ベンダー支払いとは:企業向け必須ガイド

Imagine this: You run a thriving business, and everything is going smoothly. Orders are coming in, products are flying off the shelves, and your team is buzzing with activity.

But there’s one crucial element that keeps everything in balance, and that’s vendor payment. You might be wondering, “What is vendor payment, and why is it so important? ” Well, you’ve come to the right place. Understanding vendor payment is key to maintaining healthy relationships with your suppliers and ensuring that your business continues to grow without a hitch.

It’s not just about transferring money; it’s about creating trust, managing cash flow, and keeping your operations running like a well-oiled machine. Stick with us as we unravel the intricacies of vendor payment and show you how mastering this simple concept can unlock new levels of success for your business.

Vendor Payment Basics

Vendor payment is the money given to vendors for goods or services. Companies pay vendors for things they buy from them. Paying vendors on time is very important. It helps keep good relationships. Vendors provide things that businesses need. Tracking these payments is crucial for financial health.

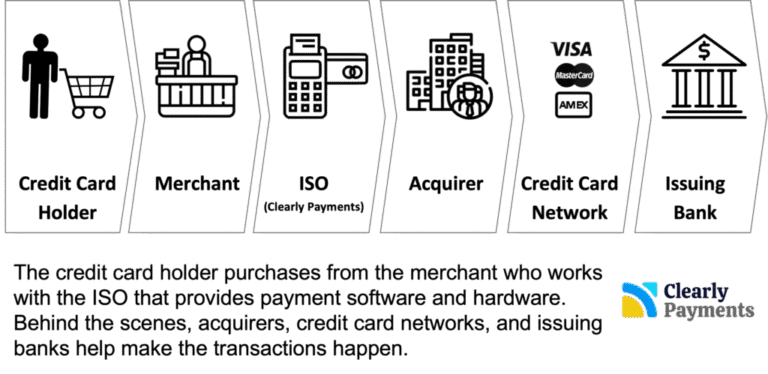

Payments can be made in different ways. Some use checks or bank transfers. Others might use credit cards or digital payments. Each method has its benefits. Choosing the right one can save time and money. Businesses must keep records of all payments. This helps when reviewing expenses.

Vendor payment terms differ. Some ask for payment in 30 days. Others might want it sooner. Understanding these terms avoids late fees. It also helps with cash flow. Knowing when and how to pay is key for smooth operations.

Types Of Vendor Payments

Electronic transfers are fast and safe. Money goes straight to the vendor’s bank. This method is popular and easy to track. Many people use it for quick payments.

Checks are paper forms of payment. You write the amount and sign it. Vendors must deposit checks in their bank. This method takes longer than electronic transfers.

Credit cards are plastic cards. They let you pay vendors quickly. Vendors get money from your card company. It’s easy, but watch for fees. Always check your card limit.

Cash is money in coins or bills. You give it directly to the vendor. Cash payments are simple but hard to track. Always count your cash before paying.

Setting Up Vendor Payment Systems

Start by picking the right payment methods. ペイパル, クレジットカード、 そして 銀行振込 are common choices. Each has pros そして cons. PayPal is fast but has fees. Credit cards are easy but need secure systems. Bank transfers are safe but slow. Vendors may prefer one over another. Choose wisely for smooth operations.

Install software to manage payments. QuickBooks そして FreshBooks are popular. They offer トラッキング, reports、 そして alerts. Integration with your website is crucial. Keep data safe with encryption. Software should be easy to use. Test it for errors. Fix issues quickly. Happy vendors mean smooth business.

Create accounts for each vendor. Use クリア そして 単純 details. Account numbers and contact info are essential. Keep data organized. Update regularly. Secure accounts with 強力なパスワード. Share account info safely. Vendors should access their accounts easily. Good accounts build trust.

Managing Vendor Relationships

Smart payment terms help both parties. Clear terms prevent confusion. Start with a friendly discussion. Understand their needs. Suggest terms that work for both. Keep it fair and simple. This builds long-lasting relationships.

Good communication solves many problems. Talk often with vendors. Share updates regularly. Ask for feedback. Listen to their concerns. Clear messages create trust. It keeps projects on track. Everyone stays happy and informed.

Trust is key in business. Pay on time always. Keep your promises. Respect their time and effort. Show appreciation for their work. Honesty and respect strengthen bonds. This leads to successful partnerships. Vendors feel valued and respected.

Streamlining Payment Processes

Automating payments makes work easy. It removes the need for manual tasks. This saves time and reduces mistakes. With automation, money goes out fast. No delays. Vendors get their pay on time.

Faster processes mean happy vendors. Quick payments build trust. No one likes waiting for their money. Short payment times are better for everyone. This helps business run smooth.

Errors happen less with automation. Computers do not make human mistakes. Wrong numbers or missing info are rare. This makes everyone feel safe. It is important to keep records clean.

Security In Vendor Payments

Keeping 財務情報 safe is very important. Vendors must secure data. Use strong passwords and encryption. Update systems regularly. Train staff on data safety. Keep software patched.

Fraud is a big risk in payments. Verify vendor identities. Use 安全な支払い方法. Monitor transactions closely. Report suspicious activity quickly. Educate staff on fraud signs.

フォローする legal rules for payments. Know the laws. Keep records of transactions. Use compliance tools. Regularly audit payment processes. Train staff on compliance policies.

Challenges In Vendor Payments

Disputes can slow down payments. Vendors may disagree on amounts または services. It’s crucial to have clear contracts. This helps resolve issues faster. Good communication is key. It prevents misunderstandings. Keep all records safe. This helps during disagreements.

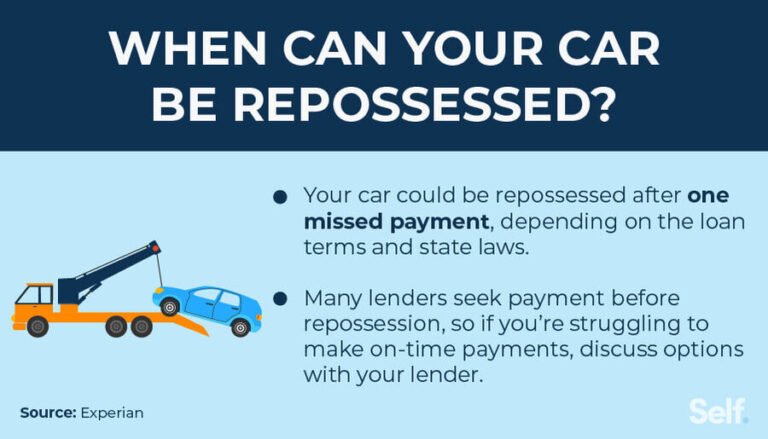

Late payments upset vendors. They might stop providing goods. It’s important to pay on time. Make sure to set reminders. This prevents delays. Discuss payment terms clearly. Avoid surprises. Follow up on payments regularly. Ensure vendors get paid.

Handling many vendors can be tricky. It’s essential to stay organized. Use a system to track payments. This avoids confusion. Pay attention to each vendor’s needs. Prioritize payments to maintain good relationships. Balance all tasks effectively. Keep things running smoothly.

Best Practices For Vendor Payments

指揮 regular audits helps keep track of money. It ensures everything is correct. Mistakes can happen. Audits catch them early. This saves time and money. Audits also build trust. Vendors feel safe with accurate payments.

Good record keeping is important. Always keep records clear and open. Everyone should know what is happening. This avoids confusion. It makes the process smooth. Vendors appreciate clear records. They like to see where their money goes.

Talking well with vendors is key. Keep communication simple and clear. Answer questions quickly. Solve problems fast. Good communication builds strong relationships. It makes future dealings easier. Vendors trust those who communicate well.

Future Trends In Vendor Payments

Blockchain offers a secure way to make payments. It helps prevent fraud and ensures transparency. Vendors can trust blockchain for faster transactions. Businesses save time and money with blockchain. It reduces middlemen and fees. A reliable choice for global payments.

Mobile payments are growing fast. People use phones to pay everywhere. Easy and quick. Vendors benefit from mobile apps. Customers love the convenience. Mobile payments boost sales. They attract more customers. A smart move for businesses today.

AI helps in vendor payments. It analyzes data quickly. AI predicts trends and improves efficiency. Vendors use AI for better service. It speeds up payment processes. Saves time for both parties. AI reduces errors and enhances accuracy. Smart technology for smart payments.

よくある質問

What Is Vendor Payment Process?

Vendor payment is the process of compensating suppliers for goods or services provided. It involves verifying invoices, ensuring accuracy, and authorizing payment. This process is crucial for maintaining good supplier relationships and ensuring business operations run smoothly. Effective vendor payment management can also help in optimizing cash flow and negotiating better terms.

Why Is Vendor Payment Important?

Vendor payment is vital for maintaining strong supplier relationships and ensuring timely delivery of goods or services. Prompt payments help build trust and reliability, which can lead to better terms and discounts. Efficient vendor payment processes also enhance cash flow management and prevent potential disruptions in the supply chain.

How Does Vendor Payment Affect Cash Flow?

Vendor payments directly impact a company’s cash flow by determining the timing of cash outflows. Proper management ensures that payments are made without depleting cash reserves excessively. Timely payments can also enable businesses to take advantage of early payment discounts, thus positively influencing cash flow.

What Are Common Vendor Payment Methods?

Common vendor payment methods include checks, electronic funds transfers (EFT), wire transfers, and credit cards. EFT and wire transfers are popular for their speed and security. Choosing the right method depends on factors like transaction volume, cost, and vendor preferences.

結論

Vendor payment plays a crucial role in business success. It ensures smooth operations. Timely payments build trust with vendors. This trust strengthens business relationships. Efficient payment processes save time and reduce errors. They also prevent payment delays, which can harm reputations.

Adopting clear vendor payment strategies is wise. It helps businesses manage cash flow better. Accurate records keep financial health transparent. Businesses gain more reliability with organized payments. Understanding vendor payment boosts financial management skills. It is essential for sustainable growth.

So, prioritize vendor payments for a stable business future.