Visaトラベルマネーカードはどこで買えますか?最適な選択肢

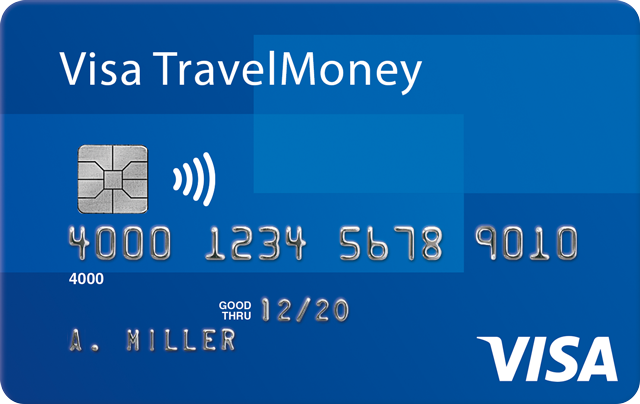

Are you planning your next adventure and wondering how to manage your money abroad? A Visa Travel Money Card could be your perfect solution.

This card offers a safe and convenient way to carry your funds while traveling. But where can you purchase one? We’ll guide you through the best options available. You’ll discover the benefits of using a Visa Travel Money Card and find out how easy it is to get one.

Stay with us to ensure your travels are hassle-free and financially secure. Your adventure awaits!

Bank Issued Cards

Bank issued Visa Travel Money Cards are a popular choice for travelers. They are safe and easy to use. Many banks offer these cards. You can buy them directly from your bank. This section covers major banks, how to apply, and the benefits of these cards.

Major Banks Offering Travel Cards

Many well-known banks provide Visa Travel Money Cards. Here are some of them:

- バンク・オブ・アメリカ

- 追跡

- Citi

- ウェルズ・ファーゴ

- HSBC

These banks have branches and online services. You can easily find a card that fits your needs.

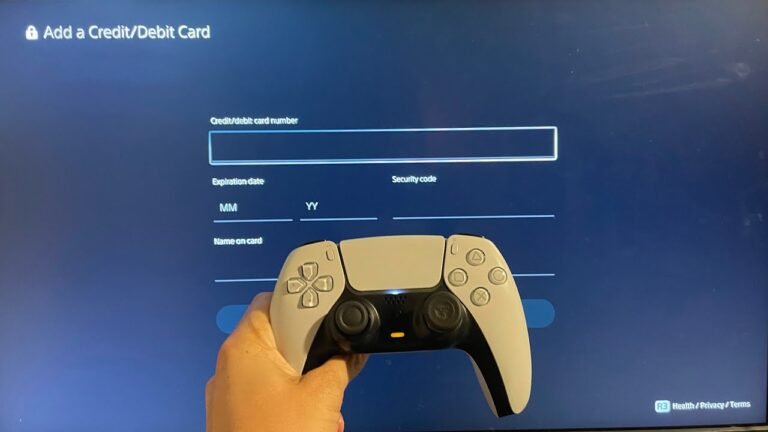

How To Apply Through Your Bank

Applying for a Visa Travel Money Card is simple. Visit your bank’s website or a local branch. Fill out the application form. Provide necessary identification, like a passport or driver’s license. Choose the amount to load on the card. After approval, you will receive your card.

Many banks allow you to manage the card online. You can check your balance and reload funds. This makes it convenient for travelers.

Benefits Of Bank-issued Cards

Bank-issued cards offer several advantages. First, they are secure. You can report a lost or stolen card easily. Funds are protected.

Second, these cards often have low fees. Some banks charge no monthly fees. This saves you money while traveling.

Lastly, they are widely accepted. You can use them at millions of locations around the world. This makes spending money abroad simple and hassle-free.

Credit: www.visa.com.tt

Retail Stores And Supermarkets

Buying a Visa Travel Money Card is easy. Many retail stores and supermarkets offer them. These places provide a simple way to get your travel money. You can purchase the card on the spot. No need to wait for shipping or delivery.

Popular Stores Selling Travel Cards

Many well-known stores sell Visa Travel Money Cards. Big retailers like Walmart, Target, and CVS are good options. They often have cards available at their customer service desks. Local grocery stores may also carry them. Check your nearby supermarket for availability.

Convenience Of Purchasing In-store

Buying in-store is very convenient. You can get the card right away. No online forms or waiting for approval. Just walk in, pay, and leave with your card. This option saves time and effort. It’s perfect for last-minute trips.

考慮すべき制限事項

There are some limitations to buying in-store. Not all stores have the cards in stock. Sometimes, they may charge a fee. Be sure to ask about any costs. Store hours can also limit your options. Plan your visit during open hours to avoid disappointment.

オンラインプラットフォーム

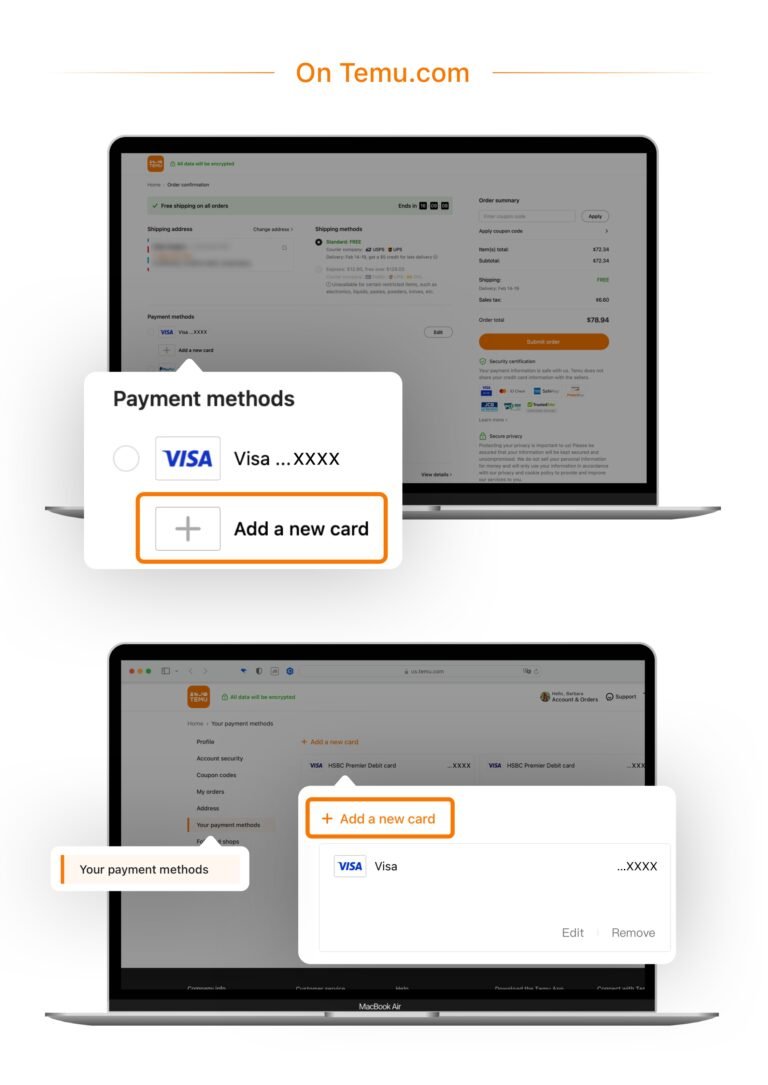

Buying a Visa Travel Money Card online is simple and convenient. Many websites offer this service. You can compare options and prices easily. This guide will help you find the best places to purchase.

Trusted Websites For Visa Travel Cards

Several trusted websites sell Visa Travel Money Cards. Popular banks and financial institutions offer these cards. Websites like Visa’s official site also provide options. Other reliable platforms include PayPal and major online retailers.

Steps For Online Purchase

Follow these steps to buy your card online. First, visit a trusted website. Look for the Visa Travel Money Card section. Choose the card that fits your needs. Fill out the required information. Provide your personal details and payment method. Review your order before confirming. Finally, complete the purchase and check your email for confirmation.

Security Tips For Online Transactions

Keep your information safe while shopping online. Use secure websites that start with “https.” Check for a padlock symbol in the address bar. Avoid public Wi-Fi when making purchases. Use strong passwords and change them regularly. Monitor your bank statements for unusual activity. Report any suspicious transactions immediately.

Credit: mmccu.com

Travel Agencies

Travel agencies offer many services. They help plan trips and make travel easier. Some agencies also sell Visa Travel Money Cards. This option is convenient for travelers.

Agencies Providing Prepaid Cards

Many travel agencies sell prepaid cards. These cards are easy to use. You can load money onto them before your trip. Popular agencies like AAA and Flight Centre provide this service. Check with your local agency for options.

Combining Cards With Travel Packages

Some agencies bundle cards with travel packages. This can save time and money. You can get a card along with flights and hotels. This makes planning your trip simpler. It is a one-stop shop for all your travel needs.

Why Choose Travel Agencies

Choosing travel agencies is beneficial. They provide expert advice. Agencies can help you find the best deals. They make sure your travel plans go smoothly. Their experience can enhance your travel experience.

Airport Kiosks And Services

Traveling can be hectic. Finding a Visa Travel Money Card at the airport can save time. Many airports offer kiosks and services for travelers. These services are convenient for anyone needing money quickly.

Availability Of Cards At Airports

Many major airports sell Visa Travel Money Cards. Look for kiosks or currency exchange counters. They usually have cards ready for purchase. This makes it easy to get funds before your trip begins.

Ideal For Last-minute Travelers

Last-minute travelers often face tight schedules. Buying a Visa Travel Money Card at the airport is quick. No need to wait for online orders. Just grab a card and load it with money.

Fees And Charges To Watch Out For

Airport kiosks may charge higher fees. Always check the rates before buying. Some airports have additional service fees. Knowing these costs helps you plan your budget better.

モバイルバンキングアプリ

Mobile banking apps provide a convenient way to manage your money. You can easily access your Visa travel money card using these apps. Many banks and financial services offer mobile options. This makes it simple to purchase and use your travel card.

With a few taps on your smartphone, you can load funds. Monitoring your balance is just as easy. Mobile banking apps make traveling more manageable and less stressful.

Digital Alternatives For Travel Cards

Digital alternatives for travel cards are gaining popularity. Many people prefer apps over traditional cards. These apps often provide better features. They allow you to send money and pay bills quickly.

Some popular options include PayPal and Venmo. These apps can store money and make transactions. They offer a simple way to transfer funds internationally.

Features Of App-based Visa Cards

App-based Visa cards have many useful features. You can set spending limits and receive alerts. These features help you stay within your budget.

Some cards offer rewards for spending. You might earn points for travel or shopping. Easy integration with your bank account adds convenience.

How To Load And Manage Funds

Loading funds onto your Visa travel card is straightforward. You can link your bank account or debit card. Simply transfer the amount you need.

Managing your funds is just as easy. Check your balance and transaction history anytime. Most apps provide notifications for every transaction.

This helps you keep track of your spending. Use the app to adjust your limits as needed. Mobile banking apps make travel finances simple and effective.

Prepaid Card Providers

Finding the right Visa Travel Money Card can be simple. Many companies offer prepaid cards. These cards are designed for travel and help manage your money abroad. They provide safety and convenience. Let’s explore some options.

Specialized Companies Offering Travel Cards

Several companies focus on travel prepaid cards. These include brands like Travelex, Wise, and Revolut. Each company has unique features. Travelex provides cards in multiple currencies. Wise offers low conversion fees. Revolut allows users to hold different currencies in one card.

Choosing a specialized provider can make travel easier. They understand travelers’ needs. They often offer better rates and support for international use.

How They Differ From Bank Options

Bank prepaid cards differ from specialized ones. Banks often charge higher fees. They may have limited currency options. Specialized providers focus on travel benefits. They offer lower exchange rates and fewer fees.

Many banks require a lengthy application process. Specialized companies offer quick online signup. This makes it easier to get a travel card fast.

Advantages Of Dedicated Providers

Using dedicated providers has clear benefits. They usually offer better rates than banks. This can save you money while traveling. Customer support is often more travel-focused. They help with issues like lost cards or blocked transactions.

Dedicated providers also provide useful tools. You can track spending in real-time. Some offer budgeting features, which help manage your money. This can make your travel experience more enjoyable.

Key Factors When Choosing A Card

Choosing the right Visa Travel Money Card involves considering fees, exchange rates, and where to buy. Many banks, travel agencies, and online platforms offer these cards. Look for options that suit your travel needs and provide good customer support.

Choosing the right Visa Travel Money Card can significantly enhance your travel experience. With various options available, it’s essential to consider several key factors that can impact your overall satisfaction. Understanding these factors will help you make an informed decision and ensure that your travels are smooth and worry-free.Fees And Exchange Rates

Fees can quickly add up, so take time to analyze them before committing. Look for cards that offer low or no fees for transactions, ATM withdrawals, and foreign currency exchange. Compare exchange rates too. A card with a favorable exchange rate can save you money while spending abroad. Some cards may charge a markup on the exchange rate, which can eat into your budget. Consider a card that provides transparent fee structures. This way, you won’t face any surprises when you check your account balance.Reload Options And Limits

It’s crucial to know how you can reload your card while traveling. Some cards allow reloading online, while others may require you to visit a physical location. Check the limits as well. Many cards have daily or monthly limits on how much you can load or withdraw. Knowing these limits can help you plan your spending effectively. You might prefer a card that allows multiple reload methods, like bank transfers or cash deposits. This flexibility can save you time and hassle during your trip.Customer Support And Card Security

Reliable customer support is vital when using a travel money card. Look for providers that offer 24/7 assistance. You never know when you might need help, especially in a foreign country. Card security is equally important. Check if the card offers features like chip technology, contactless payments, and fraud protection. These measures can give you peace of mind while spending. Consider reading reviews about the customer service experiences of other users. Their insights can guide you toward a card that not only meets your needs but also offers excellent support when you need it most. Choosing the right Visa Travel Money Card is about more than just convenience; it’s about ensuring your travel experience is enjoyable and stress-free. What features are most important to you when selecting a card?

Credit: www.omahafcu.org

よくある質問

Where Can I Buy A Visa Travel Money Card?

You can purchase a Visa Travel Money Card at various locations. These include banks, credit unions, and selected retail stores. Additionally, many online platforms offer the card for purchase. Check with your local financial institutions for availability and further details on fees and features.

Is A Visa Travel Money Card Safe?

Yes, a Visa Travel Money Card is safe to use. It provides a secure way to carry funds while traveling. The card is protected by a PIN, and you can report it lost or stolen. This ensures that your money is safeguarded while you enjoy your travels.

Can I Reload My Visa Travel Money Card?

Yes, you can reload your Visa Travel Money Card easily. You can add funds at participating retail locations or online through your card issuer’s website. Some cards also allow direct deposits or bank transfers. Make sure to check for any reload fees that may apply.

What Are The Fees For A Visa Travel Money Card?

Fees for a Visa Travel Money Card can vary. Common fees include purchase fees, reload fees, and ATM withdrawal fees. It’s essential to review the fee schedule before purchasing the card. Understanding these fees will help you manage your travel budget more effectively.

結論

Finding a Visa Travel Money Card is simple. Many banks and financial institutions offer them. You can also purchase online through trusted websites. Check local stores that sell travel products. Compare fees and features before buying. Always read the terms carefully.

Having a Visa Travel Money Card can make your travels easier. It provides a safe way to carry money. Enjoy your trips with peace of mind. Choose the option that works best for you. Happy travels!