60000ポンドの住宅ローンの月々の支払額とは?

Are you curious about how much a $60,000 mortgage will impact your monthly budget? You’re not alone.

Many people wonder what their financial commitment will look like with a loan of this size. Understanding your monthly payment is crucial for planning and peace of mind. It helps you manage your finances better and avoid any surprises down the road.

But don’t worry, the math isn’t as intimidating as it seems. We’ll break down the factors that determine your monthly payment, ensuring you feel confident and informed about your mortgage decision. Stick around to discover how you can make this financial journey smoother and more predictable.

Factors Affecting Monthly Payments

Shorter loan term means higher monthly payments. Longer term reduces monthly costs. Choose wisely based on your budget. Short terms save money on interest. Long terms lower monthly stress. Think about your future and current needs.

Interest rate changes affect monthly payments. Lower rates mean smaller payments. Higher rates increase your monthly costs. Fixed rates keep payments stable. Variable rates can change over time. Secure a good rate early.

Larger down payment reduces monthly costs. Smaller down payment increases monthly payments. Save more to pay less each month. A big down payment lowers your loan amount. Smaller loans mean smaller monthly payments. Plan your finances carefully.

Fixed Vs. Variable Rates

Fixed rates stay the same. Always. They offer stability. You know your payment every month. No surprises. Budgeting becomes easier. Protects from rising rates. Great for long-term planning. Peace of mind guaranteed.

Variable rates can change. Sometimes they are lower. Can save money initially. Good if rates fall. Offers flexibility. Allows for early payoff. Potential for savings in short term. Great for risk-takers.

Fixed rates suit planners. Good for long-term stability. Variable rates fit risk-takers. Both have benefits. Consider your situation. Think about future plans. Decide what feels right. Seek expert advice if unsure.

Amortization Process

The monthly payment on a $60,000 mortgage includes both principal and interest. At the start, most of the payment goes to interest. This is because the loan balance is high. As months pass, the principal amount increases. The interest part decreases.

Understanding this can help you see how your loan reduces. It’s like a seesaw. At first, interest is heavier. Over time, the principal becomes heavier. By the end of the loan, you pay mostly principal.

Amortization means spreading out loan payments over time. This helps in making payments easy. Each month, you pay a fixed amount. This makes it simple to budget. Your payment stays the same, but the interest decreases. This can save money in the long run. You pay less interest overall.

Using A Mortgage Calculator

A mortgage calculator helps determine monthly payments on a $60,000 mortgage. Enter loan amount, interest rate, and term length. Instantly see how different variables affect your payment.

Inputting Loan Details

Enter the loan amount of $60,000. Set the 金利 そして loan term. These details help calculate the monthly payment. Choose fixed or variable 金利. Enter any 頭金 or fees. Accurate details ensure correct calculations.

Understanding The Results

The calculator shows the monthly payment amount. It breaks down payments into principal そして 興味. See how interest impacts total payments. Smaller interest rates mean lower payments. Compare different loan terms easily. Shorter terms often have higher payments.

Estimating Additional Costs

Beyond monthly payments, consider 追加費用. Property taxes vary by location. Home insurance protects your investment. PMI might be needed for low down payments. Include these costs for a complete budget. Plan ahead for 予期せぬ出費.

Additional Costs And Fees

Insurance and Taxes can add to your monthly payment. Home insurance protects your house. Taxes go to the government. These are important. They ensure your home stays safe. They support public services too.

Private Mortgage Insurance is needed if your down payment is low. It protects the bank if you can’t pay back. This fee can be a surprise. Always check if you need it.

Closing Costs are fees paid at the end. They cover things like legal fees and paperwork. These costs can add up. Be prepared for them. They are a part of buying a home.

Tips For Reducing Payments

低金利 can save money. Refinancing helps to get these rates. It might change loan terms. This could mean longer or shorter payment times. Talk to a loan expert. They can help decide the best option. Make sure to check all fees. Sometimes fees can be high. Compare different offers. Choose the one that saves the most money.

Paying more than the monthly amount reduces debt. Even small extra payments help. They reduce interest over time. Less interest means paying less overall. Try to pay a bit more each month. This helps finish the loan faster. Check if there are any penalties for extra payments. Some loans charge fees. Always ask first.

A good credit score can lower interest rates. Better scores mean better deals. Pay bills on time. Avoid too much debt. Keep credit card balances low. These actions improve credit scores. Check credit reports regularly. Fix any mistakes quickly. A higher score saves money on loans. Work on improving credit regularly.

よくある質問

How Is The Monthly Payment On A Mortgage Calculated?

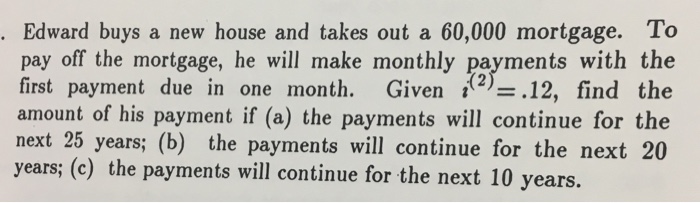

The monthly payment is calculated using the loan amount, interest rate, and loan term. Lenders use the amortization formula to determine this. It includes principal and interest components. The result gives you a consistent monthly payment over the loan duration.

What Factors Affect Mortgage Monthly Payments?

Several factors can influence your monthly mortgage payments. Key factors include the loan amount, interest rate, and loan term. Additional costs may include property taxes, homeowners insurance, and private mortgage insurance. These components together determine the total monthly payment.

Can I Lower My Monthly Mortgage Payment?

Yes, there are ways to lower it. Refinancing to a lower interest rate can reduce payments. Extending the loan term also decreases monthly costs. Making a larger down payment initially reduces the loan amount. Consider discussing options with a financial advisor.

What Is The Impact Of Interest Rates On Payments?

Interest rates significantly affect monthly payments. Higher rates increase the payment amount, while lower rates reduce it. Even a small change in interest rate can have a big impact over the loan term. It’s important to shop around for the best rates.

結論

Understanding your monthly mortgage payment is crucial. It helps manage your budget better. A $60,000 mortgage might seem large, but with proper planning, it’s manageable. Calculate your interest rate and loan term carefully. This will help you know your exact monthly payment.

Remember to include insurance and taxes in your budget. This ensures you don’t face surprises later. Always review your financial situation before committing. A well-planned mortgage helps secure your financial future. Stay informed and make wise decisions. That’s the key to stress-free homeownership.