Authorize.Net Geld overmaken naar een bankrekening: de ultieme handleiding

Are you looking for a seamless way to transfer money to your bank account using Authorize.Net? You’ve come to the right place.

Navigating the world of online transactions can be daunting, but with Authorize. Net, you have a trusted partner by your side. Imagine the peace of mind you’ll feel knowing your funds are moving securely and efficiently to your bank account.

Whether you’re a business owner managing daily transactions or an individual sending money across accounts, understanding this process can empower you to take control of your finances. Dive into this guide to discover how Authorize. Net makes transferring money to your bank account as easy as a few clicks. Your financial freedom is just a step away—let’s get started.

Setting Up Your Authorize.net Account

Easily manage your finances by setting up your Authorize. Net account to transfer money to your bank. Securely link your bank account for hassle-free transactions. Ensure smooth operation by following simple steps for seamless money transfers.

Setting up your Authorize.Net account is the first step to transferring money seamlessly to your bank account. Whether you’re a small business owner or managing a larger operation, Authorize.Net provides a reliable platform for processing payments. Setting up your account correctly ensures you can manage transactions smoothly and efficiently. Let’s walk through the essential steps to get you started.Account Creation Process

Creating an Authorize.Net account is straightforward. Begin by visiting the Authorize.Net website and clicking on the sign-up button. Enter your basic information like your business name, email address, and contact details. Next, choose the plan that suits your business needs. Authorize.Net offers various options, so consider factors like transaction volume and business type. Once selected, you’ll be prompted to set up a username and password. Make sure they are strong and secure to protect your account. Finally, review the terms and conditions and submit your application. You’ll receive a confirmation email once your account is ready. Have you ever wondered how a simple setup can pave the way for efficient financial management?Verification Steps

After creating your account, the verification process is crucial. Start by linking your bank account to Authorize.Net. This involves entering your bank account details in the provided fields. To verify your bank account, Authorize.Net will make two small deposits. Check your bank statement and confirm these amounts in your Authorize.Net account to complete the verification. This step ensures that your account is secure and ready for transactions. Once verified, you can begin configuring additional settings like payment methods and security preferences. Need to ensure that your transactions are safe? Authorize.Net’s verification steps help you build a secure payment environment. Setting up your Authorize.Net account doesn’t have to be daunting. With these simple steps, you’re on your way to efficient money transfers and better financial management. What’s stopping you from taking control of your financial transactions today?

Bankrekening koppelen

Linking your bank account to Authorize.Net is essential for seamless transactions. This connection allows smooth transfers from your Authorize.Net account to your bank. It ensures quick access to your funds, enhancing your financial operations. Below, learn how to easily link your bank account.

Bank Account Requirements

First, check if your bank account meets the necessary criteria. It must be active and able to receive ACH transactions. Ensure your account has no restrictions. Verify that you have the correct routing and account numbers. These are crucial for establishing the link.

Step-by-step Linking Guide

Start by logging into your Authorize.Net account. Navigate to the settings or account section. Look for the option to add a bank account. Enter your bank’s routing number carefully. Then, input your account number. Double-check all entered information for accuracy.

Next, Authorize.Net may initiate a verification process. This usually involves small test deposits to your bank account. Monitor your bank account for these deposits. Once you see them, return to Authorize.Net. Enter the deposit amounts to confirm your account.

After successful verification, your bank account is linked. You can now transfer money securely. This process is simple and ensures your financial transactions are smooth.

Initiating Money Transfer

Authorize. Net simplifies transferring money to a bank account securely. Users can easily initiate transactions with straightforward steps. The process ensures funds move quickly and safely, offering peace of mind.

Transferring money from Authorize.Net to your bank account can be a seamless experience, but it helps to know the ins and outs of the process. Whether you’re a small business owner or managing a larger operation, understanding how to initiate a money transfer effectively is crucial. Here’s a breakdown of how you can do this effortlessly. ###Transfer Options

When you’re ready to move funds, Authorize.Net provides you with a variety of transfer options. You can opt for standard bank transfers, which are typically free but may take a few days to process. If you’re in a hurry, there’s also an express transfer option that moves your money faster, though it might come with a fee. Consider your cash flow needs. Do you need the money in your account ASAP, or can you wait a few days? Balancing speed and cost is key. ###Scheduling Transfers

Did you know you can schedule your transfers? This feature allows you to set up terugkerende overboekingen on a weekly or monthly basis. It’s perfect for those who want to automate their financial tasks and focus on other aspects of their business. Think of it as setting your financial routine. Knowing your transfers are automatically taken care of means one less thing to worry about. Plus, you can always adjust the schedule if your needs change. Initiating money transfers doesn’t have to be complex. With Authorize.Net, you have the flexibility to choose how and when your funds are moved, making it easier to manage your finances effectively. How do you plan to optimize your transfer strategy?

Inzicht in transferkosten

Authorize.Net is a popular payment gateway for businesses. It allows seamless transactions. Understanding transfer fees is crucial. These fees impact your bottom line. It’s important to know how these fees work. You can then manage costs effectively.

Overzicht van de vergoedingenstructuur

Authorize.Net has a straightforward fee structure. Each transaction has a fee. This fee is usually a percentage. Sometimes, there is a small fixed amount. Fees can vary based on transaction type. International transfers may incur higher fees. Reviewing the fee schedule regularly is wise. This keeps you informed of any changes.

Ways To Minimize Costs

Minimizing fees is possible. One way is to consolidate transactions. Fewer transactions mean fewer fees. You can also negotiate with your bank. A strong business relationship helps. Keep an eye on currency exchange rates. Optimal timing can reduce costs. Using automated tools can also help. These tools streamline the process. They prevent unnecessary charges.

Monitoring van overdrachtsstatus

Easily monitor your transfer status with Authorize. Net as it securely transfers money to your bank account. Track progress in real-time to ensure smooth transactions and peace of mind.

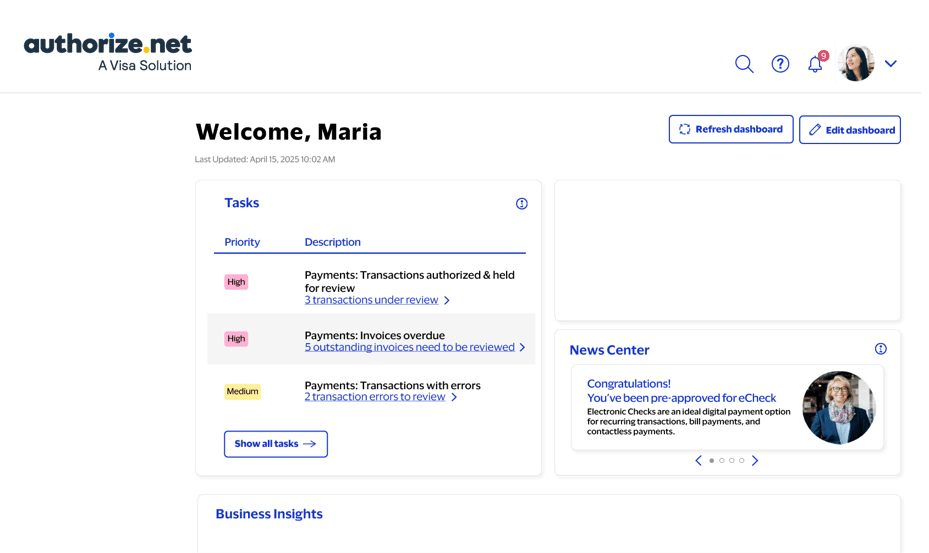

Monitoring the status of your transfers with Authorize.Net ensures peace of mind. You can easily track money moving to your bank account. This process helps you stay informed and manage your finances better.Uw overdracht volgen

Authorize.Net provides tools to track your transfer status. Log in to your account to view the transfer history. Check the dashboard for updates on your recent transfers. The system displays details like amount, date, and status. This transparency helps you stay updated with your transactions.Handling Delays

Delays may occur due to various reasons. Bank holidays can impact transfer times. Network issues might also cause delays. If a delay happens, check your account for notifications. Authorize.Net usually informs you about any disruptions. Contact customer support if delays persist. They can provide more information and assistance.Veiligheidsmaatregelen

Authorize. Net ensures secure transfers to bank accounts with advanced encryption and fraud prevention tools. Sensitive information remains protected, reducing risks during transactions. These security measures provide peace of mind for users.

Protecting Your Account

Your account security begins with strong passwords. Choose a password that combines numbers, letters, and symbols, making it difficult for hackers to guess. Change your password regularly to stay one step ahead of potential threats. Enable two-factor authentication. This adds an extra layer of security by requiring a second form of verification. Even if someone gets hold of your password, they won’t access your account without this additional code. Finally, monitor your account activity frequently. Set up alerts for any transactions, so you’re immediately notified of any unauthorized access. This proactive approach can help you catch and address issues early.Frauduleuze activiteiten herkennen

Stay vigilant by keeping an eye out for phishing scams. These often appear as emails or messages pretending to be from Authorize.Net. They may ask for your login details or personal information. Remember, Authorize.Net will never ask for sensitive information via email. If you notice any unfamiliar transactions, act immediately. Contact Authorize.Net and your bank to report the activity. Quick action can prevent further unauthorized withdrawals and protect your funds. Educate yourself on common fraud tactics. Understanding how scammers operate can help you recognize red flags and protect your account. Have you ever received a suspicious email or message? It might be time to review your security settings and ensure everything is up to date. By taking these security measures seriously, you can confidently transfer money to your bank account with Authorize.Net, knowing that your financial information is well-guarded.Problemen met veelvoorkomende problemen oplossen

When transferring money to a bank account through Authorize.Net, you might encounter some hiccups along the way. These issues can be frustrating, especially when you expect a smooth transaction. Troubleshooting common issues is essential to ensure your funds are transferred efficiently and without unnecessary delays. Let’s dive into some of the most frequent problems and how you can tackle them.

Failed Transfers

Experiencing a failed transfer can be quite unsettling. Imagine checking your bank balance only to find no trace of the expected funds. Often, failed transfers occur due to incorrect banking information. Double-check your account and routing numbers to confirm they’re accurate.

Another common issue is insufficient funds. Before initiating a transfer, ensure your account has enough balance to cover the transaction. If the problem persists, consider contacting customer support for help. They can provide insights specific to your situation.

Have you ever faced a technical glitch? These can disrupt the transfer process. Regularly update your browser or app to avoid compatibility issues, and clear cache and cookies to ensure smooth functionality.

Geschillenbeslechting

What if you find discrepancies in your transfer records? Dispute resolution is your next step. Start by gathering all relevant transaction details. This includes the date, amount, and any reference numbers you might have.

Reach out to Authorize.Net’s support team with this information. It’s crucial to be clear and concise, as this will help expedite the resolution process. Sometimes, disputes arise from misunderstandings rather than errors. A quick clarification can save you time and stress.

If you find the resolution process dragging, ask yourself: Is there something more you can do? Engage actively with support and follow up regularly. This proactive approach often leads to quicker outcomes.

Transferring money should be simple, yet hiccups are sometimes unavoidable. Addressing these common issues can make your experience smoother. Have you encountered any of these problems? Share your insights or ask questions to improve your transfer process!

Veelgestelde vragen

How Do I Transfer Money With Authorize.net?

To transfer money with Authorize. Net, log into your account, navigate to the Transfer section, and follow the prompts. You’ll need to enter your bank account details, specify the amount, and confirm the transaction. The process is straightforward and designed for user convenience.

Hoe lang duurt een bankoverschrijving?

Bank transfers with Authorize. Net typically take 1 to 3 business days. The exact duration depends on your bank’s processing times. Ensure your bank details are correct to avoid delays. Authorize. Net prioritizes efficiency, aiming to complete transactions as swiftly as possible.

Zijn er kosten verbonden aan het overmaken van geld?

Yes, Authorize. Net may charge fees for transferring money to your bank account. These fees vary based on transaction type and bank policies. It’s advisable to review the fee structure on Authorize. Net’s official website or contact customer support for detailed information.

Can I Transfer Internationally With Authorize.net?

Authorize. Net primarily supports domestic transfers within the United States. For international transfers, check if your account offers this feature or consider alternative services. Always verify the terms and conditions related to international transactions with Authorize. Net.

Conclusie

Transferring money to your bank account with Authorize. Net is simple. The process is secure and user-friendly. Businesses benefit from seamless transactions. Funds are transferred efficiently, ensuring peace of mind. This service supports business growth. Reliable and straightforward. No complicated steps involved.

Just a few clicks. Ideal for businesses of all sizes. Authorize. Net provides a practical solution for financial needs. It helps maintain cash flow effectively. An essential tool for modern businesses. Easy to implement and manage. Make informed choices for your business.

Consider using Authorize. Net for your transactions today. Enjoy smoother financial operations.