer lies in combining various tools to suit your unique financial needs. By exploring these alternatives, you can ensure your money is accessible and work around the limitations of direct transfers from Klarna.

Problemen met veelvoorkomende problemen oplossen

Transferring money from Klarna to your bank account can hit snags. Understanding how to troubleshoot these issues is vital. This section will guide you through common problems. It offers clear steps to resolve them. Let’s dive into the details.

Failed Transfer Attempts

Failed attempts can happen due to various reasons. Check your bank details first. Ensure they match exactly with Klarna’s records. Mismatched details are a common cause of failure.

Insufficient funds may also lead to a failed transfer. Verify your account balance before initiating a transfer. Always double-check the amount to transfer.

Technical glitches can also cause issues. Log out and log back in to Klarna. Refreshing the app can solve minor glitches.

Contact opnemen met de ondersteuning

If problems persist, contact Klarna support. They provide expert help and quick solutions. Visit their help center for contact details.

Prepare necessary information before contacting support. This includes your account details and recent transactions. It helps speed up the troubleshooting process.

Be clear about the issue when reaching out. The more specific you are, the better support you receive.

Beveiligings- en privacyoverwegingen

Transferring money from Klarna to a bank account involves security and privacy steps. Users must ensure their account details are protected. Always verify transactions and keep personal information secure.

Transferring money from Klarna to your bank account involves a variety of security and privacy considerations. As digital transactions become more common, understanding how to protect your financial information is crucial. You want to ensure that your personal data remains safe while recognizing potential threats such as fraudulent activities. Let’s delve into these aspects to ensure your financial transactions are secure.Bescherming van uw financiële informatie

The security of your financial data should be a top priority. Klarna employs encryption and other security measures to safeguard your information during transactions. However, you can further protect yourself by ensuring your passwords are strong and unique. Consider using a password manager to keep track of your login details. This not only prevents unauthorized access but also makes it easier to remember complex passwords. Additionally, always check for the padlock symbol in the browser address bar when accessing Klarna’s website to ensure the connection is secure. Are you cautious about sharing your financial details online? It’s vital to limit the amount of personal information you provide. Only give necessary details when required and avoid sharing sensitive data on public or unsecured networks.Frauduleuze activiteiten herkennen

Identifying fraudulent activities can save you from potential financial losses. Stay alert for suspicious emails or messages claiming to be from Klarna. These might ask for your login credentials or bank information. Always verify the sender before responding or clicking on any links. If you notice any unusual activity in your Klarna account, act quickly. Contact Klarna’s customer service immediately to report your concerns. They can help you secure your account and investigate any unauthorized transactions. Do you regularly monitor your bank statements? This simple habit can help you spot unauthorized charges early. By keeping track of your transactions, you can quickly identify discrepancies and address them before they escalate. Security and privacy are paramount when dealing with online financial services. By taking proactive steps, you can ensure your transactions are secure and your financial information remains private. How do you safeguard your online transactions? Share your thoughts and experiences in the comments below.Veelgestelde vragen

Can You Transfer Money From Klarna To Bank?

No, you cannot directly transfer money from Klarna to your bank account. Klarna is primarily a payment solution for purchases. It does not function as a traditional bank account or a money transfer service.

How Does Klarna Manage Payments?

Klarna manages payments by allowing you to buy now and pay later. You can choose from several payment plans, like paying immediately or in installments. Klarna handles transactions between the retailer and your payment method.

Is Klarna Safe For Online Transactions?

Yes, Klarna is safe for online transactions. It uses advanced encryption and security measures to protect your data. Your payment details are securely stored, ensuring a safe shopping experience.

What Are Klarna’s Payment Options?

Klarna offers multiple payment options, including Pay Now, Pay Later, and Slice It. Pay Now allows immediate payment, Pay Later lets you pay within 30 days, and Slice It splits payments into monthly installments.

Conclusie

Transferring money from Klarna to your bank account isn’t possible directly. Klarna focuses on payments for purchases, not direct fund transfers. To use Klarna, shop online and pay through their platform. Klarna offers flexible payment options. Use it wisely for easy shopping.

Always check Klarna’s terms before transactions. This ensures a smooth experience. Remember, Klarna helps with purchases, not bank transfers. Keep exploring online payment methods for options. Knowledge is power. Always stay informed for better decisions. Enjoy your shopping experience with Klarna, and keep your finances organized.