Kan ik geld overmaken van American Express naar een bankrekening: eenvoudige handleiding

Have you ever found yourself wondering if you can transfer money from your American Express card to your bank account? You’re not alone.

Many people face this question and feel uncertain about the process. Knowing how to manage your finances efficiently is crucial, and understanding this transfer can be a game-changer. Imagine the convenience of seamlessly moving funds from your card to your bank account without any hassle.

This guide will unravel the mystery behind this process, helping you make informed financial decisions. Stick around to discover how you can take control of your money transfers with ease and confidence.

Understanding American Express Transfers

Understanding American Express transfers can simplify financial transactions. Many wonder about the process of moving money from an American Express account to a bank account. It’s essential to know how these transfers work.

How American Express Transfers Work

American Express transfers involve sending money to linked bank accounts. This requires a verified bank account on your American Express profile. Transfers usually happen online through your account dashboard.

Not all American Express accounts support transfers. Check your account settings for transfer options. Ensure your bank account details are accurate and verified.

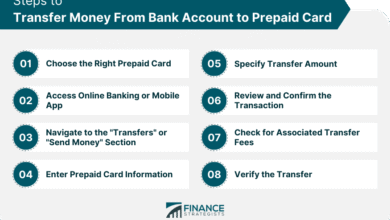

Log into your American Express account. Navigate to the transfer section. Select the linked bank account for the transfer. Enter the amount you wish to transfer. Confirm the transaction details before submission.

Transfer Time And Fees

Transfer times vary based on your bank’s processing speed. Usually, it takes a few business days. Some transfers may incur fees, depending on your account type. Always check for any applicable fees before transferring.

Eligibility For Transfers

Understanding the eligibility for transferring money from American Express to a bank account is crucial. Not everyone can initiate such transfers. Specific requirements must be met.

Eligibility Criteria

American Express cardholders must check their account type. Not all card types allow direct transfers to bank accounts. Some cards have restrictions.

Accountverificatie

Bank accounts must be verified before transfers. Verification ensures security and prevents fraud. American Express usually requires additional identification.

Overdrachtslimieten

Limits on transfer amounts exist. These limits depend on the cardholder’s account status. Checking these limits is important to avoid transaction failures.

Geographic Restrictions

Transfers may be restricted by location. Some regions have limitations due to regulatory requirements. It’s essential to understand these geographic restrictions.

Transactiekosten

Fees can apply to transfers. These fees vary based on the transfer method. Knowing the fees beforehand helps in planning the transfer.

Uw bankrekening instellen

Transferring money from American Express to a bank account is possible through their Express Cash feature. This service allows cardholders to access funds conveniently. Always check terms and conditions with your bank and American Express for seamless transactions.

Uw bankrekening koppelen

To begin, you’ll need to link your bank account to your American Express account. This is the bridge that allows your funds to travel between the two. Start by logging into your American Express account and navigate to the account settings. Look for the option that says “Add a bank account” or something similar. Once you find it, have your bank account number and routing number handy. These are essential for creating a secure connection. Enter these details carefully to avoid any errors. Think of it like setting up a new contact on your phone—precision is key.Verifying Account Details

After linking, the next step is verifying your bank account details. This is a safeguard to ensure that the account you’ve linked is indeed yours. You might notice a small transaction appear in your bank account. It’s not a mistake—it’s a test deposit from American Express. To complete the verification, log back into your American Express account and confirm the amount of the test deposit. This step is crucial because it confirms that your account is ready for transfers. Miss this, and you could find yourself wondering why your funds aren’t moving. Have you ever sent a text to the wrong person because you didn’t double-check the number? This is similar. Verifying ensures your funds land where they’re supposed to. Once your account is verified, transferring money becomes a breeze. You’ll have the peace of mind knowing your hard-earned cash is just a few clicks away from your bank account. So, are you ready to set up your account and make your money transfers smoother?Steps To Transfer Money

Transferring money from your American Express account to a bank account is simple. Follow these steps to ensure a smooth process. This guide will help you with each step involved in the transfer. From accessing your account to confirming the transaction, you will learn everything you need.

Accessing Your American Express Account

Begin by logging into your American Express account online. Use your username and password to access your account dashboard. Make sure your internet connection is secure. Look for the option labeled ‘Transfers’ or ‘Send Money’. This is usually found in the main menu.

Het initiëren van de overdracht

Once you find the transfer option, click on it. You will be prompted to enter the amount you wish to transfer. Choose the bank account you want to transfer to. Ensure you have the correct bank details. Double-check the bank account number and routing number.

Confirming The Transaction

Review all details before confirming. Make sure the amount and bank details are correct. Click ‘Submit’ to finalize the transfer. You will receive a confirmation message. This message will confirm that your transaction is being processed.

Kosten en vergoedingen

Transferring money from your American Express card to a bank account involves fees. Understanding these costs can help you make informed decisions. Knowing the fees ensures you avoid unexpected charges. Let’s break down the details.

Inzicht in transferkosten

American Express charges a fee for each transfer. This fee depends on the amount transferred. It’s important to check this fee beforehand. You might find it on your account statement or online portal. The fee is often a percentage of the transfer amount. Some users find it a bit high. Always verify the exact fee before transferring.

Comparing Costs With Other Methods

Many methods exist for transferring money. Comparing fees with other options can save you money. Bank transfers often have different fees. PayPal and wire transfers are alternatives. Each has its own cost structure. Some might charge a flat fee. Others might take a percentage like American Express. Evaluate each option’s cost before choosing. This ensures you pick the most cost-effective method.

Overdrachtstijdlijnen

Transferring money from American Express to a bank account is straightforward. The process typically takes one to three business days. Ensure correct bank details to avoid delays and check for any fees.

Transferring money from your American Express account to a bank account is a straightforward process, but understanding the timeframes involved can help you manage your finances better. Whether you’re planning a big purchase or simply need to transfer funds for monthly expenses, knowing how long it will take for the money to reach your bank account is crucial. Let’s explore the different transfer timeframes and how they might affect your financial planning. ###Standaard verwerkingstijden

Typically, transferring money from your American Express account to a bank account takes about 1 to 3 business days. This is the standard processing time and applies to most transactions. The transfer speed may vary slightly depending on the bank you are using. Some banks process these transactions faster, while others might take the full three days. It’s always a good idea to initiate your transfer early in the day to avoid any delays. If you’ve ever waited for a paycheck to clear, you know that even a single day’s delay can be frustrating. ###Expedited Transfer Options

Need to move your money faster? American Express offers expedited transfer options that can speed up the process significantly. These options might involve additional fees, but they can be worth it for urgent situations. Imagine you’re planning a weekend getaway and realize your bank account is running low. An expedited transfer ensures your funds are available before you hit the road. Check with American Express for any expedited services they offer and the associated costs. Is the convenience worth the extra fee? Only you can decide based on your current needs. Understanding these transfer timeframes empowers you to make informed decisions. Whether you stick with the standard processing times or opt for expedited options, knowing the details allows you to plan effectively. What’s your preferred method of transferring money, and why?Problemen met veelvoorkomende problemen oplossen

Transferring money from your American Express account to your bank might seem straightforward, but it can sometimes hit a few bumps along the road. Whether it’s a transaction that seems stuck or a missing amount, troubleshooting these common issues is crucial. Let’s dive into some of the frequent challenges you might face and how to tackle them effectively.

Unsuccessful Transfers

Ever found yourself staring at your transaction history, wondering why your transfer didn’t go through? You’re not alone. Unsuccessful transfers can be due to several reasons—incorrect account details, insufficient funds, or even technical glitches.

Double-checking your account numbers is a simple yet effective step. Sometimes, a small typo can halt the entire process. Ensure your bank details are accurate to avoid unnecessary delays.

If funds are tight, consider your balance before initiating a transfer. You wouldn’t want an overdraft situation to complicate things further. Is your bank account adequately funded?

Contact opnemen met de klantenservice

When all else fails, reaching out to customer support is your best bet. American Express offers various channels for assistance, including phone support, online chat, and social media.

Have you ever felt the frustration of waiting on hold? Try using live chat for quicker responses. It’s often faster than traditional phone calls and can resolve issues swiftly.

Sharing your experience can be helpful. If you’ve encountered a unique problem, detailing it might assist the support team in finding a solution faster. Who knows, your insight could help others facing similar issues.

Navigating these common transfer issues can be straightforward with the right approach. Remember, accuracy and timely communication are your allies in ensuring smooth transactions. Have you encountered any surprising challenges while transferring money? Share your insights and solutions in the comments below!

Benefits Of Using American Express For Transfers

American Express offers seamless money transfers to bank accounts. Users enjoy swift transactions with robust security features. The process is straightforward, ensuring funds are safely transferred without hassle.

Transferring money can sometimes feel like a daunting task, especially with so many options available. However, using American Express for your transfers can simplify the process and provide numerous benefits. Let’s explore why you might consider this option for your next transaction.1. Secure Transactions

American Express is known for its strong security measures. When you transfer money, you want peace of mind knowing your funds are protected. American Express offers fraud detection and purchase protection, ensuring your transactions are safe.2. Speed And Efficiency

Time is precious, and waiting days for a transfer to complete can be frustrating. With American Express, transfers are often processed quickly. This means you can access your funds without unnecessary delays, making it ideal for urgent transactions.3. Reward Programs

One of the standout features of using American Express is the potential to earn rewards. Imagine transferring money and earning points or cashback in return. This added benefit can make your financial management more rewarding.4. International Transfers

If you’re dealing with international transfers, American Express can be a valuable ally. They offer competitive exchange rates and reduced fees for cross-border transactions. This can save you money and provide a seamless experience when dealing with different currencies.5. User-friendly Experience

Ease of use is important, especially when managing your finances. American Express provides a user-friendly platform, making it straightforward to initiate and track transfers. You don’t have to be a tech wizard to navigate their system. Consider the convenience of having everything in one place, from monitoring your transactions to accessing customer support. American Express aims to streamline your experience. Wouldn’t you prefer a transfer method that combines security, speed, and rewards? American Express might just be the solution you’ve been looking for.Alternative Transfer Methods

Transferring money from American Express to a bank account might not be as straightforward as you think. While American Express doesn’t offer a direct transfer option, you can explore alternative methods to achieve this. Whether you’re looking to send funds quickly or prefer a more direct approach, understanding your options can make all the difference. Let’s dive into some practical methods that can help you move your money efficiently.

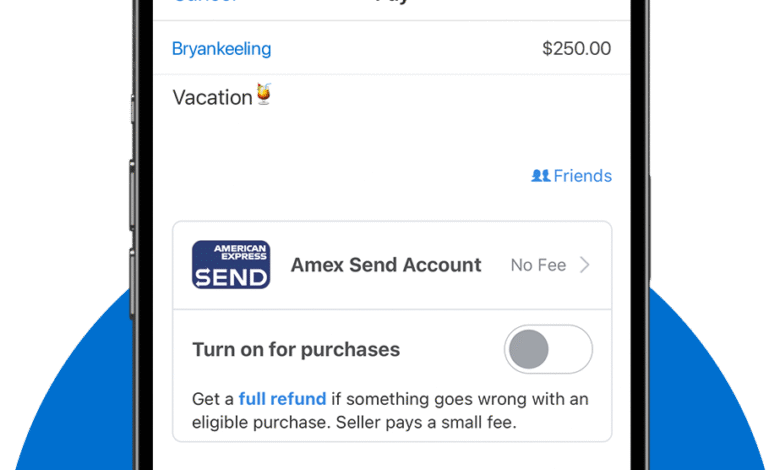

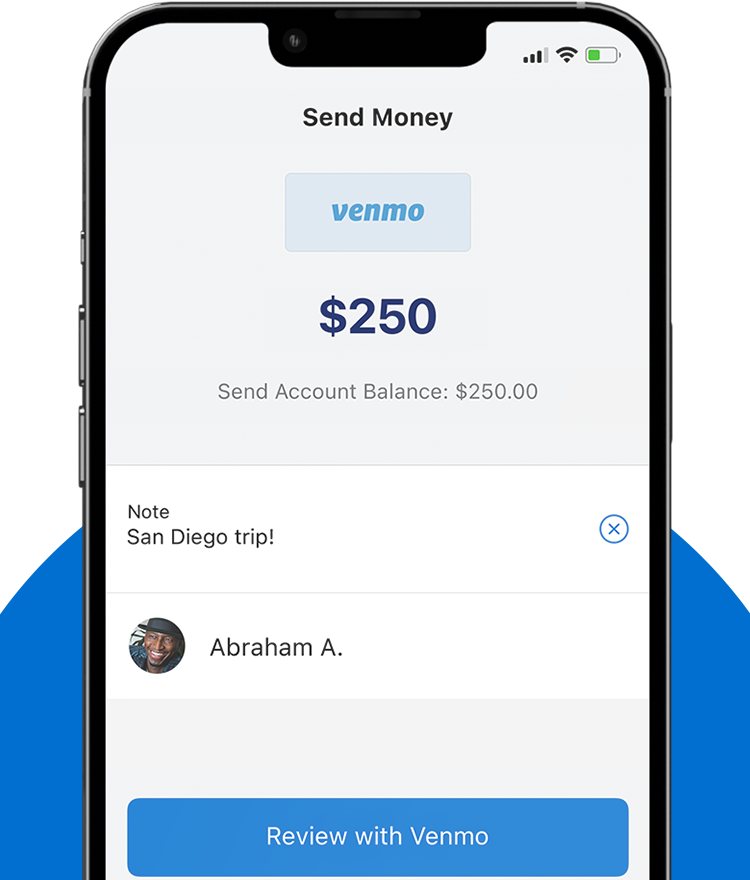

Gebruik van diensten van derden

Third-party services like PayPal, Venmo, and Cash App can be lifesavers. These platforms enable you to link your American Express card and transfer funds to your bank account. They offer user-friendly interfaces and fast processing times. Have you ever wondered why so many people use these apps? It’s because they simplify complex transactions.

Imagine you’re splitting a dinner bill with friends. You can easily pay with your American Express card using Venmo and then transfer the remaining balance to your bank account. It’s quick, convenient, and widely accepted. However, be mindful of transaction fees that might apply, as they vary depending on the service.

Direct Bank Transfers

While American Express doesn’t provide a direct bank transfer option, some banks offer ways to connect your credit card account for automated bill payments. This means you can indirectly move funds by paying your credit card bill from your bank account. It’s a strategic approach that may require setting up recurring payments.

Think of it like this: instead of transferring funds, you pay your card balance directly from your bank account. This approach can help you manage your finances better and ensure you never miss a payment. Would this method suit your financial habits? Consider how it aligns with your budgeting needs.

Alternative transfer methods offer flexibility and convenience, but choosing the right one depends on your specific needs. By understanding and using these options, you can make informed decisions and manage your finances more effectively.

Veelgestelde vragen

Can I Transfer Money From Amex To My Bank Account?

Yes, you can transfer money from your American Express account to your bank. Use the AmEx mobile app or website. Log in, select ‘Transfer Funds,’ and enter bank details. Confirm the transaction to initiate the transfer. Ensure you have sufficient funds in your AmEx account.

What Are The Fees For Amex Transfers?

American Express may charge fees for transferring money to your bank account. Fees vary based on the transaction amount and type. Review the fee structure on the AmEx website or contact customer service. Always check for any applicable fees before initiating a transfer.

How Long Does Amex Transfer Take?

Transfers from American Express to a bank account typically take 1 to 3 business days. Processing time depends on the bank and transaction type. Some transfers may occur instantly. Always check with your bank for specific processing times and any potential delays.

Is There A Limit On Amex Transfers?

Yes, American Express may impose limits on transfer amounts. Limits depend on account type and transaction history. Check your account terms or contact AmEx support for specific limits. Regularly review limits to ensure smooth and hassle-free transfers.

Conclusie

Transferring money from American Express to a bank account is possible. Follow the right steps to ensure a smooth transaction. Check if your card offers this feature. Not all cards do. Explore different methods available to you. Online platforms or third-party services can assist.

Keep an eye on fees involved. They vary between services. Prioritize security in every transaction. Protect your financial information. Always verify details before sending money. This ensures your funds reach the right place. Understanding these steps makes the process easier.

Stay informed. Make sure your transfers are safe and efficient.