支払いIDとは:安全な取引を実現する

Have you ever wondered what a payment ID is and why it’s so important for your transactions? Imagine you’re making an online purchase or sending money to a friend.

You want everything to go smoothly, right? That’s where a payment ID comes into play. It’s like the secret code that ensures your money reaches the right place without any hiccups. Knowing about payment IDs can save you from a lot of potential headaches, and it’s simpler than you might think.

Curious to learn more? Stick around, and we’ll break down everything you need to know about payment IDs in a way that’s easy and straightforward. This could be the key to making your transactions more secure and hassle-free!

Payment Id Basics

Payment Id is a unique number. It helps track payments. Think of it as a payment fingerprint. Each payment gets its own Id. This makes it easy to find. No confusion with other payments. Businesses use it a lot. It helps keep records straight.

オンラインショッピング relies on Payment Ids. They ensure safety. You know your money goes to the right place. Banks use them too. They track money in and out. It’s important for keeping things organized. Avoids mistakes in transactions.

Payment Id is vital. It makes transactions smooth. Keeps records tidy. Helps avoid payment errors. Helps you check your payments. Always use the right Id. It ensures your payment is safe.

Role In Secure Transactions

Payment IDs are important for 安全な取引. Each ID is unique. It helps to track each payment. This keeps money 安全 and avoids mistakes. When you buy something online, the ID is like a receipt. It shows you paid for what you got. Banks and stores use these IDs. They make sure your money goes to the right place. Without them, money might get lost. They are like a secret code. Only you and the store know it. This keeps your information プライベート and safe.

Types Of Payment Ids

Static Payment Ids stay the same every time. They are fixed and do not change. Businesses use them for regular payments. These ids are easy to remember. They are like a permanent タグ for your payments. Static ids make managing payments simple. They are useful for subscriptions. You can trust them for regular billing.

Dynamic Payment Ids change with each use. They are new every time you pay. This makes them more 安全な. They help in one-time transactions. Dynamic ids are like secret codes. They protect your money from 詐欺. Many people prefer them for online shopping. These ids are temporary but reliable.

How Payment Ids Work

Payment IDs are created to keep track of money exchanges. Each ID is unique and helps identify transactions. Systems use special algorithms to make these IDs. It ensures that every ID is different and cannot be repeated. The process is quick and happens in seconds. This helps users find their transaction details easily.

Payment IDs must be checked for accuracy. Systems use validation checks to ensure IDs are correct. This process helps prevent errors in transactions. Validation involves checking if the ID matches stored records. If it matches, the transaction is confirmed. If it doesn’t, the system alerts the user. This is important to keep transactions safe and secure.

Benefits For Consumers

Payment Ids provide extra security for online payments. They help keep your 個人情報は安全. This means less chance of 詐欺 and stolen data. Payment Ids protect you by keeping your details hidden. Only you and the seller know this Id. This makes it harder for others to misuse your data.

Payment Ids make tracking your transactions easy. Each payment has a unique Id. This helps you find details about every purchase. You can check if a payment was successful or not. It also helps when you need 払い戻し or have questions. You can quickly find and show proof of payment. This saves time and reduces confusion.

Business Advantages

Payment Id helps to reduce fraud. Each transaction gets a unique identifier. This makes it hard for thieves to trick the system. Businesses feel safer. Customers trust more when they know their money is safe. Fraud costs money. Reducing it saves businesses a lot. It also saves time. Less fraud means less time fixing problems.

Payment Id makes operations smooth. It organizes payments quickly. Workers waste less time checking errors. More time is spent on important tasks. This boosts productivity. Businesses see faster growth. Customers enjoy quick service. Happy customers come back. Streamlined operations make everyone happy. It saves money and effort too.

Challenges And Limitations

Payment Ids often face challenges with security and privacy. Many users worry about data breaches and identity theft. Limited understanding of how Payment Ids work can lead to misuse or errors. This can cause transaction delays or failures.

Technical Complexities

Systems must handle large amounts of data. This can be hard. It needs advanced technology. Errors can happen easily. Fixing them takes time. 安全 is also a big concern. Protecting data is not easy. It requires strong measures. If systems fail, users face problems. Downtime can affect businesses. It may lead to losses. Technical skills are crucial here.

User Adoption

Users might find new systems confusing. Many people prefer simple processes. Changes can be scary. Understanding the new way is tough. Some users resist new tech. They fear mistakes. Learning takes effort and time. Support is needed for users. Help desks and tutorials can assist. Adoption rates might be slow. Patience is key for success.

将来の動向

Payment ID serves as a unique identifier for tracking transactions. It ensures secure and accurate processing of payments. This trend in digital finance simplifies managing payments efficiently.

Integration With Blockchain

Payment Ids can work well with ブロックチェーン technology. Blockchain offers a safe way to record transactions. Every transaction gets a unique code. This code is called a Payment Id. It helps in tracking and verifying transactions. This makes things more 安全な for users. People can trust the system more. They feel safe with their money. Businesses also like this feature. It helps them keep records easily. It reduces errors and fraud.

Ai And Machine Learning Innovations

AI can make Payment Ids smarter. Machines can learn patterns. They can spot unusual transactions. This helps in stopping fraud early. Payment Ids can become more 効率的 with AI. They can process payments faster. This saves time for users and businesses. AI also helps in reducing mistakes. Machines can check details quickly. This makes the payment system 信頼性のある. People can depend on it for everyday use.

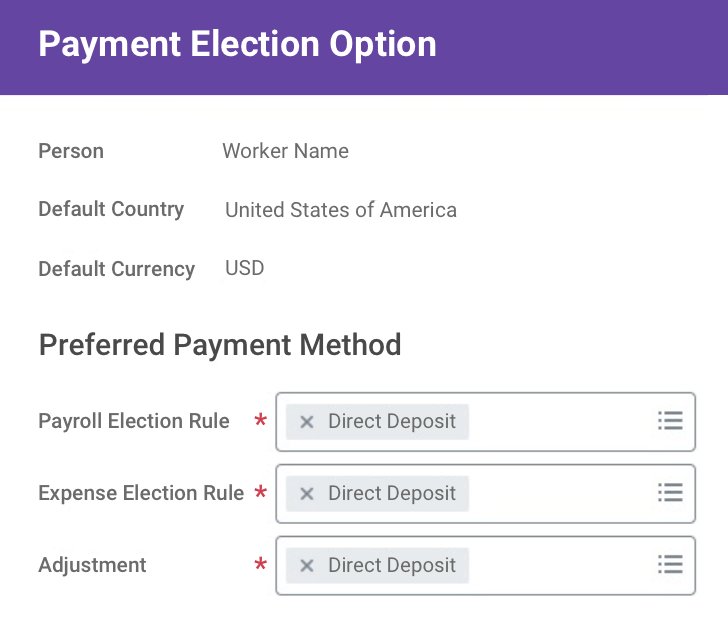

Implementing Payment Ids

Payment Ids are used to track payments. They make transactions easier to trace. Using a unique identifier for each payment helps. This prevents confusion and errors. Storing Payment Ids securely is important. It keeps sensitive data safe. Always test the Payment Id system. Ensure it works correctly. Use Payment Ids consistently across platforms. This supports smooth operations.

Many companies use Payment Ids successfully. A small business reported fewer errors. They used Payment Ids for every transaction. A large retailer improved customer service. They tracked refunds with Payment Ids. Banks found Payment Ids helpful. They reduced fraud by using them. In each case, Payment Ids added value. They made processes more efficient.

よくある質問

What Is A Payment Id?

A Payment Id is a unique identifier for transactions. It helps in tracking payments accurately. This identifier ensures that each transaction is distinct. Payment Ids are essential for online payments. They facilitate error-free processing and record-keeping.

How Is Payment Id Used?

Payment Id is used to track transactions. It ensures that payments are processed correctly. Businesses use it to verify transactions. Customers use it to confirm their payments. It is crucial for secure and accurate payment processing.

Why Is Payment Id Important?

Payment Id is crucial for transaction accuracy. It helps in identifying and resolving payment issues. Without it, tracking payments is challenging. It ensures secure and efficient payment processes. Payment Ids are essential for both businesses and customers.

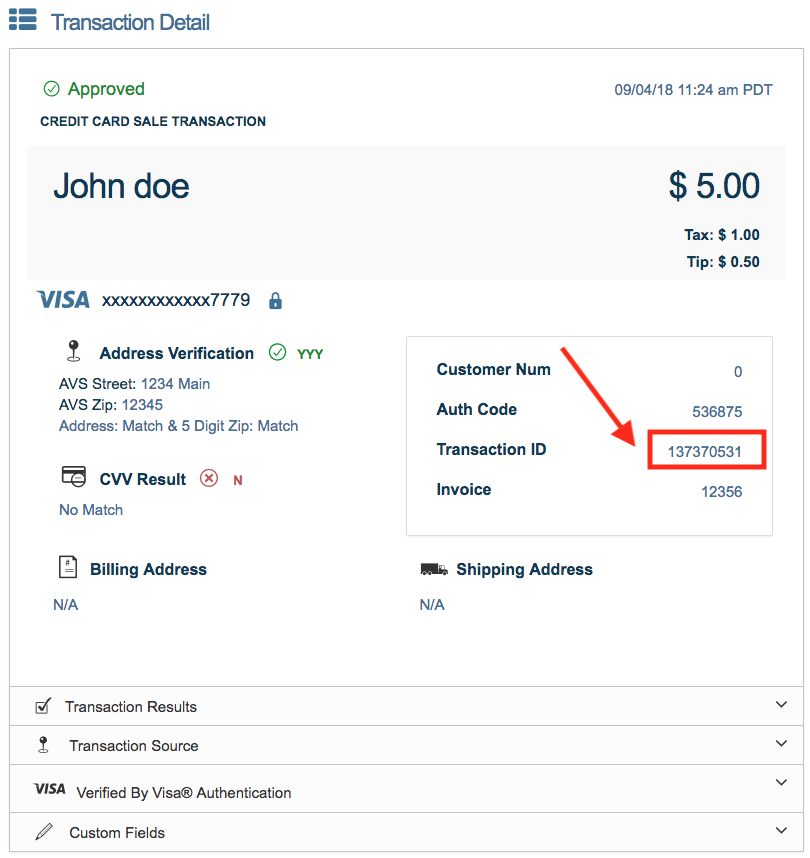

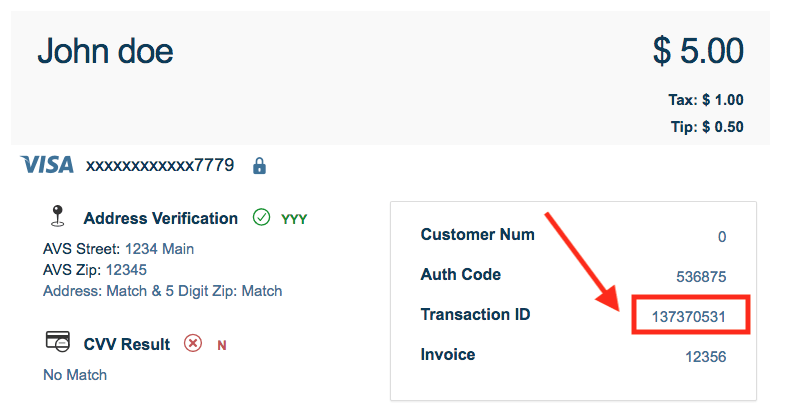

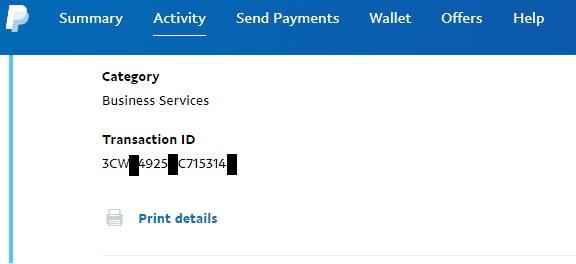

How Do I Find My Payment Id?

You can find your Payment Id in transaction details. It is usually provided by the payment processor. Check your email or payment confirmation receipt. It is often listed as “Transaction Id” or “Payment Reference. ” Contact customer support if you cannot locate it.

結論

Payment IDs are vital for secure transactions. They ensure payments reach the right destination. These IDs offer both safety and clarity in financial exchanges. Understanding them helps in smooth online transactions. Businesses and individuals benefit from using payment IDs. They reduce errors and enhance trust.

Always keep your payment ID confidential. This protects you from fraud. Learning about payment IDs simplifies digital payments. It makes the process straightforward and secure. So, next time you make a payment, remember the importance of your payment ID. It’s a small step towards safer financial transactions.