大学生がクレジットカードを持つべき理由

It's almost impossible to navigate college life without a クレジットカード—you'd be lost in a sea of expenses and missed opportunities. While many might argue that credit can lead to debt, having a credit card can actually be a powerful tool for 金融教育 and stability. Think about it: managing your own budget, 信用履歴の構築, and even earning rewards on everyday purchases can set you up for future success. What if you could turn these potential pitfalls into stepping stones towards 経済的自立?

信用履歴の構築

構築する 堅実な信用履歴 during college can greatly impact your 経済的な将来 and open doors to better loan terms and lower interest rates. By obtaining a credit card and using it responsibly, you're establishing a track record that lenders will review in the future. タイムリーな支払い and maintaining low credit utilization ratios signal your reliability. It's essential to monitor your 信用報告書 regularly to catch any discrepancies early. Additionally, consider starting with a secured credit card if you're concerned about overspending. This approach allows you to build credit while minimizing financial risk. Ultimately, a 良好な信用履歴 not only aids in securing loans but also can influence rental applications, insurance premiums, and even job opportunities.

Financial Flexibility and Security

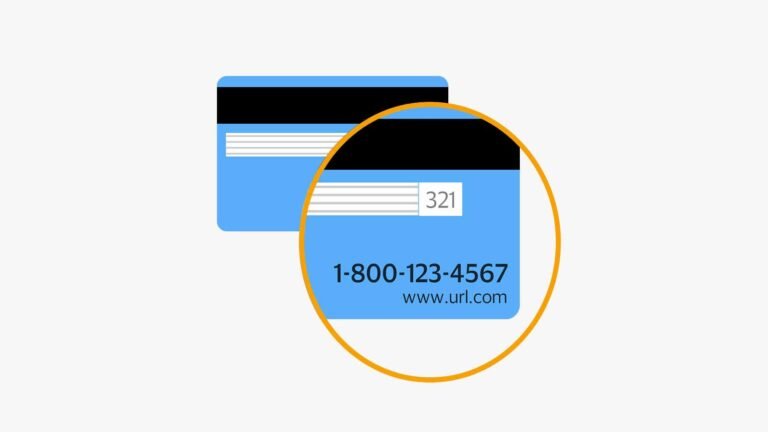

Having a credit card can greatly enhance your 財務の柔軟性 and security during college by providing quick access to funds for emergencies or unforeseen expenses. For instance, if an unexpected medical bill arises, having a credit card can prevent you from scrambling for cash or relying on less favorable loans. Furthermore, credit cards often come with 不正行為防止機能内蔵, which adds an extra layer of security to your finances. This means that if your card is lost or stolen, you're likely protected from 不正な請求. Additionally, managing a credit card responsibly can help you build a safety net for future financial needs, ensuring that you're prepared for life's uncertainties while pursuing your education.

Rewards and Cashback Benefits

Credit cards designed for college students often come with enticing rewards and cashback benefits that can enhance your purchasing power while you manage your academic expenses. Taking advantage of these features can make your spending more efficient and beneficial. Here are some common rewards you might encounter:

- Cashback on Purchases: Earn a percentage back on every dollar spent, which can add up over time.

- Bonus Rewards Categories: Some cards offer increased cashback for specific categories like dining, groceries, or gas, aligning with your typical spending habits.

- Sign-Up Bonuses: Many cards provide a substantial bonus if you meet a minimum spending requirement within the first few months.

Emergency Fund Access

Accessing an emergency fund through a credit card can provide college students with a financial safety net during unexpected situations, such as medical emergencies or urgent travel needs. Having a credit card allows you to cover these costs immediately, rather than scrambling for funds. Below is a comparison of potential emergency expenses and how a credit card could help:

| Emergency Type | Estimated Cost | Credit Card Advantage |

|---|---|---|

| Medical Emergency | $1,000 | Immediate access to funds |

| Urgent Travel Needs | $600 | 柔軟な返済オプション |

| Car Repair | $500 | Avoiding late fees |

| Housing Issue | $800 | Building credit history |

金銭的責任を学ぶ

Maneuvering the world of credit cards can teach college students essential financial responsibility skills that are crucial for their future. By managing a credit card, you'll learn key principles that will serve you well beyond college. Here are three critical lessons:

- 予算編成: You'll need to track your spending to avoid debt, which helps develop a budget that aligns with your financial goals.

- Credit Score Awareness: Understanding how your actions affect your credit score can motivate you to make responsible financial choices.

- Payment Timeliness: Regularly making payments on time not only builds your credit but also instills a sense of discipline.

These skills enhance your financial literacy, ensuring that you're better equipped for financial independence in the long run.

Preparing for Future Expenses

Planning ahead for future expenses is essential for college students, as it helps establish a 財政的なクッション that can alleviate stress during unexpected situations. By utilizing a クレジットカード responsibly, you can build a safety net for emergencies, such as medical bills or unexpected travel costs. Having a credit card allows you to manage cash flow more effectively, enabling you to cover immediate expenses while planning for future repayments. Additionally, timely repayments can enhance your credit score, which is important for larger financial decisions later, like renting an apartment or buying a car. Ultimately, preparing for future expenses with a credit card not only offers convenience but also promotes 経済的安定, ensuring you're better equipped to handle life's uncertainties.