A Check Drawn by a Company for 340 in Payment: Simplified

Imagine receiving a check from a company, but instead of the expected amount, it’s for an intriguing $340. Whether you’re a seasoned entrepreneur, a curious consumer, or someone who just stumbled upon this unusual payment, you probably have questions.

Why $340? What does this amount signify? Understanding the nuances behind such transactions can unlock valuable insights into company operations, financial strategies, and even your own financial planning. This isn’t just another dry explanation; it’s an opportunity to demystify corporate finances and discover how they might affect you.

Dive in, and let’s unravel the story behind that check together. You’ll find that understanding these details could be more beneficial—and interesting—than you might think.

Understanding Company Checks

Company checks are important for paying bills. They help in managing business expenses. Companies use checks to pay for supplies. Checks are also used for paying employees. Payments to vendors are common with checks. This method is safe and easy. It keeps track of payments. Businesses rely on checks for routine transactions.

Every check has essential parts. De date shows when the check is written. The payee is who gets the money. The hoeveelheid is written in numbers and words. The signature of the authorized person is crucial. The check number helps track the check. The accountgegevens link to the company’s bank. These parts make checks trustworthy.

Payment Process With Company Checks

A company check is a way to pay money. It shows the amount to pay. Here, it is $340. The company writes the check to a person or another company. The name of the receiver is on the check. The company has a special account for checks. The money comes from this account. Checks make payments safe and clear.

Signatories are people who sign the check. Their role is very important. They must check the amount is correct. They ensure the money is in the account. Their signature makes the check valid. Without a signature, the check is just paper. The signatories hold responsibility. They make sure the payment is right. The company trusts them to do this job well.

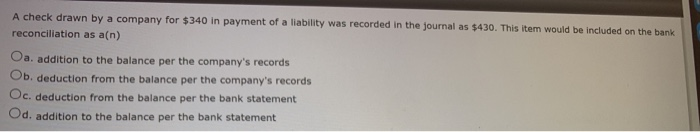

Decoding The $340 Payment

De company issued a check for $340. This amount was for goods of diensten received. Payments like this keep business operations smooth. They also fulfill contract agreements. Sometimes, it covers supplies of employee expenses. A clear reason ensures vertrouwen between parties. This shows the company is responsible. It also maintains a good relationship with vendors.

Such payments affect the company’s budget. Paying $340 means a reduction in cash reserves. It is essential to track these payments carefully. Monitoring helps avoid overspending. It ensures the company remains financially healthy. This payment may impact the profit margins slightly. Still, it is a part of regular business transacties. Keeping a record is crucial for financiële planning.

Managing Check Payments

Keeping records of check payments is very important. Use a simple system to track each check. Write down the date and amount. Note the name of the person or company paid. Save all checks in a safe place. This helps if you need to check something later. Having clear records makes managing money easier. It also helps with taxes.

Mistakes can happen when writing checks. Check the amount twice before sending. Make sure numbers and words match. Do not leave blank spaces. Someone might change the amount. Always sign the check. Without a signature, the bank will not accept it. Be careful with these steps to avoid problems.

Alternatives To Check Payments

Digital payments are quick and easy. Many people use them today. Let’s look at some popular methods.

| Methode | Voordelen | Nadelen |

|---|---|---|

| Creditcards | Fast and accepted widely | May have fees |

| PayPal | Secure and easy to use | Not accepted everywhere |

| Bankoverschrijvingen | Direct and reliable | Can take time |

| Mobiele betalingen | Convenient and quick | Needs a smartphone |

Each method has its voordelen En drawbacks. Choose the best one for you. Digital payments make life easier. Always check for hidden fees. Stay safe and enjoy the ease of digital methods.

Security Measures For Company Checks

Ensuring security for company checks is crucial to prevent fraud. A check drawn for $340 requires verification. Confirm details like signature and recipient to safeguard transactions.

Preventing Fraud

Companies must stay alert to stop fraud. Cheques need special care. Use watermarks En security threads on checks. These make copying hard. Signature verification is important. Always check the person signing. Use secure storage for checks. Lock them in a safe place. Train staff to spot fake checks. Tell them what to watch for. Create a system to report fraud quickly. Everyone should know how to use it.

Ensuring Secure Transactions

Make sure checks get to the right place. Use trusted couriers for delivery. Track checks until they arrive. Encryptie keeps check data safe online. Use strong software for this. Regular audits are helpful. Check all transactions often. Spot mistakes early. Limit access to check systems. Only trusted staff should use them. Change passwords often. Keep them strong. Clear policies are key. Write rules everyone follows.

Veelgestelde vragen

What Is A Company Check Payment?

A company check payment is a financial transaction where a business issues a check. It is used to pay for goods or services. The check represents a promise from the company to pay the specified amount. This method ensures a paper trail for accounting purposes.

Why Would A Company Issue A $340 Check?

A company might issue a $340 check for various reasons. It could be for vendor payments, service fees, or employee reimbursements. The amount indicates a specific expense that needs settling. Such transactions are common in business operations to maintain good financial relationships.

How Does A Check Improve Payment Tracking?

Checks improve payment tracking by providing a documented transaction. Each check has a unique number, date, and payee information. This helps in accurate record-keeping and auditing. Businesses can easily verify payments against their bank statements, ensuring transparency and accuracy in financial dealings.

Are Company Checks Secure?

Company checks are generally secure if properly managed. They require signatures and often additional verification. However, they can be susceptible to fraud if not handled carefully. Businesses should implement security measures like watermarks or encryption to protect against unauthorized use.

Conclusie

A company’s $340 check shows the basics of business payments. Understanding the process helps in better financial management. Knowing how checks work ensures smoother transactions. It also builds trust between businesses. Proper handling of checks avoids errors and disputes. This simple tool remains vital in business dealings.

Stay informed about check writing and payment methods. Keep your transactions clear and efficient. This knowledge benefits both small and large businesses. Always ensure accuracy in financial records. It safeguards your business interests and reputation.